How much does Medicare cost?

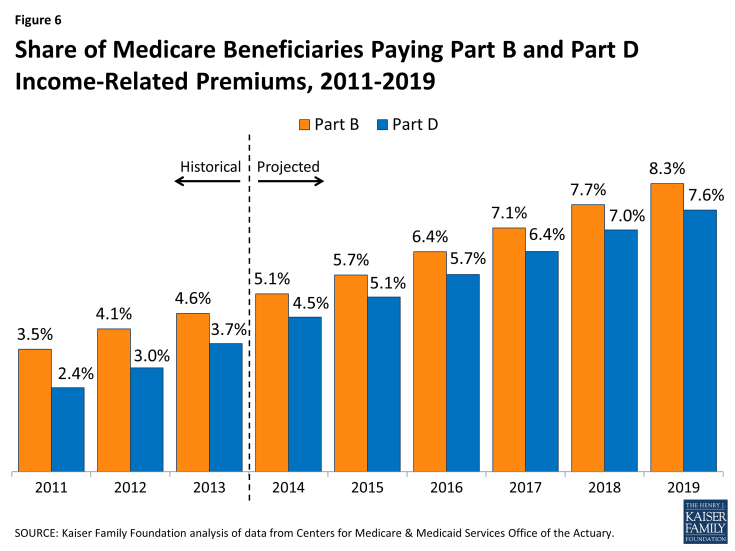

Official 2018 Part B premium rates have not yet been released, but current enrollees can expect to pay about $134 a month next year. Of course, higher-income enrollees are subject to even higher rates for Medicare Part B.

How to calculate Medicare payments?

Nov 17, 2017 · The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees. For these enrollees, any increase in Part B premiums must be lower than the increase in their Social Security benefits.

How do you calculate Medicare payment?

Back to Cost Reports by Fiscal Year; 2018 Fiscal Year. 2018. Facility Type. HOSPITAL-2010. HOSP10FY2018.ZIP. Home A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244. CMS & HHS Websites [CMS Global Footer] Medicare.gov ...

What is the monthly premium for Medicare Part B?

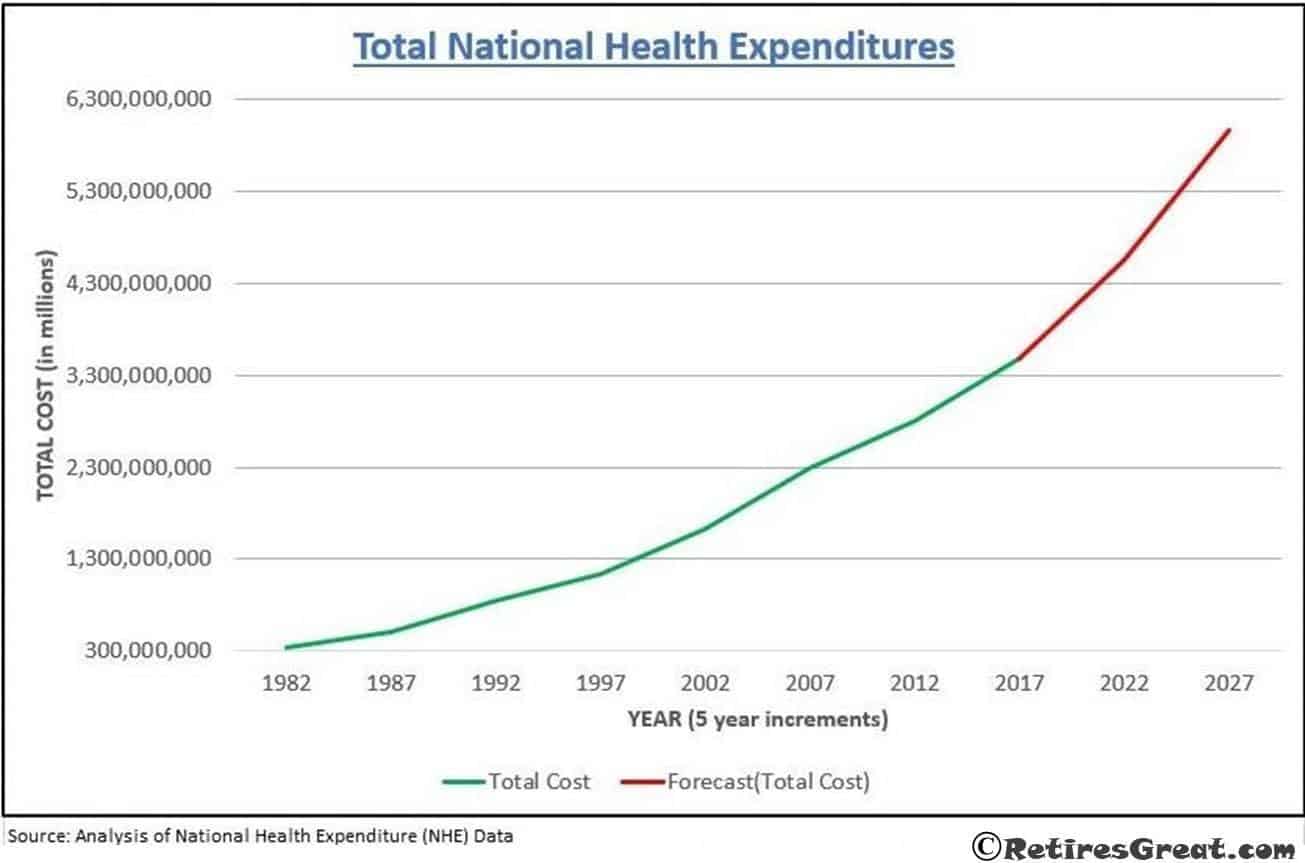

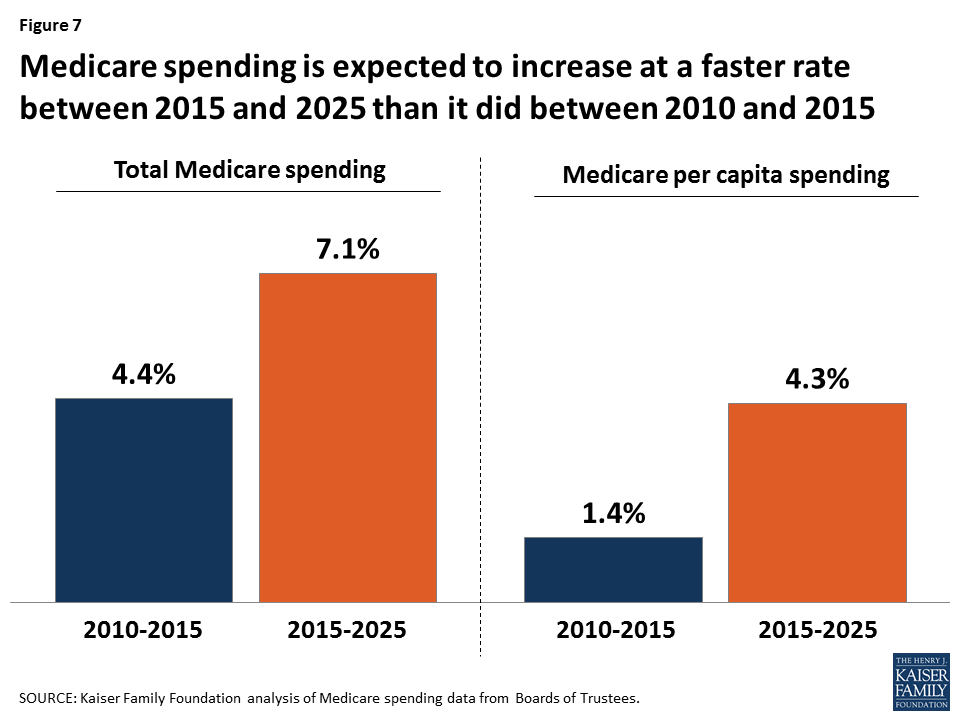

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare: Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure.

What was the cost of Medicare in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$85,001 to $107,000$170,001 to $214,000$187.505 more rows

What is the yearly cost to the American taxpayer for Medicare?

In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How much did Medicare cost in 2019?

