Likewise, what does AARP Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Does AARP offer the best Medicare supplemental insurance?

May 02, 2022 · Covers the Part A deductible of $1,556 for the first 60 days, $389 per day for days 61 to 90, and $778 per day for days 91 and beyond while using 60 lifetime reserve days. Once lifetime reserve days have been used, 100% of eligible costs are covered for 365 days more.

How much does AARP Medicare supplemental insurance cost?

Apr 12, 2022 · The primary goal of a Medicare Supplement insurance (Medigap) plan is to help cover some of the out-of-pocket costs of Original Medicare (Parts A & B). As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary …

Does AARP offer Medicare Advantage plans?

Medicare Parts A and B ("Original Medicare") only cover some of your health care costs. That's where Medicare Supplement Insurance ("Medigap") comes in. Medigap plans cover some of the costs not covered by Original Medicare, like coinsurance, copayments and deductibles. AARP …

What does AARP Medicare supplement plan I cover?

Feb 01, 2021 · Like all Medigap plans, AARP plans are designed to cover some of the gaps in Medicare coverage, such as copays, coinsurance, and deductibles. Each plan varies in terms of …

What does AARP supplemental cover?

What does Medicare supplement plan I cover?

Does AARP Medicare Supplement cover Part A deductible?

What does AARP pay for?

Is there a Medicare supplement that covers everything?

What is not covered by Medigap?

Does AARP Part G cover prescriptions?

Does AARP cover Medicare copay?

Does AARP plan F cover prescriptions?

Why you should not join AARP?

Is AARP worth getting?

Does Walmart give AARP discounts?

What are the features of Medicare Supplement plans?

Helps cover some out-of-pocket costs that Original Medicare doesn’t pay.See any doctor who accepts Medicare patients.No referrals needed to see a s...

What Medicare Supplement plans are available?

Medicare Supplement plans are often called “Medigap.” There are ten standardized Medicare Supplement plans.Each plan has a letter assigned to it. E...

What does each Medicare Supplement plan cover?

Each of the Medicare Supplement plans offers a varying level of coverage. See what plans match up with the coverage you want.

Is AARP an insurer?

AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products.

What is Medicare Supplement?

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as "Medigap", are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits.

Does Medigap work with Medicare?

When you have a Medigap plan to work with Original Medicare it can help with some of the following costs that you would have to pay on your own: About 20% in out-of-pocket expenses not paid by Medicare Part B for doctor and outpatient medical expenses (after the annual deductible is met—$203 in 2021).

How long does Medicare cover hospital coinsurance?

Part A coinsurance, and most plans include a benefit for the Part A deductible (which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.) Hospital coverage up to an additional 365 days after Medicare benefits are used up. Part A hospice/respite care coinsurance or copayment.

Does UnitedHealthcare have a Medicare Advantage plan?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare. You do not need to be an AARP member to enroll in a Medicare Advantage ...

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP® Medicare Supplement Insurance Plans.

When is the best time to enroll in Medicare Supplement?

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you're both age 65 or older and enrolled in Medicare Part B.

Speak with a Medicare Expert today

Medicare Supplement plans can be complicated, but UnitedHealthcare is here to help make it clear.

Learn about Medicare Supplement plans

Learn how Medicare Supplement plans work with Medicare and review plans in your area.

The biggest benefit is peace of mind

Don't worry about finding a new doctor, shopping for a plan each year, or network changes. With a Medicare Supplement insurance plan, you also avoid the hassle of out-of-pocket costs, which puts the control right where it belongs...with you.

Providing coverage and building relationships for over 40 years

In addition to the standard benefits of Medicare Supplement plans, an AARP Medicare Supplement Insurance Plan from UnitedHealthcare has many features that stand out.

Expert advice right at your fingertips

If you have questions about the different plan options, are curious about plan benefits or just don’t know where to start, that’s OK. UnitedHealthcare is here and ready to help.

What is AARP Medicare Supplement?

AARP is a nonprofit, membership organization that offers Medigap plans through the UnitedHealthcare insurance company. There are eight AARP Medicare supplement plans you may be able to choose from, although not every plan can be purchased in every state or county.

Does AARP offer Medicare Advantage?

AARP offers Medicare Advantage and Medicare supplement (Medigap) plans through the UnitedHealthcare insurance company. Medigap plans are a type of supplemental insurance that is sold by private insurers. As the name implies, Medigap is meant to cover some of the gaps in healthcare costs that original Medicare ( Part A and Part B) doesn’t pay.

What are the different Medicare plans?

