What does N356 mean on Social Security records?

Also refer to N356) Social Security Records indicate that this individual has been deported. This payer does not cover items and services furnished to individuals who have been deported. This is a misdirected claim/service for a United Mine Workers of America (UMWA) beneficiary.

What does B22 and B23 mean on a Medicare claim?

B22 This payment is adjusted based on the diagnosis. B23 Payment denied because this provider has failed an aspect of a proficiency testing program. D1 Claim/service denied.

What does ma73 mean on a Medicare receipt?

MA73 Informational remittance associated with a Medicare demonstration. No payment issued under fee-for-service Medicare as patient has elected managed care. or returned. MA75 Missing/incomplete/invalid patient or authorized representative signature. physician is performing care plan oversight services.

What does N31 mean on a Medicare claim form?

N31 Missing/incomplete/invalid prescribing provider identifier. N32 Claim must be submitted by the provider who rendered the service. N33 No record of health check prior to initiation of treatment. N34 Incorrect claim form for this service. N35 Program integrity/utilization review decision. payment.

What are Medicare remark codes?

Remittance Advice Remark Codes (RARCs) are used in a remittance advice to further explain an adjustment or relay informational messages that cannot be expressed with a claim adjustment reason code. Remark codes are maintained by CMS, but may be used by any health plan when they apply.

What does patient has not met the required eligibility requirements mean?

Patient has not met the required residency requirements. This denial comes usually because of patient not submitting the required documents to Medicare. Call Medicare and find what document missing and ask the patient to update.

What is a remark code from an Explanation of Benefits document?

7 Remark Code is a note from the insurance plan that explains more about the costs, charges, and paid amounts for your visit. After you visit your provider, you may receive an Explanations of Benefits (EOB) from your insurer.

How do you handle a co 16 denial?

To resolve this denial, the information will need to be added to the claim and rebilled. For commercial payers, the CO16 can have various meanings. It is primarily used to indicate that some other information is required from the provider before the claim can be processed.

What does denial code pr177 mean?

Patient has not met the required eligibility requirementsPatient's visit denied by MCR for "PR-177: Patient has not met the required eligibility requirements".

What are the top 10 denials in medical billing?

These are the most common healthcare denials your staff should watch out for:#1. Missing Information. You'll trigger a denial if just one required field is accidentally left blank. ... #2. Service Not Covered By Payer. ... #3. Duplicate Claim or Service. ... #4. Service Already Adjudicated. ... #5. Limit For Filing Has Expired.

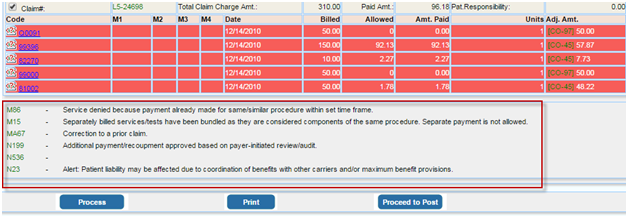

How do I read my Medicare EOB?

How to Read Medicare EOBsHow much the provider charged. This is usually listed under a column titled "billed" or "charges."How much Medicare allowed. Medicare has a specific allowance amount for every service. ... How much Medicare paid. ... How much was put toward patient responsibility.

How do I read my insurance explanation of benefits?

How to read your EOBProvider—The name of the doctor or specialist who provided the service.Service/Procedure—The type of service you received.Total Cost—The amount we pay for the service. ... Not Covered—The amount of the service not covered (this usually only occurs if the service is denied).More items...•

What are reason codes in medical billing?

Reason codes appear on an explanation of benefits (EOB) to communicate why a claim has been adjusted. If there is no adjustment to a claim/line, then there is no adjustment reason code.

What does CO 16 mean in Medicare denial code?

The CO16 denial code alerts you that there is information that is missing in order for Medicare to process the claim. Due to the CO (Contractual Obligation) Group Code, the omitted information is the responsibility of the provider and, therefore, the patient cannot be billed for these claims.

What does remittance code 16 mean?

Description. Reason Code: 16. Claim/service lacks information or has submission/billing error(s) which is needed for adjudication. Do not use this code for claims attachment(s)/other documentation.

What does Adjustment Reason code 16 mean?

Claim/service lacks information which is16 Claim/service lacks information which is needed for adjudication. At least one Remark Code must be provided (may be comprised of either the NCPDP Reject Reason Code, or Remittance Advice Remark Code that is not an ALERT.) 17 Requested information was not provided or was insufficient/incomplete.

What is a Medicare denial code?

Medicare denial code - Full list - Description. Medicare denial code and Description. A group code is a code identifying the general category of payment adjustment. A group code must always be used in conjunction with a claim adjustment reason code to show liability for amounts not covered by Medicare for a claim or service.

Why was the 21 claim denied?

21 Claim denied because this injury/illness is the liability of the no-fault carrier.

What is a CO code?

CO or contractual obligations is the group code that is used whenever the contractual agreement existing between the payee and payer or the regulatory requirement has resulted in a proper adjustment.

