Medicare tax is a two-part tax where you pay a portion as an automatic deduction from your paycheck, and your employer pays the other part. The tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.

How much do tax payers pay for Medicare?

Jan 10, 2022 · Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The 3.8% tax applies to the lesser of either your net investment income or the amount by which your MAGI exceeds $200,000 (or $250,000 for joint filers). That …

What income is subject to Medicare tax?

Feb 24, 2022 · Medicare taxes fund hospital, hospice, and nursing home expenses for elderly and disabled individuals. In 2022, the Medicare tax rate is 2.9%, which is split between an employee and their employer.

Does Medicare count as health insurance for taxes?

Jun 29, 2010 · Updated on December 06, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn.

How much do I pay for Medicare tax?

Mar 28, 2022 · What is the Medicare tax used for? Medicare payroll tax: 88% ($284 billion) Other funding from taxes, premiums, transfers and interest: 12% ($39 billion)

What tax includes Social Security and Medicare?

Is Medicare included in taxable income?

Is Medicare Part B and D tax deductible?

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

This is a standard deduction, and it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax prov...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

Where is Medicare tax kept?

Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, which is funded with premiums paid by beneficiaries, tax revenue, and investment earnings. 4. ...

How much Medicare tax do self employed people pay?

Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, ...

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Do self employed pay Medicare?

Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury. Medicare tax is kept in the Hospital Insurance Trust Fund ...

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

What is the Medicare tax rate for 2021?

In 2021, the Medicare tax rate is 2.9%, which is split evenly between employers and employees. W-2 employees pay 1.45% and their employer covers the remaining 1.45%. Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Is Medicare a part of self employment?

Medicare as Part of the Self-Employment Tax. You'll take something of a double hit on the Medicare tax if you're self-employed. You must pay both halves of the tax because you're the employee and the employer.

Do you have to pay Medicare taxes if you are self employed?

You'll take something of a double hit on the Medicare tax if you're self-employed. You must pay both halves of the tax because you're the employee and the employer. Together with also paying both halves of the Social Security tax, this obligation is known as the self-employment tax and amounts to 15.3% of your income. 5 .

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

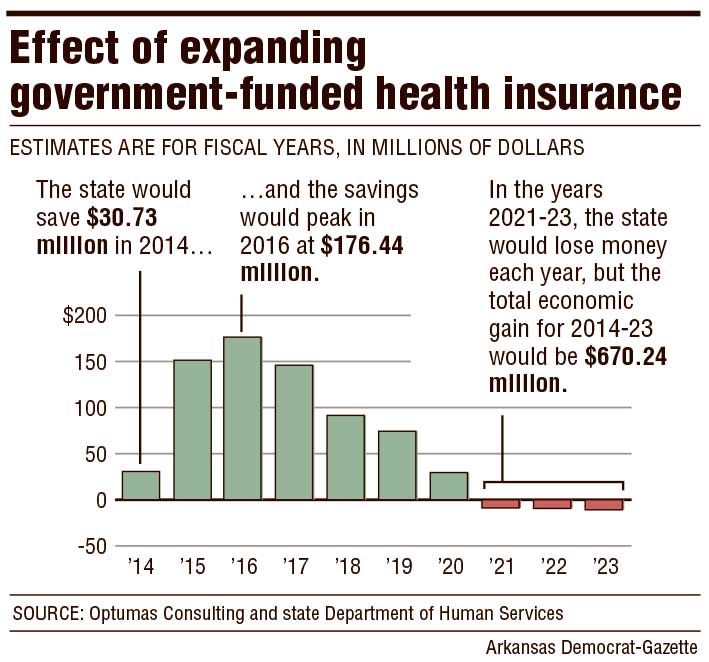

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Is Medicare deductible on taxes?

Share on Pinterest. While a person may need to pay income tax on Social Security benefits, Medicare premiums and out-of-pocket costs are tax deductible. Original Medicare comprises of Part A, hospital insurance, and Part B, medical insurance. Most people who have Part A do not pay premiums, but a person may deduct from their taxes ...

Is Medicare premium tax deductible?

Monthly premiums and out-of-pocket costs of Medicare programs are tax-deductible. When a person has a high accumulation of medical expenses, they may wish to itemize them on their tax return. The Internal Revenue Service (IRS) permits a person to deduct costs that exceed a certain percentage of their income. However, an individual may wish ...

What is a coinsurance for Medicare?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Is Medicare deductible on Social Security?

