Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Which Medicare supplement plan should I Choose?

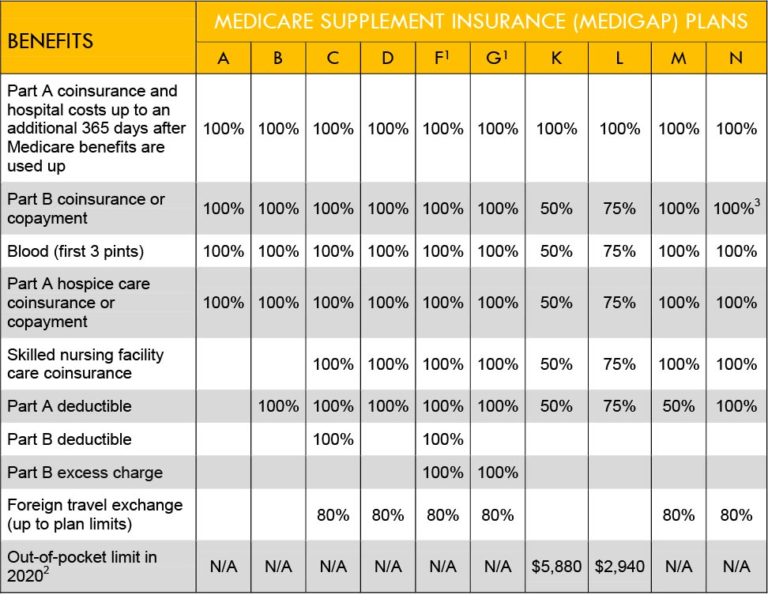

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

How to pick the best Medicare supplement plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

Which Medicare supplement plan is the most popular?

Medicare supplement Plan G is one of the most popular Medigap plans available today. More people will enroll in Plan G than any other Medigap plan, and for good reason. Medicare Plan G pays 100% of the gaps in Medicare Part A and B after you simply pay a small annual deductible. Keep reading to learn why Plan G might be the best option for you.

Do I really need a Medicare supplement insurance plan?

So yes…I do recommend buying Medicare Supplement Insurance. You don’t necessarily need an expensive, luxury plan, but having something in place is essential. Even if you can’t afford a Supplement, you can (at the very least), purchase a low or no cost Medicare Advantage Plan that will cap your annual out-of-pocket spending at $4-6,000.

How do plans L and K differ from other plans?

In general, Plan K offers a lower monthly premium than Plan L, but offers higher coinsurance amounts and a higher annual out-of-pocket limit.

Does Medicare Supplement plans K and L cover 100% once you meet the yearly limit?

**For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($198 in 2020), the Medigap plan pays 100% of covered services for the rest of the calendar year.

What is the difference between Supplemental plan F and G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Is plan n Better Than G?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is K and L Medigap?

Medicare Supplement Plan K and Plan L are unique in the Medicare Supplement (Medigap) world. These two plans cost relatively little on a monthly basis since you'll also share the cost of coinsurance for your Plan K and L bills (50 percent for K and 25 percent for L) up to an annual out-of-pocket limit.

Do Medicare Supplement plans have maximum out-of-pocket?

Medicare Supplement insurance Plans K and L have out-of-pocket limits that may change from year to year. In 2021, the out-of-pocket limit for Plan K is $6,220 and the limit for Plan L is $3,110. Both plans require you to meet the Part B deductible.

Why was plan F discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What plan G does not cover?

Medicare Plan G will not cover your original Medicare Part B deductible, which is $233 in 2022. You would pay for medical services — such as outpatient care, preventative care and ambulance services — until you have reached the deductible amount. Then Medicare would cover your health care costs.

Why is plan F more expensive than plan G?

Because it offers the most benefits, Plan F premiums are generally the most expensive. If you didn't become eligible for Medicare until 2020 or later, Plan F won't be available to you.

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Which Medigap plans are no longer available?

