What is not covered by Medicare Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Does Medicare Part A pay for everything?

In general, Part A covers: Skilled nursing facility care. Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care) Hospice care. Home health care.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is paid by Medicare Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

How does Medicare Part A and B work?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Helps cover the cost of prescription drugs (including many recommended shots or vaccines).

Does Medicare Part A cover MRI?

Does Medicare Cover MRIs? Original Medicare — Medicare Part A and Part B — covers 80 percent of an MRI's cost if the health care providers involved accept Medicare. You'll be responsible for 20 percent of the cost and your deductible.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is there a maximum out of pocket for Medicare Part A?

Medicare Part A. With Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is the difference between Medicare Part A and Part B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

What is Covered Under Medicare A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bi...

What is Not Covered Under Medicare Part A?

Even in the case of an inpatient stay that Medicare Part A covers, Part A won’t cover:

Does Medicare Part A Cover Doctor Visits?

Part A covers qualifying hospital visits; Part B, rather than Part A, covers doctors’ services at the hospital, much like Part B covers non-emergen...

Does Medicare Part A Cover 100 Percent?

For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay th...

What Does Medicare Part A Cost?

Most people don’t have to pay a monthly premium for Part A. If you or your spouse have worked 40 quarters (10 years) while paying Medicare taxes, y...

How to Enroll in Medicare Part A?

If you believe you would benefit from Part A coverage and qualify for it, the final step is the Part A enrollment process. If you are near the Medi...

Do you need Medicare Part A for hospital coverage?

If you, like most people, don’t have to pay a monthly premium for Part A, there is no downside to enrolling when you become eligible at age 65. You...

Do you need more than Part A for hospital coverage?

While Part A covers a significant portion of a typical hospital bill and usually provides coverage for U.S. citizens age 65 and older without a mon...

What is unique about Medicare Advantage when it comes to hospital coverage?

Medicare Advantage plans protect you with an annual out-of-pocket maximum — a dollar amount specific to your plan that defines the most money you w...

What happens if you don't enroll in Medicare B?

People who don’t enroll in Medicare B when first eligible are charged a late enrollment penalty that amounts to a 10 percent increase in premium for each year they were eligible for Medicare B but not enrolled.

How long do you have to pay Medicare taxes if you have end stage renal disease?

You have end-stage renal disease (ESRD) and are receiving dialysis, and either you or your spouse or parent (if you’re a dependent child) worked and paid Medicare taxes for at least 10 years.

How long does Medicare coverage last?

Medicare coverage begins as soon as your SSDI begins, and Medicare Part A has no premiums as long as you or your spouse (or parent, if you’re a dependent child) worked and paid Medicare taxes for at least 10 years.

How much is Medicare premium for 2020?

These premiums are adjusted annually. Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly). For 2020, the threshold for having to pay higher premiums based on income increased.

Do you have to pay Social Security premiums if you are 65?

You may also not have to pay the premium: If you haven’t reached age 65, but you’re disabled and you’ve been receiving Social Security benefits or Railroad Retirement Board disability benefits for two years. You have end-stage renal disease (ESRD) and are receiving dialysis, and either you or your spouse or parent (if you’re a dependent child) ...

Do you have to pay Medicare premiums?

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don’t pay a premium for Part A. You may also not have to pay the premium: If you haven’t reached age 65, but you’re disabled and you’ve been receiving Social Security benefits ...

What is not covered by Part A?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

What services are paid for under Part B?

The following services are paid for under Part B instead of Part A: All physicians’ services — including those provided by doctors, surgeons and anesthetists in the hospital or a skilled nursing facility, or as part of the home health care or hospice benefits.

What is private nursing care?

Private nursing care. A television or telephone in your room, and personal items like razors or slipper socks, unless the hospital or skilled nursing facility provides these to all patients at no additional charge.

Can you get Medicare for a stay in a nursing home?

If you have been in the hospital “under observation” — even for longer than three days — you do not qualify for Medicare coverage of a stay in a skilled nursing facility. The costs of staying as a long-term resident in a nursing home or assisted living facility.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

Why is Medicare Part A called Medicare Part A?

Medicare Part A is commonly referred to as “hospital insurance” because its primary function is to help older adults manage the cost of hospital bills.

What is Medicare Part A?

Medicare Part A#N#Medicare Part A, also called "hospital insurance ," covers the care you receive while admitted to the hospital, skilled nursing facility, or other inpatient services. Medicare Part A is part of Original Medicare.#N#provides coverage to U.S. citizens age 65 and older for inpatient stays in hospitals and similar medical facilities.

