IRMAA is the Income Related Monthly Adjustment Amount added to your Medicare Part B and Medicare Part D premiums. You will only need to pay an IRMAA if your annual modified adjusted gross income (MAGI) exceeds a predetermined amount. In 2003, IRMAA was added as a provision to the Medicare Modernization Act.

What income is included in irmaa?

Nov 13, 2021 · IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you’re married), but as discussed below, there’s an …

Who has to pay irmaa?

Nov 16, 2021 · IRMAA is for people with higher yearly incomes on Medicare. We explain what IRMAA is, the relevant parts of Medicare, how to file an appeal, and more. Health Conditions

Does Medicare calculate irmaa annually?

Feb 15, 2022 · February 15, 2022. Reviewed by John Krahnert. The Medicare Part B and Part D Income-Related Monthly Adjusted Amount (IRMAA) charged to higher income earners changed in 2022. Learn how some Medicare beneficiaries may …

Is irmaa based on AGI?

Jul 05, 2017 · The Income-Related Monthly Adjustment Amount (IRMAA) is not a tax per se, but it is an added fee you will pay for Parts B and/or D if your income is above a certain level. The funds go directly to Medicare, not to the private insurance company that sponsors your Medicare plan, and will be based on your modified adjusted gross income or MAGI.

How do I stop paying Irmaa?

How do I know if I have to pay Irmaa?

Who is eligible for Irmaa?

How long do you pay Irmaa?

Do both spouses have to pay Irmaa?

What will Irmaa be in 2023?

| PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART B | ||

|---|---|---|

| Above $149,000 – $178,000 | Above $298,000 – $356,000 | Standard Premium x 2.6 |

| Above $178,000 – $500,000 | Above $356,000 – $750,000 | Standard Premium x 3.2 |

| Greater than $500,000 | Greater than $750,000 | Standard Premium x 3.4 |

Is Irmaa based on AGI or magi?

What is the Irmaa amount for 2021?

Will Irmaa be refunded?

Is Irmaa deducted from Social Security?

What is IRMAA in Medicare?

One such case might be an income-related monthly adjustment amount (IRMAA). IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

Does Medicare pay monthly premiums?

Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income. One such case might be an income-related monthly adjustment amount (IRMAA). IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, ...

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

Does IRMAA affect Part A?

It covers inpatient stays at locations such as hospitals, skilled nursing facilities, and mental health facilities. IRMAA doesn’t affect Part A. In fact, most people who have Part A don’t even pay a monthly premium for it.

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

What are the taxes on Medicare?

Another tax added by the Affordable Care Act is the Net Investment Income Tax (NIIT), also known as the Unearned Income Medicare Contribution Surtax. It applies to people who earn above the following MAGI levels and who have investment income: 1 Single or head of household - $200,000 2 Married filing jointly - $250,000 3 Married filing separately - $125,000 4 Qualifying widow (er) with dependent child - $250,000

When did Medicare start?

The Medicare Tax originated in 1966 and is applied to your earned income, minus any deductions for employer-sponsored health premium or for other pre-tax deductions. It does not apply to capital gains and other investment income. The proceeds from this tax go directly towards the Medicare Trust Fund.

What is Medicare Trust Fund?

Taxes paid to the federal government are put towards the Medicare Trust Fund, which is used to fund Part A coverage only. This includes not only your inpatient hospital care but other services like hospice, skilled nursing facility care, and home health care.

Do self employed pay Medicare taxes?

Those who are self-employed are required to pay the full Medicare Tax amount, both employee and employer contributions. It is expected that the self-employed pay their taxes quarterly to the government or otherwise face late penalties. In 1966, the Medicare Tax began at a modest rate of 0.7 percent.

What is gross income based on?

Your gross income is based on your wages (including tips), income from businesses/investments, interest earned, unemployment benefits, and alimony. It is "adjusted" based on any IRS-approved deductions you can then make, e.g., expenses ranging from IRA contributions to student loan interest.

What is the purpose of MAGI?

For the purposes of Medicare, MAGI is used to determine if you will pay IRMAA.

What is the net investment income tax?

