Plan G fully covers these health care costs:

- Part A coinsurance and hospital costs at the end of your Medicare benefits for up to an additional 365 days.

- Deductible for Medicare Part A.

- Coinsurance or copayment for Part B.

- Hospice care coinsurance or copayment for Part A.

- Coinsurance for skilled nursing facility care.

- Excess charge for Part B.

Full Answer

Does plan G cover everything?

Plan G offers great value for beneficiaries willing to pay a small annual deductible. After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your Medicare Part A hospital deductible, copays, and coinsurance. It also covers the 20% that Medicare Part B doesn’t cover.

How to use G Plan?

9 rows · Dec 03, 2021 · Once you meet your Part B deductible, Plan G covers Part B outpatient medical services such as ...

What does Medigap Plan G cover?

10 rows · Dec 12, 2019 · Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help ...

What is Humana plan G?

Sep 17, 2020 · Benefits Of Plan G Plan G covers 100% of the Medicare Part A and Part B co-pays and coinsurance, those gaps and holes that Medicare doesn’t cover. Plan G covers Skilled Nursing and rehab facility stays and also Hospice care. You also won’t have to worry about any balance billing, known as excess charges.

What does plan G include?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is a Medicare G plan?

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.Jan 24, 2022

Does Medicare Plan G cover prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications. These prescriptions are typically for medications used for treatment within a clinical setting, such as for chemotherapy.May 27, 2020

What are advantages of Medicare Plan G?

The main benefit of Medicare Plan G is that it covers 100 percent of your Medicare Part A deductible, coinsurance, and copayments. In addition to that, Plan G also covers: 100 percent of Medicare Part B coinsurance, copayments, and excess charges. 100 percent of coinsurance at nursing facilities.Sep 29, 2021

Does Medicare Plan G cover deductible?

All Medigap plans, including Plan G, sold to new Medicare members don't cover the following: Part B deductible. (Since 2020, new Medicare members can't buy any plan that covers the Part B deductible, although existing members may own older plans that do.)Feb 3, 2022

Does Medigap plan G pay Part A deductible?

Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end.Nov 11, 2020

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the out-of-pocket maximum for Medigap Plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year.Dec 12, 2019

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is not covered by Medigap?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...Nov 18, 2020

What is the most comprehensive Medicare supplement plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Plan G?

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans.

What are the benefits of Medicare Supplement Plan G?

Medicare Supplement Plan G covers: 1 Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out 2 Part A deductible ($1,484 in 2021) 3 Part A hospice care coinsurance or copayment 4 Part B coinsurance or copayment 5 Part B excess charges 6 Blood (the first three pints needed for a transfusion) 7 Skilled nursing facility coinsurance 8 Foreign travel emergency care (up to plan limits of $50,000)

How much does Medicare pay for an appointment?

State law may add more limits in some states. So, if Medicare allows a fee of $100 for a doctor’s office appointment, a physician who doesn’t accept assignment may charge an additional 15% ($15) for the appointment. Medicare Part B pays 80% of only the allowed rate, or $80.

What is a Part D plan?

