The Affordable Care Act (ACA) increased the cost to taxpayers —particularly those in the top tax brackets—by extending medical coverage to more Americans. 2 3 According to the most recent data available from the CMS, national healthcare expenditure (NHE) grew 9.7% to $4.1 trillion in 2020. That's $12,530 per person.

Is Medicaid expansion worth the cost?

While hundreds of studies have detailed the costs and benefits of Medicaid expansion in terms of access to care, fiscal impacts, health outcomes, and other factors, consensus remains elusive. 1 Many skeptics still question whether expansion is worthwhile from a budget perspective.

How much does Medicaid expansion increase local tax receipts?

Richardson et al.’s 2019 study of Medicaid expansion in Louisiana found that it maintained or supported $60.6 million in local tax receipts in FY2018. Virginia did not expand Medicaid until 2019. As a late-expanding state, it could learn from earlier states when developing estimates for the likely fiscal impacts of expansion.

What is the additional Medicare tax?

The Additional Medicare Tax applies to people who make more than a set income level for the year. As of 2013, the IRS requires higher-earning taxpayers to pay more into Medicare. The extra tax was announced as part of the Affordable Care Act and is known as the Additional Medicare Tax. The tax rate for the Additional Medicare Tax is 0.9 percent.

How does Ohio pay for Medicaid expansion?

Ohio funds Medicaid expansion with revenues from two health care taxes tied to expansion. These taxes are expected to generate $248 million in FY2021, or 46 percent of the state’s share of expansion costs. Combined, these factors offset 70 percent of the cost of expansion.

How much does Medicare cost the taxpayers?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How much does the Affordable Care Act cost taxpayers?

Also prior to this year, ACA subsidies cost taxpayers about $50 billion a year. And yet they led to only about 2 million people gaining exchange-plan coverage. That's a small number in a nation of 330 million.

Is Medicare subsidized by taxpayers?

Most people qualify for premium-free Part A, but those who don't will have premiums that cost up to $499 in 2022. That means Medicare is primarily funded by taxpayers through general federal tax revenue, payroll tax revenue from the Medicare tax, and premiums paid by its beneficiaries.

How much did Medicare cost the government?

Historical NHE, 2020: NHE grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE.

How much did Obamacare raise taxes?

Excise taxes on the health care industry raised $12 billion in 2019. An additional 0.9 percent Medicare tax on earnings and a 3.8 percent tax on net in-vestment income (NII) for individuals with incomes exceeding $200,000 and couples with incomes exceeding $250,000.

Who benefited from Obamacare?

More than 20 million Americans gained health insurance under the ACA. Black Americans, children and small-business owners have especially benefited. Thirty-seven states have expanded Medicaid, deepening their pool of eligible residents to those who live at or below 138% of the federal poverty level.

Where does funding for Medicare come from?

Medicare is funded through multiple sources: 46% comes from general federal revenue such as income taxes, 34% comes from Medicare payroll taxes and 15% comes from the monthly premiums paid by Medicare enrollees. Other sources of funding included taxation of Social Security benefits and earned interest.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How does Medicare affect the economy?

In addition to financing crucial health care services for millions of Americans, Medicare benefits the broader economy. The funds disbursed by the program support the employment of millions of workers, and the salaries paid to those workers generate billions of dollars of tax revenue.

How much did the government spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.

Does Medicare run a deficit?

Last year, the Medicare Part A fund ran a deficit of $5.8 billion, and that excess of spending over revenue is expected to continue until it finally runs dry.

What is the ACA expansion?

Medicaid expansion, a part of the Affordable Care Act (ACA), expands eligibility to all individuals earning less than 138 percent of the federal poverty level. Medicaid was initially, intended as a safety net for those unable to work, children from low-income households, disabled, pregnant women and senior citizens.

