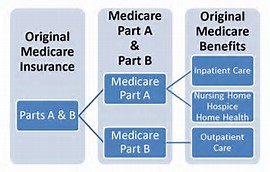

Medicare features a handful of "parts," with different functions. Part A covers inpatient hospital care (such as surgery), as well as care provided by skilled nursing facilities, hospice

Hospice

Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…

What does Medicare Part a hospital insurance cover?

May 09, 2015 · Medicare Part A, the traditional form of Medicare that is funded through payroll taxes, only covers costs associated with inpatient healthcare, skilled nursing, some home healthcare, and hospice.

Does Medicare Part a cover home care?

Medicare features a handful of "parts," with different functions. Part A covers inpatient hospital care (such as surgery), as well as care provided by skilled nursing facilities, hospice, and some...

What are the different types of Medicare coverage?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care. What Part B covers Learn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care.

What's covered by Medicare Advantage plans?

The amount you pay can change each year depending on your income. If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. 2015 Part B Deductible. The 2015 Medicare Part B annual deductible remains $147 (unchanged from 2014 and 2013). 2015 Part B Premium Slightly higher Income Related Medicare ...

What services are covered under Medicare Part A?

In general, Part A covers:Inpatient care in a hospital.Skilled nursing facility care.Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care)Hospice care.Home health care.

What benefits fall under Medicare Part A?

Part A generally covers inpatient hospital stays, skilled nursing care, hospice care, and limited home health-care services. You typically pay a deductible and coinsurance and/or copayments.

What is not covered under Medicare Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

What covers the Part A deductible of Medicare?

Medicare Part A Deductible Medicare Part A covers certain hospitalization costs, including inpatient care in a hospital, skilled nursing facility care, hospice and home health care. It does not cover long-term custodial care. For 2022, the Medicare Part A deductible is $1,556 for each benefit period.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Whats the difference between Medicare Part A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

Does Medicare Part A pay for surgery?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare Part A cover medications?

Generally, Part A payments made to the hospital, SNF, or other inpatient setting cover all drugs provided during a covered stay. If a person with Medicare gets hospice care, Part A will cover drugs they get for symptom control or pain relief.

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

How often do you pay Medicare Part A deductible?

Key Points to Remember About Medicare Part A Costs: With Original Medicare, you pay a Medicare Part A deductible for each benefit period. A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

What do Medicare Parts A and B cover?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

Does Medicare have a maximum out of pocket?

There is no limit on out-of-pocket costs in original Medicare (Part A and Part B). Medicare supplement insurance, or Medigap plans, can help reduce the burden of out-of-pocket costs for original Medicare. Medicare Advantage plans have out-of-pocket limits that vary based on the company selling the plan.

How much does Medicare pay for Lou Gehrig's disease?

Also, people who don't qualify for Medicare Part A can choose to pay as much as $407 per month to buy it.

How long do you have to pay payroll taxes to get Medicare?

Typically, someone who pays payroll taxes for 10 years amasses enough credits to qualify to receive Medicare Part A. Since 10 years is also the typical amount of time required to qualify for Social Security, people who qualify for Social Security, including those who qualify as a spouse, usually also qualify for Medicare Part A.

How much is Part A tax?

That payroll tax is currently 2.9% annually , and it's split between employees and employers. High income earners pay an additional 0.9% per year.

What is Medicare Part A?

Medicare Part A is a valuable program that provides peace-of-mind to millions of seniors, many of whom will require hospitalization at some point during their golden years.

When was Medicare Part A created?

Medicare Part A was born in 1965 under XVIII of the Social Security Act, but while it was created under Social Security, the program is run by the Centers for Medicare and Medicaid Services, which are part of the Department of Health and Human Services. People become eligible for Part A after they have paid into the system through payroll taxes ...

Does Medicare pay inpatient expenses if you are readmitted?

That means if you are readmitted within the 60 day window, Medicare Part A will continue paying inpatient expenses, however if you're admitted on day 61 or later, then you'll be on the hook for that deductible again. Filling the gaps.

Does Medicare pay for home health?

Medicare Part A will also help pay for some home healthcare, but strict limitations and qualifications apply. Generally, Medicare Part A will pay for eligible nursing care, physical therapy, speech-language pathology services, and continued occupational services, but only if a patient is under the care of a doctor, is home bound, ...