How many charges are adjusted for failure to obtain second surgical opinion?

61 Charges adjusted as penalty for failure to obtain second surgical opinion.

Do 40 charges meet the criteria for emergent care?

40 Charges do not meet qualifications for emergent/urgent care.

When did CMS standardize reason codes?

In 2015 CMS began to standardize the reason codes and statements for certain services. As a result, providers experience more continuity and claim denials are easier to understand.

What does CMS review?

CMS contractors medically review some claims (and prior authorizations) to ensure that payment is billed (or authorization requested) only for services that meet all Medicare rules.

What is Medicare review contractor?

Historically, Medicare review contractors (Medicare Administrative Contractors, Recovery Audit Contractors and the Supplemental Medical Review Contractor) developed and maintained individual lists of denial reason codes and statements. If you deal with multiple CMS contractors, understanding the many denial codes and statements can be hard. In 2015 CMS began to standardize the reason codes and statements for certain services. As a result, providers experience more continuity and claim denials are easier to understand.

What is the most common Medicare comment code?

Most Common Medicare Remark codes with description. OA4 The procedure code is inconsistent with the modifier used or a required modifier is missing. OA5 The procedure code/bill type is inconsistent with the place of service. OA6 The procedure/revenue code is inconsistent with the patient's age.

What is OA5 in billing?

OA5 The procedure code/bill type is inconsistent with the place of service.

What is CO125 payment?

CO125 Payment adjusted due to a submission/billing error (s). At least one Remark Code must be provided (may be comprised of either the Remittance Advice Remark Code or NCPDP Reject Reason Code.)

What is OA116 payment denied?

OA116 Payment denied. The advance indemnification notice signed by the patient did not comply with requirements.

Why is CO15 payment adjusted?

CO15 Payment adjusted because the submitted authorization number is missing, invalid, or does not apply to the billed services or provider.

Why is OA19 denied?

OA19 Claim denied because this is a work-related injury/illness and thus the liability of the Worker's Compensation Carrier. OA20 Claim denied because this injury/illness is covered by the liability carrier. OA21 Claim denied because this injury/illness is the liability of the no-fault carrier.

Do OA40 charges meet the requirements for emergent care?

OA40 Charges do not meet qualifications for emergent/urgent care.

What are the remittance advice remark codes?

CMS is the national maintainer of the remittance advice remark code list, one of the code lists included in the ASC X12 835 (Health Care Claim Payment/Advice) and 837 (Health Care Claim, including COB)version 4010A1 Implementation Guides (IG). Under HIPAA, all payers, including Medicare, are required to use reason and remark codes approved by X12 recognized code set maintainers rather than local proprietary codes to explain adjustments in payment. As the X12 recognized maintainer of the Remittance Advice Remark Codes for the United States, CMS receives requests for codes that do not apply to Medicare, as well as code requests that do apply to Medicare. Not every remark code approved by CMS applies to Medicare.

What is a claim adjustment reason code?

Claim Adjustment Reason Codes and Remittance Advice Remark Codes are required for use in remittance advice and coordination of benefit (COB) transactions.

What is a CARC code?

New Claim Adjustment Reason Code (CARC) to Identify a Reduction in Payment Due to Sequestration

Does CMS change MAC statement of work?

CMS does not construe this as a change to the MAC statement of Work. The contractor is not obliged to incur costs in excess of the amounts allotted in your contract unless and until specifically authorized by the Contracting Officer.

Is Medicare cut higher than 2 percent?

The Medicare cut will never be higher than 2 percent. • Importantly, the Medicare cuts each year are not cumulative. So, the 2 percent cut this year will not be followed by another 2 percent cut next year, and so forth, producing a cumulative double-digit cut at the end of the sequestration period.

What is non-covered revenue code?

A non-covered revenue code is shown on the claim with covered charges greater than $0.00.

What is missing in a CPT code?

A principal procedure code or a surgical CPT/HCPCS code is present, but the operating physician's National Provider Identifier (NPI), last name, and/or first initial is missing.

What is the NPI of a service line?

The service line contains a line level rendering physician NPI but the first digit of the NPI is not equal to 1 or the 10th digit of the NPI does not follow the check digit validation routine.

What is a XX7 bill?

The adjustment (XX7) or Cancel (XX8) bill contains an invalid cross reference DCN. The cross reference DCN should be the Document Control Number of the original processed claim that is either being adjusted or canceled.

How long does Medicare have to submit a claim?

The claim was not submitted timely. Medicare regulations require claims to be submitted within one year of the date of service (through ‘To’ date of service on the claim).

What is the frequency code of an adjusted claim?

An adjusted claim contains frequency code equal to a ‘7’, ‘Q’, or ‘8’, and there is no claim change reason code (condition code D0, D1, D2, D3, D4, D5, D6, D7, D8, D9, or E0.

When is condition code A6 required?

Condition code 'A6' is required when billing the influenza or pneumococcal vaccine (s) and/or administration.