Medigap Plan D is about midway between the least and most comprehensive Medicare Supplement insurance plans. Medigap Plan D covers many out-of-pocket costs associated with Original Medicare, but does not cover the Part B deductible or Part B excess charges.

Full Answer

What is the best Medicare supplement insurance?

Dec 06, 2021 · Plan D covers 80% of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3 No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

How to compare Medicare Part D plans?

Part D (Medicare drug coverage) helps cover cost of prescription drugs, may lower your costs and protect against higher costs.

What does Medicare Part G cover and more?

Medicare Supplement Plan D pays many of the costs you’re responsible for with Original Medicare alone. Plan D covers the following expenses: Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance and copayment Blood (first three pints) Part A hospice care coinsurance or copayment Skilled nursing facility coinsurance

Do you have a Medigap policy with prescription drug coverage?

Medicare Part D helps cover the cost of prescription drugs. Part D is optional and only provided through private insurance companies approved by the federal government. However, Part D is offered to everyone who qualifies for Medicare.

What items are covered under Medicare Part D?

All Part D plans must include at least two drugs from most categories and must cover all drugs available in the following categories:HIV/AIDS treatments.Antidepressants.Antipsychotic medications.Anticonvulsive treatments for seizure disorders.Immunosuppressant drugs.Anticancer drugs (unless covered by Part B)

What is a Medicare Plan D supplement?

Medigap Plan D is about midway between the least and most comprehensive Medicare Supplement insurance plans. Medigap Plan D covers many out-of-pocket costs associated with Original Medicare, but does not cover the Part B deductible or Part B excess charges.

What benefit does Medicare Part D provide?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...Jun 4, 2019

What is the difference between Part D and plan D?

Part D is not a Medigap policy, though it is purchased from private companies. It is coverage specific to prescription drugs. Supplement Plan D does not cover prescription drugs but does cover many medical bills that Part A and Part B don't.

How Does Medicare Plan D work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What is the difference between Medicare Supplement Plan G and Plan D?

Medigap Plan D It is very similar to Medigap Plan G, with only one benefit difference. Just like the difference in Plans F and C, the only difference in Plans G and D is the coverage of the Medicare Part B Excess charges. Whereas Plan G covers those at 100%, Plan D does not cover them at all.

Which Medicare Part D plan is best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Does Medicare Part D cover prescriptions?

Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

Do Medicare supplements cover Part D?

A: Modern Medigap plans do not include prescription drug benefits. Instead, Medicare offers prescription drug coverage under Part D.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What Does Medicare Supplement Plan D Cover?

Medicare Supplement Plan D pays many of the costs you’re responsible for with Original Medicare alone. Plan D covers the following expenses:

Is Medicare Supplement Plan D Right for Me?

While Medicare Supplement Plan D offers a fair amount of coverage, it isn’t widely offered by insurance carriers. If you’re looking for a plan that has similar coverage, you may want to consider Medigap Plan G or Plan N instead. Choosing a plan can be intimidating at first, but the right coverage can give you peace-of-mind about your future.

What is a Medigap Plan D?

Medigap Plan D is a mid-range benefits plan similar to Plan N . Plan D provides more benefits than basic Plan A and Plan B, but it does not cover the Medicare Part B deductible and Part B excess charges, which are covered by Plan F.

What is Medicare Supplement Plan D?

Medigap Plan D is one of the standardized Medicare Supplement Insurance options available in most states. (Massachusetts, Minnesota, and Wisconsin have different options). Medicare Supplement Plan D helps cover a number of costs your Original Medicare (Part A and Part B) coverage doesn't pay for.

How much is Medicare Part A deductible in 2021?

Medicare Part A comes with a deductible, which is $1,484 per benefit period in 2021. You could potentially have to meet this deductible multiple times in a single year, which can add up quickly.

How much is coinsurance for skilled nursing?

Medical care provided at skilled nursing care facilities is covered by Medicare Part A, but it requires coinsurance costs of $85.50 per day in 2021 after day 20 of your stay.

