What is Medicare Part E used for?

Medigap Plan E helps cover your basic Medicare expenses, including some Part A and Part B costs, blood transfusions, and foreign travel medical costs. Medigap Plan E is no longer available to new Medicare beneficiaries but if you already have the plan, you can continue to use the benefits available to you.

Does AARP plan E cover Medicare deductible?

Plan E pays the 20% remainder of Medicare Approved Amounts. Foreign Travel Emergency benefits are included in this plan. The Basic Benefits, the Part A deductible of 1100.00 is paid by the plan and Skilled Nursing Coinsurance is included in this plan. The plan pays the Part A Deductible of $ 1100.00 per benefit period.

What does Medicare Supplement insurance primarily cover?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

What is the most comprehensive Medicare Supplement plan?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the difference between Medigap plan F and G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.Feb 18, 2021

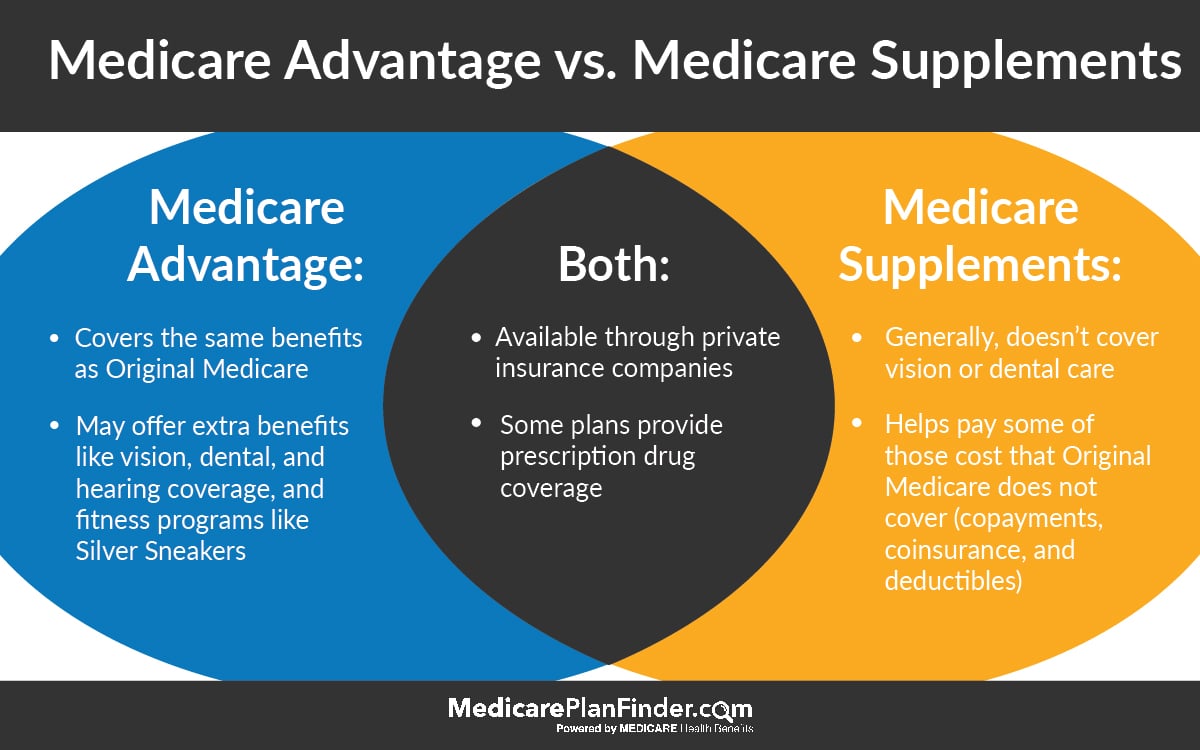

What is the difference between a Medicare Supplement and a Medicare Advantage plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Can I change from Medicare Supplement to Medicare Advantage?

Can you switch from Medicare Supplement (Medigap) to Medicare Advantage? Yes. There can be good reasons to consider switching your Medigap plan. Maybe you're paying too much for benefits you don't need, or your health needs have changed and now you need more benefits.Jun 24, 2021

What happened to Medicare Supplement Insurance Plan E?