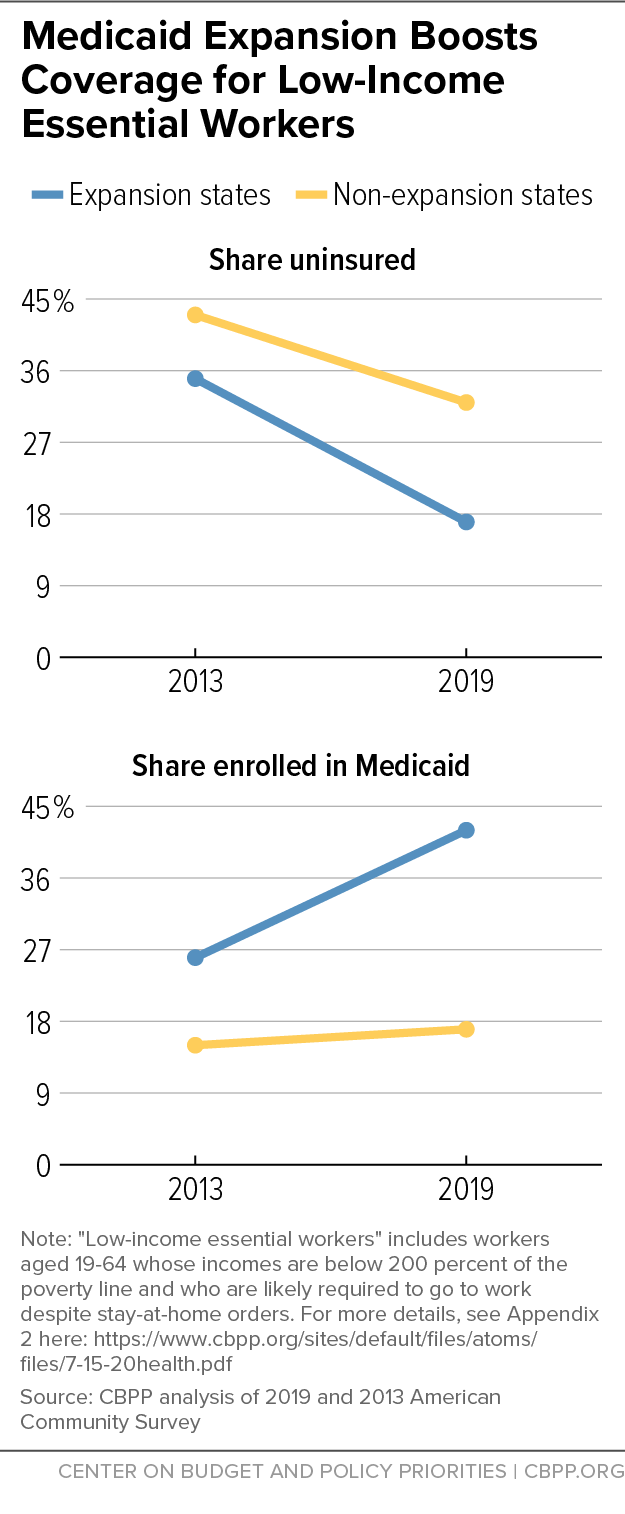

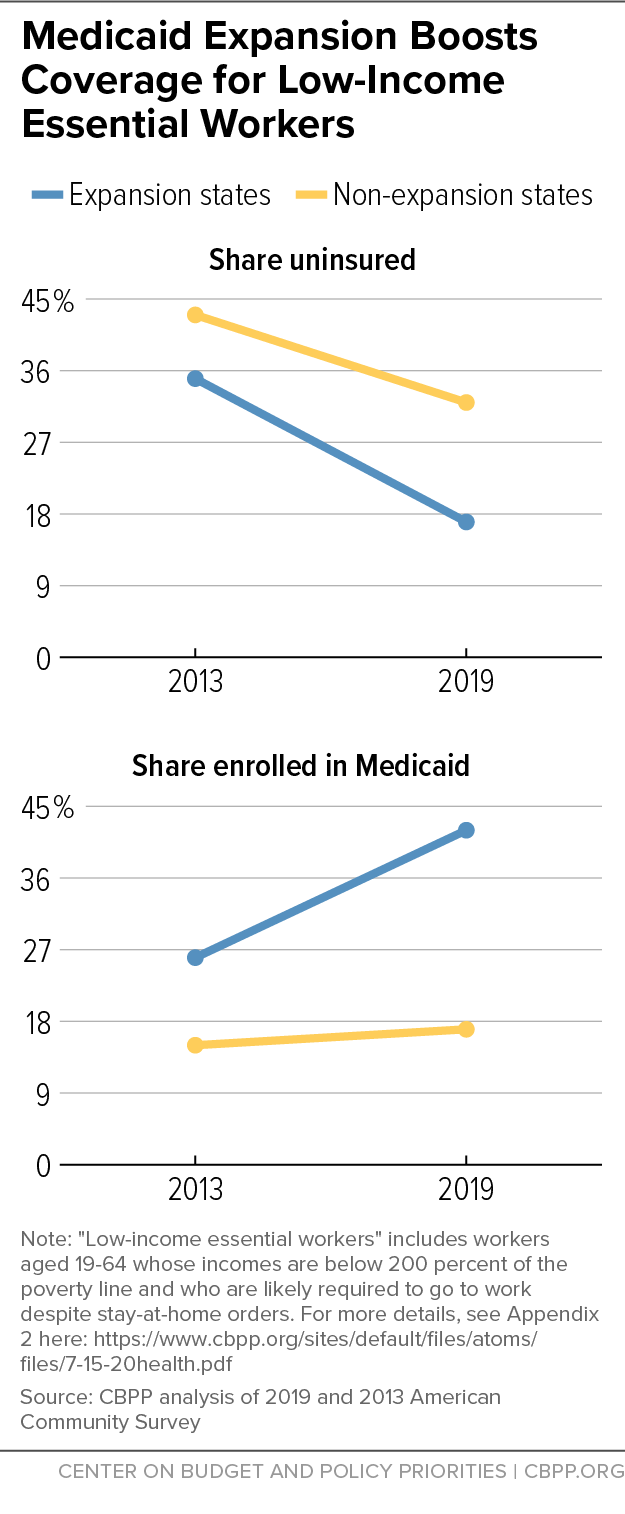

Why did Medicaid expansion fail?

Medicaid expansion failed to account for the human element of public policy— how people and systems are motivated and prodded by incentives. Between 2013 and 2016, total Medicaid spending (state and federal dollars) grew nearly twice as fast in states which expanded eligibility relative to those which did not.

Why do states share a greater portion of the burden with the federal government?

When states share a greater portion of the burden with the federal government, as they do with non-expansion Medicaid enrollees, they monitor insurers closely to reduce costs, which in turn causes insurers to be more judicious in what procedures they cover. Placing 90 percent of the expansion costs on the federal government greatly diminishes ...

What did the federal government threaten to do with Medicaid?

Initially, the federal government threatened to withhold all Medicaid funding for any state refusing to accept the expansion offer. However, the Supreme Court ruled this paired threat to be unconstitutionally coercive. The carrot without the proverbial stick proved sufficient to entice 32 states to adopt the expansion.

How much of the cost of Medicaid will be covered by the federal government?

In order to entice states to adopt this costly expansion, the Affordable Care Act stipulated that the federal government would cover 100 percent of the cost for the first three years of Medicaid expansion, tapering down to 90 percent by 2020 and onward. Initially, the federal government threatened to withhold all Medicaid funding ...

Is expansion bad for the opioid crisis?

But expansion has also created some unexpected, negative impacts, such as fueling the opioid crisis. The benefits for expansion states have come at the immense cost which are, Despite the rosy initial projections, the costs for benefits in expansion states are rising steeply and are likely to climb in the years to come.

Will the spending and debt increase the economic growth?

The spending and debt will suppress economic growth and eventually require a heavier federal tax burden. All states- including those which have not expanded their Medicaid programs—will suffer from this short-sighted strategy. Policy makers should seek to improve medical care and access for low-income individuals.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How much tax do you pay on Medicare?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000. So, in this example, you’d pay $4,075 in Medicare taxes for the year.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What is TCE tax?

Tax Counseling for the Elderly (TCE). TCE centers are available to provide free tax preparation. Call 888-227-7669 or use the IRS locator to find a local center.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What happens when you file Medicare taxes?

In some cases, you might owe more, and in other cases, you might have paid too much. Any payment owed or refund adjustment needed will be added to your overall required payment or refund amount.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

What would happen if Medicare was expanded?

This proposed Medicare expansion, based on Medicare rates and taxpayer subsidies, would further erode private health coverage—and create a new class of persons dependent on government. It would make federal taxpayers pay for private businesses’ heath care bills.

What is the expansion of government health care financing?

The expansion of government health care financing is the expansion of government power and control over Americans’ health care. That, finally, is the point of the Biden ...

Who Would Be Impacted?

