2021 Medicare Part A coverage for an inpatient hospital typically includes:

- semi-private rooms

- meals

- nursing care

- drugs

- medical equipment that a doctor uses during the inpatient stay

- rehabilitation services, such as physical therapy

Full Answer

What is the difference between Medicare Part an and Part B?

Summary:

- Both Medicare Part A and B are federally funded plans that come with different coverages.

- Part A is free, and the patients need not pay a premium for the coverage. People have to pay some premium for availing themselves of the Part B coverage.

- Part A can be called hospital insurance whereas Part B can be termed as medical insurance.

What does part a cover in Medicare?

- You are 65 or older and meet the citizenship or residency requirements.

- You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work.

- You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

What are the four parts of Medicare?

Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is premium part a Medicare?

Medicare’s premiums and deductibles have seen a larger-than-expected rise this year. For example, Medicare Part B monthly premiums have risen to $170.10, a 14.5% increase. The deductible for Part B rose to $233. The Part A deductible increased to $1,556 ...

What do you get with Medicare Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

What is not covered by Medicare Part A?

Medicare Part A will not cover long-term care, non-skilled, daily living, or custodial activities. Certain hospitals and critical access hospitals have agreements with the Department of Health & Human Services that lets the hospital “swing” its beds into (and out of) SNF care as needed.

Does Medicare Part A cover 100%?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is the difference between Medicare Part A and B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

Does Medicare Part A pay for surgery?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare Part A cover emergency room visits?

Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Does Medicare Part A pay for xrays?

If you receive an X-ray as an inpatient, coverage would fall under Medicare Part A. You'll pay your Medicare Part A deductible for each benefit period. In 2020, the deductible is $1,408. Once that amount has been met, medically necessary services ordered by your doctor will be covered.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Does Medicare Part A cover prescriptions?

Some Medicare Advantage Plans or other Medicare health plans offer prescription drug coverage. You generally get all of your Medicare Part A (Hospital Insurance), Medicare Part B (Medical Insurance), and Part D through these plans.

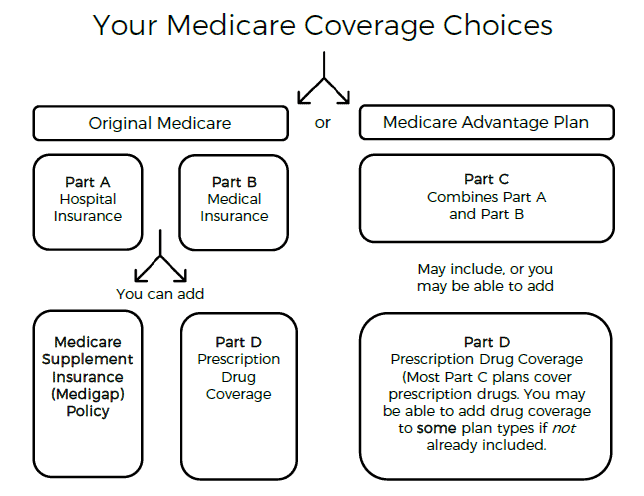

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Which is Better Part A or Part B?

Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care. These plans aren't competitors, but instead are intended to complement each other to provide health coverage at a doctor's office and hospital.

Do you have to pay for Medicare Part B?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

What is covered by Medicare Part A?

2021 Medicare Part A coverage for an inpatient hospital typically includes: 1 semi-private rooms 2 meals 3 nursing care 4 drugs 5 medical equipment that a doctor uses during the inpatient stay 6 rehabilitation services, such as physical therapy

How many quarters does Medicare cover?

Medicare Part A plans are free for people who have worked for 40 quarters and paid Medicare tax. According to the United States Census Bureau, Medicare plans provided coverage to approximately 17.9% of the population in 2018. In this article, we define what Medicare Part A covers and its cost.

What is the Medicare deductible for inpatient hospital stays in 2021?

People who use their Medicare Part A coverage for inpatient hospital stays still have to meet their deductible before Medicare funds any treatment. In 2021, this deductible is $1,484.

How much does Medicare pay for a skilled nursing home stay?

If an inpatient stay extends beyond 90 days, Medicare provides 60 reserve days that will cost a person $742 a day. Medicare Part A also covers skilled nursing home stays. However, the rules are different. There is no copayment for the first 20 days of the stay. Between days 21 and 100, the copayment is $185.50 per day.

