Benefits from the high-deductible Plan F will not begin until out-of-pocket expenses are $ 2,490. Out-of-pocket expenses for this deductible are expenses that would ordinarily be paid by the policy. This includes the Medicare deductible for Part A and Part B, but does not include the plan’s separate foreign travel emergency deductible.

Full Answer

What is high deductible Medigap plan F?

Nov 07, 2019 · Costs for the high-deductible Plan F may also include monthly premiums, which are usually lower than the premiums for the standard plan because of the higher deductible amount. If you choose this option, you’ll need to pay for all out-of-pocket Original Medicare costs until you reach a designated amount ( $2,300 in 2019 ), before your policy pays anything.

What is the deductible for high deductible health insurance?

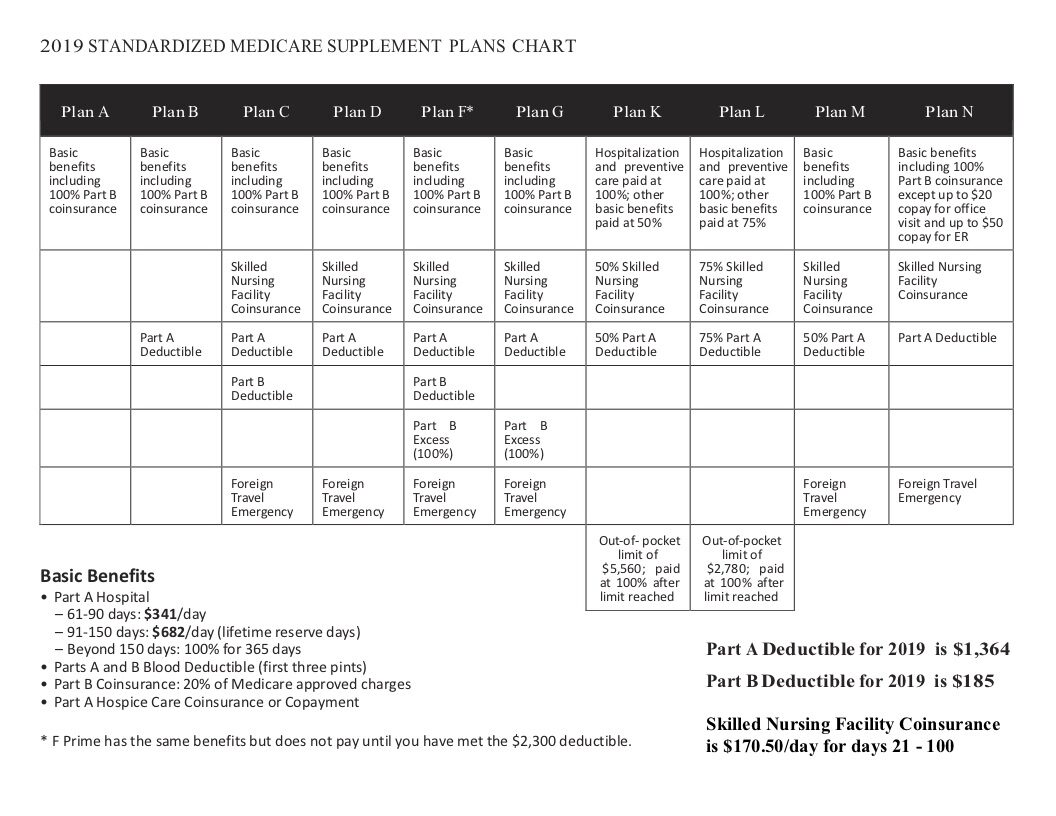

Jan 14, 2022 · High-deductible Medigap Plan F provides coverage for: Medicare Part A coinsurance and hospital costs; Medicare Part B coinsurance or copayment; First three pints of blood; Part A hospice care coinsurance or copayment; Coinsurance for skilled nursing facility; Medicare Part A deductible; Medicare Part B deductible; Medicare Part B excess charges; 80 …

Does Medigap plan F cover all Original Medicare costs?

The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age ...

What are the costs for the High-Deductible Plan F?

Jun 12, 2020 · While the deductible itself changes every year, in 2020, the deductible was $2,340. This means you must pay for all Medicare-covered costs, such as coinsurance, copayments, and deductibles up to this amount. After you pay $2,340, your plan benefits kick in. This option is suitable for people who anticipate fewer health expenses throughout the year but still want full …

What Is Medicare Supplement Plan F (Medigap Plan F)?

Medicare Supplement plans are offered by private insurance companies. Medicare Supplement Plan F, like other Medigap plan options signified by a le...

What Benefits Does Medigap Plan F Cover?

Here are the extensive benefits that Medicare Supplement Plan F and the high-deductible Plan F provide: 1. First three pints of blood 2. 100% of Me...

What Are The Costs of Medicare Supplement Plan F?

Because Plan F generally offers the broadest coverage of the 10 Medigap plans, it is usually the most expensive plan. This might not always be the...

What Are The Costs For The High-Deductible Plan F?

Costs for the high-deductible Plan F may also include monthly premiums, which are usually lower than the premiums for the standard plan because of...

What is a high deductible plan?

High deductible Plan F provides the same level of coverage as the standard Plan F with potentially lower monthly premiums. The tradeoff for these lower monthly premiums is a high deductible.

How much will Medicare cover in 2021?

You must pay for Medicare-covered costs up to $2,370 in 2021 before your plan coverage will kick in. For example, if you need a blood transfusion, a traditional Medigap plan will cover the cost of the first three pints, and Medicare will cover the cost of pints four and beyond.