Massey Whorely et al., “Medicare Expansion Could Have a Mixed Impact on Premiums,” Avalere Health, Insights and Analysis, May 19, 2021, p. 7 (hereafter “Medicare Expansion Could Have a Mixed Impact on Premiums”), https://avalere.com/insights/medicare-expansion-could-have-a-mixed-impact-on-premiums (accessed June 23, 2021).

What is the age limit for Medicare?

President Joe Biden is committed to expanding the Medicare program by reducing the normal age of entitlement eligibility from 65 to 60. According to his fiscal year (FY) 2022 budget submission to Congress, the President wishes to provide Americans in the 60 to 64 age group “the option to enroll in the Medicare program with ...

What should lawmakers focus on in Medicare reform?

Lawmakers should focus on reforms that improve Medicare, including the Health Insurance Trust Fund, so that the program is solvent and available in the future.

How does Biden's proposal affect private health insurance?

By crowding out private coverage options, the Biden proposal would, over time, further consolidate the nation’s health insurance coverage under direct federal control, thus further weakening competition in the already severely damaged health insurance markets , as well as further eroding personal choice of coverage and alternatives to medical care.

How many people are on Medicare?

Medicare, serving 61.2 million beneficiaries, is the nation’s largest payer for health care benefits and services. Beneficiaries’ premiums cover only 15 percent of the program’s total cost; taxpayers cover the rest. 12

How Does Medicaid Expansion Affect State Budgets?

That’s because the federal government pays the vast majority of the cost of expansion coverage , while expansion generates offsetting savings and , in many states, raises more revenue from the taxes that some states impose on health plans and providers. 19

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much will healthcare cost in 2028?

The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028. This means healthcare will cost an estimated $6.2 trillion by 2028. Projections indicate that health spending will grow 1.1% faster than GDP each year from 2019 to 2028.

When did Trump sign the Cares Act?

On March 27, 2020 , former President Donald Trump signed the CARES Act—a $2 trillion coronavirus emergency relief package —into law. A sizable chunk of those funds—$100 billion—was earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19. 4

How much of the Medicaid expansion will be paid?

States will never be responsible for more than 10 percent of the cost of Medicaid expansion. The federal government paid the full cost of expansion from 2014 through 2016. The federal government's portion gradually dropped to 90 percent by 2020, and will stay there permanently.

Why is Medicaid expansion important?

There are a few reasons for that: Medicaid expansion allows some states to shift certain populations from traditional Medicaid eligibility to the Medicaid expansion category, where the federal government pays a much larger portion of the cost.

How many states are expanding Medicaid?

36 states and the District of Columbia have expanded Medicaid as of early 2021, and two more — Oklahoma and Missouri — will expand Medicaid in mid-2021.

When did the federal government pay for the expansion?

The federal government paid the full cost of expansion from 2014 through 2016. The federal government's portion gradually dropped to 90 percent by 2020, and will stay there permanently. Q.

Does Medicaid cover mental health?

Medicaid expansion reduces the need for state spending on uncompensated care and mental health/substance abuse treatment for low-income residents, since fewer low-income people in the state are uninsured. It also allows states to use the Medicaid program to cover the cost of inpatient medical care for incarcerated people.

How much will the Senate bill increase Medicaid?

Calculations of state costs, derived from the coverage and federal cost estimates prepared by the Centers for Medicare and Medicaid Services (CMS), show that the Senate bill would increase state Medicaid spending—for both benefits and administration—by $32.6 billion for FY 2014 to FY 2019, while the increased Medicaid costs to states under the House bill would be $60 billion for FY 2013 to FY 2019. [3]

Which states have been given temporary increases in their federal matching rates for spending on their existing Medicaid populations for periods of three and?

Massachusetts and Vermont were given temporary increases in their federal matching rates for spending on their existing Medicaid populations for periods of three and five fiscal years, respectively. [5] The rationale offered is that those states have already expanded Medicaid coverage above the levels specified in the Senate bill and thus would incur few or no new costs as a result of the expansion.

How are state level estimates generated?

State-level estimates were generated by using the CMS Actuary’s estimates for the effect of the Medicaid expansions on enrollment at the national level and on federal Medicaid spending to derive the average federal cost per enrollee per year and by using the distribution of the uninsured population by income among the various states as a proxy for the distribution of the population that would be newly enrolled under the expansion provisions.

Why are CMS projections used instead of CBO projections?

