Does Medicare Supplement Plan N cover Medicare Part B deductible?

What does an n plan cover?

Does Plan n pay the Part B coinsurance?

What is Medicare type N?

Does Plan N have a deductible?

Does Plan N cover prescriptions?

What are the copays for Plan N?

Is Plan N guaranteed issue?

Can I switch from Plan N to Plan G?

What is difference between Plan G and N?

What is AARP plan N?

Is Plan N cheaper than Plan G?

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

What is Medicare Supplement Plan N?

Medicare Supplement Plan N. Medicare Supplement Plan N is one of the more popular plans among beneficiaries in 2021. It’s the plan for those who prefer lower monthly premiums without forfeiting benefits. Yet, when you enroll in this plan, you’re responsible for deductibles and a few copays.

What is Plan N insurance?

Plan N covers your inpatient deductible, which falls under Part A. It also covers your inpatient copays and coinsurance, minus a small copay of $50. This is what helps keep your monthly premium low.

What is a plan F?

Plan F is a Medigap plan offering comprehensive coverage. It covers 100% of your out-of-pocket costs. Outside of the monthly premium, you never need to pay out-of-pocket. Plan N is two steps down from Plan F in terms of coverage. Yet, the premiums for Plan F are higher because the more benefits a plan offers, the higher the premiums will be.

Why is Plan N so popular?

This popularity is not surprising, because the policy offers a decent amount of coverage at a reasonable price. Plan N offers extra coverage to supplement your Medicare benefits without breaking the bank. The small copays this plan involves keeping the monthly premium lower.

How much does Medigap cost in 2021?

How Much Does Medigap Plan N Cost in 2021. The average cost of Plan N is around $120-$180 per month. However, in some states, it can be as much as $200 and in others, it can be as low as $80. Your premium rates depend on your personal information as well as the plan letter you choose. Factors such as your state of residence, gender, age, ...

What is the job of a Medicare agent?

Our job is to keep you informed and up-to-date with the latest Medicare changes. You can depend on your agent and our client care team to help you manage claims and to make sure you have the best rate at all times.

Which is better, Advantage or Medigap?

Yet, if you don’t want to deal with restrictive doctor networks, a Medigap plan such as Plan N will likely better suit your needs.

What is Plan B coverage?

Plan B Coverage. Plan B is one notch above the coverage in Plan A. Basic coverage includes Part A coinsurance and hospital costs for up to 365 additional days after Original Medicare benefits have been exhausted.

What is Medicare Supplement Insurance?

Medicare supplement insurance plans, otherwise known as Medigap policies, are designed to help with some of the cost exposure inherent in Original Medicare, such as copayments, coinsurance and deductibles. Some of these policies cover deductibles as well.

How long is the Medicare Supplement enrollment period?

When you are 65 years of age and enrolled in Medicare Part B, you enter your Medicare Supplement Initial Enrollment Period. This is a 6-month period when you have a guaranteed issue right to purchase any Medicare Supplement plan sold in your state.

Do private insurance companies have to include Medigap?

These regulations require that if a private insurance company elects to offer Medigap policies, they must include plan A in their offering because it is the standard plan for basic coverage. Plan B Coverage.

Does Medicare Advantage include Part D?

Additionally, unlike some Medicare Advantage plans, supplement plans do not include Part D. Therefore, a premium would also be due to the insurance company carrying your drug coverage. It is possible that the company in which you are enrolled for supplement insurance also offers Part D.

Does Plan B cover deductible?

Also, Plan A covers Part B coinsurance or copayments, the first three pints of blood annually, Part A hospice care coinsurance or copayments and skilled nursing facility care coinsurance. Where Plan B becomes advantageous is that it also covers the Part A deductible, which, in 2020, is projected to rise to $1,420.

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

How much does Medicare pay for a medical bill?

Medicare pays 80% and then sends the bill to your Medigap plan. If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

What happens if a doctor doesn't accept Medicare?

If your doctor does not accept Medicare assignment, you will pay a 15% excess charge. Read more about how this would work in our Medigap Plan N Example below.

When is the best time to enroll in Medicare Plan N?

You must also live in the plan’s service area. The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment Period. This six-month window starts with your Part B effective date. It’s your one chance to enroll in any Medigap plan without health underwriting.

How long does Medicare Supplement Plan N cover?

Medicare Supplement Plan N covers Medicare Part A coinsurance costs in full along with 365 days of inpatient hospital costs after all Medicare benefits are exhausted.

What is the deductible for Medicare Supplement 2021?

