The amount you could need to cover premiums and out-of-pocket prescription drug costs from age 65 on could be $130,000 if you’re a man and $146,000 if you’re a woman, according to one study. Sometimes, it comes as a surprise to older folks that Medicare is not free.

Full Answer

How much do you pay for Medicare at age 65?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

How much will Medicare cost me at age 65?

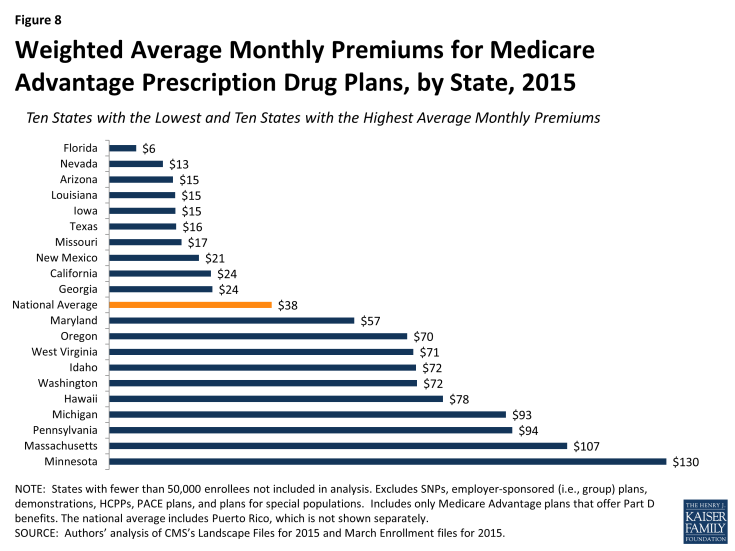

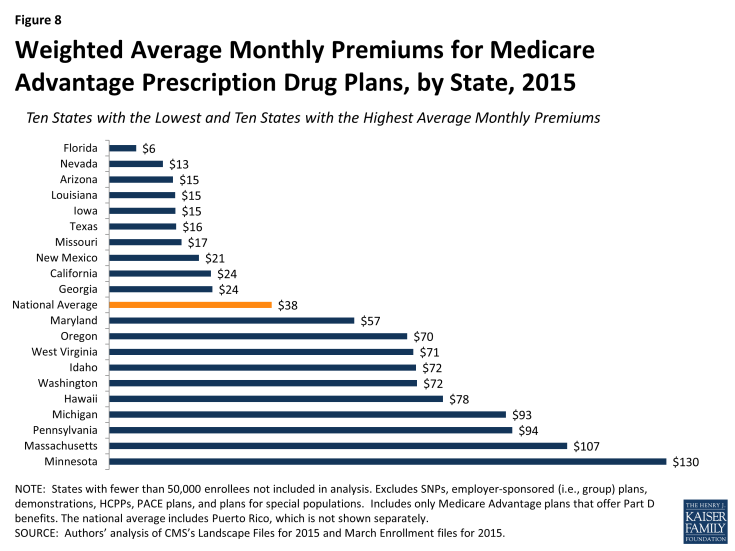

Aug 19, 2021 · According to the Center of Medicare Services, today, the average cost for Medicare Part D is 32.50 USD per month. However, high-income earners are charged more for their premiums. The average deductible for this plan is 415 USD.

Does Medicare automatically start at 65?

How Much Does Medicare cost at age 65. Medicare covers a lot, but not everything. Typically, you will need to pay for about 30 percent of your health care costs in retirement out of your own pocket. After paying into Medicare through payroll withholdings at work for many years, some people approach their eligibility age of 65 with a misconception that their coverage will be free.

Do you automatically get Medicare at 65?

If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. Part A hospital inpatient deductible and coinsurance: You pay: $1,556 deductible for each benefit period

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Is Medicare free at 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

Is Medicare Part A free for everyone?

Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

Does Medicare reduce Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is Part B Medicare for?

Medicare Part B (Medical Insurance) Part B helps cover medically necessary services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B also covers many preventive services.

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Medicare Part A (Hospital Insurance)

Medicare Part A pays for inpatient clinic and hospital care as well as partial expert nursing and home-based healthcare services. You usually don’t have to pay periodic premiums for Part A coverage if you or your spouse paid for Medicare charges for ten years and above during your employment days.