The federal government standardizes all Medigap plans. Plans H, I, and J are no longer available due to the addition of a prescription drug benefit, Part D, to Medicare after a 2003 act became a law. They went away because they duplicated existing letter plans but added a drug benefit.

Can I switch from plan N to plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

What is Medicare Supplement Plan L?

Takeaway. Medicare Supplement Plan L is one of the two Medigap plans with a yearly cap on out-of-pocket spending. Medigap plans, also called Medicare supplement plans, are offered by private companies to help cover some healthcare costs not paid for by original Medicare. These plans are standardized in 47 states.

What is a Medigap Plan L?

A Medigap Plan L policy helps cover many of the gaps in your original Medicare coverage, such as the Part A deductible.

What is not included in Medigap Plan L?

Coverage not included with Medigap Plan L includes vision, hearing, dental, and prescription drugs. The information on this website may assist you in making personal decisions about insurance, but it is not intended to provide advice regarding the purchase or use of any insurance or insurance products.

What is the out-of-pocket limit for Medigap 2021?

What’s the out-of-pocket limit? In 2021, the out-of-pocket limit for Plan L is $3,110. Once you meet your yearly Part B deductible ( $203 in 2021) and your out-of-pocket yearly limit, Medigap will pay for 100 percent of covered services for the rest of the year.

How many states have Medigap plans?

These plans are standardized in 47 states. In Massachusetts, Minnesota, and Wisconsin, there are different standardization policies. To qualify for any Medigap plan, including Plan L, you must have Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

Does Medigap Plan L have a cap?

Only two of the 10 Medigap plans offer this feature: With original Medicare and the other eight Medigap plans (A, B, C, D, F, G, M, N), there’s no cap on your yearly out-of-pocket healthcare costs.

Does Medigap cover spouse?

If you purchase a Medigap Plan L policy, it will only cover you. If your spouse is eligible for Medicare and needs Medigap coverage, they’ll need to purchase a separate policy.

What Does Medicare Supplement Plan L Offer?

Medicare Supplement Plan L covers several expenses that are not fully paid for by Original Medicare. These include:¹*

How You Can Purchase Medicare Supplement Plan L

As Medicare Supplement Plan L plans are offered by private insurance companies, prices and benefits vary based on your geographical location and carrier. HealthMarkets can help you and your loved ones easily find the plan that best meets your needs, and our services are available at no cost to you.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medicare cover prescription drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Why do people buy Medicare Supplement Plan L?

Limiting the amount of money spent on healthcare is one reason people purchase a Medicare supplement plan (Medigap). Because Medicare Supplement Plan L has an out-of-pocket limit, choosing this supplement can help you better plan for your medical expenses. That’s because you’ll know the maximum you may have to spend in any given year ...

How much is Medicare Supplement Plan L in 2021?

Some also pay the deductible. Coverage withMedicare Supplement Plan L includes: out-of-pocket limit: $3,110 in 2021, with 100 percent of covered services for the rest of the year paid after you meet your yearly Part B deductible and your out-of-pocket yearly limit.

How many Medigap plans are there?

If Medigap is the right decision for your health care and financial needs, you have a choice of 10 Medigap plans, each offering different levels of coverage and options. If a limit on out-of-pocket spending is important to you, consider Medicare Supplement Plan L.

Can private companies sell Medicare?

Because original Medicare doesn’t cover all healthcare costs, private companies can sell supplemental insurance to Medicare recipients to help cover those expenditures.

Is Healthline Media a licensed insurance company?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S . jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on February 12, 2020.

Is Medicare plan change every year?

Medicare plan options and costs are subject to change each year. Healthline.com will update this article with 2022 plan information once it is announced by the Centers for Medicare & Medicaid Services (CMS).

Does Medigap have a yearly limit?

One of its features, offered by only one other Medigap policy, is setting a yearly limit on the amount of money you will spend out-of-pocket. The yearly out-of-pocket limit may be especially beneficial if you: have a chronic health condition with high costs for ongoing medical care.

What Does Medicare Supplement Plan L Cover?

Plan L provides full coverage for 1 benefit and 75% coverage for 5 other benefits.