In 2003, Congress passed the Medicare Prescription Drug, Improvement and Modernization Act, which expanded certain Original Medicare benefits. This...

What does Medicare Supplement Plan E cost?

Medigap plan costs may vary based on factors such as age, gender, health, how your insurance company rates (prices) its plans, and where you live.

Does Medicare Supplement Plan E cover prescriptions?

Medigap Plan E does not cover prescription drugs. Medigap plans can only help cover certain out-of-pocket Medicare costs, such as deductibles and c...

Should I switch from my Medigap Plan E to another Medigap plan?

The first thing to consider is the plan cost. Because no new members are being accepted into Plan E, the overall plan risk pool can only increase i...

What is the most popular Medicare plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is the most popular Medigap plan currently available. 53 percent of all Medicare Supplement Insurance beneficiaries are enrolled in Plan F. 1. Plan G is the second-most popular Medigap plan currently available. 17 percent of all Medigap beneficiaries are enrolled in Plan G.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used alongside your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles. Medigap Plan E was discontinued for new enrollees in 2010.

What is Medigap Plan E?

At the time, certain Medigap plans – such as Medigap Plan E – covered some of these services and devices for people who joined those plans. But in 2003, Congress passed the Medicare Prescription Drug, Improvement and Modernization Act, which expanded certain Original Medicare benefits.

What is Medicare Advantage?

You can enroll in a Medicare Advantage Prescription Drug plan (MAPD). These plans cover all of the same hospital and medical insurance benefits that are covered by Original Medicare, as well as prescription drug costs. Many plans also offer benefits such as routine hearing, vision and dental.

How many Medigap plans are there?

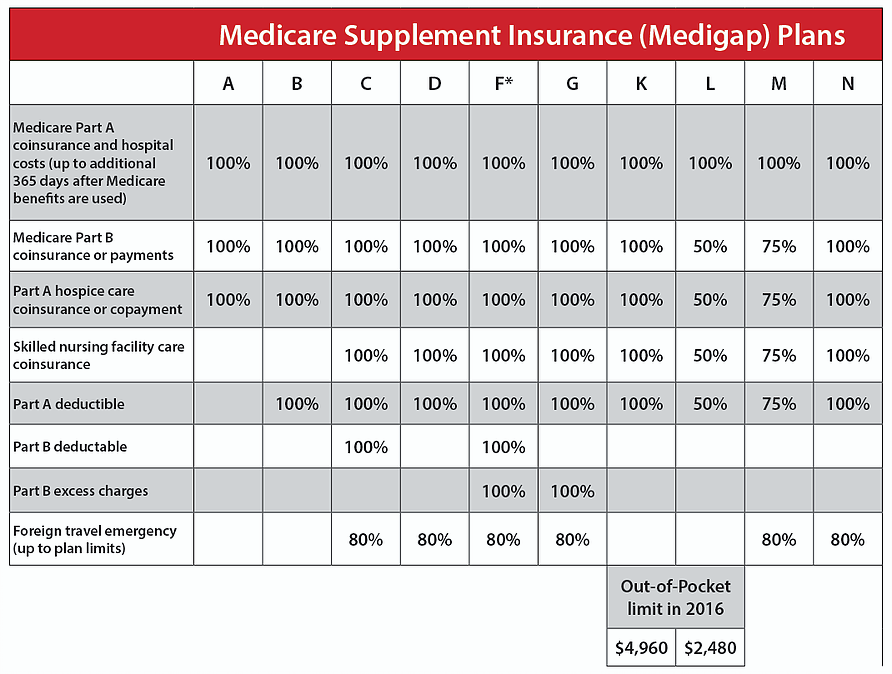

There are 10 Medigap plans that are currently available in most states, however. These plans include Plan A, B, C, D, F, G, K, L, M and N. Each type of Medigap plan offers a different combination of standardized benefits, which are outlined below. Massachusetts, Minnesota, and Wisconsin have different Medigap standards and plan options.

When did Medicare Supplement Insurance stop selling plan E?

