What are indemnity health plans?

Oct 30, 2021 · Benefits can be as low as $50 for lower-end services and as much as $2,000 for things like surgery. These amounts will be predetermined in your plan. Some average cash benefits you may receive with fixed indemnity health insurance include: $50: X-rays, preventative care. $800 per day: daily hospital confinement or.

What is an indemnity benefit plan?

Indemnity health insurance plans are also called fee-for-service. These are the types of plans that primarily existed before the rise of HMOs, PPOs, and other network-type plans. With indemnity plans, the insurance company pays a pre-determined percentage of the reasonable and customary charges for a given service, and the insured pays the rest. With an indemnity plan, …

What are indemnity plans?

Jul 27, 2021 · Updated on September 21, 2021. Hospital Indemnity insurance can help lower your costs if you have a hospital stay. The average price of a hospital stay for seniors is nearly $15,000 for a five-day visit. While Medicare may cover some of this, it won’t cover the entire cost. Hospital indemnity plans are especially beneficial for those with high deductible insurance plans.

What is indemnity and why is it important?

Medical Indemnity plans, also known as an Indemnity Health Plan, are health plans designed to give you choices when choosing health care providers and facilities.

/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F151047634%2F0x0.jpg%3FcropX1%3D0%26cropX2%3D4256%26cropY1%3D219%26cropY2%3D2612)

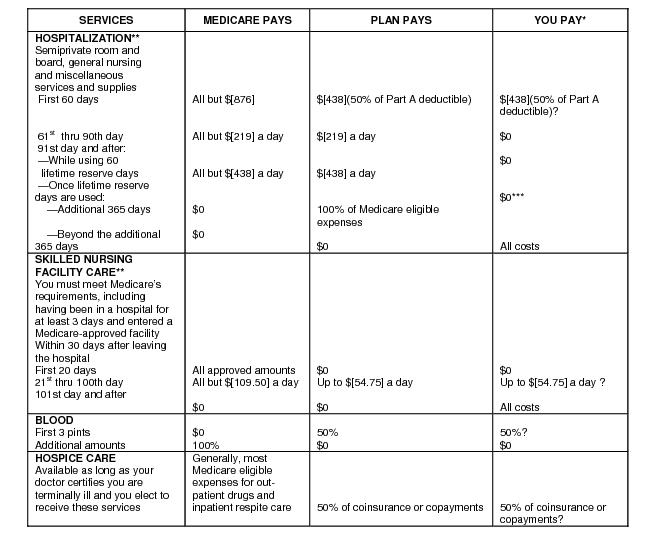

How does an indemnity plan work with Medicare?

What are the cons of an indemnity plan?

How does an indemnity plan work?

What is the difference between an indemnity plan and a PPO?

Are limited-benefit plans worth it?

What is an indemnity benefit?

Are indemnity plans secondary to Medicare?

What is an example of an indemnity plan?

What does indemnity coverage include?

Why do I need indemnity insurance?

What is currently the most popular medical insurance plan in America?

What is the difference between an indemnity insurance plan also known as fee for service and a managed care plan?

What is indemnity health insurance?

An indemnity health insurance plan is a healthcare plan that allows you to choose the doctor, healthcare professional, hospital or service provider of your choice and gives you the greatest amount of flexibility and freedom in a health insurance plan. 1.

What is deductible insurance?

The deductible is the amount you are required to pay before policy benefits are provided. After the deductible, you may be required to pay a co-payment. A co-payment is a percentage you pay of the remaining charges after your deductible. For example: If your eligible charges are $800 and you have a $200 deductible, then that leaves $600 left. Say your co-payment is 20%. That means you are still required to pay 20% of the remaining amount of $600, which would be $120. Find out the deductible and co-insurance requirements of an indemnity health insurance plan to be sure you are able to cover the costs.

Who is Mila Araujo?

Mila Araujo is a certified personal lines insurance broker and the director of personal insurance for Ogilvy Insurance. She has over 20 years of experience in the insurance industry, and as insurance expert, has written about homeowners, auto, health, and life insurance for The Balance.

What is UCR rate?

Usual, Customary, and Reasonable (UCR) Rate. UCR rates are the amounts that medical service providers in your area usually charge for services because indemnity plans are self-managed health insurance plans there is no network specifying the rates that your chosen providers will charge.

Is self refer to a specialist a benefit?

The ability to self-refer to a specialist can be a significant advantage in obtaining the best health care and is easily one of the greatest advantages with indemnity health care insurance plans. 12

Who is Tom Catalano?

