Medigap Plan N has coverage for 4 basic areas:

- Hospitalization: pays Part A coinsurance and provides coverage for 365 additional days after Medicare benefits end.

- Medical Expenses: pays Part B coinsurance (excluding copays for office visits and ER) and 20% of Medicare-approved expenses or copayments for hospital outpatient services.

- Blood: pays the first 3 pints of blood annually. ...

Full Answer

Is Medicare plan N a cost-effective choice?

Mar 02, 2022 · Medicare Supplement Plan N is a standardized Medicare Supplement insurance plan available in most states nationwide. As a Medicare Supplement, this plan helps cover certain cost-sharing expenses that would otherwise be the …

What are the benefits of plan N?

May 13, 2020 · Medicare Supplement Plan N coverage includes: 100 percent of Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. 100 percent of the Part A...

Is plan N guaranteed issue?

What Does Medicare Plan N Cover? This standardized Medicare Supplement covers the 20% that Medicare Part B doesn’t. It also pays for your hospital deductible and all your hospital copays and coinsurance. You will pay your own excess charges, Part B deductible, and some small copays at the doctor’s office and the emergency room.

Does AARP plan N cover Medicare deductible?

Dec 02, 2020 · Medicare Supplement Plan N covers 100% of the Medicare Part A deductible, no matter how many benefit periods you face in a year. Foreign Emergency Care Medicare does not pay for emergency care received outside of the United States except for in rare situations. Plan N covers 80% of the costs for foreign emergency medical care.

See more

Mar 20, 2022 · Medicare Supplement Plan N covers the following: Covers Part A hospital coinsurance and hospital costs for up to 365 days after your Original Medicare benefits are exhausted. Covers the Part A hospice care copayment or coinsurance charges. Plan N pays the annual Original Medicare Part A deductible

What does an n plan cover?

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and covers 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).Jan 24, 2022

What is Plan N on Medicare?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.Nov 23, 2021

What is difference between Plan G and N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Does Medicare Part N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.May 12, 2020

Does Plan N have copays?

With Plan N, you are responsible for copayments up to $20 when you visit the doctor's office (or up to $50 for emergency room visits). You are also responsible for any excess charges, the additional amount a doctor may charge for services above what Medicare covers.Oct 1, 2021

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Is Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Can you switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

What is the difference between Medigap Plan D and Plan N?

The benefits of Medigap Plan N are similar to Plan D's policy, the sole exception being how it covers Medicare Part B coinsurance costs. Under Medigap Plan N, 100% of the Part B coinsurance costs are covered, except up to a $20 copayment for office visits and up to $50 for emergency room visits.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

What is Medicare Supplement Plan N?

Medicare Supplement Plan N coverage is one of 10 federally standardized options to help fill “gaps” in original Medicare coverage. It’s an option for people who want broad coverage but, to lower their premiums, are willing to pay for some copays and a small annual deductible.

How many Medigap plans are there?

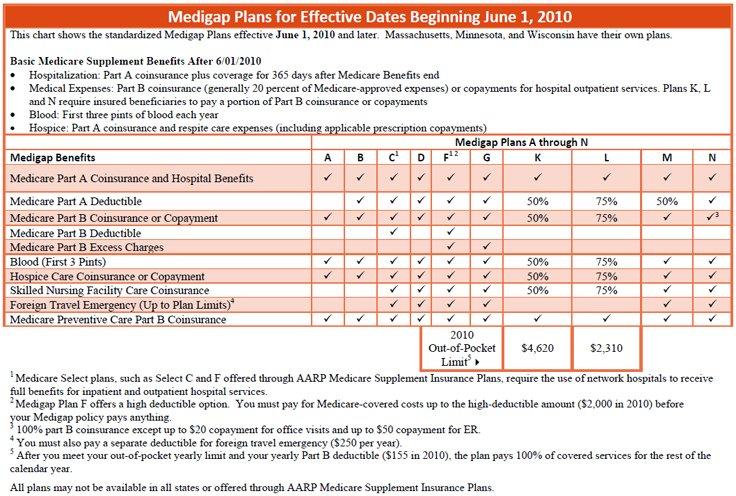

There are 10 different Medigap Plans (A, B, C, D, F, G, K, L, M, N) which all feature different coverage and have different premiums. This selection allows you to choose coverage based on your needs and budget.

How to get a Medigap policy?

Getting a Medigap policy. Once you have original Medicare, you can purchase a Medigap policy from an insurance company. To pick a specific plan and insurance company, many people consult with a trusted family member, friend with a current Medigap policy, or insurance agent.

Is Medigap standardized?

Standardization. Medigap plans are standardized the same way in 47 of the 50 states. If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies (including Medicare Supplement Plan N coverage) are standardized differently.

Does Medicare Supplement Plan N cover dental?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

How much does Medicare pay for a medical bill?

Medicare pays 80% and then sends the bill to your Medigap plan. If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

When is the best time to enroll in Medicare Plan N?

You must also live in the plan’s service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. It’s your one chance to enroll in any Medigap plan without health underwriting.

Does Plan N cover hospital deductible?

For inpatient care, Medicare Supplement Plan N fully covers her hospital deductible.

How much is Medicare Supplement Plan N deductible?

Medicare Part A requires a $1,484 deductible for each benefit period in 2021. This deductible is not an annual deductible, which means that you could potentially have to pay the Part A deductible more than once in a year. Medicare Supplement Plan N covers 100% of the Medicare Part A deductible, no matter how many benefit periods you face in a year.

How much is Medicare Part A coinsurance for 2021?

Medicare Part A requires daily coinsurance payments for inpatient hospital stays beginning on day 61 of a benefit period. In 2021, these Part A coinsurance costs are $371 per day for days 61-90 of an inpatient stay and $742 per day for days 91 and beyond for up to 60 lifetime reserve days.

What is the deductible for Medicare Supplement 2021?

Plans C and F are not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020. 2. Plans F and G also offer a high deductible plan which has an annual deductible of $2,370 in 2021.

How much is coinsurance for skilled nursing?

But beginning on day 21 of a benefit period, you’ll owe a Part A coinsurance cost of $185.50 per day until day 100 of your inpatient stay. ...

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance (often called Medigap) is sold by private insurance companies. While the costs of each type of Medigap plan may vary depending on where and by whom it is sold, all of the benefits remain standardized by the federal government. For example, Plan N purchased in New York will include the same coverage as ...

Does Medicare cover foreign emergency care?

Foreign Emergency Care. Medicare does not pay for emergency care received outside of the United States except for in rare situations. Plan N covers 80% of the costs for foreign emergency medical care.

Does Medicare cover the first 3 pints of blood?

First Three Pints of Blood. Original Medicare does not cover the first three pints of blood you might need for a blood transfusion. Medicare blood coverage kicks in beginning with the fourth pint. Medicare Supplement Plan N covers the full cost of the first three pints of blood .