Therefore, Medicare Supplement Insurance companies were no longer allowed to sell Medigap Plan E to new enrollees as of June 1, 2010.

Is Medicare Part B deductible in 2021?

Plan G and Medigap Plan F are nearly identical except for the fact that Plan F covers the Medicare Part B deductible, while Plan G does not. The Medicare Part B deductible is $203 per year in 2021. If you can find a Plan G option that only costs $203 more per year (or less) than Plan F, you could save money in the long run by choosing Plan G.

When did Medicare Supplement Plan E end?

Overview of Medicare Supplement Plan E. Medicare Supplement Plan E is one of the four Medicare Supplement Plans that was eliminated on June 1st, 2010 due to the Medicare Modernization Act.

Is it a good idea to purchase a Medicare Supplement Plan?

It is a good idea to consider purchasing a more current "Modernized" Medicare Supplement Plan that will cover the gaps left by Medicare, but one that will not duplicate benefits already provided as standard coverage.

Is Medicare Supplement Plan J a duplication?

With this upgrade in Medicare coverage, some of the "old" Medicare Supplement Plans were eliminated due to the duplication of benefits.

Is it ok to have an old Medicare supplement?

With an increase in these types of standard Medicare coverage, it does not make sense to have one of the "old" Medicare supplement plans, because you will simply be paying for additional benefits on your Medicare Supplement Policy that you get for free by just having Medicare.

What is not included in Plan E?

Not included in Plan E are the Medicare Part B deductible, the Medicare Part B Excess Charges, and recovery care at home, Medicare excess charges which aren’t covered and don’t count toward the out of pocket limit. You are obligated to pay these excess charges.

Why is preventive care being removed from Medicare?

Preventive Care and At Home Recovery are being removed due to a lack of use, making Plan D and Plan E identical .

Does Medicare Supplement Plan E lose coverage?

Current policyholders should note that current Plan E enrollees will not lose their current Plan E coverage. Medicare Supplement Plan E is one of the few Supplement Plans that has offered enrollees Preventive Care Coverage. Overall Plan E is very similar to Plan D.

Will there be more Medicare Supplement plans after June 2010?

There will simply be no more Plan E coverage sold after June 1, 2010. It can be difficult to determine which plan is right for you, and not all providers offer every single Medicare Supplement Plans. Our trained specialists can help you find the plan that best fits your needs and budget.

Is Plan E still a Medigap?

Effective Ju ne 1, 2010 Plan E will no longer be offered as a Medigap supplementary insurance policy. Policyholders can take note, however, that current Plan E enrollees will not lose their current Plan E coverage. One of the main changes in Medicare’s effort to modernize their plan offerings is the elimination of certain benefit options.

Is Plan E the same as Plan D?

Overall Plan E is very similar to Plan D. It however does not offer the At Home Recovery benefits that Plan D has, and Plan D does not offer the Preventative Care Coverage that Plan E offers. It does not offer the overall comprehensive benefits of some of the other plans, but it also offers lower premiums.

How long do you have to be in a hospital to be eligible for Medicare?

You must meet Medicare's requirements, including having been in a hospital for at least 3 days and entered a Medicare-approved facility within 30 days after leaving the hospital: First 20 days. All approved amounts. $0. $0. 21st through 100th day. All but $137.50 a day. Up to $137.50 a day. $0.

How much is the Part A deductible for nursing?

The Basic Benefits, the Part A deductible of 1100.00 is paid by the plan and Skilled Nursing Coinsurance is included in this plan. The plan pays the Part A Deductible of $ 1100.00 per benefit period. The Plan pays up to $ 120.00 for preventative not paid by Medicare per year. Click here to start your free quote.

Is a dipstick urinalysis covered by Medicare?

BENEFIT- NOT COVERED BY MEDICARE. Some annual physical and preventative tests and services such as: digital rectal exam, hearing screening, dipstick urinalysis, diabetes screening, thyroid function test, tetanus and diphtheria booster and education, administered or ordered by your doctor when not covered by Medicare:

Is Plan E still available?

Plan E is no longer available for sale. If you currently have a plan E you will be grandfathered in and can keep the plan. If you would like to look at the 2019 Modernized plans click here. You pay the Part B excess when you see a provider that does not accept Medicare Assignment.