Another tax added by the Affordable Care Act is the Net Investment Income Tax (NIIT), also known as the Unearned Income Medicare Contribution Surtax. It applies to people who earn above the following MAGI levels and who have investment income: Single or head of household - $200,000.

Does Medicare add IRMAA to Part B?

When a person makes more than the allowed income amount, Medicare may add an IRMAA to the Part B premium, Part D premium, or both. The amounts are based on a person’s adjusted gross income, and Medicare adds them every month. This amount can change each year based on a person’s income.

How many income levels are there in IRMAA?

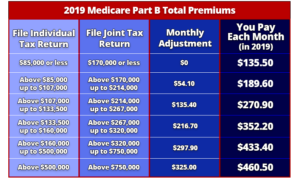

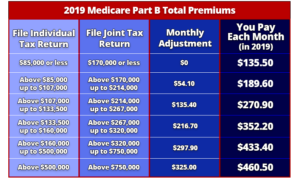

The calculation for IRMAA covers five income levels. There are also three tax filing status levels. The charts below show the five different IRMAA levels for each of the three tax filing status levels for 2021. The examples use the tax year 2019.

What are the different types of Medicare?

Medicare is a federal insurance plan for people aged 65 and over. Younger people may be eligible if they have a disability or end stage renal disease (ESRD). Medicare parts include: 1 Original Medicare, which includes Part A and Part B. Medicare Part A pays hospital costs. Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care. 2 Medicare Part C, also called Medicare Advantage. This policy combines the benefits of Medicare Part A and Part B. People pay a premium for Medicare Part B and for Medicare Advantage. 3 Medicare Part D, a prescription drug plan. Some Medicare Advantage plans also include prescription drug plans. 4 Medicare Supplement Insurance, also called Medigap. These are policies that help pay out-of-pocket costs of original Medicare.

How to get extra help for Medicare?

Extra Help is a program to help pay some of the out-of-pocket costs of Medicare Part D premiums. To get Extra Help, a person must: 1 have Medicare Part A, Part B, or both 2 live in the United States 3 have income and assets below specified limits

What are the parts of Medicare?

Younger people may be eligible if they have a disability or end stage renal disease (ESRD). Medicare parts include: Original Medicare, which includes Part A and Part B. Medicare Part A pays hospital costs. Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care.

What is Medicare Part B?

Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care. Medicare Part C, also called Medicare Advantage. This policy combines the benefits of Medicare Part A and Part B. People pay a premium for Medicare Part B and for Medicare Advantage.

How much is Medicare Part B in 2021?

People must pay a premium for Medicare Part B and Part D. In 2021, the standard premium for Part B is $148.50. Medicare Part D premiums vary depending on the plan a person chooses. The amount of an individual’s Part B premium, Part D premium, or both, may change based on their modified adjusted gross income (MAGI), ...

What is IRMAA?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What are the income brackets for IRMAA Part D and Part B?

The income brackets for both IRMAA for Medicare Part B and Medicare Part D are the same in 2021. They’re based on your 2019 tax returns.

How do I pay my IRMAA Part D and the Medicare IRMAA for Part B?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an acronym for Medicare’s income-related monthly adjustment amount (IRMAA). This is a higher premium charged by Medicare Part B and Medicare Part D to individuals with higher incomes.

How much is Medicare premium 2020?

The beneficiary is left with approximately 25% of the premium – $144.60/month in 2020. For people with higher incomes, you pay a higher percentage of the total – 35, 50, 65 or 80 percent – based on where you fall on Medicare’s income-related monthly adjustment amount scale (see below).

What Is IRMAA?

Am I Eligible to Request A New Initial Determination?

- There are five qualifying circumstances where an individual may be eligible to request a “New Initial Determination.” They are: 1. An amended tax return since original filing 2. Correction of IRS information 3. Use of two-year-old tax return when SSA used IRS information from three years prior 4. Change in living arrangement from when you last filed taxes (e.g., filing status is now “m…

Requesting A New Determination

- If any of the above life-changing events apply, individuals are likely eligible to request a new initial determination by calling their local Social Security office or, alternatively, completing and submitting this formfor reconsideration along with appropriate documentation. We highly recommend calling the Social Security hotline at 800-772-1213 to discuss if more than one LCE …