What is Medicare Part A?

Medicare Part A Coinsurance. Medicare Part A is known as hospital insurance and it includes cost-sharing measures like coinsurance. Inpatient hospital stays covered by Medicare Part A require coinsurance fees if they exceed 60 days.

What is the maximum out of pocket amount for Medicare Plan K?

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021.

How much does Medicare pay for coinsurance?

Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases, after you meet the Part B deductible.

What is the cost of Medicare Part B?

After you meet your Medicare Part B deductible (which is $203 per year in 2021), you are typically responsible for a coinsurance or copay of 20 percent of the Medicare-approved amount for covered services.

What is a Medigap Plan D?

Medigap Plan D is one of the 10 Medigap plans available in most states, which include Plan A, B, C, D, F, G, K, L, M and N. Each type of Medigap plan offers a different combination of standardized benefits. Let’s take a look at what Medicare Supplement Insurance Plan D covers and review the average cost of Medigap Plan D.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used together with your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles. Medigap Plan D is one of the 10 Medigap plans available in most states, ...

How much is coinsurance for skilled nursing?

Skilled nursing facility care coinsurance. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How much does Medicare Part A cover in 2021?

If you are admitted to a hospital for inpatient treatment, Medicare Part A helps cover your hospital costs once you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021. For the first 60 days of your hospital stay, you aren’t required to pay any Part A coinsurance.

Does Medicare Supplement Insurance cover dental?

Many Medicare Advantage plans also offer benefits that Original Medicare doesn’t cover, such as coverage for prescription drugs, dental, vision, hearing and more. Medicare Supplement Insurance does not offer any medical benefits or coverage for prescription drugs and other services. Medigap plans only cover certain Medicare Part A ...

Can you have Medicare Advantage and Medigap at the same time?

Medigap Plan D vs. Medicare Advantage plans. Medigap plans and Medicare Advantage plans are very different things. You cannot have a Medicare Supplement Insurance (Medigap) plan and a Medicare Advantage plan at the same time. Medicare Advantage plans provide all the same benefits as Original Medicare.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you buy a Medigap and Medicare?

If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums. It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

What is Medicare Advantage?

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

What is a Medigap plan?

These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

Does Medicare coordinate with Part D?

You coordinate between Medicare, your Medigap plan and your Part D prescription drug plan, if you have one. One company coordinates all your care. Helps pay for costs you have with Original Medicare. Many plans include extra benefits Original Medicare doesn't offer like dental, vision and prescription coverage.

Does Medicare Supplement Plan work?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. Hospital costs after you run out of Medicare-covered days.

Can I see a doctor outside of my network?

No network rules. You can see any doctor that accepts Medicare. Some plans won't cover care you get outside their network. Medicare supplement plans don't include Part D prescription drug coverage. So if you're thinking about buying one of these plans, you'll want to make sure you buy a separate Part D plan.

What caused the demise of Plan J?

Changes in Original Medicare caused the demise of Plan J. Once Original Medicare began to cover wellness visits, home health services and introduced Part D for prescription drug coverage, the appeal of Plan J declined. However, the plan is grandfathered for those already enrolled.

What is the first step to Medicare?

Once eligible for Medicare coverage, the first step is signing up for Original Medicare, which includes Part A, for hospital stays and inpatient care, and Part B, for visits to the doctor’s office and outpatient care.

When did Medicare discontinue Plan J?

Medicare Supplement Plan J. Before Plan J was discontinued in 2010, as a result of the Medicare Prescription Drug, Improvement and Modernization Act, it was highly favored relative to the other plans. Basic supplement plan coverage, which is Plan A, includes Medicare Part A coinsurance, hospital costs up to 365 days after all Medicare benefits have ...

Does Medicare leave a shortfall?

