Full Answer

What does Medicare cover and what can you claim?

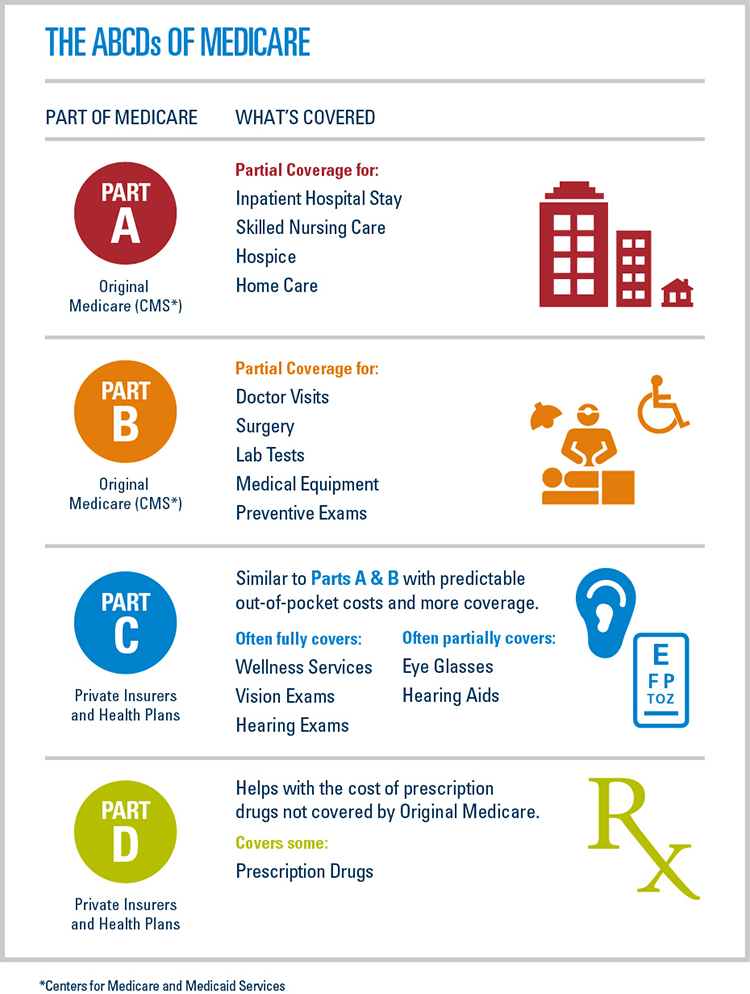

In general, Part A covers: Inpatient care in a hospital; Skilled nursing facility care; Nursing home care (inpatient care in a skilled nursing facility that’s not custodial or long-term care) Hospice care; Home health care; 2 ways to find out if Medicare covers what you need

What Medicare plan should I Choose?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care. What Part B covers Learn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care.

How much does Medicare Part a cover?

Apr 16, 2021 · Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided in the U.S. without a break for at least five years. You’re eligible if you’re 65 and older or …

What items are covered by Medicare?

Medicare coverage for many tests, items and services depends on where you live. This list only includes tests, items and services (both covered and non-covered) if coverage is the same no matter where you live. If your test, item or service isn’t listed, talk to your doctor or other health care provider about why you need certain tests, items ...

See more

Medicare is federal health insurance offered to people over the age of 65 and to people with disabilities, ESRD, and ALS. Different plans or parts under Medicare broadly cover services ranging from hospital care, diagnostics and treatment of conditions, and prescription drugs. This article will explain what Medicare is, the different parts of ...

What is covered under Part A of Medicare?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What Is Medicare a plan?

Medicare Part A is hospital insurance. Part A generally covers inpatient hospital stays, skilled nursing care, hospice care, and limited home health-care services. You typically pay a deductible and coinsurance and/or copayments.

What does Medicare Part A reimburse for?

Medicare Part A covers hospital services, hospice care, and limited home healthcare and skilled nursing care. All your Part A–related expenses are covered by Medicare if you receive them through a participating provider who accepts Medicare assignment.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What medical expenses are not covered by Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

Who does Medicare cover?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does Medicare Part A cover emergency room visits?

Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

What is the difference between Medicare Part A and Part B?

Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care. Together, the two parts form Original Medicare.May 7, 2020

How much does Medicare reimburse for Covid test?

Your plan is required to reimburse you at a rate of up to $12 per individual test (or the cost of the test, if less than $12). Save your receipt(s) to submit to your plan for reimbursement at a rate of at least $12 per individual test (or the cost of the test, if less than $12).Jan 12, 2022

What Is Medicare Part A Coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided i...

What Does Medicare Part A Cover?

Medicare Part A (hospital insurance) helps cover a variety of services, including the following: 1. Inpatient hospital care: May include semi-priva...

What Are My Medicare Part A Costs?

Many people get Medicare Part A without a premium if they’ve worked the required amount of time under Medicare-covered employment, generally 10 yea...

When Do I Sign Up For Medicare Part A?

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.Automatic enrollment in Med...

How Do I Sign Up For Medicare Part A?

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board (RRB). You can sign up in...

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

What happens if you wait to enroll in Part A?

Keep in mind that if you wait to enroll in Part A after you’re first eligible, you may owe a late-enrollment penalty in the form of a higher premium. Your Part A premium could go up 10%, and you’ll have to pay this higher premium for twice the number of years that you could have enrolled in Part A but went without it.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

What is Medicare health care?

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine. under Medicare. If you're not sure whether a service is covered, check with your provider before you get the service.

What is Medicare Advantage?

Most Medicare Advantage Plans offer coverage for things that aren't covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). Plans can also cover more extra benefits than they have in the past, including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, ...

How much is Medicare Advantage 2021?

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. In 2021, the standard Part B premium amount is $148.50 (or higher depending on your income). If you need a service that the plan says isn't medically necessary, you may have to pay all the costs of the service.

What happens if you have a Medicare Advantage Plan?

If you have a Medicare Advantage Plan, you have the right to an organization determination to see if a service, drug, or supply is covered. Contact your plan to get one and follow the instructions to file a timely appeal. You also may get plan directed care.

Is Medicare Advantage covered for emergency care?

In all types of Medicare Advantage Plans, you're always covered for emergency and. Care that you get outside of your Medicare health plan's service area for a sudden illness or injury that needs medical care right away but isn’t life threatening.

Does Medicare cover hospice?

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you're always covered for emergency and Urgently needed care.

What is a dual eligible plan?

A key feature of a dual eligible plan like MSHO is that members get to work with a Care Coordinator. Care Coordinators are registered nurses or licensed social workers who can help you get the care you need. They’ll support you through all stages of your health care journey.

What does MSHO cover?

Medical benefits in an MSHO plan cover routine eye exams and eyeglasses when medically necessary. The plan pays for contact lenses to correct your vision after cataract surgery or for conditions when eyeglasses won’t work.

What is MSHO transportation?

MSHO provides transportation to medical and dental appointments or for other services like lab work. There are general mileage limits to the clinics. Some MSHO plans may provide additional transportation so members can use their plan benefits, like to a fitness club or to health education classes.

What are the benefits of MSHO?

MSHO has benefits to help people live on their own and stay in their home. Benefits cover home care services or personal care assistance. You may qualify for additional benefits like chore and companion services or home-delivered meals.

What is assisted living in MSHO?

Assisted living is housing where people get help with daily activities like getting dressed, meals and housekeeping if they qualify. MSHO covers services provided at assisted living facilities, as well as home care services or personal care assistance. You may qualify for additional care services like chore and companion services or home-delivered meals.

Does MSHO include fitness?

Many MSHO plans include a fitness program to keep you active and healthy. This may include a free health club membership or at-home fitness kits. Each plan has its own extra benefits, which may include additional fitness-related tools like an activity tracker or a weight management program.

Does MSHO cover physicals?

An MSHO plan covers one Medicare annual wellness visit each year at no cost to you. It’s not a physical exam but rather a conversation with your doctor or care team about these topics: