Full Answer

Is there still a donut hole in Medicare?

Aug 09, 2010 · By 2020, the coverage gap will be closed, meaning there will be no more “donut hole,” and you will only pay 25% of the costs of your drugs until you reach the yearly out-of-pocket spending limit. Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan.

How to avoid the Medicare Part D Donut Hole?

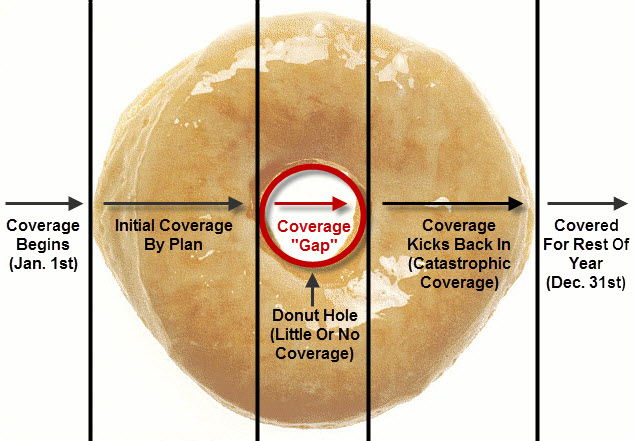

Feb 10, 2022 · The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the Initial Coverage Limit.

Where did the donut hole really come from?

Oct 01, 2021 · The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In …

How much is a donut hole?

Sep 07, 2021 · The Medicare “donut hole,” or coverage gap, is an increase in your medication copays that occurs after you reach a certain spending threshold. Because Medicare is a federal program, only additional federal action can further reduce enrollees’ medication costs. AJ_Watt/E+ via Getty Images

What is the Medicare donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

What happens when you reach the donut hole in Medicare?

The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs. In the past, you were responsible for a higher percentage of the cost of your drugs.

How long do you stay in the donut hole with Medicare?

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole.

Will the donut hole go away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Has the donut hole been eliminated?

The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs. Your coinsurance in the donut hole is lower today than in years past, but you still might pay more for prescription drugs than you do during the initial coverage stage.

Does Medigap cover the donut hole?

There is not a Medicare plan that covers the donut hole. You may wonder if a Medigap could help you avoid donut hole costs. Medigap policies are private Medicare supplement insurance plans that are sold to cover additional costs and some services not traditionally covered by Original Medicare.Dec 2, 2021

What happens when you reach the donut hole?

You enter the donut hole once your Medicare Part D plan has paid a certain amount toward your prescription drugs in 1 coverage year. Once you fall into the donut hole, you'll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit.

Do all Medicare Part D plans have a donut hole?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

How does Medicare Part D calculate donut holes?

3The Donut Hole (Coverage Gap Stage)25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost.25% of the cost of Part D brand name medications.

What is the catastrophic coverage amount for 2021?

$6,550Catastrophic coverage refers to the point when your total prescription drug costs for a calendar year have reached a set maximum level ($6,550 in 2021, up from $6,350 in 2020).

What is a donut hole?

What is the Donut Hole? The Medicare Part D Donut Hole, or Coverage Gap, is one of four stages you may encounter during the year while a member of a Part D prescription drug plan. Specifically, the Donut Hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached ...

How to contact Medicare for copays?

If you qualify, you may receive help paying for your monthly premium and prescription drug copays. For more information, contact Medicare at 1-800-633-4227 (TTY 1-877-486-2048), the Social Security Office at 1-800-772-1213 (TTY 1-800-325-0778), or the Office of Medicaid Commonwealth of Massachusetts at 1-617-573-1770.

What tiers are deductibles?

The deductible counts toward any combination of drugs on Tiers 3, 4, and 5. You will not pay a separate deductible for each tier. After you pay the deductible, you will pay only your copay for Tier 3, 4, and 5 drugs.

Does Tufts Medicare have a Part D deductible?

All other plans do not have a Part D deductible. If you are a member of Tufts Medicare Preferred HMO Value Rx, Basic Rx, or Saver Rx plan: There is no deductible for drugs on Tier 1 and Tier 2. The is a deductible for drugs on Tier 3, Tier 4, and/or Tier 5.