Tom Catalano is the owner and Principal Advisor at Hilton Head Wealth Advisors, LLC. He holds the coveted CFP designation from The Certified Financial Planner Board of Standards in Washington, DC, and is a Registered Investment Adviser with the state of South Carolina. Article Reviewed on August 06, 2020.

How does an indemnity plan work?

An Indemnity plan may work for you if: 1 If you want a policy that doesn’t place network limits on doctors or hospitals 2 You don’t want to have a designated primary care physician. 3 You’ll need to be able to pay for your services upfront.

Does Medicare Advantage have deductibles?

Advantage plans usually have low premiums. But Advantage policies can include deductibles, copays, and coinsurance making them more costly. Indemnity insurance joins works with Medicare Advantage to help you pay even less for health coverage. If you want the ultimate protection, these two policies may work for you!

What are the benefits of a syringe?

Benefits can include one of four services: 1 Before your hospital stay 2 During your hospital stay 3 After your hospital stay 4 During an outpatient hospitalization

Does Medicare cover hospital expenses?

Hospital Indemnity payments can work hand-in-hand with Medicare coverage. Medicare may cover a good part of the hospital expenses, but it won’t cover everything. Since these plans are Supplemental, you can gain relief by pairing this plan with your Part A and Part B.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is a Medical Indemnity Plan?

Medical Indemnity plans, also known as an Indemnity Health Plan, are health plans designed to give you choices when choosing health care providers and facilities.

Understanding Insurance

Medical plans are insured and/or administered by Cigna Health and Life Insurance Company (CHLIC) or Connecticut General Life Insurance Company. Plans contain exclusions and limitations and may not be available in all areas. For costs and details of coverage, see your plan documents.

What is an indemnity plan?

Indemnity plans allow you to direct your own health care and visit almost any doctor or hospital you like. The insurance company then pays a set portion of your total charges. Indemnity plans are also referred to as "fee-for-service" plans.

Do you have to pay a deductible on an insurance claim?

An Indemnity plan may also require that you pay up front for services and then submit a claim to the insurance company for reimbursement. You'll likely be required to pay an annual deductible before the insurance company begins to pay on your claims. Once your deductible has been met, the insurance company will typically pay your claims ...

What is eHealth insurance?

eHealthInsurance is the nation's leading online source of health insurance. eHealthInsurance offers thousands of health plans underwritten by more than 180 of the nation's health insurance companies, including Aetna and Blue Cross Blue Shield.

What Does Indemnity Plan Mean?

An indemnity insurance plans allow individuals to direct their own healthcare and visit almost any doctor or hospital they choose. A set portion of the total charges are then covered by the insurance company.

Insuranceopedia Explains Indemnity Plan

There are two types of indemnity insurance plans: professional indemnity and indemnity health. Most indemnity insurance plans are voluntary, but some businesses are required by law to provide such a policy for their employees.

What is indemnity insurance?

The insurance will cover only the cost of damage, not going beyond it. In legal terms, indemnity is a contractual clause that protects one party from being liable to pay for the losses sustained by a third party. In insurance, indemnity insurance is the financial protection given to a business or professional from the financial losses incurred due ...

Why is indemnity insurance important?

Indemnity insurance protects professionals and business owners from capital losses if their client files a civil suit to claim compensation. They are necessary for high-risk professions, such as medical, finance, and legal, to avoid lawsuits in possible oversights.

Do you need indemnity insurance for a building?

Indemnity Insurance for Building. The solicitor or contractor recommends homeowners get this insurance before buying or selling a building of any kind. It is a fundamental step for any homeowner because it may solve problems they never imagined.

Is malpractice insurance compulsory?

Having malpractice insurance is compulsory in the field of medicine. Medical professionals see a large number of civil claims for medical negligence harming patients physically or mentally. A medical indemnity insurance policy usually covers damages from incorrect medicine dosage or wrong prescription and surgical errors.

What is hospital indemnity insurance?

Hospital indemnity insurance is coverage you can add to your existing health insurance plan. This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement. They usually pay you this daily benefit amount for up to a year.

How long do you have to wait to receive your unemployment benefits?

In general, there is a 30-day waiting period before your benefits can be used toward an illness that results in hospital confinement. However, there may not be a waiting period for accidental injuries that land you in the hospital.

How many emergency department visits were there in 2017?

And hospital visits aren’t that uncommon. Did you know that in 2017, there were 139 million emergency department visits? Out of those 139 million, only 40 million of those visits were injury-related. And unfortunately, 14.5 million visits required hospital admission.