While a person may need to pay income tax on Social Security benefits, Medicare premiums and out-of-pocket costs are tax deductible. Original Medicare comprises of Part A, hospital insurance, and Part B, medical insurance. Most people who have Part A do not pay premiums, but a person may deduct from their taxes the Part B monthly premium of $148.50.

What is the alternative to Medicare?

The alternative to original Medicare is Part C, also known as Medicare Advantage . A person with this program pays a monthly Part B premium, in addition to their monthly Medicare Advantage plan premium. They may deduct both monthly premiums from their taxes. Some people who have original Medicare may have a Part D plan for prescription drug coverage.

Can you deduct over the counter medications?

People may not deduct costs for items such as: over-the-counter medications. medications from other countries. nicotine patches and gum that do not require a prescription. cosmetic surgery or hair transplants. toothpaste and other toiletries. programs for general health improvement. funeral expenses.

How much is the Part B premium?

Part B premiums are $148.50 per month. $148.50 multiplied by 12 months is $1,782. If a person has surgery, it would involve the Part A deductible of $1,484 for the hospital stay. The total amount for the Part B premium and Part A deductible is $3,266 (not including any other healthcare costs).

Is Medicare Part A essential?

Medicare Part A and Medicare Part C were considered minimum essential coverage under the ACA. If you have one of these plans, the form was sent to prove compliance with the individual mandate and minimal essential coverage requirements.

Do you get a 1095B form if you have Medicare?

Here’s what you need to know about the 1095-B form.

What happens if you don't have Medicare?

If you had Medicare Part A or Medicare Part C, you met the individual mandate. If you didn’t have health insurance coverage, though, you were subject to a penalty fee, which was calculated as a percentage of your income. In 2019, the U.S. Department of Justice and federal appeals courts ruled that the individual mandate was unconstitutional.

What is a 1095-B?

The 1095-B Qualifying Health Coverage Notice is a tax form that was developed in response to a provision of the 2010 Affordable Care Act (ACA). The ACA was phased in over several years, and in 2014, everyone was required to have health insurance through the individual mandate provision. If you had Medicare Part A or Medicare Part C, ...

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

How much is 40 credits for Medicare?

Earning 40 credits qualifies Medicare recipients for Part A with a zero premium. A sliding scale is used to determine premiums for those who work less than 40 quarters. In 2020, this equates to $252 per month for 30 to 39 quarters and $458 per month for less than 30 quarters.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

How much is the 2020 tax premium?

In 2020, the monthly premium starts at $144.60, referred to as the standard premium. Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40.

Self-employed health insurance deduction for Medicare premiums

Self-employed people (who earn a profit from their self-employment) are allowed to deduct their health insurance premiums on Schedule 1 of the 1040, as an “above the line” deduction — which means it lowers their AGI.

Above-the-line deduction for people who are self-employed

If you’re self-employed, the self-employed health insurance deduction — putting your Medicare premiums on Schedule 1 of your 1040 — is the most direct way to reduce your tax burden. And as noted above, this is an “above-the-line” deduction, which means it reduces your adjusted gross income.

Additional considerations

So, let’s review: You’re self-employed, your business made money (congratulations!), and you’re ready to file. Here are few more things to remember before you get started.

Another alternative: Using your HSA funds to pay Medicare premiums

If you have a health savings account (HSA) , know that you can withdraw tax-free money from the account and use it to pay your premiums for Medicare Parts A, B, C, and D (but not Medigap premiums). This is an alternative to deducting your premiums on your tax return, since you can’t do both.

What is Medicare tax?

The Medicare Program. The Medicare tax deducted from employee wages goes towards the Medicare program provided to Americans over 65 years of age. A line item in an employee pay stub, Medicare tax is implemented under FICA (Federal Insurance Contributions Act) and calculated on the employee’s Medicare taxable wage.

What is the Medicare tax rate on W-2?

Employers are required to withhold Medicare tax on employees’ Medicare wages. This is a flat rate of 1.45%, with employers contributing a matching amount. Medicare tax is reported in Box 5 of the W-2 ...

When was Medicare enacted?

In 1965 , Medicare was enacted into law, with Medicare coverage intending to be an important source of post-retirement health care. Medicare is divided into four parts: Part A, Hospital Insurance: This helps pay for hospice care, in-patient hospital care, and nursing care.

What are the gross earnings?

Gross earnings are made up of the following: Regular earnings . Overtime earnings. Paid time-off earnings. Payouts of time-off earnings (Sick, holiday, and vacation payouts) Non-work time for paid administrative leave, military leave, bereavement, and jury duty. Bonus pay.