What drugs are excluded from Part D plans?

Mar 06, 2022 · Definition of Medicare Part D Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system.

What plans are available for Medicare Part D?

Jul 27, 2021 · There are six protected drug classes that all Part D plans must cover: 1 Anticonvulsants (drugs used to prevent seizures) Antidepressants Antipsychotics Cancer drugs HIV/AIDS drugs Immunosuppressants (drugs used to protect transplanted organs) Most, if not all, of the medications in these categories will be included on every Part D formulary.

What does Medicare Part D really cost?

Apr 16, 2021 · Part D, which is your prescription drug coverage. Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

How much does Medicare Part D cover?

What Does Medicare Part D Cover? Part D is an optional insurance plan you can add to your Part A and Part B Medicare coverage. Medicare Part D covers prescription drugs, which can help you save money. This is especially true if you’re managing a condition that requires regular medication. Is There A Medicare Part D Coverage Gap (Donut Hole)?

What does Medicare Part D provide?

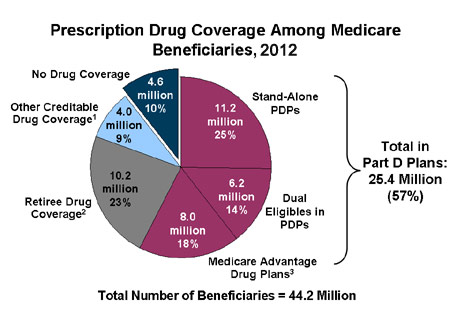

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...Jun 4, 2019

What does standard Part D coverage include?

Part D plans are required to cover all drugs in six so-called “protected” classes: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.Oct 13, 2021

What is not covered under Medicare Part D?

Drugs not covered under Medicare Part D Weight loss or weight gain drugs. Drugs for cosmetic purposes or hair growth. Fertility drugs. Drugs for sexual or erectile dysfunction.Jun 5, 2021

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Is Part D mandatory?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Are vitamins covered by Part D?

Medicare Part D does cover prenatal vitamins, fluoride and vitamin D analogs, such as calcitriol, doxercalciferol and paricalcitol. Prescription drugs used for cosmetic purposes or hair growth, but Medicare Part D does cover prescription drugs to treat psoriasis, acne, rosacea and vitiligo.

Is there a deductible for Medicare Part D?

The Medicare Part D deductible is the amount that you will pay each year before your Medicare plan pays its portion. Some drug plans charge a $0 yearly deductible, but this amount can vary depending on the provider, your location, and more. The highest deductible amount that any Part D plan can charge in 2021 is $445.

What is the Part D deductible for 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

How does Medicare Part D calculate donut holes?

3The Donut Hole (Coverage Gap Stage)25%* of the cost of generic (non-brand name) Part D medications. Tufts Health Plan pays the remaining 75% of the cost.25% of the cost of Part D brand name medications.

What Is Medicare Part D Prescription Drug Coverage?

As a Medicare beneficiary, you don’t automatically get Medicare Part D prescription drug coverage. This Medicare Part D coverage is optional, but c...

What Types of Medicare Part D Prescription Drug Plans Are available?

You can get Medicare Part D prescription drug coverage in two different ways, depending on whether you’re enrolled in Original Medicare or Medicare...

Am I Eligible For A Medicare Part D Prescription Drug Plan?

You’re eligible for Medicare Part D prescription drug coverage if: 1. You have Part A and/or Part B. 2. You live in the service area of a Medicare...

When Can I Sign Up For Medicare Part D Coverage?

As mentioned, you don’t have to enroll in Medicare Part D coverage. That decision will not affect the Original Medicare coverage you have, but if y...

What’S The Medicare Part D Coverage Gap (“Donut Hole”), and How Can I Avoid It?

The coverage gap (or “donut hole”) refers to the point when you and your Medicare Part D Prescription Drug Plan or Medicare Advantage Prescription...

What Does Medicare Part D Cost?

Your actual costs for Medicare Part D prescription drug coverage vary depending on the following: 1. The prescriptions you take, and how often 2. T...

