CPT 94664 is intended for device “demonstration and/or evaluation" and will be usually paid for once per beneficiary for the same provider or group. (Occasional extenuating circumstances, new equipment, etc, may merit two sessions or other repeat training or evaluation.

Full Answer

How to Bill 94664?

94664 – Demonstration and/or evaluation of patient utilization of an aerosol generator, nebulizer, metered dose inhaler or IPPB device can be used demonstrating (teaching) patients to use an aerosol generating device property. (94664 can be reported 1 time only per day of service) Inhalation Treatment for Acute Airway Obstruction

What is Procedure Code 94664?

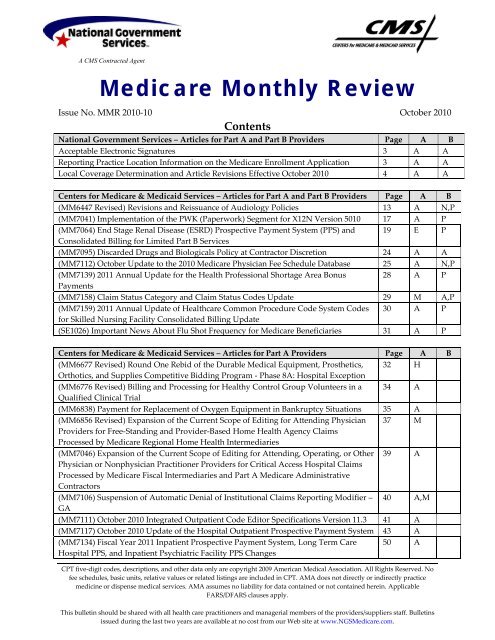

Article Guidance

- Spirometry - CPT codes for Spirometry include 94010, 94011, 94012, 94060, 94070, 94150, 94200, 94375, 94726 and 94727. ...

- Lung Volume - CPT codes for lung volume determination are 94013, 94726, 94727 and 94728.

- Diffusion Capacity - CPT codes for diffusion capacity include 94729.

Does Medicare cover CPT 94640?

• The Medicare National Correct Coding Initiative (NCCI) edits pair code 94664 with code 94640 (inhalation treatment for acute airway obstruction with an aerosol generator, nebulizer, metered dose inhaler or intermittent positive pressure breathing device) but allows both services to be reported when they are clinically indicated and modifier 59 (distinct procedural service) is appended to code 94664.

What Revenue Code is billed with procedure 94640?

treatments exceeding one hour, CPT codes 94644 and 94645 should be reported instead of CPT code 94640. When providing inhalation treatment for acute airway obstruction, Medicare will not pay for both 94640 and 94644 or 94645 if they are billed on the same day for the same patient. The coder must decide which of the two codes to submit.

What is procedure code 94664?

The CPT Code is 94664: Demonstration and/or evaluation of patient utilization of an aerosol generator, nebulizer, metered dose inhaler or IPPB device.

Can CPT code 94664 and 94640 be billed together?

To bill both 94640 and 94664 on the same date of service, there must be documentation supporting that the procedures were separate and distinct from one another. The medical record should include a request for each procedure, and therapist documentation should support that procedures occurred at separate times.

Can a respiratory therapist bill Medicare?

In order to be considered for reimbursement by Medicare, respiratory therapy services must be fully documented in the medical records. The documentation must clearly indicate that the services rendered were reasonable and medically necessary and required the skills of a licensed respiratory therapist.

How do you bill for breathing treatments?

CPT code 94640 should be reported only once during an episode of care, regardless of the number of separate inhalation treatments that are administered. This means that if the patient requires two separate nebulizer treatments during the same visit, you would still only bill CPT code 94640 once.

Does 94664 need a modifier?

According to Optum encoder: the CPT code 94664 (demonstration or evaluation of patient utilization of nebulizer) is bundled into CPT 94640 (treatment with nebulizer) when performed on the same date of service. You can however bill your E/M code with a modifier 25 and 94664. You must log in or register to reply here.

Does Medicare pay for pulmonary function test?

Medicare does not cover screening tests. Medicare coverage excludes routine (screening) tests for asymptomatic patients with or without high risk of lung disease (e.g., prolonged smoking history). It also excludes studies as part of a routine exam, and studies as part of an epidemiological survey.

Can you bill for oxygen administration?

Answer: Oxygen therapy, including high-flow oxygen, is not defined by a CPT code. The cost for delivery of the oxygen (gas) is billed as a supply item with revenue code 271. Panacea consultants recommend that the charge be submitted based on a time increment that documentation supports.

How do you bill for spirometry?

