Medicare compliance consists of providers’ being familiar with what parts A, B, C, and D cover and do not cover. Medicare compliance also requires providers to bill Medicare in a specific format using specific diagnostic and treatment codes.

Are Medicare plans complying with CMS regulation?

Nov 16, 2020 · Medicare compliance consists of providers’ being familiar with what parts A, B, C, and D cover and do not cover. Medicare compliance also requires providers to bill Medicare in a specific format using specific diagnostic and treatment codes.

What is Medicare compliance officer?

May 19, 2010 · During the life of the claim, CMS paid $22,549.67 in Medicare claims for medical services related to the accident. As a result, after Harris forwarded to CMS details of the settlement, CMS sought ...

What is the effective compliance program?

The only way, and the only recognized way in healthcare to do so, is to have a compliance program. That is, you have written materials that demonstrate, for everyone visible, that you want to do things right. A compliance program stands for you having good intent.

What are the requirements for compliance?

Dec 01, 2021 · The current review reason codes and statements can be found below: List of Review Reason Codes and Statements. Please email [email protected] for suggesting a topic to be considered as our next set of standardized review result codes and statements. Page Last Modified: 12/01/2021 07:02 PM. Help with File Formats and Plug-Ins.

Does Medicare require a compliance program?

Compliance Program Requirement The Centers for Medicare & Medicaid Services (CMS) requires Sponsors to implement and maintain an effective compliance program for its Medicare Parts C and D plans.

What does a Medicare compliance officer do?

The Medicare Compliance Officer is responsible for the implementation of the compliance plan, defining the plan structure, educational requirements, reporting, and complaint mechanisms, response and corrective action procedures, and compliance expectations of all employees and first tier, downstream, and related ...

Who enforces Medicare compliance?

The CMS National Standards Group, on behalf of HHS, administers the Compliance Review Program to ensure compliance among covered entities with HIPAA Administrative Simplification rules for electronic health care transactions.Dec 17, 2021

Is a compliance plan mandatory?

Each physician's practice will need its own unique plan to properly suit its services, and there is no single model plan to follow. However, OIG has issued suggested compliance program guidance that was initially voluntary, but now is mandatory under the ACA.Jul 30, 2014

What does healthcare compliance do?

Healthcare compliance is the process of following rules, regulations, and laws that relate to healthcare practices. Compliance in healthcare can cover a wide variety of practices and observe internal and external rules.Dec 22, 2020

What does a healthcare compliance specialist do?

Healthcare compliance specialists are responsible for providing service, support, and advice in response to the changing needs of the organization, healthcare laws, and governmental policies.

Why is healthcare compliance important?

Ultimately, the purpose and primary benefit of healthcare compliance is to improve patient care. Patient care is improved when healthcare decisions are based upon appropriate and current clinical standards. Patient care decisions based upon improper motives rarely results in the delivery of quality care.

Why is program compliance important?

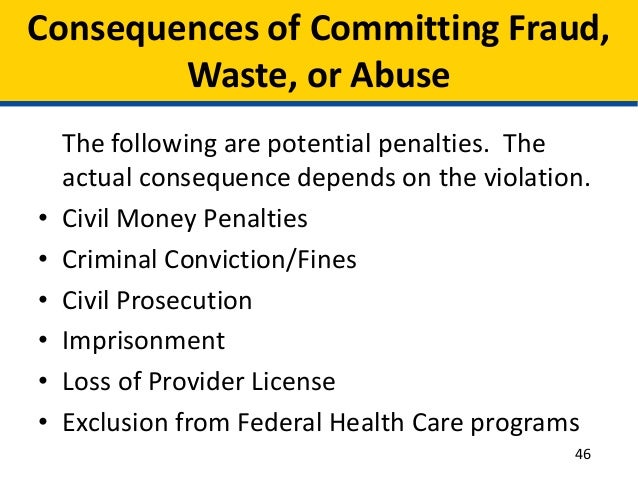

The purpose of compliance programs is to promote organizational adherence to applicable federal and state law, and private payer healthcare requirements. An effective compliance program can help protect practices against fraud, abuse, waste, and other potential liability areas.Jul 26, 2017

What is healthcare regulation compliance?