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How much is Medicare Advantage premium for 2015?

The 2015 Medicare Advantage plan premiums range from $0 to $348.

How much is Medicare Part B deductible in 2015?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2015 Medicare Part B annual deductible remains $147 (unchanged from 2014 and 2013).

What is Medicare Part D 2015?

2015 Part D (Medicare Prescription Drug Plan) Monthly Premium & Deductible. Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage ...

How much is the 2015 Part D premium?

The 2015 Part D plan premiums range from $0 to $172. The 2015 standard Part D plan deductible is $320, however the actual plan deductible can be anywhere from $0 to $320 .

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

What happens if you wait to enroll in Part A?

Keep in mind that if you wait to enroll in Part A after you’re first eligible, you may owe a late-enrollment penalty in the form of a higher premium. Your Part A premium could go up 10%, and you’ll have to pay this higher premium for twice the number of years that you could have enrolled in Part A but went without it.

Does Medicare cover nursing care?

Medicare Part A only covers nursing care if skilled care is needed for your condition. You must require more than just custodial care (help with daily living tasks, such as bathing, dressing, etc.).

What happens when you turn 65?

When you turn 65, you become eligible for Medicare benefits. If you are already receiving retirement benefits from either Social Security or the Railroad Retirement Board when you turn 65, these administrations automatically enroll you in both parts of Medicare.

How long do you have to pay Medicare taxes to get premium free?

If you or your spouse has worked and paid Medicare taxes for at least 40 quarters (10 years), you are eligible for premium-free Part A Medicare. Here’s a detailed look at what Part A covers: 1. Inpatient care in a hospital.

How long does Medicare cover long term care?

Long-term care hospital. Part A covers the cost of long-term care in a Medicare-approved facility for up to 60 days after you pay your deductible for the current benefit period. After 60 days you pay the costs that apply. 4. Hospice care.

What percentage of Medicare Part A is covered by home health?

Your Medicare Part A benefits also cover 100 percent of the cost for certain home health services if you’re eligible. If you need durable medical equipment, you pay 20 percent of the Medicare-approved cost for this equipment.

What is Part A coverage?

Under Part A, you also get coverage in: • Acute care and critical access hospitals. • Inpatient rehabilitation and psychiatric facilities. • Long-term care hospitals. • Inpatient care if you are in a qualifying clinical research study. 2. Skilled nursing facility care.

Does Medicare cover skilled nursing?

Medicare hospital insurance (Part A), covers care in a skilled nursing facility on a short-term basis if you have days remaining in your current benefit period, you’ve been in the hospital and need more skilled nursing care to get better, or your doctor orders this care for a specific reason .

Does Medicare Advantage have the same coverage as Medicare Part A?

If you choose to enroll in a Medicare Advantage plan, you will have at least the same coverage as Original Medicare Part A and Part B, but most Medicare Advantage plan include additional benefits. If you’ll be qualifying for Medicare soon, or want to explore your options, check out the Medicare Advantage plans in your area.

How much is the deductible for inpatient hospital?

This is about a $24 increase since 2018. The inpatient hospital deductible covers the patient’s share of costs for the first 60 days of hospital care. In 2019, beneficiaries will have to pay a coinsurance amount of $341 per day for days 61 to 90 and $682 per day for lifetime reserve days (anything past 90 days).

How much is the deductible for Medicare Part A?

In 2019, the deductible for hospital admission was $1,364 per year. This is about a $24 increase since 2018.

What happens if you miss Medicare enrollment?

It’s important to note that if you miss the enrollment period, you could end up paying a higher premium for Medicare Part A and Medicare Part B. The Bottom Line. Medicare Part A coverage is government-run health insurance that covers hospital care for people age 65 and older. It covers most costs, but it does not cover the cost ...

What is Medicare Part A?

Medicare Part A is the basic Medicare coverage that all qualifying Americans receive at age 65. Learn how it works and what it costs and covers. Loading. Home Buying.

How much does Medicare cost if you don't have free coverage?

If you’re not eligible for free coverage, you can buy Medicare Part A. You may have to pay up to $427 each month for your premium. If you paid Medicare taxes for less than 30 quarters, your standard premium payment will be $437. If you paid Medicare taxes for 30 to 39 quarters, your standard premium will be $240.