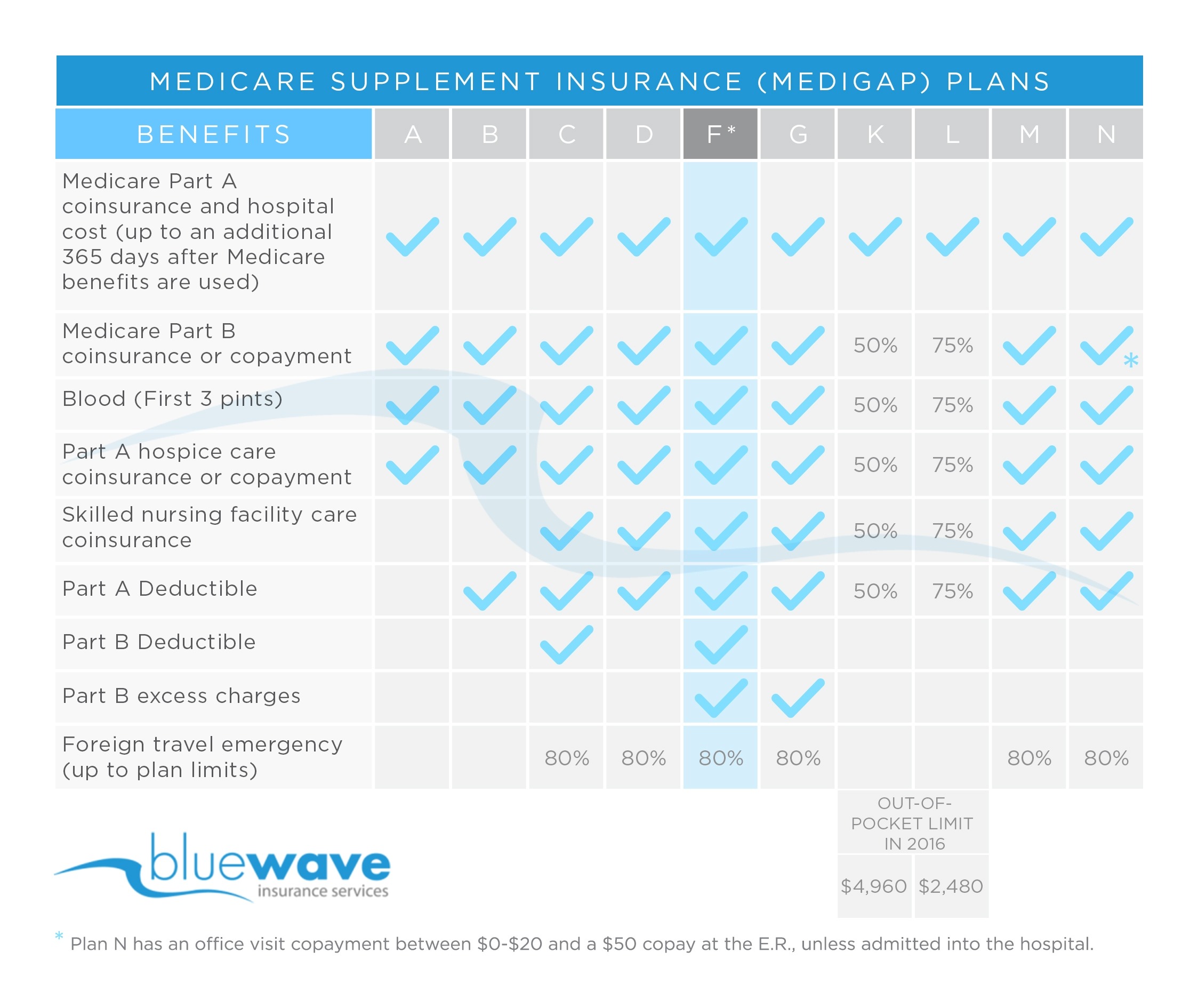

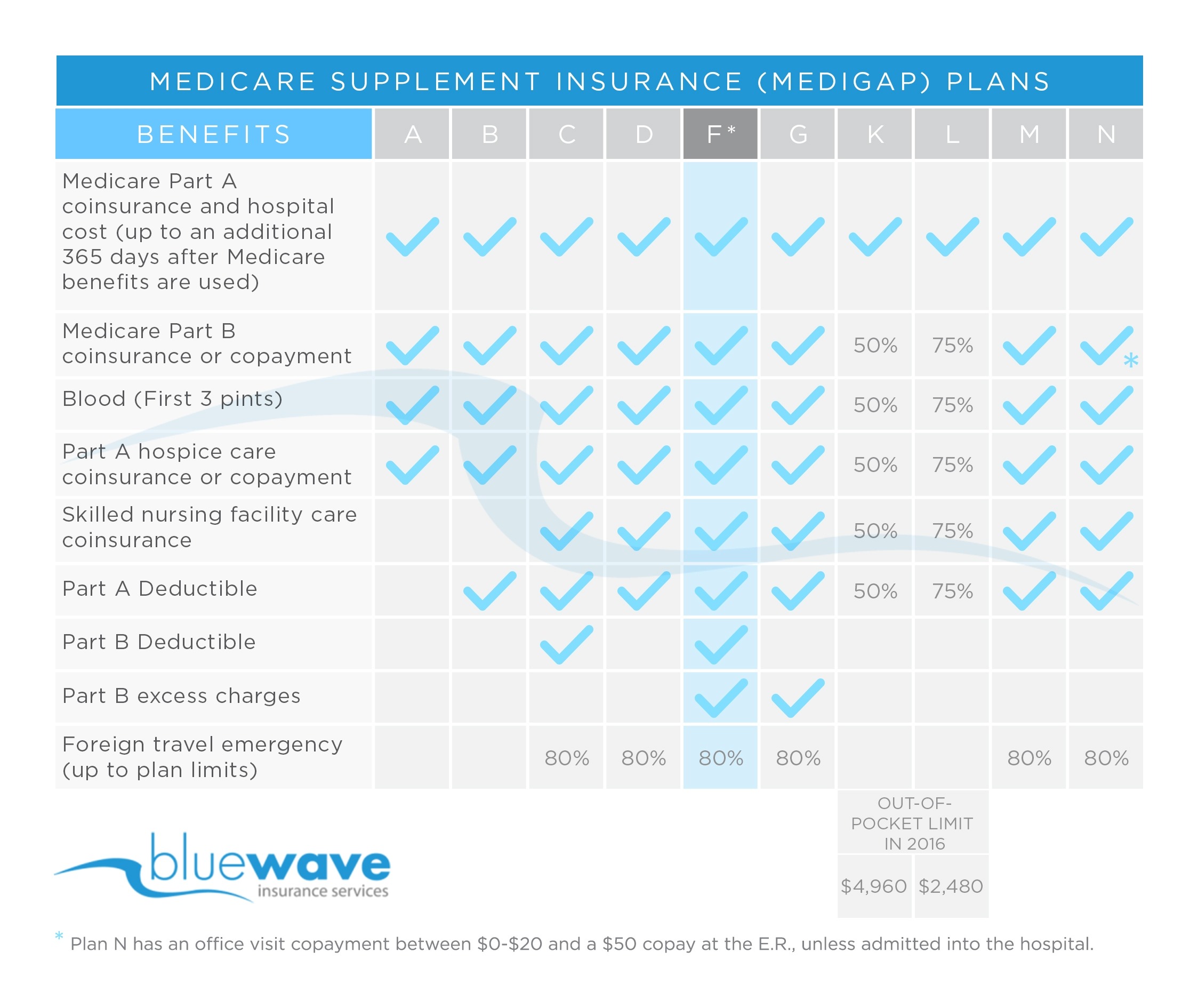

Part D prescription drug plans. After that come the 10 different Medigap plans – otherwise known as Medicare Supplement insurance – which each have a letter title, including Plans A, B, C, D, G, F, K, L, M and N.

How much does Medicare Part B cost?

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate ($20) plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan (besides Plan F) which pays both the $20 coinsurance and the $15 excess charge in this example.

How much is Plan G deductible?

Let’s imagine a situation where the Plan G premium is $120 a month where you live. That’s $1,440 a year. If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,484 for each benefits period in 2021 before your Part A benefits kick in.

Does Plan G cover Part B?

The only thing that Plan G does not cover that Plan F does is the Part B deductible. However, Plan F is no longer available to those who became eligible for Medicare after. Jan. 1, 2020. So for the newly eligible, Plan G may be the best option for the most extensive Medicare Supplement coverage.

What is Medicare Plan G?

December 12, 2019. Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help cover certain health care costs, such as deductibles, coinsurance, and copayments. Without a supplement plan, you’d have to pay those expenses yourself. Some people call Medicare supplement plans “Medigap” because they “fill in ...

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.

Who is Kathryn Stewart?

Kathryn Anne Stewart. Kathryn Anne Stewart is a freelance writer who covers the intersection of health and money. She has written for Johns Hopkins Medicine, Weight Watchers, Newsmax Magazine, Franklin Prosperity Report, and the National Hemophilia Foundation, often crafting clear explanations of complex topics.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

Does Medigap Plan G cover Part B?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

Can I switch Medicare Supplement Plans?

You can enroll in or switch Medicare Supplement plans at other times, but the insurance companies can deny you or charge you more based on your health. Most Medigap plans are standardized across the nation. However, if you live in Massachusetts, Minnesota, or Wisconsin, different types of plans are available.

What does Plan G cover?