Medicare Part B (Medical Insurance)

Although Medicare Part A pays for inpatient services and some home-based healthcare services, you still need Part B coverage for protective care and medical appointments. Unfortunately, Medicare Part B doesn’t have a premium-free alternative like Part A.

Medicare Part D

Medicare Part D pays for treatment drugs, and its paid via premiums. Although Part D pays for your prescription drugs, you’re still liable for a portion of your medication expenses. Just like Part D, Medicare Part C is provided by private insurance companies backed by Medicare.

Medicare Part B

If you fail to register for Medicare Part B when you are eligible, you’ll have to pay a 10% fine for each year that you should have signed up. This amount is added to your monthly premiums, and the penalty goes up the more you delay signing up for Part B.

Final Thought

To sum it all up, Medicare coverage is a bit complex, and there are many considerations unique to your condition. For instance, how long you have been employed, how much money you make are all factors that will be used to calculate your total Medicare premiums.

Things that are not covered by Medicare

Things that are not covered by Medicare — dental, basic vision, over-the-counter medicines, long-term care.

Changes in Medicare 2020

It is important for senior citizens to know about the changes that will happen to Medicare in 2020.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Part B Medicare

Part A of Medicare has no charge as long as you or a spouse have worked 40 quarters (ten years) and paid into Medicare through payroll taxes. Otherwise there will be a charge for Part A. The standard Part B premium amount in 2021 is $148.50 or higher depending on your income. See IRMAA section below.

Part D Medicare

You do not pay for Part D of Medicare unless you are means tested. See IRMAA section below. This does NOT provide you drug coverage. It is only enrollment in “PART” D of Medicare.

Income Related Medicare Adjustment Amount (IRMAA)

High-income Medicare beneficiaries pay extra for their Part B and Part D. This is known as a surcharge. The premium adjustment is based on income tax returns from two years prior. For example, 2019 tax returns are used to determine whether you pay the surcharges in 2021.

How long does Medicare last?

Original, or basic, Medicare consists of Part A (hospital coverage) and Part B (outpatient and medicare equipment coverage). You get a seven-month window to sign up that starts three months before your 65th birthday month and ends three months after it.

How old do you have to be to sign up for Medicare?

While workers at businesses with fewer than 20 employees generally must sign up for Medicare at age 65 , people working for larger companies typically have a choice: They can stick with their group plan and delay signing up for Medicare without facing penalties down the road, or drop the company option and go with Medicare.

What to do if you are 65 and still working?

If you’ll hit age 65 soon and are still working, here’s what to do about Medicare 1 The share of people age 65 to 74 in the workforce is projected to reach 30.2% in 2026, up from 26.8% in 2016 and 17.5% in 1996. 2 If you work at a company with more than 20 employees, you generally have the choice of sticking with your group health insurance or dropping the company option to go with Medicare. 3 If you delay picking up Medicare, be aware of various deadlines you’ll face when you lose your coverage at work (i.e., you retire).

What happens if you don't sign up for Part A?

If you don’t sign up when eligible and you don’t meet an exception, you face late-enrollment penalties. Having qualifying insurance — i.e., a group plan through a large employer — is one of those exceptions. Many people sign up for Part A even if they stay on their employer’s plan.

How much does Medicare cover?

But mid-way through the year, it’s hard to say.”. Generally speaking, Medicare only covers about two-thirds of the cost of health-care services for the program’s 62.4 million or so beneficiaries, the bulk of whom are age 65 or older. That’s the age when you become eligible for Medicare.

How much is Medicare Part A deductible?

However, Part A has a deductible of $1,408 per benefit period, along with some caps on benefits.

Is there a cap on out of pocket Medicare?

For starters, there is no cap on out-of-pocket spending for basic Medicare.

Is Medicare free for older people?

Sometimes, it comes as a surprise to older folks that Medicare is not free. Depending on the specifics of your coverage and how often you use the health-care system, your out-of-pocket costs could reach well into six-figure territory over the course of your retirement, according to a recent report from the Employee Benefit Research Institute. ...