How much does Medicare pay for an additional day?

For example, Medicare Part A covers the first 60 days of an inpatient stay. However, an individual will have to pay $371 for each additional day between 61 and 90 days.

How much is the copayment for skilled nursing?

Between days 21 and 100, the copayment is $185.50 per day . Medicare Part A does not cover more than 100 days of an inpatient stay in a skilled nursing facility, which means that the individual is responsible for the entire cost after their 100th day in the hospital.

What is Medicare 2021?

2021 coverage. Summary. Medicare is federal health insurance for people aged 65 years or older and for younger people with disabilities. There are four parts of Medicare: A, B, C, and D. Part A covers inpatient care, skilled nursing services, some home health and rehabilitation costs, and hospice care. Medicare Part A plans are free ...

What is Part A coverage?

Under Part A, you also get coverage in: • Acute care and critical access hospitals. • Inpatient rehabilitation and psychiatric facilities. • Long-term care hospitals. • Inpatient care if you are in a qualifying clinical research study. 2. Skilled nursing facility care.

What percentage of Medicare Part A is covered by home health?

Your Medicare Part A benefits also cover 100 percent of the cost for certain home health services if you’re eligible. If you need durable medical equipment, you pay 20 percent of the Medicare-approved cost for this equipment.

How long do you have to pay Medicare taxes to get premium free?

If you or your spouse has worked and paid Medicare taxes for at least 40 quarters (10 years), you are eligible for premium-free Part A Medicare. Here’s a detailed look at what Part A covers: 1. Inpatient care in a hospital.

How long does Medicare cover long term care?

Long-term care hospital. Part A covers the cost of long-term care in a Medicare-approved facility for up to 60 days after you pay your deductible for the current benefit period. After 60 days you pay the costs that apply. 4. Hospice care.

Does Medicare Advantage have the same coverage as Medicare Part A?

If you choose to enroll in a Medicare Advantage plan, you will have at least the same coverage as Original Medicare Part A and Part B, but most Medicare Advantage plan include additional benefits. If you’ll be qualifying for Medicare soon, or want to explore your options, check out the Medicare Advantage plans in your area.

Does Medicare cover skilled nursing?

Medicare hospital insurance (Part A), covers care in a skilled nursing facility on a short-term basis if you have days remaining in your current benefit period, you’ve been in the hospital and need more skilled nursing care to get better, or your doctor orders this care for a specific reason .

What is the Medicare program?

Medicare is the federal health insurance program that provides coverage for American citizens and permanent residents 65 and older. Introduced in 1965, Medicare covered 61 million people in 2019, almost 19% of the population. 1.

How many people are covered by Medicare?

Introduced in 1965, Medicare covered 61 million people in 2019, almost 19% of the population. 1. The original Medicare program had two parts: hospital insurance (Part A) and medical insurance (Part B). But it has expanded over the years to include optional drug coverage (Part D). Medicare can also refer to comprehensive plans offered by private ...

How long does Medicare enrollment last?

This is referred to as the initial enrollment period, which lasts for a total of seven months (three months before you become eligible for Medicare and three months after). 2. If you already get Social Security retirement benefits (or are eligible for them), you won’t pay a premium for part A.

What is Part A in nursing?

Part A covers a percentage of hospital or skilled nursing facilities based on benefit periods. A benefit period begins when you're admitted and ends 60 days after you are no longer receiving care. There is no limit on benefit periods. Part A also covers 100% of hospice care and skilled intermittent home health care.

What is respite care in Medicare?

Aide and homemaker services. Inpatient respite care received in a Medicare-certified facility to provide rest to the usual caregiver, such as a family member. Services can be provided in the home, or at a Medicare-certified facility.

Does Medicare cover long term care?

No part of Medicare covers long-term care , or 24 hour-a-day custodial care. Custodial care is given at home or in a nursing home, such as a memory unit, and provides assistance with the six activities of daily living: eating, bathing, dressing, toileting, transferring, and continence.

Do you have to pay for Medicare Advantage?

What you pay: If you select Medicare Advantage, you have to enroll and pay for the Part B premium. However, some Medicare Advantage plans will pay the Part B premium for you, and others will charge an additional premium. Each Medicare advantage plan has its own deductibles and copays.

What is Medicare Part A?

