Medicare Advantage Plans cover almost all Part A and Part B services. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care

Hospice

Hospice care is a type of care and philosophy of care that focuses on the palliation of a chronically ill, terminally ill or seriously ill patient's pain and symptoms, and attending to their emotional and spiritual needs. In Western society, the concept of hospice has been evolving in Europe since the 11…

Full Answer

How does Medicare Advantage compare to Medicare?

Medicare Advantage: Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams. Plans must cover all of the medically necessary services that Original Medicare covers.

When to choose Original Medicare vs. Medicare Advantage?

Medicare vs. Medicare Advantage - Pros and Cons. Medicare Advantage plans have been in existence since 1997, when President Bill Clinton signed the law that created the current system allowing private health care providers to offer a one-stop-shop alternative to Original Medicare. These plans have become an integral part of the program - an estimated 42 percent of …

Is Medicare Advantage better than Medicare?

Apr 14, 2022 · Original Medicare vs. Medicare Advantage Original Medicare is health insurance provided through the federal government. Medicare Advantage, or Part C, plans are sold through private insurers that contract with Medicare. These plans must cover everything that Original Medicare covers, but may offer additional benefits such as vision and dental.

What are the best Medicare Advantage plans?

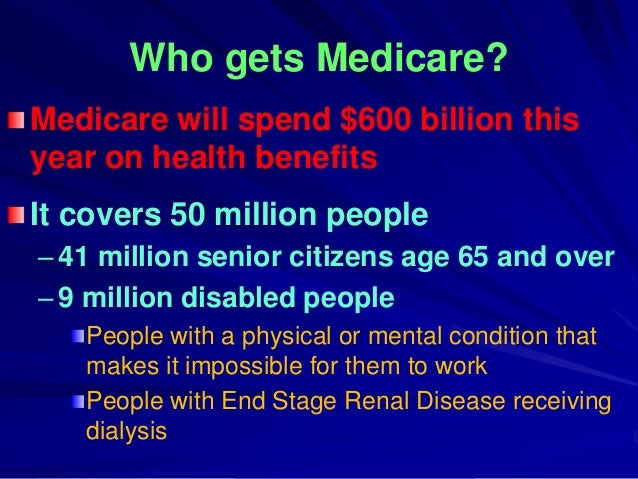

Feb 15, 2022 · Original Medicare (Medicare Part A and Part B) is the federal health insurance program for people age 65 and older and people younger than 65 who have a qualifying disability or certain medical conditions. Medicare Advantage plans (Medicare Part C) are sold by private insurers as an alternative to Original Medicare and provide at least the same benefits as …

How to compare Medicare Advantage plans?

Compare Medicare Advantage plans that may be available in your area and speak with a licensed insurance agent who can help you sign up for a Medicare Advantage plan that’s right for you. Compare Medicare Advantage plans in your area. Compare Plans. Or call. 1-800-557-6059.

How much does Medicare Advantage pay for a day after day 90?

After that, you pay $0 coinsurance for days 1-60, $371 per day for das 61-90 and $742 per day for each lifetime reserve day after day 90. After your lifetime reserve days are used, you are responsible for paying all costs. Medicare Advantage plan coinsurance amounts vary depending on the specific plan you enroll in.

How much is coinsurance for Medicare?

If you’re enrolled in Original Medicare you typically pay a 20 percent Part B coinsurance for covered services after you meet your Part B deductible, and Medicare pays the remaining 80 percent. For inpatient hospital stays in 2021, you first have to meet your Part A deductible for the benefit period.

How long do you have to be on Medicare before you turn 65?

You will typically be automatically enrolled in Original Medicare if one or more of the following applies to you: You get benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65. You’ve been getting disability benefits for at least 24 months.

How much will Medicare pay in 2021?

If you do have to pay a Part A premium, you could pay up to $471 a month in 2021.

What is Medicare Part A and Part B?

Original Medicare (Medicare Part A and Part B) is the federal health insurance program for people age 65 and older and people younger than 65 who have a qualifying disability or certain medical conditions. Medicare Advantage plans (Medicare Part C) are sold by private insurers as an ...

When do you have to enroll in Medicare Advantage?

Some people are automatically enrolled in Original Medicare three months before their 65th birthday , and some people must manually sign up for Medicare.

What are the elements of Medicare?

Under original Medicare, to get the full array of services you will likely have to enroll in four separate elements: Part A; Part B; a Part D prescription drug program; and a supplemental or Medigap policy. Physicians and hospitals have to file claims for each service with Medicare that you'll have to review.

What percentage of doctors accept Medicare?

According to the Kaiser Family Foundation, 93 percent of primary physicians participate in Medicare. That means chances are pretty good that any doctor you are currently seeing will accept Medicare and you won't have to change providers.

Does Medicare have an annual cap?

Many beneficiaries who elect original Medicare also purchase a supplemental – or Medigap – policy to help defray many out-of-pocket costs, which Medicare officials estimate could run in the thousands of dollars each year. There is no annual cap on out-of-pocket costs.

Does Medicare cover dental?

While Medicare will cover most of your medical needs, there are some things the program typically doesn't pay for -— like cosmetic surgery or routine dental, vision and hearing care. But there are also differences between what services you get help paying for.

Does MA have a copay for doctor visits?

But instead of paying the 20 percent coinsurance amount for doctor visits and other Part B services, most MA plans have set copay amounts for a physician visit , and typically that means lower out-of-pocket costs than original Medicare. MA plans also have an annual cap on out-of-pocket expenses.

Is Medicare Advantage based on out-of-network providers?