Original Medicare leaves a shortfall that impacts beneficiaries in terms of coinsurance, copayments, blood, deductibles, drugs, foreign travel emergencies and out-of-pocket limits. This is why many people decide to supplement their Medicare coverage with policies from Medicare-approved private insurance carriers.

What Is Medigap Plan D?

Medicare Plan D vs Part D

- Medigap Plan D should not be confused with Medicare Part D(prescription drug coverage). 1. Medicare Part D plans are stand-alone prescription drug plansoffered by private insurance companies. Part D plans are available to anyone with Medicare at an additional cost. 1. Medigap Plan D is designed to work alongside Original Medicareby covering some of the out-of-pocket co…

What Does Plan D Not Cover?

- There are just two benefit areas where Plan D does not offer any coverage. 1. The Medicare Part B deductible You must first satisfy an annual deductible before your Medicare Part B medical insurance kicks in. In 2022, the deductible is $233 for the year. That means you must pay for the first $233 worth of your Part B covered services and items out of your own pocket. Part B covera…

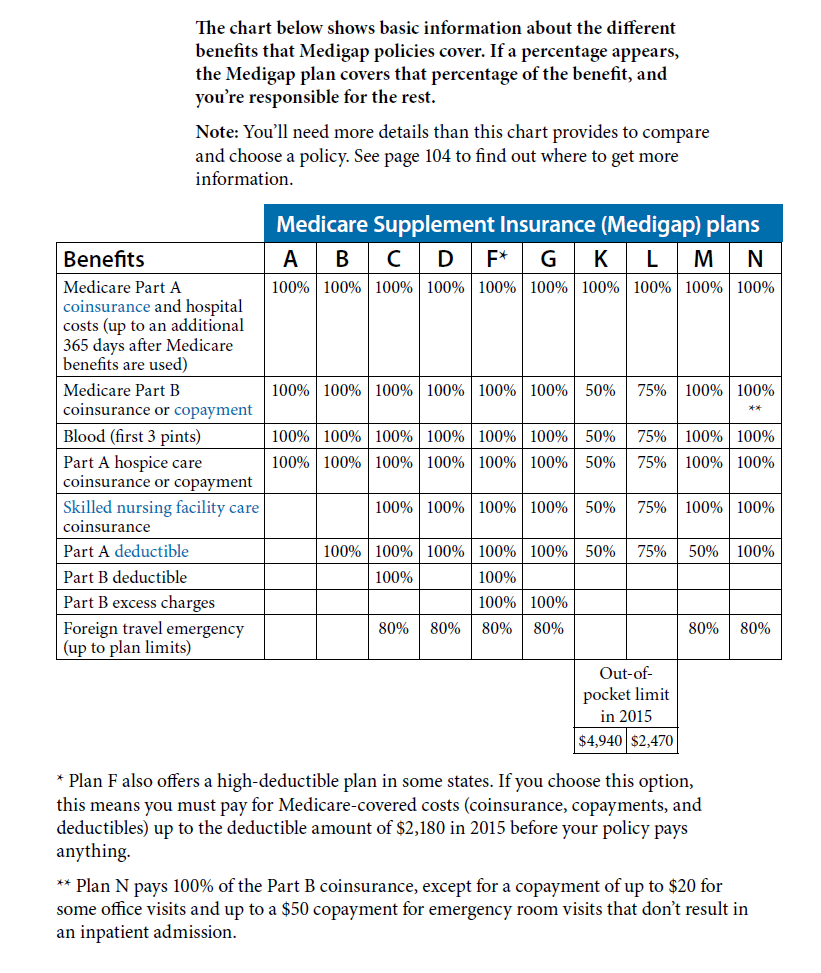

Medigap Plan D vs. Plan F and Other Plans

- Medigap Plan D is a mid-range benefits plan similar to Plan N. Plan D provides more benefits than basic Plan A and Plan B, but it does not cover the Medicare Part B deductible and Part B excess charges, which are covered by Plan F. To see the difference between Plan D and the other standardized Medigap plans, please review the chart below. Use the ...