In the Commonwealth Fund report Modernizing Medicare Cost-Sharing: Policy Options and Impacts on Beneficiary and Program Expenditures, the authors propose a range of modest policy options that would enable Medicare to reduce financial burdens on the sickest beneficiaries while offering a sounder insurance package.

What is cost sharing in healthcare?

What is cost sharing? What is cost-sharing? Cost-sharing refers to the patient’s portion of costs for healthcare services covered by their health insurance plan. The patient is responsible to pay cost-sharing amounts out-of-pocket.

How do Medicare and Medicaid work together?

In the traditional Medicare program, a provider files a claim with Medicare, then Medicare, after it has paid its portion, sends the claim to Medicaid for payment of the beneficiary’s cost-sharing.

Who pays Medicare cost-sharing for dual eligibility?

State Medicaid agencies have legal obligations to pay Medicare cost-sharing for most "dual eligibles" – Medicare beneficiaries who are also eligible for some level of Medicaid assistance. Further, most dual eligibles are excused, by law, from paying Medicare cost-sharing, and providers are prohibited from charging them. [1]

Does Medicare have a cap on cost-sharing amounts?

Original Medicare does not have a cap on cost-sharing amounts, although most enrollees have supplemental coverage (from an employer, Medicaid, or a Medigap plan) that covers some or all of their cost-sharing expenses.

What is the purpose of cost-sharing in Medicare?

In addition, if you enroll in a Medicare Cost Sharing (MCS) Program, you will be signed up for the Extra Help program through Medicare Prescription Drug Coverage. This program helps people with limited income and resources pay for their medicines.

How does cost-sharing work?

This is called "cost sharing." You pay some of your health care costs and your health insurance company pays some of your health care costs. If you get a service or procedure that's covered by a health or dental plan, you "share" the cost by paying a copayment, or a deductible and coinsurance.

What does patient cost-sharing mean?

A term used to describe the practice of dividing the cost of healthcare services between the patient and the insurance plan. For example, if a plan pays 80% of the cost of a service, then the patient pays the remaining 20% of the cost.

Do Medicare beneficiaries have cost-sharing?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries.

What is cost-sharing in healthcare give some examples?

The share of costs covered by your insurance that you pay out of your own pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn't include premiums, balance billing amounts for non-network providers, or the cost of non-covered services.

Who pays for cost-sharing reductions?

Who is eligible for cost-sharing reductions? Individuals and families with incomes up to 250 percent of the poverty line are eligible for cost-sharing reductions if they are eligible for a premium tax credit and purchase a silver plan through the Health Insurance Marketplace in their state.

Do you have to pay back cost sharing reduction?

If I underestimate my income and end up earning more than 250 percent of the federal poverty level next year, will I have to pay back the cost-sharing subsidies? No. Unlike premium tax credits, which are reconciled each year based on the income you actually earned, cost-sharing reductions are not reconciled. (42 U.S.C.

Is cost share the same as copay?

What is a co-payment or co-pay? A co-‐payment (also called a “co-‐pay”) is a form of cost-‐sharing. It is a set amount of money you will pay for a service ($3, $15, $40 etc). The amount is the same no matter how much the doctor or hospital charges for the service.

What is a cost-sharing limit?

Under the Affordable Care Act, most plans must have an out-of-pocket maximum (referred to as maximum OOP, or MOOP) of no more than $8,550 in cost-sharing for a single individual in 2021 (this limit is indexed each year in the annual Notice of Benefit and Payment Parameters).

How much do Medicare beneficiaries spend out-of-pocket on health care?

Medicare Beneficiaries' Spending for Health Care People covered by traditional Medicare paid an average of $6,168 for health care in 2018. They spent almost half of that money (47 percent) on Medicare or supplemental insurance premiums.