Medicare Advantage plans are based around networks of providers that are usually self-contained in a specific geographic area. So, if you travel a lot or have a vacation home where you spend a lot of time, your care may not be covered if you go to out-of- network providers, or you would have to pay more for care.

Is Medicare Advantage a one stop shop?

Medicare Advantage is a one-stop-shopping program that combines Part A and Part B into one plan. In addition, about 90 percent of MA plans also include prescription drugs, which means you wouldn't have to enroll in a separate Part D plan. There are no Medigap policies for Advantage plans.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What is the difference between Medicare and Medicare Advantage?

Medicare Advantage is that the Medicare Advantage program is administered by private insurance companies approved by Medicare to offer benefits. This means that premiums are set by the individual insurance companies and can vary depending on the plan you choose ...

What are the different Medicare Advantage plans?

Some of the popular ones include: Health Maintenance Organizations (HMOs).

How many people are enrolled in Medicare Advantage in 2017?

In 2017, about one-third of all Medicare beneficiaries are enrolled in Medicare Advantage plans according to CMS. If you have Medicare coverage or are approaching Medicare eligibility, you may have questions about which program is right for you.

Does Medicare cover dental and vision?

In addition, many offer coverage for routine vision, dental, and hearing services that aren’t available under Original Medicare. Medicare Advantage plans can set some of their own rules and guidelines for members.

Does Medicare cover prescription drugs?

Original Medicare generally does not include coverage for prescription drugs, except those medications that must be administered by a medical professional, such as chemotherapy and certain types of injections, for example.

Can you still be in Medicare Advantage?

Remember, if you enroll in a Medicare Advantage plan, you’re still in the Medicare program, which means you have all the same rights and protections as you have under Original Medicare.

Does Medicare cover hospice?

Original Medicare is administered by the federal government, and there are two parts to this program: Part A, which is also called hospital insurance, covers eligible costs for your care as an inpatient in a hospital or skilled nursing facility. It also may cover hospice care.

What is Medicare Advantage?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap. Instead of having multiple insurance plans to cover medical costs, a Medicare Advantage plan offers all your coverage in one place.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

Is Medicare a government or private insurance?

Original Medicare is a government-run option and not sold by private insurance companies. Medicare Advantage is managed and sold by private insurance companies. These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in ...

Does Medicare Advantage save money?

For some people, Medicare Advantage plans can help save money on long-term medical costs, while others prefer to pay for only what they need with Medicare add-ons. Below you’ll find an estimated cost comparison for some of the fees associated with Medicare Advantage in 2021: Cost. Medicare. Advantage amount.

Does Medicare cover dental and vision?

Medical services. If you’re someone who rarely visits the doctor, Medicare and Medicare add-ons may cover most of your needs. However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Does Medicare cover all your needs?

For example, Medicare may not cover all your needs, but a Medicare Advantage Special Needs Plan could help with long-term costs.

Do you pay Medicare premiums monthly?

If you have Medicare, you’ll pay a monthly premium for Part A (if you don’t qualify for premium-free Part A) and Part B, yearly deductibles for parts A and B, and other costs if you buy add-on coverage.

What is Medicare Advantage?

Medicare Advantage plans are sold by private insurance companies as an alternative to Original Medicare. Every Medicare Advantage plan must provide the same hospital and medical benefits as Medicare Part A and Part B , and most plans include Medicare prescription drug coverage.

What are the risks of hepatitis B?

You may have an increased risk if: 1 You have hemophilia 2 You have End-Stage Renal Disease (ESRD) 3 You have diabetes 4 You live with another person who has Hepatitis B 5 You work in health care and have frequent contact with blood and other bodily fluids

Do you pay for hepatitis B?

You pay nothing if you’re at medium or high risk for Hepatitis B and your doctor accepts Medicare assignment. Coverage rules and costs vary by plan. Coverage rules and costs vary by plan. These are only a few of the most commonly recommended vaccines.

How many people are on Medicare in 2018?

More than 59 million people were on Medicare in 2018. Forty million of those beneficiaries chose Original Medicare for their healthcare needs. 2 . Access to a broader network of providers: Original Medicare has a nationwide network of providers.

How did the government try to decrease expenditures from the Medicare Trust Fund?

In an attempt to decrease expenditures from the Medicare Trust Fund, the government tried to shift the cost of care to the private sector. Insurance companies contract with the government to be in the Medicare Advantage program, and the government pays the plan a monthly stipend for each beneficiary that signs up.

What is part A in nursing?

In simple terms, Part A covers inpatient care you receive in a hospital, skilled nursing facility (SNF) stays after an inpatient hospitalization, hospice care regardless of your location, and a limited number of home health services.

Does Medicare Supplement cover medical bills?

That's where a Medicare Supplement plan, also known as a Medigap plan, can come into play. These supplement plans do not cover health care directly but help to pay off any costs Original Medicare leaves on the table, i.e., deductibles, coinsurance, copays, and even emergency care in a foreign country.

Does Medicare Advantage have a restricted network?

Best of all, that network is not restricted based on where you live like it is with Medicare Advantage. All you need to do is pick a doctor that takes Medicare. If you find a doctor that accepts assignment too, meaning they also agree to the Medicare Fee Schedule that is released every year, even better.

Does Medicare cover X-rays?

Part B covers most everything else from your doctor visits to blood work to procedures and X-rays. While a limited number of medications are covered by Part B, Original Medicare generally does not offer prescription drug coverage outside of the hospital.

Can you charge more than Medicare?

That means they can offer you preventive services for free and cannot charge you more than what Medicare recommends. Keep in mind there will be doctors that take Medicare but that do not accept assignment. They can charge you a limiting charge for certain (and even all) services up to 15% more than Medicare recommends.