What services are not covered under Medicare Part?

Medicare Supplement Plan N coverage includes: 100 percent of Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. 100 percent of the Part A ...

What is not covered by Medicare Part?

Medicare Part B – ER or Doctor Visits 20% of the continuance is covered by Plan N. However, the copayments are to be paid by you for ER or physician visits. For doctor’s visits, the copayment is $20 and for the emergency room visits, it’s around $50. If you have a telehealth visit with your doctor, the $20 does not apply.

What medications are not covered by Medicare?

Parts of Medicare. Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers. Outpatient care. Home health care.

What does Medigap plan N cover?

· Medicare Part A coinsurance Medicare Part A deductible Foreign travel emergency care Medicare Part B 20% coinsurance (Beneficiaries are responsible for a $20 …

What does an n plan cover?

Plan N covers the following benefits: Medicare Part A hospital coinsurance and other costs up to an additional 365 days after Original Medicare benefits are exhausted. Medicare Part A hospice care coinsurance or copayment. Medicare Part A deductible.

What is the difference between Plan G and N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

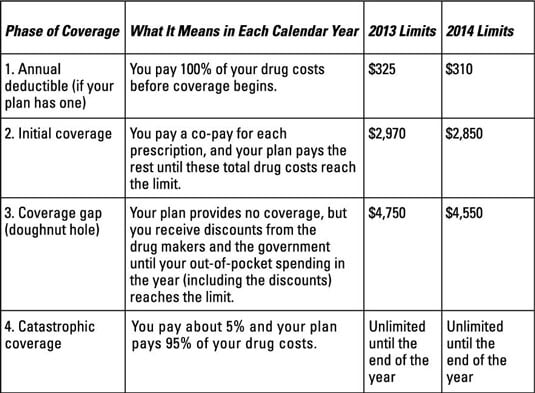

Does Medicare Part N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.

Is Medicare Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

What are the copays for Plan N?

One of the most important features of Medigap Plan N is its copays — you pay a $20 copay for each physician visit and a $50 copay for each emergency room visit that does not result in hospitalization.

Is Plan N cheaper than Plan G?

Premiums for each plan can vary by the carrier that offers it, but Plan G is typically more expensive than Plan N because it offers a higher level of coverage. However, while Plan G usually has higher premiums, it could save you money in the long run.

What is the difference between Plan F and Plan N?

Plan N premiums are typically lower than Plan F premiums, meaning, you spend less out of pocket monthly with Plan N than you will with Plan F. However, Plan F covers more out-of-pocket expenses. If you know that you will have many medical expenses throughout the year, Plan F may be a better choice.

What drugs are not covered by Medicare?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Does AARP plan n cover Medicare deductible?

Plan N also completely covers your Medicare Part A deductible, which is one of the more expensive deductibles in Medicare and repeats for each benefit period throughout the calendar year.

Does Medicare Plan N Cover Part B deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.

What does AARP Supplement Plan N cover?

Medigap Plan N covers 100% of the Medicare Part B coinsurance costs, with the only exception being that it requires a $20 co-payment for office visits and up to $50 for emergency room visits.

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

How long does Plan N cover hospitalization?

Along with that, you will get coverage for the expenses approved by Medicare for 365 days once the benefits from traditional Medicare end.

What is Plan N?

The Plan N offers coverage for the deductible of Part A. It’s one of the few supplement plans that offer you coverage for emergency services bought outside the country. You can also expect coverage for care at a nursing facility.

What is excess charge for Medicare?

Excess charges: Certain Medicare service providers can ask for up to 15% above the prescribed limit of prices set by Medicare. Usually, excess charges are taken by those providers who don’t accept the agreement with Medicare. The plan N won’t offer coverage for these excess charges

Which is the second most popular Medicare plan?

Medicare Plan N is the second most popular Medigap plan. With lower premiums and lower rate increases than Plan G, Medicare Plan N is becoming a favorite amount people on Medicare.

How long does Plan N last?

With Plan N, you can get coverage for the 1st two months in case you have to visit any other country for emergency assistance. A total of $50,000 can be covered with this plan in your total lifetime.

How long does the Part B period last?

This period lasts for six months from your Part B effective date.

Do you have to pay copays for a 401(k) plan?

However, there are copays that you need to pay. Also, there’s a part B deductible along with excess charges which aren’t covered by this plan.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

What is Medicare Advantage?

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

Is Medicare a federal or state program?

Medicaid is a joint federal and state program that provides health coverage for some people with limited income and resources. Medicaid offers benefits, like nursing home care, personal care services, and assistance paying for Medicare premiums and other costs.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N. Medicare Supplement Plan N is one of the more popular plans among beneficiaries in 2021. It’s the plan for those who prefer lower monthly premiums without forfeiting benefits. Yet, when you enroll in this plan, you’re responsible for deductibles and a few copays.

What is Plan N insurance?

Plan N covers your inpatient deductible, which falls under Part A. It also covers your inpatient copays and coinsurance, minus a small copay of $50. This is what helps keep your monthly premium low.

What is a plan F?

Plan F is a Medigap plan offering comprehensive coverage. It covers 100% of your out-of-pocket costs. Outside of the monthly premium, you never need to pay out-of-pocket. Plan N is two steps down from Plan F in terms of coverage. Yet, the premiums for Plan F are higher because the more benefits a plan offers, the higher the premiums will be.

How much does Medigap cost in 2021?

How Much Does Medigap Plan N Cost in 2021. The average cost of Plan N is around $120-$180 per month. However, in some states, it can be as much as $200 and in others, it can be as low as $80. Your premium rates depend on your personal information as well as the plan letter you choose. Factors such as your state of residence, gender, age, ...

How much does an emergency room copay?

In exchange for lower monthly premiums, you’re responsible for a small copay of $50 when visiting the emergency room (if not resulting in inpatient admission) and a $20 copay at the doctor’s office. Yet, if you visit an Urgent Care center, there is NO copay.

What is the job of a Medicare agent?

Our job is to keep you informed and up-to-date with the latest Medicare changes. You can depend on your agent and our client care team to help you manage claims and to make sure you have the best rate at all times.

Does Medicare cover dental insurance?

No , Medigap plans do not cover dental services. You’d need to select a stand-alone dental plan to supplement your Medicare coverage.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.