Medicare Part A is the basic Medicare coverage that all qualifying Americans receive at age 65. Learn how it works and what it costs and covers. Loading. Home Buying.

What are the parts of Medicare?

There are two parts that makeup Medicare: Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). As you head into retirement, it’s important to understand what each component of Medicare entails. Read on to discover what Medicare Part A coverage includes and how much it may cost.

How much is the deductible for inpatient hospital?

This is about a $24 increase since 2018. The inpatient hospital deductible covers the patient’s share of costs for the first 60 days of hospital care. In 2019, beneficiaries will have to pay a coinsurance amount of $341 per day for days 61 to 90 and $682 per day for lifetime reserve days (anything past 90 days).

How much is the deductible for Medicare Part A?

In 2019, the deductible for hospital admission was $1,364 per year. This is about a $24 increase since 2018.

What happens if you miss Medicare enrollment?

It’s important to note that if you miss the enrollment period, you could end up paying a higher premium for Medicare Part A and Medicare Part B. The Bottom Line. Medicare Part A coverage is government-run health insurance that covers hospital care for people age 65 and older. It covers most costs, but it does not cover the cost ...

How much does Medicare cost if you don't have free coverage?

If you’re not eligible for free coverage, you can buy Medicare Part A. You may have to pay up to $427 each month for your premium. If you paid Medicare taxes for less than 30 quarters, your standard premium payment will be $437. If you paid Medicare taxes for 30 to 39 quarters, your standard premium will be $240.

Does Medicare cover blood transfusions?

However, unless absolutely necessary, private rooms, private care nurses or other care items (like shampoo or razors) are not covered. Also of note, if you need blood, Medicare Part A will not cover the cost. Blood transfusions are only covered if the hospital receives the blood from a blood bank.

What is Medicare Part A?

Medicare Part A#N#Medicare Part A, also called "hospital insurance ," covers the care you receive while admitted to the hospital, skilled nursing facility, or other inpatient services. Medicare Part A is part of Original Medicare.#N#provides coverage to U.S. citizens age 65 and older for inpatient stays in hospitals and similar medical facilities.

Why is Medicare Part A called Medicare Part A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bills.

How much does Medicare cover inpatients?

Does Medicare Part A Cover 100 Percent? For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay the deductible for that benefit period.

How long does it take to pay coinsurance for Medicare?

After 60 days , you must pay coinsurance that Part A doesn’t cover. For hospital expenses covered by Part B, you have to pay 20 percent coinsurance after meeting your annual deductible. Part A and B are collectively known as Original Medicare and work hand-in-hand to help cover hospital stays.

How long does Medicare Part A and Part B last?

Your IEP begins three months before the month you turn 65. The IEP is open for a total of seven months and allows you to enroll in Medicare Part A and Part B.

Do you have to pay Medicare premiums at 65?

If you, like most people, don’t have to pay a monthly premium for Part A, there is no downside to enrolling when you become eligible at age 65. You don’t have to pay a premium if you have paid Medicare taxes for at least 10 years.

Is short term care covered by Medicare?

Short-term care in a skilled nursing facility or nursing home may also be covered by Medicare Part A if it’s a doctor-approved treatment for a medical condition stemming from an inpatient hospital stay.

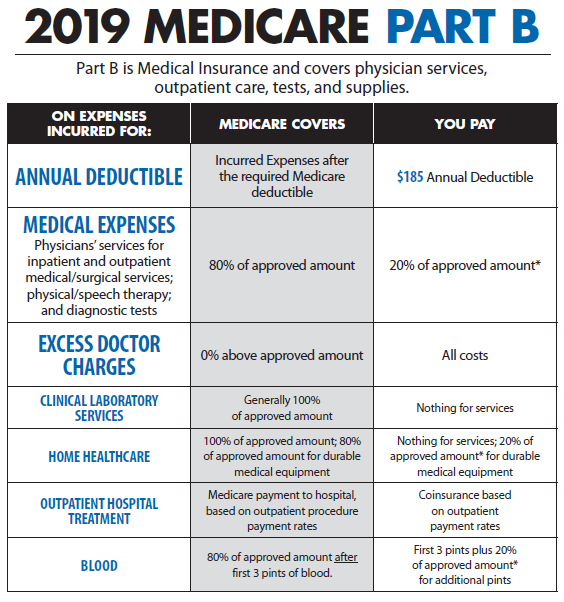

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.