CMS projections were used instead of the equivalent CBO projections because CBO implicitly assumes that this expansion would follow the observed pattern of previous expansions, with en rollment growing gradually over a period of years as newly eligible individuals sought assistance or were identified through outreach efforts. In contrast, CMS explicitly (and more plausibly) assumes that other provisions of the legislation—specifically, the individual mandate, the additional eligibility determinations to be conducted by the new exchanges for a much larger population that might be eligible for new subsidies outside of Medicaid, and the Medicaid automatic enrollment provisions—“would result in a high percentage of eligible persons becoming enrolled in Medicaid” and that “the great majority of such persons would become covered in the first year, with the rest covered by [the third year].”

How is administrative cost load calculated?

The added administrative cost load was calculated by applying current ratios for total administrative costs as a percent of total benefit spending and then apportioning those costs between the federal and state governments based on historical data that indicate an average effective Federal Medical Assistance Percentage (FMAP) of 55 percent for all administrative costs.

Why should extra federal funding be earmarked for two states?

While some might consider it illogical that extra federal funding should be earmarked for two states on the grounds that they need it the least, it is likely that the authors of these deals view the extra federal payments as “rewards” to those states for having already imposed on their taxpayers the burdens that Congress intends to impose on the other 48 states.

Does Medicaid expansion affect state budgets?

While the national debate over the cost of these bills has focused largely on their federal budget implications, their Medicaid expansion provisions would also impose significant additional costs on state government budgets and state taxpayers. Not surprisingly, governors and state legislators—from both parties and across the country—are objecting to the added costs that these bills would impose on their states. Their concerns are genuine and justified. [1]

How does Medicaid expansion affect state spending?

The Impact of Medicaid Expansion on State Spending. States must finance a share of the cost of expansion. As such, expanding Medicaid will increase state spending. However, expanding Medicaid also allows states to reduce spending on traditional Medicaid.

What percentage of Medicaid expansion was in 2014?

Key Findings: During 2014–17, Medicaid expansion was associated with a 4.4 percent to 4.7 percent reduction in state spending on traditional Medicaid. Estimates of savings outside of the Medicaid program vary significantly. Savings on mental health care, in the corrections system, and from reductions in uncompensated care range from 14 percent of the cost of expansion in Kentucky to 30 percent in Arkansas.

What are the teal bars on Medicaid?

The teal bars show the two competing effects of expansion on state Medicaid spending. During FY2015 and FY2016, the federal government paid the full cost of expansion and Medicaid spending in expansion states declined by approximately 6 percent relative to nonexpansion states.

What are the benefits of Medicaid expansion?

Prior studies identify several areas where expanding Medicaid reduces other state spending. 9 The three most common include: 1 Mental health and substance abuse treatment: Many states directly support mental health and substance abuse treatment for low-income people without health insurance. With Medicaid expansion, recipients may obtain these services via Medicaid. 2 Corrections: Medicaid expansion allows states to shift the cost of some inmates’ health care from the state corrections budget to Medicaid. 10 3 Uncompensated care: Many states help offset the cost of providing care to people who cannot pay their medical bills. By reducing the number of people without insurance, Medicaid expansion significantly reduces the amount of uncompensated care. 11 Therefore, some states have chosen to reduce payments to health care providers for uncompensated care.

How does expanding eligibility affect Medicaid?

First, expanding eligibility allows states to cut spending in other parts of their Medicaid programs. Second, it allows states to cut spending outside of Medicaid — particularly on state-funded health services for the uninsured.

What does Medicaid expansion do for corrections?

Corrections: Medicaid expansion allows states to shift the cost of some inmates’ health care from the state corrections budget to Medicaid. 10

What happens when states expand Medicaid?

When states expand Medicaid, they may see reduced spending outside of the program. Many states provide health care services to low-income residents; expansion may allow them to provide some of these services via Medicaid.

Drawbacks

Impact on Medicare

Who Would Be Impacted?

Increasing Incentives to Drop Employer Coverage

Social Policy in Search of A Problem

Worsening Medicare’s Financial Condition

- Medicare, serving 61.2 million beneficiaries, is the nation’s largest payer for health care benefits and services. Beneficiaries’ premiums cover only 15 percent of the program’s total cost; taxpayers cover the rest.12Davis, “Medicare Financial Status.” Based on Biden’s budget submission for FY 2022, compared to last year’s spending of $884 billion...

Other Potential Consequences

Conclusion