Can I Get Help With My Medicare Prescription Drug Plan Costs If My Income Is Low?

As mentioned, Medicare offers a program called the Low-Income Subsidy, or Extra Help, for eligible people with limited incomes. If you are enrolled...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

Key Takeaways. Medicare Part D is an optional coverage available for a cost that can help pay for prescription drugs. Medicare Part D is sold by private insurance companies that have contracted with Medicare to offer it to people eligible for Medicare. Not all Part D plans operate everywhere, nor do all of the plans offer ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What are the different tiers of Medicare?

The drugs in the plan’s formulary may be further placed into different tiers that determine your cost. For example: 1 Tier 1: The most generic drugs with the lowest copayments 2 Tier 2: Preferred brand-name drugs with medium copayments 3 Tier 3: Non-preferred brand name drugs with higher copayments 4 Specialty: Drugs that cost more than $670 per month, the highest copayments 4

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't enroll in Part D?

Not enrolling in Part D during the initial enrollment period could result in a late-enrollment penalty that permanently increases your Part D premium.

What are the drugs covered by Medicare Part D?

There are six protected drug classes that all Part D plans must cover: 1 . Anticonvulsants (drugs used to prevent seizures) Antidepressants. Antipsychotics.

How to take full advantage of Medicare Part D?

To take full advantage of your Medicare Part D plan, you need to understand what it does and does not cover. Each plan will have unique features but all Part D plans run on the same fundamental principles. Learn how Part D plans decide what medications to offer. With this information in hand, you will be able to choose the plan ...

What is a formulary in insurance?

A formulary is a list of preferred medications that the plan will cover. The insurance company that offers your Part D plan and the pharmaceutical companies that make the drugs negotiate a deal. Together they decide which medications will be put on that plan’s formulary. 1 Your formulary will not cover every possible medication ...

What are some examples of medications that can be used to treat hypertension?

For example, there are many classes of medications to treat hypertension: angiotensin converting enzyme (ACE) inhibitors, angiotensin II receptor blockers, beta-blockers, calcium channel blockers, and more. There will be at least two of each of these medications on your plan’s formulary to meet Medicare’s standard benefit.

How much less does generic medicine cost?

Costs drop considerably with competition in the marketplace. Generic drugs can cost as much as 85% less than their brand-name counterparts in some cases. 2 . Do not be surprised when your Part D plan recommends generic in favor of brand-name medications. The intent is to save both you and the insurance company money.

Does Medicare cover brand name drugs?

When Brand Name Drugs Are Medically Necessary. Medicare only covers medications it considers to be medically necessary. This requires that you have a medical condition that requires treatment and that the drug in question has been shown to benefit that condition.

Does Medicare cover medical marijuana?

Keep in mind Medicare Part D does not pay for medical marijuana beyond three FDA-approved cannabinoid medications. These are only covered for very specific medical conditions. This is because the DEA still classifies marijuana as a Schedule I drug.

Why was Medicare Part D created?

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

What happens if you don't have Medicare Part D?

If you go without creditable prescription drug coverage and you don’t enroll in Part D when you are first able, you’ ll pay a penalty of 1% of the national base premium for each month you go without coverage. You pay this penalty for as long as you have Medicare Part D coverage.

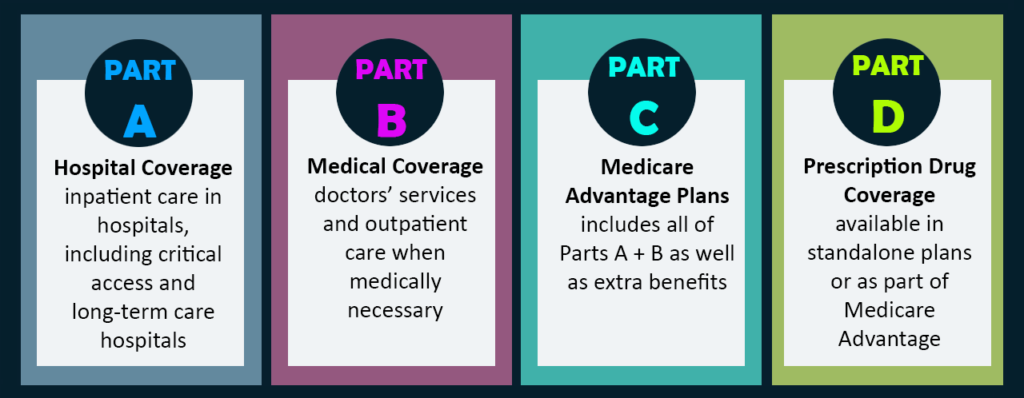

What are the different types of Medicare?