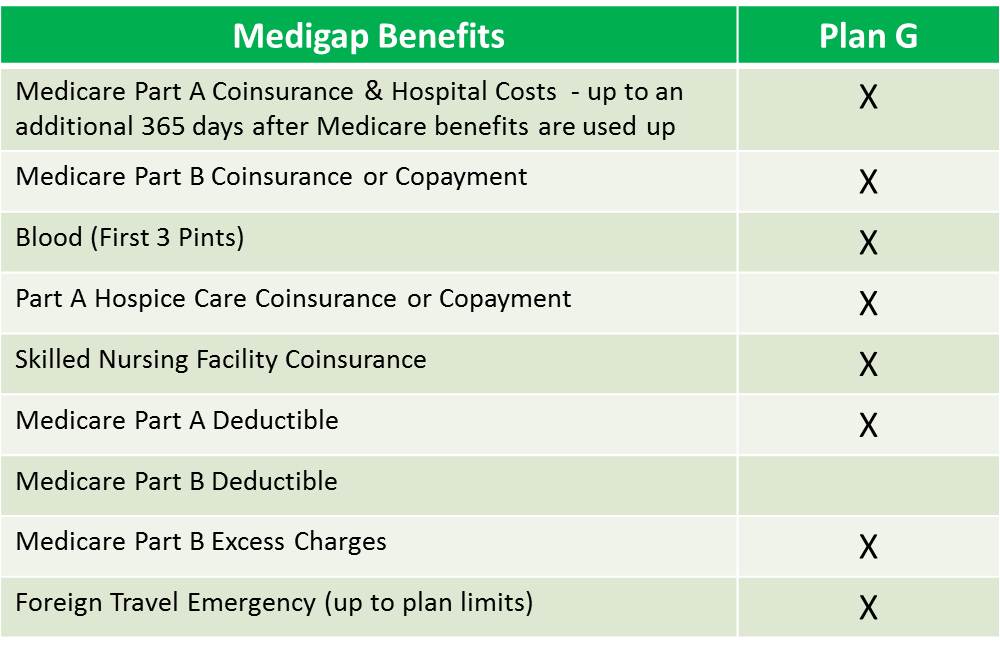

UnitedHealthcare offers eight standardized Medigap plans to AARP members: 1 Medicare Supplement Plan A. Plan A mainly helps pay for hospital and hospice coverage. 2 Medicare Supplement Plan B. Plan B offers the same coverage as Plan A but also covers your Part A deductible. 3 Medicare Supplement Plan C. Plan C is a very robust plan. It covers the Medicare Part B deductible, skilled nursing facility care, and foreign travel. This plan is available only to people who were eligible for Medicare before January 1, 2020. 4 Medicare Supplement Plan F. Plan F is the most comprehensive plan, covering the Part B excess charges in addition to all of the benefits of Plan C. This plan is also only available to those new to Medicare prior to 2020. 5 Medicare Supplement Plan G. This plan offers coverage for Part B excess charges and foreign emergency care. It is a popular plan for those who are not eligible for plans C or F. 6 Medicare Supplement Plan K. Plan K pays up to 50 percent of your costs after you meet your deductible. It also offers low monthly premiums. 7 Medicare Supplement Plan L. This plan pays up to 75 percent of your costs after you meet the deductible and also has low monthly premiums. 8 Medicare Supplement Plan N. With this plan, you’ll still have copays for Part B services, but they’ll be much lower than what you’d pay without the plan. You’ll also have coverage for hospital care, foreign travel, and more.

Is AARP a nonprofit?

AARP is a nonprofit , membership organization that offers Medigap plans through the UnitedHealthcare insurance company. There are eight AARP Medicare supplement plans you may be able to choose from, although not every plan can be purchased in every state or county. There is at least one AARP Medigap plan available for purchase in all 50 states.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F. Plan F is the most comprehensive plan, covering the Part B excess charges in addition to all of the benefits of Plan C. This plan is also only available to those new to Medicare prior to 2020. Medicare Supplement Plan G.

What is a Medigap plan?

Medigap plans are a type of supplementary insurance that you may want if you have original Medicare. These plans pay some of the out-of-pocket costs that you are typically responsible for. Not every plan is available everywhere. The costs of these plans also vary from state to state. Medigap plans are standardized.

Is Medigap the same as Medicare Advantage?

However, it is up to an insurance company to decide which plans they will sell. Medigap is not the same as Medicare Advantage (Part C).

Does AARP have Medicare Supplement?

territories. No referrals necessary and you may keep your current doctor.

What is AARP for seniors?

AARP is a nonprofit organization that works to serve the interests of people age 50 and over. AARP was founded in 1958 by Dr. Ethel Percy Andrus on three primary principles: To promote independence, dignity and purpose for older persons. To enhance the quality of life for older persons.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Who founded AARP?

AARP was founded in 1958 by Dr. Ethel Percy Andrus on three primary principles: To promote independence, dignity and purpose for older persons. To enhance the quality of life for older persons. To encourage older people "to serve, not to be served". Nearly 38 million Americans are AARP members. 1.