How much does Plan L pay for Medicare?

For example, instead of covering the entire Medicare Part A deductible, Plan L only pays 75% of it. You would have to pay the remaining 25%.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

How much does Medicare Part B pay for Plan L?

With Plan L, you still have to pay the Medicare Part B deductible, which is $198 per year in 2019.

How much is coinsurance for skilled nursing?

In 2020, the Part A coinsurance for skilled nursing facility care is $176 per day.

What percentage of Part B coinsurance is covered by Plan L?

Plan L pays for 75% of your Part B coinsurance or copayment costs.

How long does Medicare require coinsurance?

Inpatient hospital stays covered by Medicare Part A require coinsurance fees if you stay in the hospital for longer than 60 days.

What Does Medicare Supplement Plan L Cover?

Medicare Supplement Plan L protects you from most of the costs that you’re responsible for with Original Medicare, but not all of them. It also has an out-of-pocket amount that you must reach before its benefits pay in full.

Does Medicare cover all of your medical expenses?

Medicare provides millions of Americans with health insurance, but it doesn’t completely cover all of your costs. If you’re on Original Medicare alone, you’re also responsible for deductibles, copays, and up to 20% coinsurance for the services that you receive. Medicare Supplement (Medigap) plans help cover these out-of-pocket expenses. Medicare Supplement Plan L is one of the mid-range coverage Medigap plans available for purchase.

What does Medicare supplement Plan L cover?

Original Medicare, parts A and B, does not provide 100% of a person’s healthcare costs. It has “gaps” in coverage in the form of deductibles, copays, and coinsurance. Medigap plans help fill these gaps.

What does Plan L not cover?

Plan L does not cover the Medicare Part B annual deductible nor emergency care costs that a person may encounter when traveling. Also, Plan L does not cover excess charges, which are the amounts a provider charges that exceed Medicare-approved amounts.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Do you have to pay monthly premiums for Plan L?

People with Plan L must pay monthly premiums, which vary among companies. The cost of the premiums also depends on whether someone receives discounts for various reasons, such as arranging payment through electronic funds transfer.

What does Medicare Supplement Plan L cover?

What Does Medicare Plan L Cover? Medicare Supplement Plan L offers full coverage for Part B preventive care coinsurance, Part A coinsurance and hospital costs up to 365 days beyond when Medicare benefits are exhausted, as well as foreign travel emergency up to plan limits. As it is a cost-sharing plan, Plan L offers 75% coverage for Part B ...

What is the Medicare Supplement Plan L Maximum Out-of-Pocket for 2022?

Medigap Plan L and Plan K both involve maximum out-of-pocket (MOOP ) limits. The purpose of the MOOP is to protect beneficiaries from spending over a certain amount on covered services out-of-pocket in a calendar year.

What is the Average Cost of Plan L?

The average cost of Medicare Supplement Plan L is around $80-$180 per month . Medigap monthly premiums depend on numerous factors, such as the cost of living in your state. The only way to obtain an accurate estimate for what you will be paying is to speak to a Medicare agent.

What is the MOOP for Plan L 2022?

The MOOP for Plan L in 2022 is $3,310. This dollar amount is subject to change annually.

Does Plan L have more coverage than Original Medicare?

However, not all beneficiaries will be on board with the cost-sharing this plan involves. Yet, Plan L certainly offers more coverage than Original Medicare alone.

Does Medicare Supplement cover psychiatrists?

Part B covers visits with mental health professionals such as psychiatrists, so Medicare Supplement plans cover the remainder that Original Medicare doesn’t.

Is Plan F a good Medigap plan?

Plan F is the most comprehensive Medigap plan. However, it isn’t available to everyone who is eligible for Medicare. For those who can’t get Plan F and don’t mind cost-sharing, Plan L can be a good alternative with a lower premium.

Costs

The cost of a Medigap plan includes its premium and the amount that a person must pay out of pocket.

Limitations

In some states, doctors can charge 15% more than Medicare allows for some services. These are called Plan B excess charges.