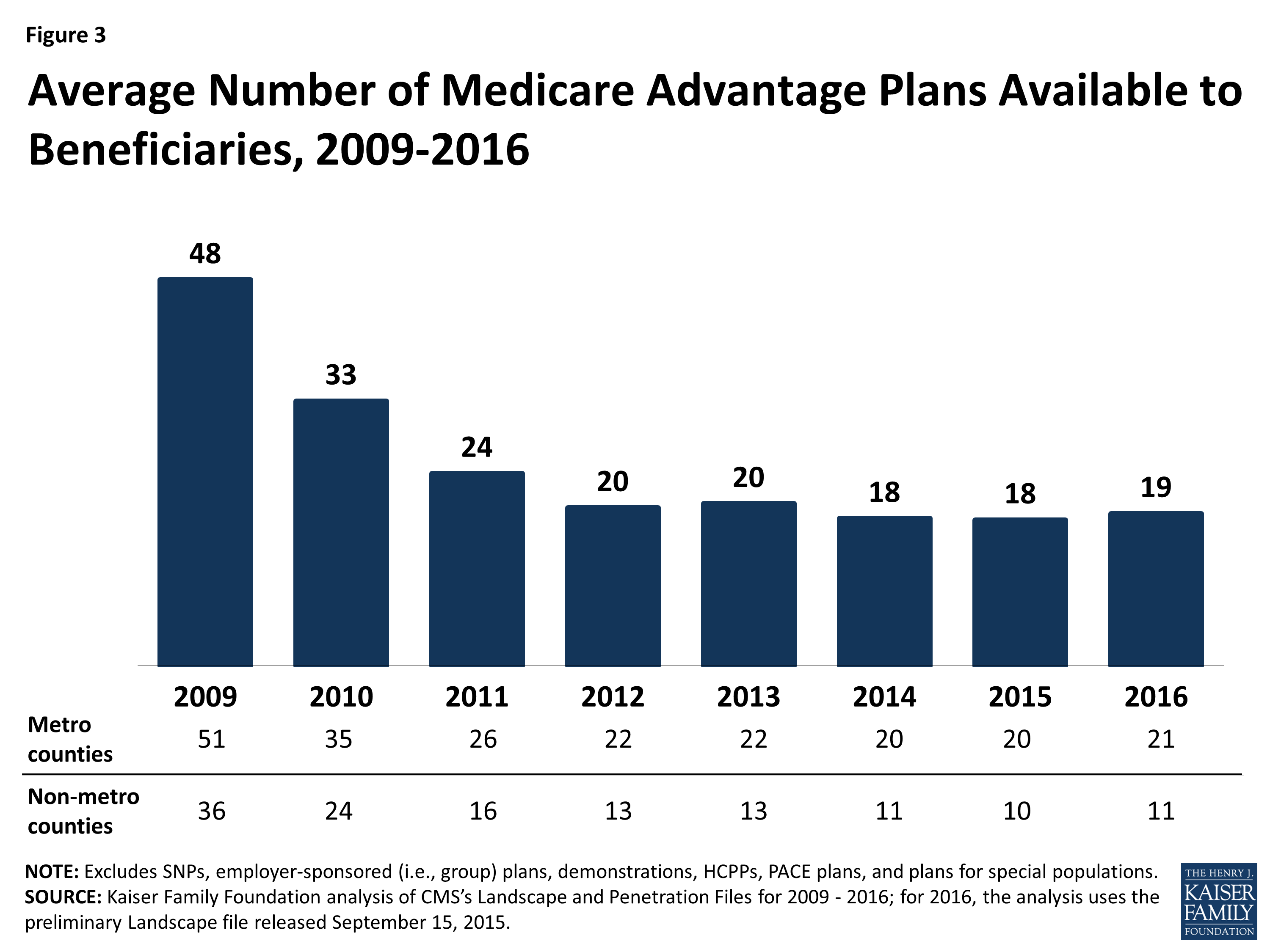

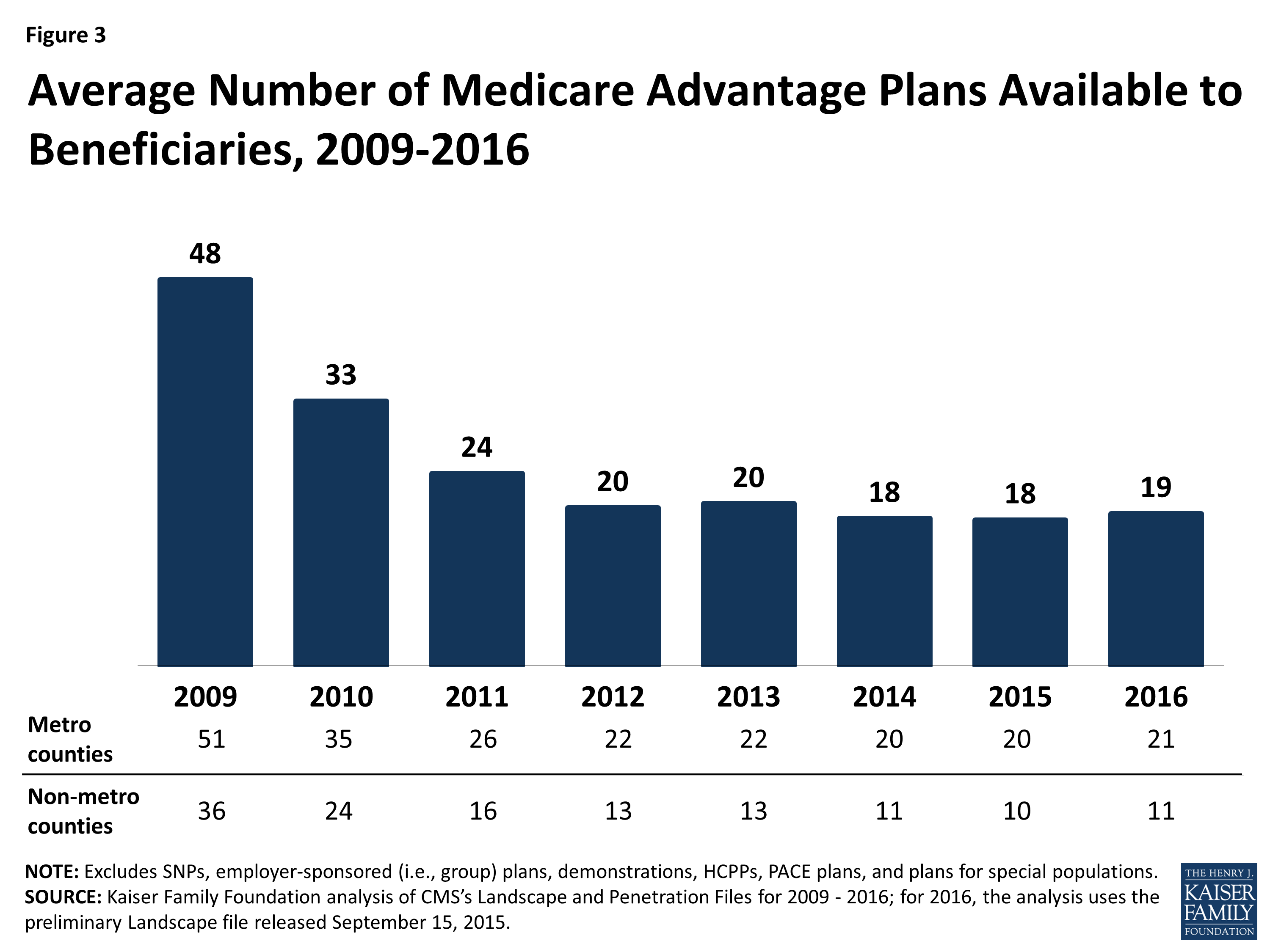

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Does Social Security count as income for QMB?

An individual making $1,000 per month from Social Security is under the income limit. However, if that individual has $10,000 in savings, they are over the QMB asset limit of $8,400.

How Do Medicare Deductibles Work

A deductible is an out-of-pocket amount beneficiaries must pay before the policy starts to pay. Part A has a deductible per benefit period, and Part B has a deductible that changes each year. Part D also has an annual deductible you must pay before benefits kick in.

Medicare Advantage Out-Of-Pocket Costs

When you enroll in an Advantage plan, the carrier determines what the cost-sharing will be. So, instead of the 20% coinsurance, you have to pay under Medicare, it could be more.

Medigap Cost-Sharing Plans

Three Medigap plans involve cost-sharing. These plans are Plan K, Plan L, and Plan M. The cost-sharing helps keep the premiums for these plans lower.

Get Quote

Compare rates side by side with plans & carriers available in your area.

Medicare Cost Sharing Definitions

Medicare cost sharing may seem more complex than other forms of insurance because Medicare has four different parts, and each one covers something different. Two of those parts are public (Parts A and B), and two are private (Parts C and D).

Medicare Part A Cost Sharing

Medicare Part A is hospital insurance and it covers inpatient procedures, hospice care, and skilled nursing facilities. Many Medicare eligibles don’t pay a monthly premium for Part A. If you don’t meet the “premium-free Part A” requirements, you may pay up to $458 per month in 2020.