What are the parts of Medicare?

There are two parts that makeup Medicare: Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). As you head into retirement, it’s important to understand what each component of Medicare entails. Read on to discover what Medicare Part A coverage includes and how much it may cost.

Does Medicare cover coinsurance?

Keep in mind, even if Medicare covers services or required supplies, you may still have to pay a deductible, coinsurance and copayment. And, if you have a Medicare Advantage Planor other Medicare plan, different rules may apply. What Medicare Part A Does Not Cover.

How much is Medicare coinsurance for 2021?

Days 61-90 : $352 coinsurance per day ($371 in 2021) Day 91 and beyond : $704 coinsurance per day for each "lifetime reserve day" after the benefit period ($742 in 2021) You get 60 “lifetime reserve days” while on Medicare. These are extra days you can apply toward your qualified stay.

How much does Medicare pay for a month?

If you’re getting retirement benefits or are eligible for retirement benefits, Medicare Part A has a $0 monthly premium payment. The same rule applies if you’re under 65 years old and have been claiming federal disability benefits for at least 24 months, or if you’ve been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis, or ALS). Americans who are eligible for Medicare, but not other federal benefits, can still get coverage for a monthly premium up to $471.

How long do you have to stay in the hospital?

If you are staying at the hospital, you’ll have to make sure you're an inpatient — that a doctor must order you to stay in the hospital for at least three days (two “midnights”). (The hospital or facility must accept Medicare.)

What is Medicare Part A?

Medicare Part A, when combined with Medicare Part B (which covers outpatient insurance) is known as Original Medicare. Much of the care you receive through Medicare Part A is free, like home health services and hospice care.

When do you enroll in Medicare Part A?

If you’re on federal retirement benefits, you get automatically enrolled in Medicare Part A and Medicare Part B on the first day of the month you turn 65. Otherwise, you will need to sign up yourself during your initial enrollment period, which starts three months before you turn 65.

Can you give yourself an intravenous injection?

After you are discharged from a hospital stay, you may still need care that you can’t give yourself, like an intravenous injection. If that’s the case, your doctor might order a stay at a skilled nursing facility where a skilled professional can administer your treatment and provide you with the proper medication.

Is hospice free?

Hospice care is free . There may be a small copayment of $5 for drugs or pain relief medication. (However, a Medicare prescription drug plan may end up covering the costs.)

How to enroll in Medicare Part A?

There are three ways to enroll in Medicare Part A: Go online to SocialSecurity.gov and click on “ Medicare Enrollment “ . Call the Social Security office at 800-772-1213. If you need TTY, call 800-325-0778. This service is open Monday through Friday from 7 a.m. to 7 p.m. Apply in person at your local Social Security Office.

How long do you have to work to get Medicare?

When you work, your employer (or you, if you’re self-employed) takes out money for Medicare taxes. As long as you or your spouse works for 10 years paying Medicare taxes, you get Medicare Part A without a premium when you’re 65 years old.

What is Medicare coverage?

Costs. Other Medicare parts. Eligibility. Enrolling. Takeaway. Medicare is the national health insurance program in the United States. If a person is age 65 or older or has certain medical conditions, they can receive Medicare coverage. The Centers for Medicare and Medicaid Services run Medicare, and they divide services into parts A, B, C, and D. ...

What are some examples of Medicare services?

Examples of services covered under each include: Part B. Medicare Part B covers some expenses for doctors’ visits, medical equipment, diagnostic screenings, and some other outpatient services that you may need. Part C. Medicare Part C (Medicare Advantage) covers the services of parts A and B.

What is inpatient care?

Inpatient care in a hospital includes services like meals, nursing services, physical therapy, and medications that a doctor says are important for care. Medicare Part A usually only covers emergency room visit costs if a doctor admits you to the hospital. If a doctor doesn’t admit you and you return home, Medicare Part B or your private insurance ...

How long after your previous health insurance ends can you apply for Medicare?

In this case, you can apply for Medicare Part A within the 8 months after your previous coverage ended.

What is the number to call for dental care?

most dental care services. routine foot care. If you aren’t sure if a service is covered under different Medicare types, you can call 800-MEDICARE (800-633-4227) to ask. If you or a loved one is in the hospital, you’ll usually have a case worker assigned to you who can help answer questions about Medicare coverage.