There are four parts to the Medicare program: 1 Part A, which is your hospital insurance 2 Part B, which covers outpatient services and durable medical equipment (Part A and Part B are called Original Medicare) 3 Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare 4 Part D, which is your prescription drug coverage

What is a formulary in Medicare?

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments.

How much is coinsurance for 2021?

If you and your plan spend more than $4,130 on prescription medications in 2021, special coverage rules kick in.

What is coinsurance in Medicare?

Copayments (flat fee you pay for each prescription) Coinsurance (percentage of the actual cost of the medication ) Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically won’t pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage.

How many Medicare Part D plans are there in 2021?

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. It’s important to comparison shop to find the one that’s right for you.

What is Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications.

When does Medicare Part D change?

Part D drug plans also have changes from year to year. Your plan’s benefits, formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance may change on January 1st of each year. Medicare gives you an Annual Election Period during which you can change your plan if you desire to do so.

What are the rules for Medicare?

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are: 1 Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed. 2 Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective. 3 Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor will need to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he shows that you have already tried less expensive alternatives that were not effective.

What is the Medicare Part D deductible for 2021?

In 2021, the allowable Medicare Part D deductible is $445. Plans may charge the full Part D deductible, a partial deductible, or waive the deductible entirely. You will pay the network discounted price for your medications until your plan tallies that you have satisfied the deductible. After that, you enter initial coverage.

Does Medicare track your out of pocket costs?

It’s important to note that Medicare itself tracks your True Out of Pocket Costs (TrOOP) for each year. This can protect you from paying certain costs twice. For example, say you have already satisfied the deductible on one plan. Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way.

How much is the deductible for Medicare Part D?

In addition to premiums, most Part D drug plans have a yearly deductible (limited by Medicare to $435 ). This means that for drugs covered by the Part D plan, you must spend this deductible amount out of your own pocket before the plan begins to pay anything.

How long does it take to enroll in Medicare Part D?

When considering enrollment, it’s important to note that if you don’t enroll in Part D or another creditable prescription drug plan within 63 days of the Medicare Initial Enrollment Period (IEP), you will pay a late enrollment penalty that is permanently added to your Part D premium when you do enroll.

What is a stand alone plan?

Some are called stand-alone plans, meaning they cover prescription drugs only and complement separate coverage under Part A for hospital insurance and Part B for medical insurance. People who opt for a Part C Medicare Advantage managed care plan can get Part D drug coverage through that plan instead.

When did Medicare start covering prescription drugs?

Medicare Part D. In 2006, Medicare began covering some prescription drugs taken at home by introducing Medicare Part D prescription drug plans, which are actually operated by private insurance companies with oversight by Medicare. The program has proven to be quite popular and beneficial to millions of Americans, ...

How much does Medicare cost per month?

Monthly premiums for stand-alone Part D plans, and for Part C Medicare Advantage managed care plans that include drug coverage, run from about $17 to $76 per month, depending on which plan someone chooses, which prescriptions he or she takes, which pharmacy he or she uses, and where he or she lives.

Does Medicare Part D cover all prescriptions?

See if your regular prescription medicines are in a Medicare Part D plan’s “formulary” list. No single Medicare Part D prescription drug plan covers all prescription medicines. Instead, each plan covers only a selected list of drugs, called the plan’s “formulary.”.

How much does a prescription drug plan cost?

In 2019, the average cost of a stand-alone prescription drug plan was about $39 per month, while the average cost of all Part D prescription drug plans was about $29 per month.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.