What is Medicare Plan E?

Medicare Plan E is a Medicare supplement (Medigap) plan that is no longer available to new enrollees in Medicare. However, some of the people who purchased this plan before its discontinuation still have it.

What is Medicare Supplement Plan E?

Summary. Medicare Supplement Plan E is a former Medicare supplement insurance (Medigap) plan that has not been available to new enrollees since 2010. However, if a person already has Plan E, they may keep it. Original Medicare pays for most, but not all, healthcare costs. Medigap plans help cover some of the remaining costs ...

Why do people choose Medigap?

A person may choose a Medigap plan to help with costs that original Medicare does not cover. Medicare-approved private health insurance companies administer Medigap plans, which help fill any gaps that original Medicare has in its coverage. These coverage gaps include: Medigap plans do not help with Medicare premium costs.

What are the benefits of Plan E?

The benefits of Plan E include coverage of: Part A copayment. Part B coinsurance. the first 3 pints of blood that a person may need. Part A deductible. SNF daily copayment. 80% of emergency care costs outside the U.S. up to $120 per year for extra preventive care that original Medicare does not cover.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

Does Medigap cover premiums?

Medigap plans do not help with Medicare premium costs. Different Medigap plans have various benefits and levels of coverage. Covered expenses may include: deductibles for a hospital stay. coinsurance for a skilled nursing facility (SNF) emergency healthcare that a person receives outside the United States.

Does Medicare cover DME?

Before 2003, original Medicare did not cover certain types of durable medical equipment (DME) or some home healthcare, and Medigap Plan E helped cover some of these costs. In 2003, Congress passed the Medicare Prescription Drug, Improvement, and Modernization Act, which saw an increase in original Medicare coverage.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you buy a Medigap and Medicare?

If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums. It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

What is Medicare Advantage?

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

What is a Medigap plan?

These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

Does Medicare coordinate with Part D?

You coordinate between Medicare, your Medigap plan and your Part D prescription drug plan, if you have one. One company coordinates all your care. Helps pay for costs you have with Original Medicare. Many plans include extra benefits Original Medicare doesn't offer like dental, vision and prescription coverage.

Does Medicare Supplement Plan work?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare. Hospital costs after you run out of Medicare-covered days.

Can I see a doctor outside of my network?

No network rules. You can see any doctor that accepts Medicare. Some plans won't cover care you get outside their network. Medicare supplement plans don't include Part D prescription drug coverage. So if you're thinking about buying one of these plans, you'll want to make sure you buy a separate Part D plan.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

Does Medicare Supplement pay for all deductibles?

From there, the benefits in the 10 standard Medicare Supplement plans vary a bit more. Some pay all or part of your Medicare Part A and/or Part B deductibles, your Part A skilled nursing facility coinsurance, and your Part B excess charges. A few even offer benefits for limited emergency health care when you’re traveling outside the U.S.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

What caused the demise of Plan J?

Changes in Original Medicare caused the demise of Plan J. Once Original Medicare began to cover wellness visits, home health services and introduced Part D for prescription drug coverage, the appeal of Plan J declined. However, the plan is grandfathered for those already enrolled.

What is the first step to Medicare?

Once eligible for Medicare coverage, the first step is signing up for Original Medicare, which includes Part A, for hospital stays and inpatient care, and Part B, for visits to the doctor’s office and outpatient care.

When did Medicare discontinue Plan J?

Medicare Supplement Plan J. Before Plan J was discontinued in 2010, as a result of the Medicare Prescription Drug, Improvement and Modernization Act, it was highly favored relative to the other plans. Basic supplement plan coverage, which is Plan A, includes Medicare Part A coinsurance, hospital costs up to 365 days after all Medicare benefits have ...

Does Medicare leave a shortfall?

Original Medicare leaves a shortfall that impacts beneficiaries in terms of coinsurance, copayments, blood, deductibles, drugs, foreign travel emergencies and out-of-pocket limits. This is why many people decide to supplement their Medicare coverage with policies from Medicare-approved private insurance carriers.