How much is AARP membership 2021?

You must be an AARP member and continue to pay your AARP dues. In 2021, the standard yearly price of AARP membership is $16 for your first year. You must be enrolled in both Medicare Part A and Part B. You must reside in the area in which the desired plan is sold.

What is a Medigap Plan A?

Medigap Plan A provides full coverage of Medicare Part A and Part B coinsurance costs, hospice care coinsurance and the first three pints of blood needed for a transfusion. Plan B. Plan B provides all of the same coverage as Plan A and also includes coverage of the Medicare Part A deductible. Plan C.

Does Medigap cover hospice?

Medigap Plan A provides full coverage of Medicare Part A and Part B coinsurance costs, hospice care coinsurance and the first three pints of blood needed for a transfusion. Plan B provides all of the same coverage as Plan A and also includes coverage of the Medicare Part A deductible.

What is Medicare Supplemental Insurance?

This is health insurance that helps pay for some of your costs in the Original Medicare program and for some care it doesn’t cover. Medigap insurance is sold by private insurance companies.

Does Medigap cover Medicare?

This is health insurance that helps pay for some of your costs in the Original Medicare program and for some care it doesn’t cover. Medigap insurance is sold by private insurance companies. By law, companies can only offer standard Medigap insurance plans. There are 11 standard plans labeled A-N.

What percentage of Medicare pays for mental health?

It pays 50 percent of mental health services and 100% of some preventive services. Medigap plans cover all or part of your share of these services – 20 percent of the Medicare-approved amount for doctor services and 50 percent for mental health services.

Does Medicare cover blood?

Blood. The Original Medicare Plan doesn't cover the first three pints of blood you need each year. Plans A-D, F-G, and M through N pay for these first three pints. Plans K pays 50% and L pays 75% part of the cost.

How long does Medicare pay for skilled nursing home?

Skilled Nursing Home Costs. The Original Medicare Plan pays all of your skilled nursing home costs for the first 20 days of each benefit period. If you are in a nursing home for more than 20 days, you pay part of each day’s bill.

What are excess charges for Medicare Part B?

Medicare Part B Excess Charges#N#When you see a doctor who doesn’t “accept assignment,” he or she doesn’t accept Medicare’s approved amount as payment in full. The doctor can charge you up to 15 percent more than Medicare’s approved amount.#N#Medigap Plans F and G pay 100% of these excess charges. You might want this benefit if you don’t know whether the doctors you see accept assignment, such as when you are in the hospital.#N#Foreign Travel Emergency#N#Medicare does not cover any health care you receive outside of the United States. Medigap Plans C, D, F, G, M and N cover some emergency care outside the United States. After you meet the yearly $250 deductible, this benefit pays 80 percent of the cost of your emergency care during the first 60 days of your trip. There is a $50,000 lifetime maximum.#N#Plans K and L#N#Important: Plans K and L offer similar coverage as plans A - G, but the cost-sharing for the benefits are different levels and have annual limits on how much you pay for services. The out-of-pocket limits are different for plans K and L and will increase each year for inflation. In 2010, the out-of-pocket limit was $4,620 for plan K and $2,310 for Plan L.#N#Ongoing Coverage#N#Once you buy a Medigap plan, the insurance company must keep renewing it. The company can’t change what the policy covers and can’t cancel it unless you don’t pay the premium. The company can increase the premium, and should notify you in advance of any increases.

What does Medigap cover?

None of the standard Medigap plans cover: • long-term care to help you bathe, dress, eat or use the bathroom. • vision or dental care. • hearing aids. • eyeglasses. • private-duty nursing.

Does Medicare cover disposable items?

With only a few exceptions, Medicare doesn’t cover disposable items. To qualify for Medicare coverage, the equipment or supplies must be: Prescribed by a doctor, a nurse practitioner or another primary care professional.

What medical equipment does Medicare cover?

What medical equipment and supplies does Medicare cover? En español | Medicare Part B helps to pay for many items of medical equipment and supplies that help you function — for example, wheelchairs, artificial limbs, pacemakers, commode chairs, hospital beds, appliances to help breathing, neck and back braces, oxygen supplies and many more.

How to qualify for Medicare?

To qualify for Medicare coverage, the equipment or supplies must be: 1 Medically necessary for you — not just convenient 2 Prescribed by a doctor, a nurse practitioner or another primary care professional 3 Not easily used by anyone who isn’t ill or injured 4 Reusable and likely to last for three years or more 5 Appropriate for use within the home 6 Provided by suppliers that Medicare has approved

What is Medicare Part B?

En español | Medicare Part B helps to pay for many items of medical equipment and supplies that help you function — for example, wheelchairs, artificial limbs, pacemakers, commode chairs, hospital beds, appliances to help breathing, neck and back braces, oxygen supplies and many more. The equipment must be durable (long-lasting).