What is the Medicare donut hole?

The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2021, you’ll have to pay 25 percent OOP from when you enter the donut hole until you reach the OOP threshold.

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

What happens if you fall into a donut hole?

Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again. Continue reading as we discuss more about the donut hole and how may it affect how ...

How much money do you have to spend to get out of the donut hole?

This is the amount of OOP money that you have to spend before you exit the donut hole. For 2021, the OOP threshold has increased to $6,550. This is up from $6,350 in 2020, meaning that you’ll have to pay more OOP than before in order to get out of the donut hole.

What to consider before choosing a Medicare plan?

Below are some things to consider before choosing a plan. Use the Medicare website to search for a plan that’s right for you. Compare a Medicare Part D with a Medicare Advantage (Part C) plan. Medicare Advantage plans include health care and drug coverage on one plan and sometimes other benefits like dental and vision.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

What are the phases of a Part D plan?

Your drug coverage will change throughout the year, depending on how much you spend. If you don’t spend very much on drugs, or you have drug coverage from another source, you may never reach the donut hole phase.

How has the donut hole coverage gap changed?

The ACA began closing the donut hole in 2011, shrinking it little by little each year. The process began with a 50% reduction in brand-name drug prices and a 7% government subsidy on generic drugs within the coverage gap. The subsidies for generic drugs increased each year until 2020.

The bottom line

Even though policymakers say the Medicare Part D donut hole is now fully closed, prescription drug copayments still often increase after the initial coverage phase. To keep your costs down, look for a Part D plan with a formulary that charges less for your medications.

What is Medicare Donut Hole?

Summary. The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

How much does the insurance company add up to the donut hole?

The insurance company will add up what a person has paid out-of-pocket for medications in the donut hole. Once this total reaches $6,350, a person has crossed the donut hole. A person is now in the catastrophic coverage stage of their medication coverage.

What does closing the donut hole do?

Closing the donut hole can help a person reduce prescription drug costs. However, they will still be responsible for 25% of costs, once they reach the donut hole. If an individual has difficulty paying for medications, state, federal, and private organizations can assist. Public Health.

Why did the Donut Hole change?

The aim of these changes was to make drugs more affordable once a person reached the donut hole, which would encourage people to continue taking their medications and reduce the risk of a break in treatment . A person pays their co-payment for their prescription drugs, depending upon their drug plan.

What is Medicare Part D?

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private- or employer-based insurance. In this article, we define the donut hole and how it applies ...

Why do people stop taking drugs after reaching the donut hole?

The issue with the donut hole is that many people in the United States stop taking their medications upon reaching the donut hole because they cannot afford to pay the high costs for the drugs. They often have to pay thousands of dollars for prescription drugs until they cross this coverage gap.

What is a donut hole?

The term donut hole refers to the way a person needs to pay for coverage. A person pays a specified amount for their prescription drugs, and once they meet this deductible, their plan takes over the funding. However, when the plan has paid up to a specified limit, the person has reached the donut hole.

What happened before the ACA closed the donut hole?

Before the ACA closed the donut hole, it caused some seniors to pay significantly higher costs for their medications after they had reached a certain level of spending on drugs during the year. Those higher costs would continue until the person reached another threshold, after which the costs would decrease again.

How does the Donut Hole work?

Each year, the federal government sets a maximum deductible for Part D plans, and establishes the dollar amounts for the thresholds where the donut hole starts and ends.

How much does Mary pay for her prescriptions?

This is what her prescription medications will cost in the plan she has selected: Mary will pay a deductible of $435.

How much does Medicare pay for drugs?

If you're enrolled in a Medicare Part D plan, you now pay a maximum of 25% of the cost of your drugs once you meet your plan's deductible (if you have one). Some plans are designed with copays that amount to less than 25% of the cost of the medication, but after the deductible is met, Part D plans cannot impose cost-sharing that exceeds 25% ...

How much is deductible for Medicare?