Spirometry - CPT codes for Spirometry include 94010, 94011, 94012, 94060, 94070, 94150, 94200, 94375, 94726 and 94727. Routine and/or repetitive billing for unnecessary batteries of tests is not clinically reasonable. Lung Volume - CPT codes for lung volume determination are 94013, 94726, 94727 and 94728.

What is the difference between 94010 and 94375?

Spirometry (94010) is the basis for pulmonary function testing. When it is performed before and after the administration of a bronchodilator, report 94060. A flow volume loop (94375) is included in codes 94010 and 94060. Code 94010 is not included in codes 94726 and 94727; they are reported separately.

How do you bill for Albuterol Sulfate inhalation Solution?

Use J7613 for, "Albuterol, inhalation solution, FDA-approved final product, non-compounded, administered through DME, unit dose, 1 mg." And use J7620 for, "Albuterol, up to 2.5 mg and ipratropium bromide, up to 0.5 mg, FDA-approved final product, non-compounded, administered through DME."

What ICD 10 codes cover nebulizer?

A large volume nebulizer, related compressor, and water or saline are covered when it is medically necessary to deliver humidity to a member with thick, tenacious secretions who has cystic fibrosis, (ICD 10; R09. 3), bronchiectasis (ICD-10; J47. 9), (ICD-10; J47. 1), (ICD-10; A15.

What is the CPT code for Albuterol treatment?

HCPCS code J7613 for Albuterol, inhalation solution, FDA-approved final product, non-compounded, administered through DME, unit dose, 1 mg as maintained by CMS falls under Inhalation Solutions .

What is CPT 94664?

CPT 94664 is intended for device “demonstration and/or evaluation" and will be usually paid for once per beneficiary for the same provider or group. (Occasional extenuating circumstances, new equipment, etc, may merit two sessions or other repeat training or evaluation. Simple follow-up observation during an E/M exam for pulmonary disease is not a stand-alone procedure, unless the E/M session is not billed).

What is the CPT code for spirometry?

Spirometry - CPT codes for Spirometry include 94010, 94011, 94012, 94060, 94070, 94150, 94200, 94375, 94726 and 94727. Routine and/or repetitive billing for unnecessary batteries of tests is not clinically reasonable.

When are diagnostic tests payable?

42 CFR §410.32 and §410.33, indicate that diagnostic tests are payable only when ordered by the physician who is treating the beneficiary for a specific medical problem and who uses the results in such treatment.

Is diagnostic testing covered by Medicare?

CMS Manual System, Publication 100-02, Medicare Benefit Policy Manual, Chapter 15, §§60 and 80, indicate that the technical component of diagnostic tests are not covered as "incident-to" physician healthcare services, but under a distinct coverage category and subject to supervision levels found in the Physician Fee Schedule database. See also 42 CFR §§410.32 and 410.33.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

Who is authorized to request additional documentation from third parties?

Contractors are explicitly authorized to request additional documentation from third parties (e.g. ordering physician) when needed to evaluate the medical necessity of the service and may consider care prior to or subsequent to the service in question.

Does Medicare require medical records?

Documentation must be available to Medicare upon request and must be legible. The medical record must document the test results and usage in treatment.

What is an outpatient encounter in Medicare?

Medicare defines a hospital outpatient encounter as “a direct personal contact between a patient and a physician, or other person who is authorized by State licensure law and, if applicable, by hospital or CAH staff bylaws, to order or furnish hospital services for diagnosis or treatment of the patient.”.

What is the procedure code for sputum induction?

Procedure code 94640 (Pressurized or non-pressurized inhalation treatment for acute airway obstruction or for sputum induction for diagnostic purposes [e.g., with an aerosol generator, nebulizer, metered dose inhaler, or intermittent positive pressure breathing (IPPB) device]) for the first treatment.

Why do contractors need to specify revenue codes?

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service . In most instances Revenue Codes are purely advisory; unless specified in the policy services reported under other Revenue Codes are equally subject to this coverage determination. Complete absence of all Revenue Codes indicates that coverage is not influenced by Revenue Code and the policy should be assumed to apply equally to all Revenue Codes.

When multiple medications are administered and the medications cannot be mixed and administered at one time, the patient’s records must be?

When multiple medications are administered and the medications cannot be mixed and administered at one time, the patient’s records must be documented to explain the medical necessity for the separate administrations.

When can evaluation and management code be reported?

Evaluation and management code can be reported if significant, separately identifiable evaluation and management service provided by the same physician.

When is respiratory therapy paid?