$135.50Part B. On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What was the Medicare Part B premium for 2019?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

How much does Social Security and Medicare cost the government?

In 2019, the combined cost of the Social Security and Medicare programs is estimated to equal 8.7 percent of GDP. The Trustees project an increase to 11.6 percent of GDP by 2035 and to 12.5 percent by 2093, with most of the increases attributable to Medicare.

What will Medicare cost in 2021?

In 2021 “net” Medicare spending was $696 billion and “gross” Medicare was $875 billion. Viewed from a GDP perspective, Medicare spending increased from 2.3 percent GDP in 2005 to 3 percent of GDP in 2009.

What is the Medicare Part B deductible 2018?

$183 in 2018The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement.Nov 17, 2017

How Much Does Part B cost in 2019?

$135.50Medicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.Oct 12, 2018

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

Are Medicare Part B premiums going up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Does Medicare Part B have a monthly premium?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

What is the discount for generic drugs?

If you fall into the donut hole, you’ll get a discount on the cost of your prescriptions. In 2018, the discount is: 56 percent for generic medications (you pay 44 percent) 65 percent for brand name drugs (you pay 35 percent)

What is catastrophic limit?

This will effectively close the coverage gap. As it stands, the catastrophic limit prevents you from paying higher prescription drug costs forever. Once you hit the catastrophic limit ($5,000 in 2018), you’ll only be responsible for about 5 percent of the cost of your medications for the rest of your plan year.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How does CMS address new technology add-on payments?

Each year in the proposed rule, CMS addresses the applications for new technology add-on payments under the IPPS by presenting its evaluation and analysis of the applications. CMS does not make proposals in the rule, but rather describes any concerns it may have with regard to whether a particular technology meets the criteria for payment as a new technology and seeks additional information as needed for use in making a decision on the applications in the final rule. Included among the 15 applications for new technology add-on payment for FY 2019 presented in this year’s proposed rule are applications for Chimeric Antigen Receptor (CAR) Tâcell therapy. Separately, for FY 2019, CMS is proposing to reassign CAR T-cell therapy to a higher-weighted MS-DRG, and is seeking comment on alternative MS-DRG assignment.

When did CMS change?

On April 24, 2018, the Centers for Medicare & Medicaid Services (CMS) proposed changes to empower patients through better access to hospital price information, improve the use of electronic health records, and make it easier for providers to spend time with their patients. The proposed rule issued today proposes updates to Medicare payment policies ...

What is the market basket for IPPS?

By law, CMS is required to update payment rates for IPPS hospitals annually, and to account for changes in the prices of goods and services used by these hospitals in treating Medicare patients, as well as for other factors. This is known as the hospital “market basket.”.

What is the CMS request for information?

Specifically, CMS is requesting stakeholder feedback through a Request for Information on the possibility of revising Conditions of Participation related to interoperability as a way to increase electronic sharing of data by hospitals. This will inform next steps to advance this critical initiative. In the proposed rule, CMS is proposing to make changes to the EHR Incentive program to greater promote interoperability and to make the EHR Incentive program more flexible and less burdensome by placing a strong emphasis on measures that require the exchange of health information between providers and patients. This will inform the discussion on future regulatory action related to inpatient and long-term hospitals.

When is the deadline for comment on the RFI?

The deadline for submitting comments on the proposed rule and the RFI is June 25, 2018. The proposed rule and the RFI (CMS-1694-P) can be downloaded from the Federal Register at: https://s3.amazonaws.com/public-inspection.federalregister.gov/2018-08705.pdf.

What is the purpose of the EHR incentive program?

In 2011, the Medicare and Medicaid EHR Incentive Programs were established to encourage eligible professionals, eligible hospitals, and critical access hospitals (CAHs) to adopt, implement, upgrade (AIU), and demonstrate meaningful use of certified EHR technology (CEHRT).

Do hospitals have to post standard charges?

Online posting of standard charges. Under current law, hospitals are required to establish and make public a list of their standard charges. In an effort to encourage price transparency by improving public accessibility of charge information, CMS is updating its guidelines to specifically require hospitals to make public a list of their standard charges via the Internet.