How much does Medicare cover inpatients?

Does Medicare Part A Cover 100 Percent? For a qualifying inpatient stay, Medicare Part A covers 100 percent of hospital-specific costs for the first 60 days of the stay — after you pay the deductible for that benefit period.

What is Medicare Original?

Original Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities. Original Medicare is provided by the federal government and is made up of two parts: Part A (hospital insurance) and Part B (medical insurance). or other medical insurance may provide coverage.

How long does it take to pay coinsurance for Medicare?

After 60 days , you must pay coinsurance that Part A doesn’t cover. For hospital expenses covered by Part B, you have to pay 20 percent coinsurance after meeting your annual deductible. Part A and B are collectively known as Original Medicare and work hand-in-hand to help cover hospital stays.

How long does Medicare Part A and Part B last?

Your IEP begins three months before the month you turn 65. The IEP is open for a total of seven months and allows you to enroll in Medicare Part A and Part B.

Does Medicare cover chemotherapy?

What does Medicare Part A cover and not cover based on your status as a patient? If, for example, you need chemotherapy, Part A will cover it if it’s administered as a part of an inpatient hospital stay; if it’s done on an outpatient basis, Part A won’t cover it (but Part B will).

When do you enroll in Medicare Part A?

You’re automatically enrolled in original Medicare — which is made up of parts A and B — starting on the first day of the month you turn 65 years old.

How long do you have to work to get Medicare?

If you’ve worked for at least 40 quarters — roughly 10 years — and paid Medicare taxes out of your paycheck, you won’t pay a premium for Medicare Part A. If you worked less than that amount of time, you will pay a monthly premium for Part A. Even if you don’t owe a premium, other costs are typically associated with services covered under Part A.

What is Medicare Part A 2021?

Deductibles and hospital coinsurance. With Medicare Part A, you’ll also pay a deductible and coinsurance costs for each benefit period. In 2021, these costs are: Each day beyond day 90 is considered a lifetime reserve day. You have up to 60 of these days to use in your lifetime.

How much is skilled nursing in 2021?

In 2021, these costs are: $0 coinsurance for days 1 through 20 for each benefit period. $185.50 daily coinsurance for days 21 through 100 for each benefit period.

How much is the Part A premium for 2021?

If you or your spouse worked for 30 to 39 quarters, the standard monthly Part A premium cost is $259 in 2021. If you or your spouse for worked fewer than 30 quarters, the standard monthly Part A premium cost is $471 in 2021.

How long do you have to be on Medicare if you are 65?

If you’re under age 65 and receiving Social Security or RRB disability benefits, you’ll automatically be enrolled in Medicare Part A when you’ve been receiving the disability benefits for 24 months. If you’re not automatically enrolled, you can sign up manually through the Social Security Administration.

How old do you have to be to get Social Security?

You’re 65 years old and receive retirement benefits from Social Security or the Railroad Retirement Board (RRB). You’re 65 years old and you or your spouse had Medicare-covered health benefits from a government job. You’re under age 65 and have received Social Security or RRB disability benefits for 24 months.

What is Medicare Part A?

Medicare Part A is also called "hospital insurance," and it covers most of the cost of care when you are at a hospital or skilled nursing facility as an inpatient. Medicare Part A also covers hospice services. For most people over 65, Medicare Part A is free. The following list gives you an idea of what Medicare Part A pays for, ...

How much does Medicare pay for hospital bills?

Medicare Part A pays only certain amounts of a hospital bill for any one spell of illness. (And for each spell of illness, you must pay a deductible before Medicare will pay anything. In 2020, the hospital insurance deductible is $1,408.)

How many days can you use Medicare lifetime reserve?

If you are in the hospital more than 90 days during one spell of illness, you can use up to 60 additional "lifetime reserve" days of coverage. During those days, you are responsible for a daily coinsurance payment of $704 per day in 2020. Medicare pays the rest of covered costs.

How long does a skilled nursing home stay in the hospital?

Your skilled nursing stay or home health care must begin within 30 days of being discharged.

How long does Medicare cover psychiatric hospitals?

Psychiatric Hospitals. Medicare Part A hospital insurance covers a total of 190 days in a lifetime for inpatient care in a specialty psychiatric hospital (meaning one that accepts patients only for mental health care, not just a general hospital). If you are already an inpatient in a specialty psychiatric hospital when your Medicare coverage goes ...