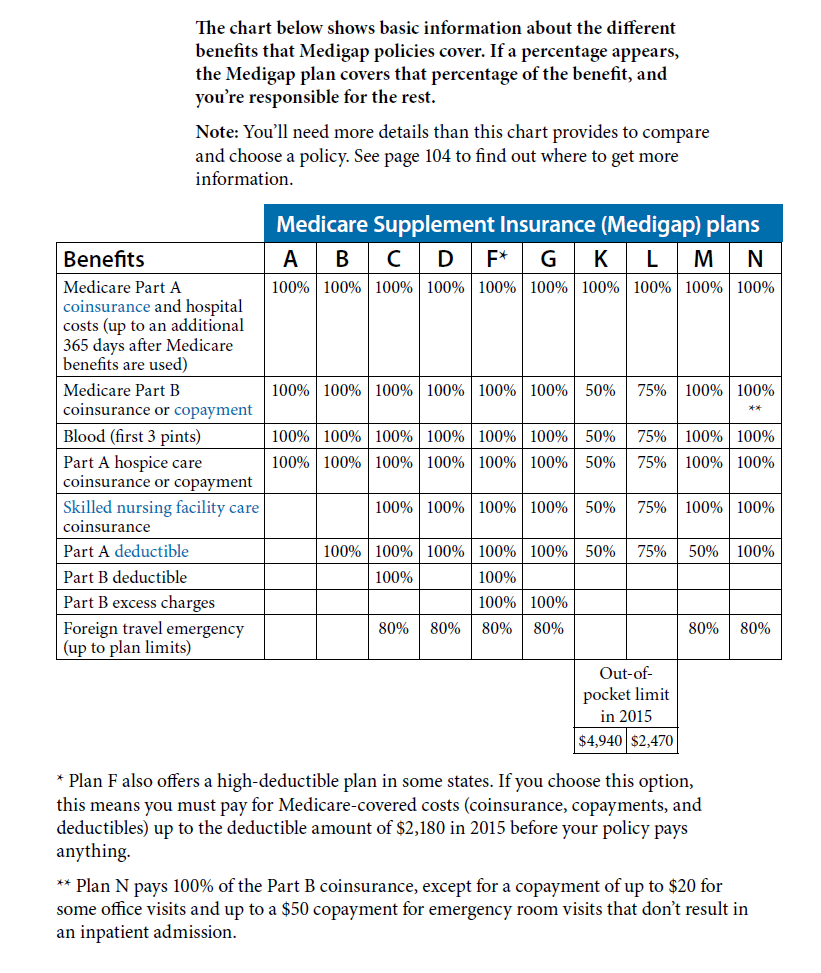

Plans C and F are not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020. 2. Plans F and G also offer a high deductible plan which has an annual deductible of $2,370 in 2021.

How much is Medicare Part A coinsurance for 2021?

Medicare Part A requires daily coinsurance payments for inpatient hospital stays beginning on day 61 of a benefit period. In 2021, these Part A coinsurance costs are $371 per day for days 61-90 of an inpatient stay and $742 per day for days 91 and beyond for up to 60 lifetime reserve days.

How much is coinsurance for skilled nursing?

But beginning on day 21 of a benefit period, you’ll owe a Part A coinsurance cost of $185.50 per day until day 100 of your inpatient stay. ...

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance (often called Medigap) is sold by private insurance companies. While the costs of each type of Medigap plan may vary depending on where and by whom it is sold, all of the benefits remain standardized by the federal government. For example, Plan N purchased in New York will include the same coverage as ...

Does Medicare Supplement Plan N cover deductible?

Medicare Supplement Plan N covers 100% of the Medicare Part A deductible, no matter how many benefit periods you face in a year.

Does Medicare cover the first 3 pints of blood?

First Three Pints of Blood. Original Medicare does not cover the first three pints of blood you might need for a blood transfusion. Medicare blood coverage kicks in beginning with the fourth pint. Medicare Supplement Plan N covers the full cost of the first three pints of blood .

Does Medicare cover prescriptions?

Both Medigap and Original Medicare do not cover prescriptions. A separate Medicare Part D Prescription Drug Plan would need to be purchased in order to receive prescription drug coverage.

Does Medicare cover out of pocket expenses?

Original Medicare Part A and Part B covers many costs for medical services and supplies, but some Medicare recipients find that out-of-pocket costs can still be too high. Supplemental insurance is offered by private insurance companies to help pay for some of the expenses Original Medicare does not cover. Medigap, or Medicare Supplement, policies are sold in most states. Medigap plans are sold as standardized policies and identified by a letter, but each plan’s coverage and costs may vary.

Does Medicare Advantage cover dental insurance?

While Medicare Advantage plans may also help reduce costs for your cost-sharing obligations, they are not standardized across all carriers, which means policies can vary depending on insurer and location. Additional benefits can include vision and dental coverage in addition to prescription drug coverage, which are not covered by any Medigap plans.

Does Medigap cover Part B?

