What is the ORM indicator and how does it work?

The ORM Indicator may also trigger Medicare recovery efforts. When ORM is indicated, the Commercial Repayment Center (CRC) will search Medicare records for claims paid by Medicare for medical services and supplies related to the beneficiary’s reported illness or injury.

What is the ORM indicator for Section 111?

hence, the ORM Indicator is key to Section 111 processing. The ORM Indicator may also trigger Medicare recovery efforts. When ORM is indicated, the Commercial Repayment Center (CRC) will search Medicare records for claims paid by Medicare for medical services and supplies related to the beneficiary’s reported illness or injury.

How does Original Medicare work?

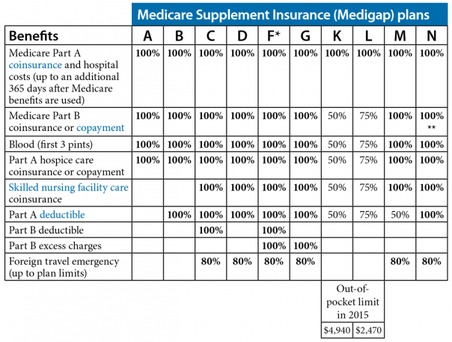

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

What are the terms in Medicare program?

this page. This glossary explains terms in the Medicare program. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

What is Medicare's payer ID?

01112Medicare claim address, phone numbers, payor id – revised listStatePayer IDCaliforniaCA01112ColoradoCO04112ConnecticutCT13102DelawareDE1210246 more rows

What is Medicare abbreviation?

CMSMedicare A & B Common Acronyms and AbbreviationsAcronymPhraseCMPLCivil Monetary Penalty LawCMRComprehensive Medical ReviewCMSCenters for Medicare and Medicaid ServicesCNSClinical Nurse Specialist235 more rows•Jan 19, 2021

How do I bill a Medicare claim?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

What are the two most common claim submission errors?

Common Errors when Submitting Claims:Wrong demographic information. It is a very common and basic issue that happens while submitting claims. ... Incorrect Provider Information on Claims. Incorrect provider information like address, NPI, etc. ... Wrong CPT Codes. ... Claim not filed on time.

What does MCR stand for in billing?

Medical cost ratio (MCR), also referred to as medical loss ratio, is a metric used in the private health insurance industry. The ratio is calculated by dividing total medical expenses paid by an insurer by the total insurance premiums it collected.

What are medical abbreviations?

In clinical practice, abbreviations are often used in patient progress notes, prescriptions, pharmacy notes, discussions, etc. They are often used by practitioners to save time and can be helpful if you know what they stand for.

Can I submit claims directly to Medicare?

If you have Original Medicare and a participating provider refuses to submit a claim, you can file a complaint with 1-800-MEDICARE. Regardless of whether or not the provider is required to file claims, you can submit the healthcare claims yourself.

What does value code QV mean?

Value-based purchasing adjustment amountQV – Value-based purchasing adjustment amount.

What is the claim filing indicator code?

The claim filing indicator code is used to identify whether the primary payer is Medicare or another commercial payer. It is entered in Loop 2000B, segment SBR09 on both 837I and 837P electronic claims. The code is not used on paper claims.

What are the 3 most common mistakes on a claim that will cause denials?

5 of the 10 most common medical coding and billing mistakes that cause claim denials areCoding is not specific enough. ... Claim is missing information. ... Claim not filed on time. ... Incorrect patient identifier information. ... Coding issues.

What are the top 10 denials in medical billing?

These are the most common healthcare denials your staff should watch out for:#1. Missing Information. You'll trigger a denial if just one required field is accidentally left blank. ... #2. Service Not Covered By Payer. ... #3. Duplicate Claim or Service. ... #4. Service Already Adjudicated. ... #5. Limit For Filing Has Expired.

What are five reasons a claim might be denied for payment?

Here are some reasons for denied insurance claims:Your claim was filed too late. ... Lack of proper authorization. ... The insurance company lost the claim and it expired. ... Lack of medical necessity. ... Coverage exclusion or exhaustion. ... A pre-existing condition. ... Incorrect coding. ... Lack of progress.

List of Social Security Acronyms

This list identifies many of the common abbreviations used by the Social Security Administration in Social Security Disability claims, particularly Title II (Social Security Disability Insurance) and Title XVI (Supplemental Security Income).

Work with an Experienced Social Security Disability Attorney

Ortiz Law Firm focuses primarily on disability claims, including Social Security Disability Insurance claims and Supplemental Security Income claims. We assist claimants with initial applications, reconsiderations, and hearings before an administrative law judge.

When to use PI?

This can be used when the claim is paid in full and there is no contractual obligation or patient responsibility on the claim. PI (Payer Initiated Reductions) is used by payers when it is believed the adjustment is not the responsibility of the patient.

What are the four ANSI codes?

The four you could see are CO, OA, PI and PR.

What is PR code?

The reason code will give you additional information about this code. PR (Patient Responsibility) is used to identify portions of the bill that are the responsibility of the patient. These could include deductibles, copays, coinsurance amounts along with certain denials.

What is an EOB?

An EOB is a summary page showing how much money your insurance plan paid and how much money you must pay (if any) for a health service you got, like a doctor visit or lab test. Every time you get a health service, you’ll get an EOB from your insurance company in the mail or by email. An EOB is not a bill.

Why do you check your EOB?

Check your EOB to make sure you got the health services it shows you got. It might list more than one health service and provider. For example, if your doctor did a blood test during your visit, your EOB might list the doctor visit and the blood test as separate charges.

What happens to your insurance when you reach your deductible?

Once you reach your deductible amount, the insurance plan will start sharing the cost of health care with you. For example, if you go for a doctor visit that costs $100, your share may be $20 and your insurance plan’s share may be the remaining $80.

What is deductible amount?

Deductible Amount: the amount of allowed charges that apply to your plan deductible that must be paid before benefits are payable. 26. Copay: the amount of allowed charges, specified by your plan, that you must pay before benefits are paid. 27.