Plan G covers Skilled Nursing and rehab facility stays and also Hospice care.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G – What does it cover? Plan G is a great option if you’re looking for a plan that has comprehensive benefits and low out of pocket costs.#N#All Medicare Supplement Insurance Plans are Standardized by the government. This means that the plan benefits are exactly the same from company to company.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

What is the Medicare Supplement Plan G deductible for 2021?

With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

What is Medicare Plan G?

Plan G is one of the most popular Medicare Supplement plans available to Medicare participants. If you’re enrolled in Original Medicare, or receiving Part A and Part B coverage, you can purchase Plan G from a private insurance company that serves the zip code where you live.

Medigap Plan G coverage

Plan G provides comprehensive coverage and pays 100% of many healthcare costs, including:

What is not covered by Plan G?

There are a few things, however, that Plan G does not cover, including:

How to enroll in Plan G

If you’re enrolled in Medicare Part A and B, you can buy a Medigap Plan G policy. You can purchase a plan from any insurance company that’s licensed in your state to sell Medicare Supplement coverage.

Medicare supplement plan types

There are 10 standardized Medicare Supplement, or Medigap, plans: A, B, C, D, F, G, K, L, M, and N. The primary purpose of these plans is to help reduce your costs of Original Medicare Part A and B, as well as fill “gaps” in services that Medicare doesn’t cover.

Is it important to stay in shape?

Staying in shape is important at any age, but it’s especially important when you start to age. One easy way to accomplish this is to go to the gym. But this can get expensive, especially if you don’t use it a lot.

Does Medicare Advantage include Silversneakers?

The program that many Medicare Advantage plans include in their coverage is SilverSneakers. This program doesn’t cost anything extra for policyholders, and they pay for it when they pay their deductibles or premiums each year or each month.

Does Medicare cover gym memberships?

Unfortunately, gym memberships are not on the list of covered expenses under Original Medicare. It won’t cover fitness program fees or gym memberships. This means you pay 100% of the costs associated with it if you plan to get a gym or fitness program membership.