What is the high deductible plan for Medicare Supplemental?

The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020.

What is the deductible for Medicare 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370.

When will Medicare plan F be available?

The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020.

What is a high deductible plan?

High Deductible Plan F. High Deductible Plan F is an alternative version of the standard Plan F. The difference is the beneficiary agrees to pay the deductible before full coverage kicks in. Once you reach the deductible, the plan covers the left-over costs going forward, keeping the monthly premium low.

What is a standard plan F?

Standard Plan F is the Medigap plan offering the most comprehensive benefits. Yet, with more coverage comes higher monthly premiums. Thus, this plan, with its lower monthly premiums, could be a good choice for cost-conscious beneficiaries who find standard Plan F’s benefits attractive.

How much is the 2021 deductible?

In 2021, the deductible is $2,370. Therefore, you would have to pay $2,370 out-of-pocket on this plan. Once you reach this deductible, the plan will cover 100% of the costs.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is the High Deductible Plan F?

The standard Medicare Supplement Plan F offers the most comprehensive benefits of all 10 standardized Medicare Supplement plans. High Deductible Plan F covers all of the same benefits listed just like the Medicare Standard Plan F, after you meet the deductible. The deductible for 2021 is $2,370.

Am I eligible for High Deductible Plan F?

High Deductible Plan F is only available if you first become eligible for Medicare before January 1, 2020. This means your 65th birthday occurred before January 1, 2020 or you qualified for Medicare due to a disability before January 1, 2020.

Who should apply for High Deductible Plan F?

High Deductible Plan F is most suitable for someone who has fewer health expenses throughout the year.

Is High Deductible Plan F going away?

All first-dollar Medicare coverage plans were discontinued including Medicare Plan C and standard Medicare Plan F. However, this change in Medicare does not affect current beneficiaries on those specific plans, just to new beneficiaries.

When is high deductible plan F available?

Plan F is only available if you qualified for Medicare before January 1, 2020.

Does Medicare Part B pay for HDPF?

Medicare Part B will still pay 80% of your costs as it would without any Medicare Supplement. Anything you pay towards your Part A deductible ($1,408 in 2020) and Part B deductible ($198) will also count towards your HDPF deductible.

What is the most popular Medicare Supplement Plan?

There’s a good reason Plan F is the most popular Medicare Supplement plan. Largely, it provides the most comprehensive coverage of any Medigap policy. Once Medicare pays its share of covered charges for care in the U.S., Plan F will cover in full, the rest of your costs for any services covered under Medicare Parts A and B.

Does HDPF cover medical expenses?

Because an HDPF will cover your costs only once you’ve reached your deductible, it’s important that you keep track of your medical spending . It will be your responsibility to ensure your plan remembers to pick up the bill once you reach your deductible; your plan should follow the rules on its own, but there are cases where they miscalculated or miss a medical bill that was paid. Checking your medical costs will also help you strategize when you receive care so that you can realize the greatest savings.

What happens if you have high medical bills?

In other words, if you have high medical costs every so often, you’ll be financially hit at the time but you won’t see a drain on your monthly expenses in terms of the premiums you have to pay each month to keep your plan in force.

How Does Medicare Supplement Plan F Work?

Medigap Plan F offers the highest level of coverage out of the Medigap plans available. Essentially, with Plan F, you have no out-of-pocket costs for anything that’s covered under Original Medicare (Medicare Part A and Medicare Part B).

How Does High Deductible Medicare Supplement Plan F Work?

With High Deductible Medigap Plan F, Original Medicare will continue to pay its usual portion (usually about 80% of the bill), but you’ll need to pay $2,370 out-of-pocket before the plan kicks in.

Am I Eligible for Medicare Supplement Plan F and High Deductible Plan F?

Both Medigap Plan F and High Deductible Plan F are available to you if you became eligible for Medicare before January 1 st, 2020. If you’re unsure of when you became eligible, you can check by looking at the Part A start date on your Medicare card.

How Do I Choose Between Medicare Supplement Plan F and High Deductible Plan F?

Medigap Plan F is often recommended over its high deductible counterpart because, for most people, it’s less of a financial risk. While High Deductible Plan F has lower premiums, those savings can easily be offset by the bills you’d receive if you do need treatment, and you could ultimately wind up paying more out-of-pocket overall.

How Can I get Medicare Supplement Plan F or High Deductible Plan F?

Because of its popularity, Medigap Plan F is offered by most carriers. Its high deductible counterpart isn’t as widely available, so you may have fewer options for insurance companies to choose from. You can compare your options and apply with the carrier of your choice quickly and easily by using our online Find Your Plan tool.

When is high deductible plan F available?

High Deductible Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020) or you qualified for Medicare due to a disability before January 1, 2020.

What is out of pocket expenses?

Out-of-pocket expenses for this deductible are expenses that would ordinarily be paid by the policy. This includes the Medicare deductible for Part A and Part B, but does not include the plan’s separate foreign travel emergency deductible.

What is the phone number for Medicare?

Learn more*. Or call: 1 (855) 208-0542. Mon-Fri, 8:30 am-8:30 pm, ET. This plan provides the same level of coverage as regular Plan F, except that coverage will kick in after you meet your calendar year deductible. 2 This is the amount you must pay in out-of-pocket medical expenses before your plan starts sharing costs.

What is an excess charge for a doctor?

A doctor may charge an amount for services that exceeds what Medicare covers. This is called an “excess charge.” Medicare puts a 15 percent limit on the extra amount a doctor can charge.