What medications are not covered by Medicare?

Jul 11, 2018 · Part A and Part B are often referred to as “Original Medicare.”. Original Medicare is one of your health coverage choices as part of the Medicare program managed by the federal government. Unless you choose a Medicare health plan, you will be enrolled in Original Medicare. You can go to any doctor, supplier, hospital, or other facility that is enrolled in Medicare and …

Does Medicare Part B cost money?

Jun 11, 2019 · Both may cover different hospital services and items. Both may cover mental health care (Part A may cover inpatient care, and Part B may cover outpatient services). Both may cover home health care. Both have annual deductibles, as well as coinsurance or copayments, that may apply to certain services.

What are the benefits of Medicare Part B?

Original Medicare (Parts A and B) does not include prescription drug coverage. Medicare Prescription Drug Plan (Part D) is a standalone plan that can be added to Original Medicare to cover prescription drugs. Along with Part D, other plans are available to work alongside your Original Medicare or offer an alternative to Original Medicare altogether.

Does Medicare Part B pay for prescriptions?

You get all of your Part A and Part B coverage, and prescription drug coverage (Part D), through these plans. Medicare Advantage Plans with prescription drug coverage are sometimes called "MA-PDs." If you decide not to join a Medicare drug plan when you’re first eligible, and you don’t have other credible prescription drug coverage, you will likely pay a late enrollment penalty.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What's the difference between Medicare Part A and Medicare Part B?

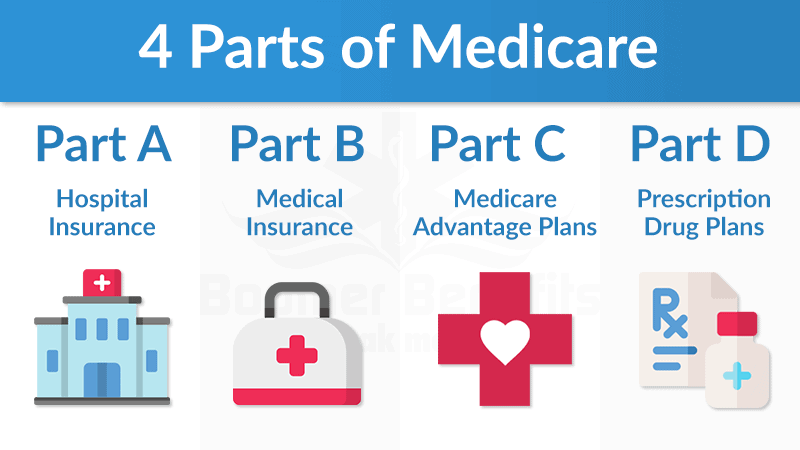

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

What benefits fall under Medicare Part A?

Part A generally covers inpatient hospital stays, skilled nursing care, hospice care, and limited home health-care services. You typically pay a deductible and coinsurance and/or copayments.

What is billed under Medicare Part A?

In general, Part A covers: Inpatient care in a hospital. Skilled nursing facility care. Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care) Hospice care.

What does Medicare C and D cover?

Medicare is a federal insurance plan. Medicare Part C combines the benefits of Part A and Part B, while Medicare Part D covers prescription drugs. Medicare Part A and Part B are known collectively as original Medicare. Part A covers hospital costs, and Part B covers other medically necessary expenses.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does Medicare Part A cover dental?

Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What medical expenses are not covered by Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

Do you need Part B Medicare?

Medicare Part B isn't a legal requirement, and you don't need it in some situations. In general, if you're eligible for Medicare and have creditable coverage, you can postpone Part B penalty-free. Creditable coverage includes the insurance provided to you or your spouse through work.

Does Medicare Part A cover emergency room visits?

Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

What is Medicare Part A?

Medicare Part A is hospital insurance. It may cover your care in certain situations, such as: You’re admitted to a hospital or mental hospital as an inpatient. You’re admitted to a skilled nursing facility and meet certain conditions. You qualify for hospice care.

How much does Medicare pay if you work for 10 years?

If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium. If you worked 30-39 quarters, you’ll generally pay $240 in 2019. If you worked fewer than 30 quarters, you’ll generally pay $437 in 2019. On the other hand, most people do pay a monthly premium for Medicare Part B.

How many Medicare Supplement Plans are there?

There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance. You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

What are preventive services?

Preventive services, like annual checkups and flu shots. Medical supplies and durable medical equipment, such as walkers and wheelchairs. Certain lab tests and screenings. Diabetes care, such as screenings, supplies, and a prevention program. Chemotherapy.

Can you get hospice care with Medicare?

You qualify for hospice care. Your doctor orders home health care for you and you meet the Medicare criteria. Medicare Part A may cover part-time home health care for a limited time. Even when Medicare Part A covers your care: You may have to pay a deductible amount and/or coinsurance or copayment.

Do you have to pay Medicare Part A or B?

Although both Medicare Part A and Part B have monthly premiums, whether you’re likely to pay a premium – and how much – depends on the “part” of Medicare. Most people don’t have to pay a monthly premium for Medicare Part A. If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium.

What is Medicare Part A?