Regulatory compliance in Healthcare is all about a healthcare organization's adherence to laws, regulations, guidelines, and specifications relevant to its business processes. Violations of regulatory compliance regulations often result in legal punishment including federal fines.Jun 7, 2019

What does a compliance plan include?

Simply put, a compliance plan is a system of checks and balances through which a reasonable effort is made to identify potential non-compliance issues regarding applicable laws and regulations, and to eliminate or mitigate those issues.Jul 17, 2014

What is compliance plan?

Compliance Plans allow for the creation of an overall plan to address regulatory requirements in a structured setting, or to structure a set of regulatory tasks. For example, a Compliance Plan might be created to track regulatory tasks, or to conduct compliance assessments against various regulatory requirements.

What are the 7 elements of a compliance program?

Seven Elements of an Effective Compliance ProgramImplementing written policies and procedures. ... Designating a compliance officer and compliance committee. ... Conducting effective training and education. ... Developing effective lines of communication. ... Conducting internal monitoring and auditing.More items...

What is Medicare insurance?

Medicare is a Federal insurance program providing a wide range of benefits for specific periods of time through providers and suppliers participating in the program. The Act designates those providers and suppliers that are subject to Federal health care quality standards.

What is Medicare Code?

Medicare is a Federal insurance program providing a wide range of benefits for specific periods of time through providers ...

What is the Social Security Act?

The Social Security Act (the Act) mandates the establishment of minimum health and safety and CLIA standards that must be met by providers and suppliers participating in the Medicare and Medicaid programs. These standards are found in the 42 Code of Federal Regulations. The Secretary of the Department of Health and Human Services has designated CMS ...

What are the types of institutions that participate in Medicaid?

In general, the only types of institutions participating solely in Medicaid are (unskilled) Nursing Facilities, Psychiatric Residential Treatment Facilities, and Intermediate Care Facilities for the Mentally Retarded.

What is Medicaid in the US?

Medicaid is a State program that provides medical services to clients of the State public assistance program and, at the State's option, other needy individuals. When services are furnished through institutions that must be certified for Medicare, the institutional standards must be met for Medicaid as well.

When was the Clinical Laboratory Improvement Amendments passed?

Congress passed the Clinical Laboratory Improvement Amendments (CLIA) in 1988 establishing quality standards for all laboratories testing to ensure the accuracy, reliability, and timeliness of patient test results, regardless of where the test was performed.

Does Medicaid require nursing facilities to meet the same requirements as skilled nursing facilities?

Medicaid requires Nursing Facilities to meet virtually the same requirements that Skilled Nursing Facilities participating in Medicare must meet. Intermediate Care Facilities for the Mentally Retarded must comply with special Medicaid standards.

What is the MSP in Medicare?

The Medicare Secondary Payer Act (MSP) mandates that conditional payments made by Medicare as a result of an injury caused by another party must be reimbursed to Medicare (42 CFR Section 411.21). Otherwise, any and all entities responsible for such reimbursement will be held responsible, including the representing attorney. The recent federal case of United States v. Harris (USDC ND W.Va. November 2008 and March 2009) highlights this.

What is the 42 CFR Section 411.25?

also seeks declaratory relief by asking the Court that the defendants must give CMS notice of all future payments to Medicare beneficiaries pursuant to 42 CFR Section 411.25 and ensure that before any future settlement payment is made to any claimant, that appropriate payment be made to the U.S.

What was the settlement agreement for Sabrina Abernathy v. Monsanto?

Monsanto Company et al. The settlement agreement indicate that the plaintiffs would accept $300 million ($171 million to the plaintiffs with supplemental annual amounts of $1.5 million to be paid from 2004 through 2013 to counsel to be allocated within their sole discretion for plaintiff’s benefit and $129 million in attorney’s fees and costs, including $1 million annually from 2004 through 2013) in exchange for any liability for punitive damages or penalties against Monsanto Co., Pharmacia Corp., and Solutia Inc., relating to the manufacture, use, release or disposal of polychlorinated biphenyls at or from the Anniston, Ala., plant or Anniston property owned or controlled by the defendants.

Who advises healthcare providers and billing companies alike to make sure no one will end up in the local newspaper?