Medicare Part B Cost Sharing

Medicare Part B is medical insurance, and it helps pay for outpatient medical services such as doctor’s appointments, emergency medical transportation, outpatient therapy, and durable medical equipment (DME).

Medicare Part C Cost Sharing

Medicare Advantage (MA or Part C) are private plans that can cover additional benefits such as prescription drugs, dental, hearing, vision, and fitness classes. You must be enrolled in both Part A and Part B before you can enroll in a MA plan.

Medicare Part D Cost Sharing

Medicare Part D is prescription drug coverage. You may have to pay a monthly premium, for which the average cost was $33.19 nationwide in 2019.

Medicare Supplement Cost Sharing

Medicare Supplement (Medigap) plans have a different cost sharing structure than MA plans. Medigap plans have eight standardized coverage levels*. In 2020 there are eight different coverage levels:

We Can Help You Navigate Medicare Cost Sharing

Cost sharing with Medicare may seem complicated, and a licensed agent with Medicare Plan Finder can help you determine what you need. Our agents are highly trained, and they can find the Medicare Advantage, Medicare Supplement, and/or Medicare Part D plans in your area.

What happens if Medicare pays $80?

If the state's payment were $90, the state would pay the difference between Medicare's payment and the state’s payment, or $10.

Can advocates work with states to increase the state's cost sharing payment to the full Medicare rate?

Advocates can work with their states to increase the state’s cost-sharing payment to the full Medicare rate. Perhaps it is time for Congress to revisit the question of whether limited cost-sharing payments adversely impact beneficiaries.

Does Medicaid cover dual eligibles?

State Medicaid agencies have legal obligations to pay Medicare cost -sharing for most " dual eligibles" – Medicare beneficiaries who are also eligible for some level of Medicaid assistance . Further, most dual eligibles are excused, by law, from paying Medicare cost-sharing, and providers are prohibited from charging them. [1] .

Is dual eligible Medicare?

But the particulars are complex in traditional Medicare and become even more complex when a dual eligible is enrolled in a Medicare Advantage (MA) plan. [2] It may be helpful to think of dual eligibles in two categories: those who are Qualified Medicare Beneficiaries (QMBs) (with or without full Medicaid coverage) and those who receive full ...

Does Medicaid require cost sharing?

In addition to this obligation, the Medicaid statute authorizes – but does not require – states to pay providers Medicare cost-sharing for at least some non-QMB dual eligibles. [5] . It appears from the language of the statute that such payment could include cost-sharing for services not covered in the state Medicaid program.

Can you pay premiums for MA plans?

States can, but are not required to, pay premiums for MA plans' basic and supplemental benefits. The "Balance Billing" Q & A referenced above answers the question, "May a provider bill a QMB for either the balance of the Medicare rate or the provider's customary charges for Part A or B services?".

Does Medicare pay for a claim?

In the traditional Medicare program, a provider files a claim with Medicare, then Medicare, after it has paid its portion, sends the claim to Medicaid for payment of the beneficiary’s cost-sharing. However, if a beneficiary is in an MA plan, the provider does not bill Medicare; the provider bills the plan or receives a capitated payment from ...

How much is the slowdown in Medicare and Medicaid?

Slow-down in Medicare and Medicaid outlays since 1995 accounts for $1 trillion of the 10-year $5.6 trillion federal budget surplus. A major portion of these savings came from the 1997 Balanced Budget Act.

What would Medicare Part A cost be in 1966?

If Medicare’s 1966 cost-sharing had only risen with general inflation, today’s Part A deductible would be $218, not $792; the Part B deductible would be $272 not $100; and the Part B annual premium would be $196, not $600.

How many Medicare beneficiaries have supplemental insurance?

Unlike employer coverage where workers rarely purchase supplemental coverage, nine of ten Medicare beneficiaries obtain supplemental coverage to augment Medicare’s benefits. About 38 percent of Medicare beneficiaries have coverage from a current or former employer.16 About 23 percent are covered by individually-purchased private supplemental insurance (Medigap), 15 percent are enrolled in Medicare+Choice plans, and 13 percent are covered in part or in full by Medicaid. About one in ten Medicare

What was the Medicare deductible in 1966?