The short answer is hospital insurance. Medicare Part A covers your costs for hospital visits#N#or other facilities. For example, Part A will include your room charges for a hospital visit. Here are the services that are usually covered by your Part A plan: 1 Inpatient care in a hospital 2 Skilled nursing facility 3 Nursing home care (when needed for short-term rehabilitation; not long-term) 4 Some home health care 5 Hospice care

What is a Part B deductible?

The Part B deductible, A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself.

How long do you have to enroll in Medigap after turning 65?

If you want to add Medicare Supplement Insurance (Medigap) to cover any gaps in your coverage, you have six months after you turn 65 to enroll in Medigap coverage without going through a health evaluation.

What is Medicare Advantage Plan?

Medicare is a public health insurance. Health insurance is a form of insurance that covers a portion of your medical expenses. In exchange, you pay a monthly premium and other costs. program available in two ways: Original Medicare and Medicare Advantage Plan (Part C). The basics of Medicare coverage are Part A, Part B, Part C, and Part D.

What is the most popular Medicare plan?

The most popular plan is Original Medicare (Parts A and B), but there has been a steady rise in Medicare Advantage popularity. If you’re new to Medicare, your coverage options may seem complicated. Don’t worry. We have answers to common questions about Medicare.

How many different Medicare Supplement Plans are there?

Medicare Supplement Insurance (Medigap) has ten different plans, all of which offer different services designed to cover medical issues or costs not picked up by Part A or Part B.

How much does Medicare pay after deductible?

Once you reach the deductible amount, you pay only 20% of Medicare-approved services for the rest of your benefit year. Medicare pays 80% of costs after deductible. For example: After your deductible is satisfied, a $100 doctor visit will cost you $20 (20%), and Medicare will pay $80.

What Is Medicare Part A (Hospital Insurance)?

Part A is hospital insurance that helps cover inpatient care in hospitals, skilled nursing facility, hospice, and home health care.

What Is Medicare Part B (Medical Insurance)?

Part B helps cover medically-necessary services like doctors' services, outpatient care, home health services, and other medical services. Part B also covers some preventive services. Check your Medicare card to find out if you have Part B.

What Is Medicare Part D (Medicare Prescription Drug Coverage)?

Medicare prescription drug coverage is insurance run by an insurance company or other private company approved by Medicare. There are two ways to get Medicare prescription drug coverage: Medicare Prescription Drug Plans.

What is Medicare Part A and Part B?

Enrollment. Takeaway. Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor’s visits and other aspects of outpatient medical care. These plans aren’t competitors, but instead are intended to complement each other ...

How much does Medicare Part B cost?

If you enrolled in Medicare during the open enrollment period and your income did not exceed $88,000 in 2019, you’ll pay $148.50 a month for your Medicare Part B premium in 2021.

What are the expenses for Medicare 2021?

For 2021, these expenses include: Quarters worked and paid Medicare taxes. Premium. 40+ quarters.

What is the Medicare deductible for 2021?

The annual deductible for 2021 is $203.

What is the deductible for Medicare Part B 2021?

The annual deductible for 2021 is $203. If you do not sign up for Medicare Part B in your enrollment period (usually right around when you turn age 65), you may have to pay a late enrollment penalty on a monthly basis.

How much is the 2021 Medicare premium?

Costs in 2021. most pay no monthly premium, $1,484 deductible per benefit period, daily coinsurance for stays over 60 days. $148.50 monthly premium for most people, $203 annual deductible, 20% coinsurance on covered services and items.

How old do you have to be to qualify for Medicare?

Eligibility. For Medicare Part A eligibility, you must meet one of the following criteria: be age 65 or older. have a disability as determined by a doctor and receive Social Security benefits for at least 24 months. have end stage renal disease.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

What is a secure gov website?

A .gov website belongs to an official government organization in the United States. Secure .gov websites use HTTPS. A lock (. lock. A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites. Basics Basics Basics.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Part B insurance?

Part B primarily helps cover costs of outpatient treatment and preventive care, such as visits to a doctor, medical equipment, and some prescriptions. The two parts have different out-of-pocket costs, including deductibles and coinsurance.

What is Part B?

Part B covers medically necessary services — those needed to support the diagnosis or treatment of a health problem. It also covers preventive services, such as regular checkups. Examples of eligible services include: most visits to a doctor. mental health treatments — inpatient or outpatient. ambulance transportation.

How much is Medicare Part B premium 2020?

Part B premium. A premium also applies for Medicare Part B. For 2020, the monthly premium is $144.60. If a person has an annual income of more than $87,000 as an individual or $174,000 alongside their spouse, they may be subject to an income-related adjustment. This adds a fee to the monthly premium.

How much does Medicare cost if you pay for 40 quarters?

If a person has paid Medicare taxes for 30–39 quarters, their premium is $252.

What is Medicare search?

durable medical equipment, such as crutches. some outpatient prescription medications. Medicare has a search function that allows a person to check whether a specific service, treatment, or device is covered — and, if so, by which Medicare part.

How long does it take to enroll in Medicare?

A person can enroll in Medicare during the “initial enrollment period.”. This extends from 3 months before the month of the person’s birthday to 3 months after it. It is possible to enroll outside of this period, but there may be a late enrollment penalty fee.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.