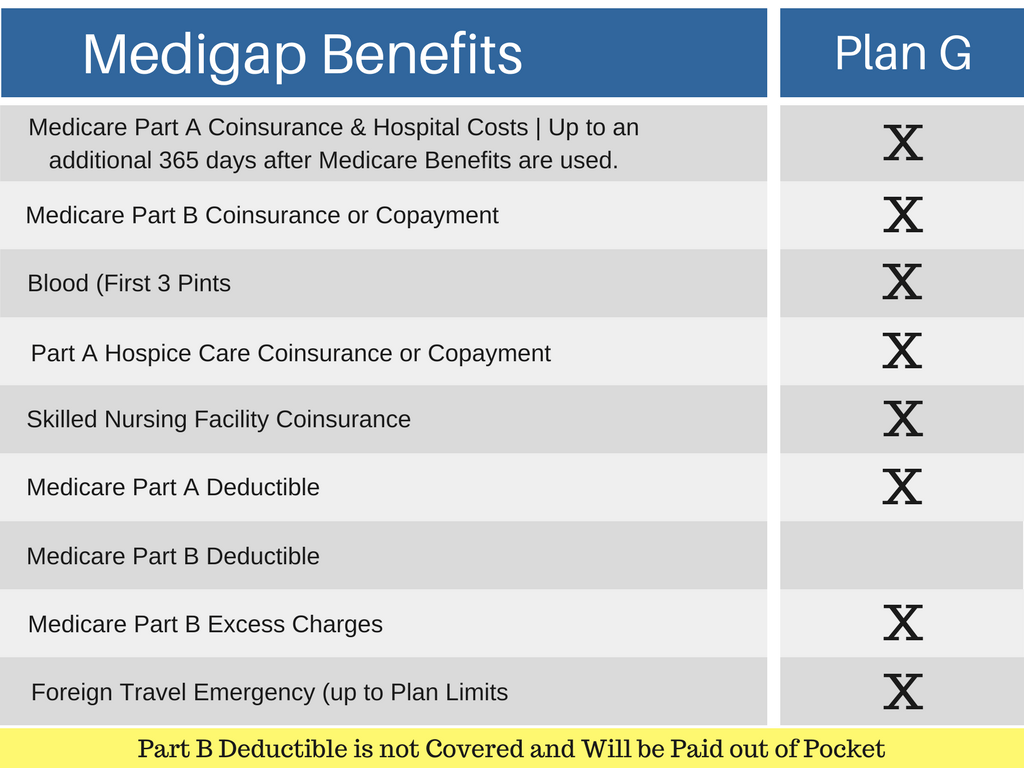

While Medigap Plan N does not cover the Part B deductible or excess charges with Part B, it does cover the Part A deductible, hospital coinsurance and hospital costs for up to 365 days once Part A’s coverage runs out. The copayment and coinsurance amounts for Part A’s hospice care are also covered, as well as any skilled nursing facility coinsurance amount. With medical procedures that require a blood transfusion, the first three pints are covered by Medigap Plan N.

Which Medicare Supplement Plan covers more?

Medicare Supplement Plan N provides more coverage than Plans K and L. For example, it covers 100% of the Medicare Part B coinsurance and copayments, whereas K and L only pay 50% and 75%, respectively. The same is true with the Medicare Part A deductible.

What is Medicare Plan N?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B . It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

How much does Medicare Supplement cost in Florida in 2021?

As a general reference, in 2021, a non-smoking 65-year-old woman living in Florida’s 32162 ZIP code would pay between $123 and $181 for Medicare Supplement Plan N monthly premiums. 2.

How old do you have to be to get Medicare Supplement?

You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase. There are 10 Medigap plan options in total. But we are going to focus on Medicare Supplement Plan N.

How long does Medicare cover hospitalization?

Hospitalization: pays Part A coinsurance and provides coverage for 365 additional days after Medicare benefits end.

When shopping for a Medicare Supplement policy, always compare apples to apples?

You want to be make certain you are comparing a Medigap Plan N from one company to a Medicare Plan N from another company. You don’t want to compare Plan N at one company to Plan B at another because you won’t get a clear comparison between the prices and benefits.

When does Medigap plan N end?

Enrollment begins the first day of the month you turn 65 and are covered under Medicare Part B and ends six months after your birthday month. Applying for benefits during this time is the most beneficial, as insurance companies are not permitted to use medical underwriting.

What is the deductible for Medicare Part B?

Medical Services for Medicare Part B: Plan C covers the $203 Part B deductible. It then covers the 20% or so for health care services that Medicare should pay at 80%.

What is covered by Plan B after day 100?

After day 100, you are responsible for all skilled nursing care costs. Plan B also covers the first three pints of blood and, for hospice care, any co-payment and co-insurance Medicare may require for outpatient drugs and inpatient respite care. 3 .

How long does it take to get Medicare if you have Social Security?

You don't have to do anything extra to be enrolled in Medicare if you receive Social Security benefits. The open enrollment period for buying a Medigap plan lasts six months. It begins the month you are enrolled in Medicare Part B and are at least 65.

What does Plan C cover?

Plan C also covers the first three pints of blood if you ever need a transfusion. It covers any copay or coinsurance Medicare may require for outpatient drugs or inpatient respite care during hospice care. 4

What does Medicare cover for a blood transfusion?

Plan A covers the first three pints of blood you receive if you need a blood transfusion. It also covers any copay or coinsurance that Medicare may require for outpatient drugs or inpatient respite care during hospice care. 2

How much does Medicare pay for hospitalization?

Hospital Services for Medicare Part A: Plan B pays the $1,484 deductible for Part A for the first 60 days of hospitalization. It then acts like Plan A. For days 61 to 90, Plan B pays the $371 per day that Medicare doesn't cover. For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days.

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.