What is a Medicare Recovery Audit Contractor (RAC)?

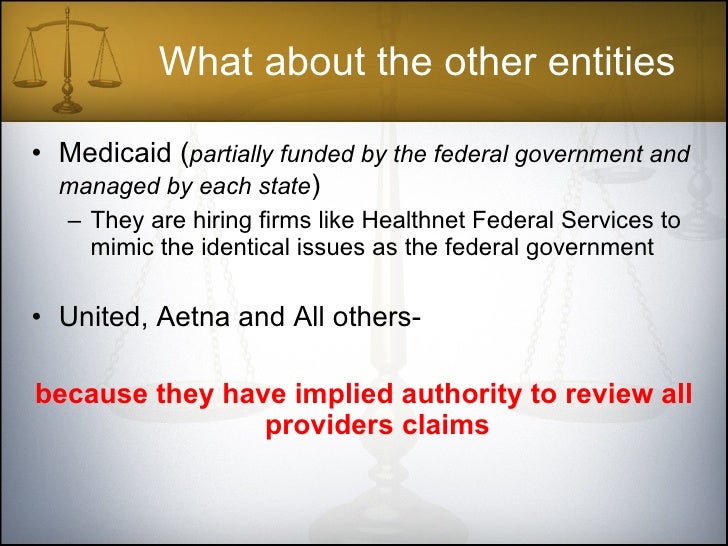

In January 2010, the Social Security Act authorized the Recovery Audit Program expansion nationwide and extended it to Medicare Parts C and D. Any medical practice submitting claims to a government program can be subject to a Medicare Recovery Audit Contractor (RAC) audit.

What is the RAC program for Medicare?

Finally, the RAC program was created to identify improper Medicare payments. RAC auditors are private contractors paid on commission by the government. They review claims on a post-payment basis to identify and correct potential overpayments and underpayments to claims specific to Medicare Part A and Part B (hospital and physician practices).

What is the CERT and RAC program?

The information from the CERT programs is a good indicator of how claims errors in the Medicare FFS Program affect the Medicare Trust Fund, which, of course, CMS needs to protect. Finally, the RAC program was created to identify improper Medicare payments. RAC auditors are private contractors paid on commission by the government.

Are RAC audits running in 2020?

These audits ran as usual before pausing in March 2020 as a result of the declaration of a national health emergency due to the COVID pandemic. After a brief break, RAC audits began again in August of 2020 and continue today. They are now often referred to as just “RAs.” ❖ Dive deeper: What Does a Recovery Audit Contractor Do?

What is the purpose of an RAC audit?

Led by the Centers for Medicare & Medicaid Services (CMS), the goal of RAC audits is to identify and correct improper payments through the detection and collection of overpayments made on claims for healthcare services provided to Medicare beneficiaries.

What is the RAC process?

First, the RAC identifies a risk pool of claims. Second, the RAC requests medical records from the provider. Once the records are received by the RAC, they will review the claim and medical records. Based on the review, the RAC will make a determination: overpayment, underpayment or correct payment.

What is a RAC review?

RAC Review Process RACs review claims on a post-payment basis and will be able to look back three years from the date the claim was paid. There are two main types of review - automated (no medical record required) and complex (medical record required).

What is RAC in medical billing and coding?

Recovery Audit Contractors (RAC) audits, as physicians know, are part of the government's program to reduce fraud, waste, and errors in medical billing practices, especially Medicare and Medicaid.

What does RAC stand for?

RACAcronymDefinitionRACRadiation Advisory Committee (EPA)RACResource Allocation CommitteeRACResource Assessment CommissionRACResident Advisory Council (Chamber of Commerce)159 more rows

How do I prepare for a RAC audit?

5 Ways You Can Begin Preparing for a RAC AuditPerform an Internal Audit. This action will help you to determine the likelihood of coding and billing mistakes within your company.Identify and Correct Coding/Billing Issues. ... Review Problem Areas. ... Check Documentation. ... Find Assistance.

What is the RAC appeal process?

There are three levels of appeal: Level I: Request for Reconsideration; Level II: Request for CMS Hearing Official Review; and Level III: Request for CMS Administrator Review. This page will assist you in understanding this process and how to file an appeal.

How far back can Medicare RAC audits go?

three yearsMedicare RACs perform audit and recovery activities on a postpayment basis, and claims are reviewable up to three years from the date the claim was filed.

How long do you have to respond to a RAC audit?

within 45 calendar daysThe response must be received within 45 calendar days or request an extension within those 45 days. The RAC may make a finding than an overpayment or underpayment exits if there is no timely response to a request for medical records.

What is a RAC letter?

If your practice receives a RAC audit notification letter, it's generally to investigate suspicion of an improper payment on a claim (either an overpayment or an underpayment). RAC auditors will usually request medical records to complete the audit.

When did RAC audits start?

2005Part D RAC Program History In 2005, CMS implemented the Medicare Recovery Audit Contractor (RAC) Program as a demonstration program for Medicare fee-for-service (FFS); Medicare Parts A and Part B. The pilot program successfully corrected more than $1.03 Billion in Medicare improper payments.

What does a RAC coordinator do?

RAC coordinators audit medical billing in hospitals, doctors offices and other medical facilities, ensuring these establishments provide proper documents and payments. When fraud or improper payments are identified, they notify the appropriate parties, or coordinate an appeals' processes for those who contest payments.

What does a Recovery Audit Contractor (RAC) do?

RAC's review claims on a post-payment basis. The RAC's detect and correct past improper payments so that CMS and Carriers, FIs, and MACs can implement actions that will prevent future improper payments.

What Topics do RAC's Review?

Stay in the know on proposed and approved topics that RAC's are able to review. These topics will be updated monthly on the RAC reviews topic page and include:

Introduction: What is a RAC Audit?

Medicare Recovery Audit Contractor Audits (RACs, or RAs) were introduced beginning in 2005 to identify and recover improper payments made in Medicare and Medicaid transactions between providers and payors. They were (and are) conducted by Recovery Audit Contractors (also known as RACs).

Chapter One: History of Recovery Audits

RAC audits were introduced in 2005, peaked around 2010 and experienced a slowdown from that point on. To understand the role of RAC audits in today’s healthcare finance space, it’s important to know how they started and why they have diminished.

Chapter Two: Types of RAC Audits

Before we look at the specific types of Recovery Audit Contractor audits, let’s review where they lie in the overall audit landscape.

Chapter Three: RAC Audit FAQ

With so many levels and types, it’s clear that audits can be complex. Adding in government legislation doesn’t necessarily make the process easier. The following frequently asked questions can provide additional clarity on the why and how of RAC audits.

Chapter Four: The Audit Process

The timing of an audit is dependent entirely upon the payor. If a RAC auditor wishes to conduct an audit, the provider must comply. Once an audit begins, the initial response process is largely the same regardless of whether it was triggered by a RAC auditor, commercial payor or other audit contractors.

Chapter Five: What Can You Do To Improve Your RAC Audit Process?

Before the ADR even arrives on your doorstep, you can take steps to train your team and implement processes designed to simplify your response process.

Chapter Six: Technology as an Audit Management Solution

When RAC audits were introduced, providers received an unmanageable volume of audit requests from payors. Now, changes in Recovery Audits have led to fewer audits and less paperwork, giving hospitals the opportunity to focus more broadly on all types of payor audits.

What is Medicare Recovery Audit Contractor?

Any medical practice submitting claims to a government program can be subject to a Medicare Recovery Audit Contractor (RAC) audit. RAC audits—which may be triggered by an innocent documentation error—are not one-time or intermittent reviews. They are part of a systematic and concurrent operating process created to ensure compliance ...

How long does it take to pay a recoupment check?

If a recoupment demand is issued and you agree with it, you have the choice of paying by check within 30 days, allowing recoupment from future payments, or requesting an extended payment plan. If you do not agree with the audit findings, there is an appeal process.

What is OIG billing?

The OIG is studying the link between electronic health record (EHR) systems and coding for billing . There is a concern that some EHR systems may generate upcoded billing through automatically generated detailed patient histories, cloning (when examination findings are copied and pasted), and templates filled in to reflect a more thorough or complex examination/visit. Review these issues with your EHR vendor and determine if your EHR program has the potential to automatically upcode billing based on EHR documentation.

Can you ignore a letter from RAC?

Most importantly, do not ignore a letter from the RAC auditor. It is recommended that an attorney assist you with your response to a RAC audit. The Doctors Company provides RAC audit legal assistance for members as part of MediGuard®, the regulatory risk coverage that is part of your medical liability policy.