Payment to a physician may be allowed for respiratory services only when the services are rendered as an integral although incidental part of the physician’s professional services in the course of diagnosis or treatment of an injury or illness. It is expected that respiratory therapy services will most often be used in cases of acute respiratory disease or acute exacerbation of chronic disease. Nevertheless, selected chronic stable conditions could require the services. Acute disease states are expected to either subside after a short period of treatment or, if no response occurs, the patient is transferred to a higher level of care.

Can a patient be transferred to general supervision for extended duration?

Extended duration services require an initial period of direct supervision, but the patient may be transitioned to general supervision once he or she is stable at the discretion of the supervising practitioner. One commenter believed that the physician’s presence should not be required for HCPCS code 94640 in the hospital, since this service can be performed by a patient at home.

What is CPT code 94760?

CPT®codes 94760, 94761, and 94762 are included in the critical care services listed in Group 2: Codes. These codes will not be paid separately when billed with a critical care code.

How long can you be on CPT 31720?

Payment for CPT®code 31720 may be allowed, on an individual consideration basis, for respiratory treatments for three consecutive days or three identical services within a 30-day time frame. Additional payment may be allowed for respiratory therapy treatments exceeding these parameters only if medical necessity can be established by medical documentation. In the case of consecutive days of care, the medical record should indicate why the patient was not transferred to a higher level of care.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

Can you pay for CPT code 94762?

CPT®codes 94760, 94761 and 94762 are bundled by the Correct Coding Initiative (CCI) with critical care services. Therefore, CPT®codes 94760, 94761 and 94762 cannot be paid separately when billed with critical care CPT®codes (99291 and 99292).

What is CMS in healthcare?

The Centers for Medicare & Medicaid Services (CMS), the federal agency responsible for administration of the Medicare, Medicaid and the State Children's Health Insurance Programs, contracts with certain organizations to assist in the administration of the Medicare program. Medicare contractors are required to develop and disseminate Articles. CMS believes that the Internet is an effective method to share Articles that Medicare contractors develop. While every effort has been made to provide accurate and complete information, CMS does not guarantee that there are no errors in the information displayed on this web site. THE UNITED STATES GOVERNMENT AND ITS EMPLOYEES ARE NOT LIABLE FOR ANY ERRORS, OMISSIONS, OR OTHER INACCURACIES IN THE INFORMATION, PRODUCT, OR PROCESSES DISCLOSED HEREIN. Neither the United States Government nor its employees represent that use of such information, product, or processes will not infringe on privately owned rights. In no event shall CMS be liable for direct, indirect, special, incidental, or consequential damages arising out of the use of such information, product, or process.

What is the ICd 10 code for Sicca syndrome?

The Code Description for M35.02 changed from Sicca syndrome with lung involvement to Sjogren syndrome with lung involvement and added the following ICD-10-CM codes to replace the deleted code R05 – cough effective 10/01/21 per the Annual ICD-10-CM Update.

What is the ICd 10 code for medical necessity?

Effective for DOS on or after 10/01/2019, added R06.83 to the list of ICD-10 Codes That Support Medical Necessity.

Is CPT a year 2000?

CPT is provided “as is” without warranty of any kind, either expressed or implied, including but not limited to, the implied warranties of merchantability and fitness for a particular purpose. AMA warrants that due to the nature of CPT, it does not manipulate or process dates, therefore there is no Year 2000 issue with CPT. AMA disclaims responsibility for any errors in CPT that may arise as a result of CPT being used in conjunction with any software and/or hardware system that is not Year 2000 compliant. No fee schedules, basic unit, relative values or related listings are included in CPT. The AMA does not directly or indirectly practice medicine or dispense medical services. The responsibility for the content of this file/product is with CMS and no endorsement by the AMA is intended or implied. The AMA disclaims responsibility for any consequences or liability attributable to or related to any use, non-use, or interpretation of information contained or not contained in this file/product. This Agreement will terminate upon no upon notice if you violate its terms. The AMA is a third party beneficiary to this Agreement.

Can you use CPT in Medicare?

You, your employees and agents are authorized to use CPT only as contained in the following authorized materials of CMS internally within your organization within the United States for the sole use by yourself, employees and agents. Use is limited to use in Medicare, Medicaid or other programs administered by the Centers for Medicare and Medicaid Services (CMS). You agree to take all necessary steps to insure that your employees and agents abide by the terms of this agreement.

Why do contractors need to specify revenue codes?

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service. In most instances Revenue Codes are purely advisory. Unless specified in the article, services reported under other Revenue Codes are equally subject to this coverage determination. Complete absence of all Revenue Codes indicates that coverage is not influenced by Revenue Code and the article should be assumed to apply equally to all Revenue Codes.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. American Medical Association. All Rights Reserved (or such other date of publication of CPT). CPT is a trademark of the American Medical Association (AMA).

What is a CPT code?

CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes. When a health care provider bills Medicare to seek reimbursement, they will use CPT codes to list the various treatments they delivered. The CPT codes used to bill for medical services and items are part ...

What is the coinsurance rate for Medicare Part B?

Looking up the reimbursement rates can also help you calculate how much you can expect to be billed for using the standard 20% coinsurance rate that applies to most services and items covered by Medicare Part B .

What Is the Average Medicare Reimbursement Rate?

The Medicare reimbursement rate varies according to the service or item being provided as well as the type of health care provider that is delivering the care and other factors.

How many digits are in a CPT code?

CPT codes consist of 5 numeric digits, while HCPCS codes are an alphabetical number followed by 4 numeric digits.

How many Medicare codes can you enter at once?

You may enter up to five codes at a time or a range of codes. You may also select either the national payment amount or a specific Medicare Administrative Contractor (MAC), as reimbursement rates can vary within specific localities.

How much does Medicare pay for coinsurance?

In fact, Medicare’s reimbursement rate is generally around only 80% of the total bill as the beneficiary is typically responsible for paying the remaining 20% as coinsurance. Medicare predetermines what it will pay health care providers for each service or item. This cost is sometimes called the allowed amount but is more commonly referred ...

How to contact Medicare for claims?

For questions about your Medicare claims, bills or costs, call 1-800-MEDICARE (1-800-633-4227).

What is the code for chest wall manipulation?

Manipulation of the chest wall is for mobilization of secretions and improvement in lung function. Use code 94667 or 94668 for “hands on” manipulation of the chest wall, per session. CPT code 94669 is used when a mechanical device is used to achieve high-frequency chest wall oscillation (HFCWC), such as a HFCWC device.

What is CPT code 2020?

These are Evaluation and Management CPT codes that are associated with services provided by physicians and other qualified healthcare professionals (NPs and PAs) that can bill Medicare directly. The descriptions and requirements are lengthy and are listed in CPT® Professional 2020, published by the AMA. The term “clinical staff” as used by the AMA refers to professionals who do not bill patients independently such as respiratory therapists and nurses.

How often can you use the PEP code?

The following code is appropriate for demonstration and/or evaluation of inhaler techniques and includes demonstration of flow-operated inhaled devices such as Positive and Oscillating Expiratory Pressure (PEP/OPEP) devices. The code may only be used once per day. For example, it cannot be billed at the same time/same visit as 94640. The code should not be reported for patients who

What are the two types of outpatient services?

Hospitals provide two distinct types of services to outpatients: services that are diagnostic in nature and services that aid the physician in the treatment of the patient. With a few exceptions, hospital outpatient departments are paid under an outpatient prospective payment system (OPPS), although there are some services that can be paid under a fee schedule. While inpatient services are paid under the IPPS as noted above, outpatient services are bundled into what are called Ambulatory Payment Classification (APC) groups. Services within an APC are similar clinically and with respect to hospital resource use. Each HCPCS Code that can be paid separately under OPPS is assigned to an APC group. The payment rate and coinsurance amount calculated for an APC apply to all services assigned to the APC.

Does Medicare cover smoking cessation?

CMS covers smoking cessation counsel ing for outpatient and hospitalized Medicare beneficiaries regardless of whether the individual has been diagnosed with a recognized tobacco-related disease or showed signs or symptoms of such a disease. When CMS

Does Medicare cover pulmonary rehabilitation?

Medicare covers pulmonary rehabilitation (PR) programs (i.e., those consisting of components set forth in law ) for patients who have been diagnosed with moderate, severe, or very severe COPD as established by the GOLD guidelines, stages II-IV. No more than two one-hour sessions may be billed in a single day and the services are only covered if provided in a physician’s office or hospital

Is 94664 bundled with 99202?

A claim was sent into insurance 99202 and 94664. Claim was bundled and only the 94664 was paid. Above the section for the pulmonary treatment in the CPT it states that if an E&M is also performed it should be billed "in addition to" the 94664.

Is modifier 25 needed for pulmonary medicine?

Hello,#N#It is advisable to append modifier-25 to the separately identifiable E and M visits, though it is not bundled with the pulmonary medicine section services. Only, 7000 and 8000 series of CPT codes, when rarely accompany an E and M code, 25 modifier is not appended. For all other services, 25 modifier is necessary. Also, one must prioritize the dx codes carefully.