What services are covered by Medicare Part?

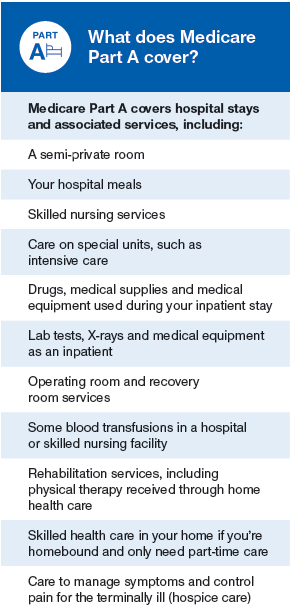

In general, Part A covers: Inpatient care in a hospital; Skilled nursing facility care; Nursing home care (inpatient care in a skilled nursing facility that’s not custodial or long-term care) Hospice care; Home health care; 2 ways to find out if Medicare covers what you need

What is covered under part a Medicare?

Apr 16, 2021 · What does Medicare Part A cover? Medicare Part A (hospital insurance) helps cover a variety of services, including the following: Inpatient hospital care: May include semi-private rooms, meals, nursing services, and prescription drugs needed for your treatment. Medicare Part A hospital coverage may include inpatient care you receive in long-term care …

What is the difference between Medicare Part an and Part B?

Medicare Part A covers hospital stays, providing invaluable assistance with potentially crippling bills for U.S. citizens age 65 and older. While people who have paid Medicare taxes through work for at least 10 years don’t have to pay a monthly premium, Medicare Part A doesn’t cover everything related to hospital stays. It’s essential to understand what’s covered and what’s not …

What does Medicare cover and what can you claim?

What Part A covers Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care. What Part B covers Learn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care.

See more

Jan 11, 2022 · Medicare Part A covers the "room and board" charges of staying in a hospital as well as other health care facilities such as ones for skilled nursing care. This coverage also includes medical procedures you undergo while you're in these facilities. Medicare Part B covers outpatient care when you don't stay in the hospital.

What benefits fall under Medicare Part A?

Part A generally covers inpatient hospital stays, skilled nursing care, hospice care, and limited home health-care services. You typically pay a deductible and coinsurance and/or copayments.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What services are covered by Medicare Part A only?

In general, Part A covers:Inpatient care in a hospital.Skilled nursing facility care.Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care)Hospice care.Home health care.

What do Medicare Parts A and B cover?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

Which one of the following does Medicare Part A not cover?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Does Medicare Part A cover emergency room visits?

Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

What does Medicare C and D cover?

Medicare is a federal insurance plan. Medicare Part C combines the benefits of Part A and Part B, while Medicare Part D covers prescription drugs. Medicare Part A and Part B are known collectively as original Medicare. Part A covers hospital costs, and Part B covers other medically necessary expenses.

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

What is the difference between Medicare Part A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

What is Covered Under Medicare A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bi...

What is Not Covered Under Medicare Part A?

Even in the case of an inpatient stay that Medicare Part A covers, Part A won’t cover:

Does Medicare Part A Cover Doctor Visits?

Part A covers qualifying hospital visits; Part B, rather than Part A, covers doctors’ services at the hospital, much like Part B covers non-emergen...

Does Medicare Part A Cover 100 Percent?

For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay th...

What Does Medicare Part A Cost?

Most people don’t have to pay a monthly premium for Part A. If you or your spouse have worked 40 quarters (10 years) while paying Medicare taxes, y...

How to Enroll in Medicare Part A?

If you believe you would benefit from Part A coverage and qualify for it, the final step is the Part A enrollment process. If you are near the Medi...

Do you need Medicare Part A for hospital coverage?

If you, like most people, don’t have to pay a monthly premium for Part A, there is no downside to enrolling when you become eligible at age 65. You...

Do you need more than Part A for hospital coverage?

While Part A covers a significant portion of a typical hospital bill and usually provides coverage for U.S. citizens age 65 and older without a mon...

What is unique about Medicare Advantage when it comes to hospital coverage?

Medicare Advantage plans protect you with an annual out-of-pocket maximum — a dollar amount specific to your plan that defines the most money you w...

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

What happens if you wait to enroll in Part A?

Keep in mind that if you wait to enroll in Part A after you’re first eligible, you may owe a late-enrollment penalty in the form of a higher premium. Your Part A premium could go up 10%, and you’ll have to pay this higher premium for twice the number of years that you could have enrolled in Part A but went without it.

Does Medicare cover nursing care?

Medicare Part A only covers nursing care if skilled care is needed for your condition. You must require more than just custodial care (help with daily living tasks, such as bathing, dressing, etc.).

How much does Medicare cover inpatients?

Does Medicare Part A Cover 100 Percent? For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay the deductible for that benefit period.

What is Medicare Part A?

Medicare Part A#N#Medicare Part A, also called "hospital insurance ," covers the care you receive while admitted to the hospital, skilled nursing facility, or other inpatient services. Medicare Part A is part of Original Medicare.#N#provides coverage to U.S. citizens age 65 and older for inpatient stays in hospitals and similar medical facilities.

What is Medicare Original?

Original Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities. Original Medicare is provided by the federal government and is made up of two parts: Part A (hospital insurance) and Part B (medical insurance). or other medical insurance may provide coverage.

How long does it take to pay coinsurance for Medicare?

After 60 days , you must pay coinsurance that Part A doesn’t cover. For hospital expenses covered by Part B, you have to pay 20 percent coinsurance after meeting your annual deductible. Part A and B are collectively known as Original Medicare and work hand-in-hand to help cover hospital stays.

How long does Medicare Part A and Part B last?

Your IEP begins three months before the month you turn 65. The IEP is open for a total of seven months and allows you to enroll in Medicare Part A and Part B.

Why is Medicare Part A called Medicare Part A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bills.

Does Medicare Part B require a monthly premium?

Part B usually does require a monthly premium. Enrolling in Part A and B of Original Medicare opens the options for you to add a Medigap supplemental plan to help with Part A deductibles and coinsurance.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

Medicare Part A Coverage

Medicare.gov explains that Medicare Part A is often referred to as “Hospital Insurance.” Rightfully so, as this is the part of Medicare that covers expenses related to hospital, nursing facility care, hospice, and home health care.

Medicare Part B Coverage

Part B is the “Medical Insurance” piece of Medicare and covers most preventative services fully. It also provides at least partial coverage for medically necessary services and supplies needed to diagnose and/or treat existing conditions. Part B also pays a set amount toward other expenses, such as:

Medicare Part C Coverage

As an alternative to purchasing Part A and Part B, some participants receive Medicare benefits through Part C, which is commonly known as Medicare Advantage. Instead of the federal government providing healthcare coverage, Medicare Advantage’s benefits are offered through private insurance companies that have been pre-approved by Medicare.

Medicare Part D Coverage

Part D refers to the prescription drug coverage portion of Medicare and each plan has its own set of covered drugs. Additionally, each drug is placed in a designated tier within that plan, which ultimately determines the copayment and/or coinsurance cost of the drug.

Medicare Supplement (Medigap) Coverage

Medicare Supplement policies, also known as Medigap, are designed to help cover expenses not covered under Original Medicare Parts A and B.

What Medicare Does Not Cover

Medicare as a whole covers a wide variety of physical and mental health services—whether in whole or in part—but there are some expenses it will not pay toward. Among them are: