Your zip code matters for Medicare because plan options change depending on your location. Also, Medicare Advantage plan networks are dependent on the private insurance company providing care to each client. Zip code is important in terms of Medicare program eligibility.

What does ZIP code have to do with Medicare?

Jan 07, 2022 · Why Does My Zip Code Matter for Medicare? Your zip code matters for Medicare because plan options change depending on your location. Also, Medicare Advantage plan networks are dependent on the private insurance company providing care to each client. Zip code is important in terms of Medicare program eligibility.

Does my ZIP code affect my Medicare coverage?

This is where your zip code matters in terms of Medicare eligibility. You will always be eligible for Original Medicare, but eligibility for specific Medicare Advantage plans require you to live in...

What diagnosis codes are covered by Medicare?

Does my ZIP code affect my Medicare coverage? Zip code does affect which plan options are available to you. For example, Medigap and Medicare Advantage plans will vary in pricing as well as features depending on your location. Additionally, you must live in the plans service area to be eligible for enrollment. Medicare Advantage plans are impacted most by zip code changes. …

Where can I find a doctor that accepts Medicare and Medicaid?

Nov 30, 2021 · Medicare can be broken down into two different plans: Medigap and Medicare Advantage. Medigap, often known as Medicare Supplement, is available to Original Medicare beneficiaries, and it covers ...

How does your zip code affect your Social Security benefits?

Social security benefits are not impacted by geographic location but other federal benefits are. We took a look at these programs and how benefits vary. Social security benefits are calculated the same nationally.Dec 9, 2021

Does Medicare vary from state to state?

Medicare Part A and Medicare Part B together are known as “original Medicare.” Original Medicare has a set standard for costs and coverage nationwide. That means your coverage will be the same no matter what state you live in, and you can use it in any state you visit.

How do you get $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Why do some ZIP codes get extra Medicare benefits?

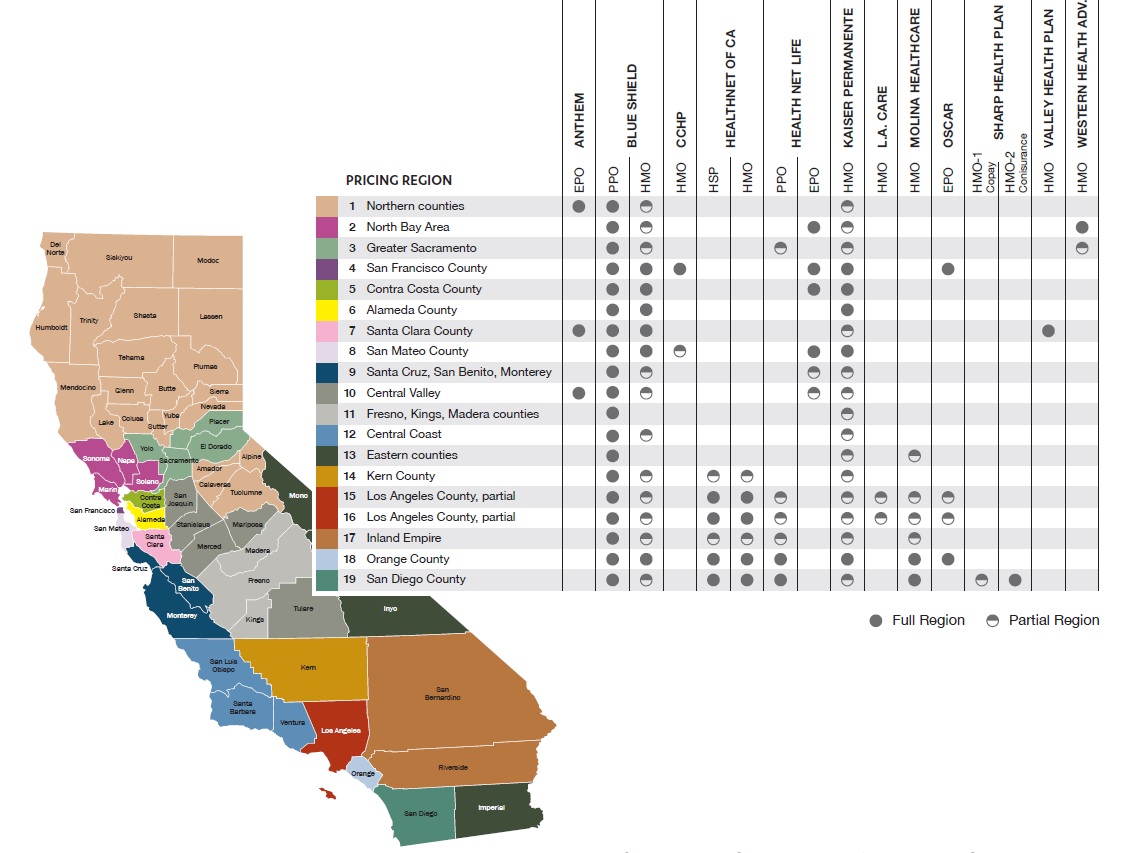

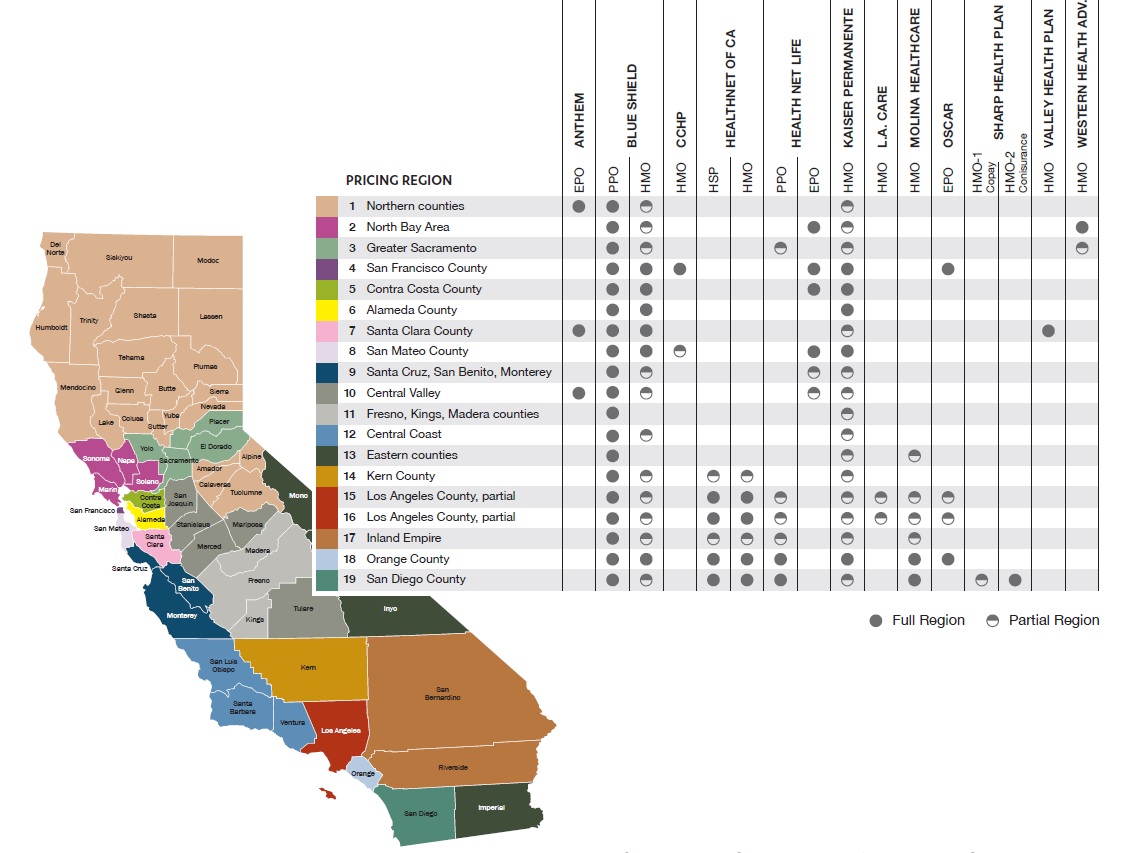

Location Is Key. According to the official U.S. government website for Medicare, the Medicare Advantage plans that are available to you differ according to your zip code. This is because Medicare Advantage plans are offered by private insurance companies who determine the specific service areas of their plans.

What state has the cheapest Medicare supplement plans?

Meanwhile, the cheapest state in the Union for Medigap plans is sun-soaked Hawaii, where policies are only $1,310 annually — $109.16 on a monthly basis.Jul 31, 2018

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Does your zip code matter for Medicare?

This is where your zip code matters in terms of Medicare eligibility. You will always be eligible for Original Medicare, but eligibility for (4 day...

How do you qualify for $148 back from Medicare?

How do you qualify for $148.50 back from Medicare? If you have Parts A and B, you can enroll in an Advantage plan with a give-back option. These pl...

How do I find Medicare Part B Giveback plans?

You can use Medicare's Plan Finder to find plans in your area that offer the giveback benefit. If you look under the "premiums" section in the Plan...

How do I find out if my Medicare plan offers a premium reduction?

The best place to start is the Medicare Plan Finder. If a plan offers the Part B premium reduction, you’ll see that noted on the details page. Find...

What makes you eligible for Medicare?

To qualify to receive Medicare services, you must be aged 65 or older, and you must have been getting disability income from Social Security or the Railroad Retirement Board (RRB) for 24 months.

How can the service vary?

Medicare can be broken down into two different plans: Medigap and Medicare Advantage.

2. Many Advantage plans serve only a few counties

They are often limited to the area around particular hospitals. This is especially true for ones that are HMOs. Not all Advantage plans are HMOs.

4. It determines what plans are available in the area

I have a plan that is only available in about 10 states. And it is not available to the general public. I have the option of enrolling in a different plan that is available in all 50 states.

12. and woe be unto you if you have to seek treatment out of network

I do not want to make insurance companies any richer than I have to, so I took Medicare B. There are no networks. My plan is good no matter where I am in the US.

14. Your plan is mostly good everywhere with the Medicare part

That pays only 80% of covered cost. The 20% is covered by your own insurance which can be just traditional or with an Advantage plan.

27. Doesn't work well for people with chronic illnesses

Original Medicare B is not capped, so you'll be paying 20% forever. Medicare Advantage plans are capped ($6700 max this year). My daughter's billed medical expenses are $200,000/year. 20% of 200,000 every year is a whole heap of money.

18. To be clear, Medicare Advantage is NOT Medicare

It is private insurance disguised as Medicare, and has many disadvantages. In other words, it's a Trojan horse designed to destroy the original Medicare program.

28. It is a Godsend if you have a chronic illness

There is no cap on the annual out-of-pocket expenses for original Medicare. Those of us with chronic, costly illnesses need an annual cap.

How many states will have Medicare Advantage in 2021?

In 2021, there will be 48 states offering a Medicare Advantage plan with a Part B premium reduction. So, it’s fair to say the popularity of these plans is increasing.

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

How much does Part B premium cost?

These plans reduce your Part B premium up to the full standard amount of $148.50 each month and add the money to your Social Security check.

Can Medicare Advantage pay Part B?

The Medicare Advantage insurance company can pay either the whole or a portion of the Part B premium for enrollees. Since the Advantage plan handles your claim instead of Medicare, these plans make more sense than a standard Part C policy. How can Medicare Advantage plans give you back some of your Part B premium money?

Who is eligible for Part B buy down?

Who is Eligible for the Part B Buy-Down Plan? Those that pay their own Part B premium will be eligible for the Part B buy-down. But, anyone with Medicaid or other forms of assistance that could pay the Part B premium can’t enroll in these plans.

Does Cigna have a Part B plan?

In some areas, Cigna may have a Part B premium reduction plan. Even Aetna has a Part B give back in some areas. Further, there are likely more companies offering this type of policy than just the ones we’ve mentioned. Also, consider the plan ratings before you enroll.

What is the Part B premium reduction benefit?

When you're enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount.

How do I receive the giveback benefit?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. Or, you can contact the plan directly.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does to take advantage of the savings opportunity.

Downsides to the Medicare giveback benefit

While the giveback benefit can help save you money, there are a few things to be aware of when considering enrolling in an MA plan that offers it.