When Medicare began in 1966, the major expenses for which beneficiaries were responsible were the average cost of the first day of hospital care under Part A, a deductible for Part B physician and other ambulatory services , 20 percent coinsurance for Part B services (plus any physician charges over the allowed fees), and a Part B premium. Even adjusting for inflation, today’s Part A hospital deductible and Part B premium are 3 to 4 times higher than they were in 1966. The rapid growth in the Part A deductible reflects changes in health care technology that have led to shorter but more intensive hospital stays, driving up the average daily cost. Only the Part B deductible is lower today in real terms than it was in 1966. If these cost-sharing amounts had remained constant adjusted for inflation, today’s Part A deductible would be $218, not $792; the Part B deductible would be $272 not $100; and the Part B annual premium would be $196 (or $16 a month), not $600 a year.6 These cost-sharing amounts or the supplemental insurance premiums required to cover them represent significant financial burdens on Medicare beneficiaries. In 2000, elderly Medicare beneficiaries spent on average $3,142 out-of-pocket on health care. About half of this amount comes from cost-sharing for covered services or private supplemental insurance premiums to pick up costs not covered by Medicare, about one-fifth is Part B premiums, and the remaining 30 percent is for services not covered by Medicare, primarily prescription drugs.

How many Medicare beneficiaries are covered by Supplemental?

Nine of ten Medicare beneficiaries obtain supplemental coverage to augment Medicare’s benefits. About 38 percent have coverage from a current or former employer; 23 percent are covered by MediGap private coverage; 15 percent are enrolled in Medicare+Choice plans, and 13 percent are covered in part or in full by Medicaid.

Does Medicare cost sharing affect access to care?

Not surprisingly, Medicare’s cost-sharing affects access to care. This is particularly true for lower-income beneficiaries and for those with serious health problems. The Kaiser/Commonwealth 1997 Survey of Medicare Beneficiaries found that about 15 percent of Medicare beneficiaries experience difficulty obtaining needed care.9 Almost one-fourth of those with incomes below the poverty level report access problems, as do one-third of the disabled under age 65. Problems paying medical bills are reported by 14

How much will Medicare cost share in 2021?

Medicare Advantage plans cannot require members to pay cost-sharing in excess of $7,550 in 2021, although many plans have cost-sharing limits below this (note that the out-of-pocket limits for Medicare Advantage plans do not include the cost of prescription drugs, which are covered separately and have separate — and unlimited — cost-sharing).

What is cost sharing?

What is cost-sharing? Cost-sharing refers to the patient’s portion of costs for healthcare services covered by their health insurance plan. The patient is responsible to pay cost-sharing amounts out-of-pocket.

What is out of pocket medical insurance?

But under private health insurance or Medicaid, “out-of-pocket costs” generally only refer to cost-sharing incurred when a person has medical claims (even though premiums are also paid out-of-pocket).

Does the ACA cover grandfathered plans?

The ACA’s limits on out-of-pocket costs only applies to in-network services that fall within the umbrella of essential health benefits. And it does not apply to grandmothered or grandfather ed plans, or to plans that aren’t regulated by the ACA at all, such as short-term health insurance.

Is health insurance a cost sharing amount?

Health insurance premiums – the monthly payments you must make to keep your coverage in force, regardless of whether or not you use a healthcare service – are not considered cost-sharing amounts.

Does Medicare have a cap on cost sharing?

Original Medicare does not have a cap on cost-sharing amounts, although most enrollees have supplemental coverage (from an employer, Medicaid, or a Medigap plan) that covers some or all of their cost-sharing expenses.

What is cost sharing in Medicaid?

Cost Sharing. States have the option to charge premiums and to establish out of pocket spending (cost sharing) requirements for Medicaid enrollees. Out of pocket costs may include copayments, coinsurance, deductibles, and other similar charges.

Can you charge out of pocket for coinsurance?

Certain vulnerable groups, such as children and pregnant women, are exempt from most out of pocket costs and copayments and coinsurance cannot be charged for certain services.

Does Medicaid cover out of pocket charges?

Prescription Drugs. Medicaid rules give states the ability to use out of pocket charges to promote the most cost-effective use of prescription drugs. To encourage the use of lower-cost drugs, states may establish different copayments for generic versus brand-name drugs or for drugs included on a preferred drug list.

Can you get higher copayments for emergency services?

States have the option to impose higher copayments when people visit a hospital emergency department for non-emergency services . This copayment is limited to non-emergency services, as emergency services are exempted from all out of pocket charges. For people with incomes above 150% FPL, such copayments may be established up to the state's cost for the service, but certain conditions must be met.