Medicare beneficiaries who have Part B premiums withheld from their Social Security checks—about 70% of beneficiaries—will continue to pay $104.90 per month for Part B. If you aren’t collecting Social Security yet or will enroll in Medicare in 2016, you will have to pay $121.80 per month in 2016.

What is the Medicare Part a deductible for 2016?

Those who had less than 40 quarters of coverage will pay either $226 per month for Part A if they worked 30 to 39 quarters or $411 per month if they had …

What does Medicare Part a cover?

Nov 10, 2015 · The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. The Part A deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Does Medicare Part a cover inpatient hospital care?

Medicare Minute Teaching Materials – June 2016 Medicare Part A-Covered Services. 1) What types of hospital care does Medicare cover? Original Medicare has parts that cover different health care services and items. Part A, also known as “hospital insurance,” covers inpatient hospital care, skilled nursing facility (SNF) care, home health care services, and hospice care.

What does Medicare Part B cover?

In general, Part A covers: Inpatient care in a hospital; Skilled nursing facility care; Nursing home care (inpatient care in a skilled nursing facility that’s not custodial or long-term care) Hospice care; Home health care; 2 ways to find out if Medicare covers what you need

What services are covered under Medicare Part A?

In general, Part A covers:Inpatient care in a hospital.Skilled nursing facility care.Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care)Hospice care.Home health care.

What does Medicare Part A reimburse for?

Medicare Part A covers hospital services, hospice care, and limited home healthcare and skilled nursing care. All your Part A–related expenses are covered by Medicare if you receive them through a participating provider who accepts Medicare assignment.

What is not covered under Medicare Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Does Medicare Part A cover 100%?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Does Medicare Part A pay for surgery?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare Part A cover medications?

Generally, Part A payments made to the hospital, SNF, or other inpatient setting cover all drugs provided during a covered stay. If a person with Medicare gets hospice care, Part A will cover drugs they get for symptom control or pain relief.

What is the difference between Medicare Part A and Part B?

Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care. Together, the two parts form Original Medicare.May 7, 2020

Does Medicare have a lifetime limit?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

What do Medicare Parts A and B cover?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.

What is Medicare Part A?

Part A, also known as “hospital insurance,” covers inpatient hospital care, skilled nursing facility (SNF) care, home health care services, and hospice care. Medicare Part A covers inpatient hospital care for at least 90 days each benefit period (see questions 4 and 5). A benefit period begins the day you’re admitted as an inpatient and ends when you’ve been out of a hospital or SNF for at least 60 days in a row. Part A also covers 60 lifetime reserve days. While Medicare Advantage Plans must offer the same benefits as Original Medicare, they may offer more services, have additional restrictions, and charge different costs. If you have a Medicare Advantage Plan, contact your plan to find out how hospital services are covered for you.

Does Medicare cover prescription drugs?

How Medicare covers prescription drugs depends on whether you are an inpatient or an outpatient. If you are an inpatient, medically necessary medications are covered under Part A. If you are an outpatient, Part B covers a limited number of medications, and it usually does not pay for drugs that you can self-administer. For covered Part B prescription drugs you get in a hospital outpatient setting, you pay a copayment. If you get drugs not covered under Part B in a hospital outpatient setting, you pay 100 percent for the drugs, unless you have Medicare Part D or other prescription drug coverage; what you pay depends on whether your drug plan covers the drug, and whether the hospital is in your drug plan’s network.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What is Medicare Advantage?

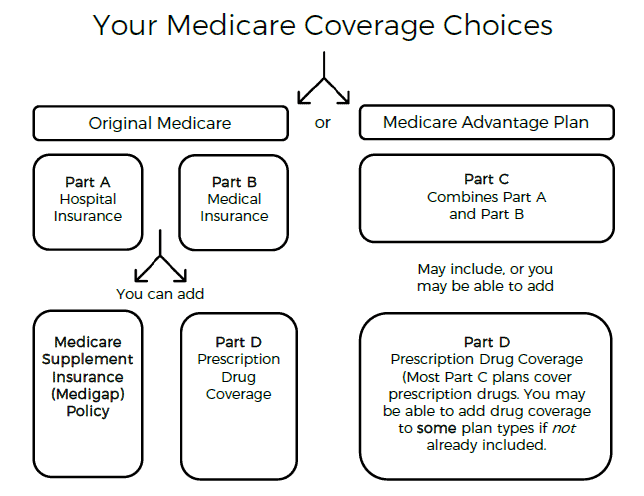

Within Medicare, there’s Original Medicare, which is parts A and B, as well as supplemental Medicare, which includes Part D (drug coverage), Medigap, which is a privately run supplemental part of Medicare that covers things Original Medicare doesn’t, and Medicare Advantage, which is a hybrid plan that covers most medical expenses, as well as what Medicare Part A and Part B cover.

Does Medicare cover home care?

If you have a medical condition that requires occasional nursing visits, physical or speech therapy, or a similar kind of at-home care, Medicare may cover close to all of the related expenses. (Note that 24-hour home care is not covered, however.)

Learn how this part of the Medicare program works

Retirees rely on Medicare to help them with their healthcare expenses, but getting a better understanding of how the program's different components can be challenging. Medicare Part B plays a key role in the everyday aspects of healthcare, and below, you'll learn more of the specifics of how much Part B costs and what it covers.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

What is Medicare Advantage?

A Medicare Advantage Prescription Drug Plan is an alternative way to receive your Original Medicare benefits (except for hospice care, which is still provided by Part A) and also receive prescription drug coverage, along with additional benefits like routine dental and vision care in some cases.

Is oxygen therapy covered by Medicare?

Also, you may be covered under Medicare Part B for equipment and supplies for medically necessary oxygen therapy for you COPD; you’d need to pay 20% of the Medicare-approved amount and any applicable Part B deductible.

Is COPD covered by Medicare?

Under Original Medicare (Part A and Part B), you are generally covered for most medically necessary treatments for COPD. If you get inpatient care in the hospital, Medicare Part A pays for allowable charges, while treatment in your doctor’s office or other outpatient center is covered under Medicare Part B.

Can you get Medicare for COPD?

Specifically, people with moderate to severe COPD may be eligible for Medicare Part B ( medical insurance) coverage of pulmonary rehabilitation programs prescribed by your doctor .