What is a spell of illness?

The benefit period begins the day you enter the hospital or skilled nursing facility as an inpatient and continues until you have been out for 60 consecutive days.

How many reserve days do you have to use for Medicare?

You do not have to use your reserve days in one spell of illness; you can split them up and use them over several benefit periods. But you have a total of only 60 reserve days in your lifetime. (Note: If you have a Medicare Advantage Plan, called Medicare Part C, you may not have to pay ...

Why did Medicare Part A end?

You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

What time do you call Medicare Part A?

You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative. You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

What happens if you wait to enroll in Part A?

Keep in mind that if you wait to enroll in Part A after you’re first eligible, you may owe a late-enrollment penalty in the form of a higher premium. Your Part A premium could go up 10%, and you’ll have to pay this higher premium for twice the number of years that you could have enrolled in Part A but went without it.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

What is Medicare Part A?

Medicare Part A is also known as hospital insurance. It’s one of the two pillars of the original Medicare program that President Lyndon B. Johnson signed into law in 1965.

How do Medicare Part A premiums work?

Once you turn 65, you’ll either be eligible for premium-free Part A, or you can choose to pay Part A premiums if you haven’t worked long enough to earn premium-free coverage.

What deductible can you expect to pay with Medicare Part A coverage?

The Medicare Part A deductible for 2021 is $1,484 for each benefit period. A benefit period starts the day you’re admitted to a hospital or skilled nursing facility and ends when you haven’t had inpatient treatment at either place for 60 days in a row.

What medical services does Medicare Part A cover?

Inpatient hospital care: Includes a semi-private hospital room, hospital meals, general nursing, drugs used to treat you during an inpatient stay, supplies, and hospital services that are part of your hospital treatment.

How to find out what your Medicare covers

You can search for whether an item, service, or test is covered here. You also can ask your doctor’s office, call Medicare at 1-800-MEDICARE ( 1-800-633-4227 / TTY 1-877-486-2048 ), or contact your Medicare plan for help with more specific needs.

How does coinsurance work with Medicare Part A?

If you’re admitted to a hospital, you will have to pay your Medicare Part A deductible ($1,484 for 2021). Your admission starts the clock on your cost-sharing, because your out-of-pocket costs are based on benefit periods.

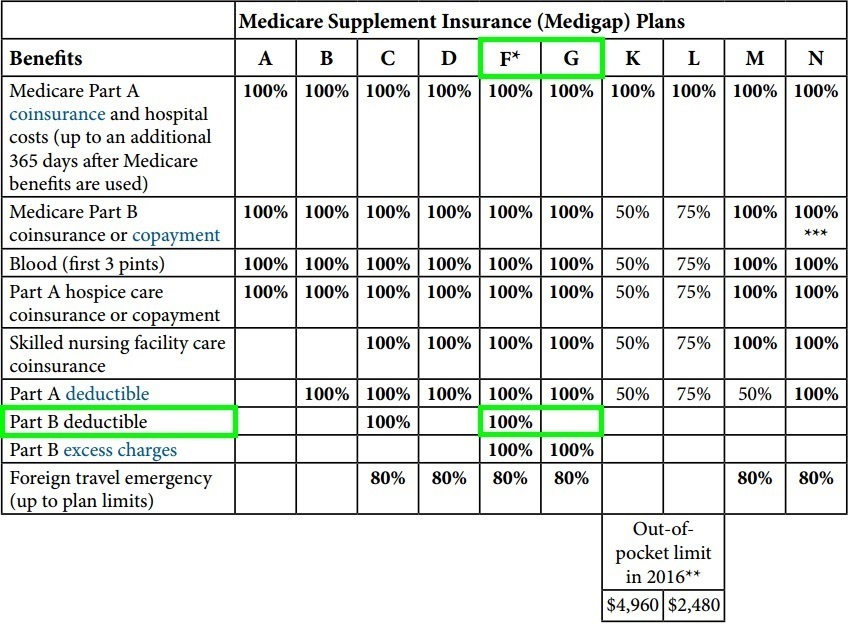

Do you need supplemental insurance to go with Medicare Part A coverage?

Hospitalization can be expensive, even with Medicare coverage. If you don’t have employer or retiree coverage, or have Medicaid to fill in the gaps from original Medicare, you might consider buying Medicare supplement insurance, known as Medigap. Some Medigap plans also cover emergency healthcare when traveling outside of the U.S.