Deductible: If you're enrolled in a Medicare prescription drug plan, you may have to pay up to the first $435 of your drug costs, depending on your plan. 5 This is known as the deductible. Some plans don't have a deductible, or have a smaller deductible, but no Part D plan can have a deductible in excess of this amount.

What is catastrophic coverage?

This level, when you're only paying a very small portion of your drug costs, is known as catastrophic coverage (this term is specific to Medicare Part D, and isn't the same thing as catastrophic health insurance ). The expenses outlined above only include the cost of prescription medications.

Can Part D Medicare be different from Part D?

It's important to understand that your Part D prescription drug plan may differ from the standard Medicare plan only if the plan offers you a better benefit. For example, your plan can eliminate or lower the amount of the deductible, or can set your costs in the initial coverage level at something less than 25% of the total cost of the drug.

What is a donut hole in Medicare?

Medicare’s “donut hole” refers to the coverage gap in your Medicare Part D prescription drug benefit — the point where your prescription drug expenses exceed the initial coverage limit of your plan, but have not yet reached the catastrophic coverage level.

How much is the donut hole deductible?

You reach the catastrophic coverage level (ie, get out of the donut hole) after your costs reach $5,100 in 2019, including your deductible (which can be no more than $415 in 2018), copays/coinsurance, and the manufacturer discount for brand-name drugs that you receive while in the donut hole.

What percentage of coinsurance is required for prescriptions?

At this coverage level, your prescription costs for the rest of 2019 are limited to the greater of 5 percent coinsurance, ...

What percentage of the cost of generic drugs is paid in the Donut Hole?

So in 2019, while in the donut hole, enrollees pay 25 percent of the cost of brand-name drugs and 37 percent of the cost of generic drugs (previously, it was slated to be 30 percent of the cost of brand-name drugs).

What is the manufacturer's discount for drugs?

In 2019, the manufacturer’s discount is 70 percent on brand-name drugs while you’re in the donut hole. You’re paying 25 percent, the drug plan is paying 5 percent, and the manufacturer’s discount is 70 percent. The portion you pay and the portion covered by the manufacturer’s discount (a total of 95 percent in 2019) counts ...

How much is a copay for a prescription?

At this coverage level, your prescription costs for the rest of 2019 are limited to the greater of 5 percent coinsurance, or copays that amount to $3.40 for generics and preferred multi-source drugs, and $8.50 for other brand-name drugs.

When will the donut hole close?

The Affordable Care Act included a provision to close the donut hole by 2020, and the percentage of costs that enrollees pay while in the donut hole has been steadily shrinking since 2011. And although the donut hole was scheduled to close in 2020, the Bipartisan Budget Act of 2018 closed it a year early, in 2019, for brand-name drugs.

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

What happens after you reach your Medicare deductible?

After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below). Initial coverage phase: After you’ve ...

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

How many phases are there in Medicare?

Stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans can have the following four coverage phases, as applicable: Deductible phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, you’ll pay 100% for medication costs until you reach ...

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

What is extra help?

Extra Help is a federal program that helps eligible individuals with limited income pay for Medicare Part D costs such as premiums, deductibles, and copayments/coinsurance. If you qualify for this assistance, you won’t enter the coverage gap.

Medicare Part D – Prescription Benefits

Before 2006, Medicare did not include insurance for prescription drugs. As the costs of drugs skyrocketed out of the reach of most people, Medicare Part D was created. This optional insurance may be purchased by people receiving Medicare.

How Prescription Coverage Works with Medicare Part D

Medicare Part D Prescription Drug Plans pay different levels of benefits depending on how much you’ve spent on prescriptions that year. There is more than one plan with differing monthly premiums and coverage rates, but those guidelines are true of most policies under Part D.

A Shrinking Hole

Since the passing of the Affordable Care Act (ACA) in 2010, the donut hole has been closing. Companies who manufacture prescription drugs are required by Congress to contribute some of the cost of the medications for seniors in the donut hole of coverage until catastrophic coverage kicks in.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

Does Medicare cover gap?

If you have a Medicare drug plan that already includes coverage in the gap, you may get a discount after your plan's coverage has been applied to the drug's price. The discount for brand-name drugs will apply to the remaining amount that you owe.