Oberheiden P.C. advises healthcare providers and billing companies alike to make sure no one will end up in the local newspaper. Billing mistakes are preventable. However, after more than a 1,000 prosecutions as former federal prosecutors and an equal amount of cases as now private defense counsel all team members of Oberheiden P.C.

What is the 18 U.S.C. 1341?

For one, the government invokes 18 U.S.C. 1341 and argues that each use of the mail system (or in case of electronic billing : 18 U.S.C. 1343) or the internet constitutes mail fraud. Additionally, recently the government added 18 U.S.C. 1952, also known as the Travel Act, to fortify its position that any and all healthcare billing fraud is federal ...

Is billing a mistake?

Most billing mistakes are completely avoidable. A routine use of a particular code (e.g . Level 3 or Level 4 office visits, overutilization of lucrative procedures) can quickly catapult your billing practices on to the desk of an auditor or fraud investiga tor. Most clinics with billing problems will sooner or later experience one of the following concerns.

Should medical billing be done in-house?

Unless the in-house billing department is equipped with highly trained, certified, and experienced coders, medical billing should never be done in-house. Physicians, healthcare providers, and business owners should shield themselves from consequences of incorrect billing by isolating their medical practice and operations from billing and coding. While there may be a premium to pay to an outside vendor, the advantages can be enormous when it comes to lack of liability in case of an audit or investigation. Call Oberheiden P.C. how to structure a billing arrangement that makes economic sense and protects your practice against unwanted liabilities.

What do you need to know about Medicare audits?

1. There are three major audit-worthy red flags for physical therapists. As you know, Medicare policy is a web of super-confusing rules and regulations.

What is RAC in Medicare?

Developed as part of the Medicare Modernization Act of 2003, the RAC program reclaims money by conducting retrospective reviews of fee-for-service (FFS) claims—a process known as “claw back.”. For this initiative, the country is divided into four regions.

What happens if you fail to comply with a federal investigation?

If you fail to comply, you will not receive reimbursement for the claim.

What does CMS review?

CMS contractors medically review some claims (and prior authorizations) to ensure that payment is billed (or authorization requested) only for services that meet all Medicare rules.

When did CMS standardize reason codes?

In 2015 CMS began to standardize the reason codes and statements for certain services. As a result, providers experience more continuity and claim denials are easier to understand.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is Medicare lien?

To enforce this right to reimbursement, a “Medicare lien” will attach to judgment or settlement proceeds that are awarded as compensation for the accident. This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out.

How much can Medicare fine for reporting?

Additionally, Medicare can fine the “Responsible Reporting Entity,” usually the insurer, up to $1,000 for each day that they are out of compliance with Medicare’s reporting requirements. That is some harsh medicine. It leaves insurance companies stone terrified.

What happened to Maryland malpractice law firm?

A Maryland malpractice law firm recently had to pay $250k for failing to pay off a Medicare lien. The firm had obtained a $1.15 million dollar settlement for one of its clients in a medical malpractice case. This client happened to be a Medicare beneficiary for whom Medicare had made conditional payments. Medicare had been notified of the settlement and demanded repayment of its debts incurred. But the law firm apparently refused or failed to pay the lien off in full, even after an administrative finding had made the debt final.

How does a lien work in personal injury?

How Medicare Liens Work in Personal Injury Cases. If you are injured in an accident and Medicare pays for some of your treatment, you will be obligated to reimburse Medicare for these payments if you bring a personal injury claim and get financial compensation for the accident. To enforce this right to reimbursement, ...

What court case did Sebelius appeal?

Sebelius, an 11th Circuit opinion from 2010. This case involved Medicare’s appeal when a Florida probate court ruled that Medicare was only entitled to recover less than $800 out of a $22,000 lien in a wrongful death nursing home case.

What is the purpose of the MSP?

The purpose of this law was to make sure that sure Medicare was not paying for medical bills that should be paid by someone else. The MSP gives Medicare the right to claim (i.e., a lien) reimbursement from any judgment or settlement proceeds that include compensation for medical bills paid by Medicare.

How much did Meyers Rodbell pay for malpractice?

Under the terms of the agreement entered into with the U.S. Attorney’s Office for the District of Maryland, Meyers Rodbell had to pay the $250,000 for the Medicare lien in the malpractice case. The firm was also required to adopt certain policies for handling Medicare liens in future cases.