What percentage is Social Security and Medicare?

Mar 15, 2022 · The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural …

How to pay Social Security and Medicare taxes?

Sep 12, 2021 · With a combined tax rate of 7.65 percent, 6.2 percent goes towards Social Security, while the remaining 1.45 percent is for Medicare. When to report Social Security and Medicare taxes? How and when you’re going to report FICA taxes all depends on where you report them. The Internal Revenue Service requires employers to report these taxes along with other payroll …

How do you calculate Medicare taxes?

Feb 06, 2021 · FICA is comprised of the following taxes: 6.2 percent Social Security tax; 1.45 percent Medicare tax (the “regular” Medicare tax); and. Since 2013, a 0.9 percent Medicare surtax when the employee earns over $200,000.

Who is exempt from paying into social security?

Jan 13, 2022 · For Social Security, the tax rate is 6.20% for both employers and employees. . For Medicare, the rate remains unchanged at 1.45% for both employers and employees. Additional Medicare Tax. A 0.9% additional Medicare tax must be withheld from an individuals wages paid in excess of $200,000 in a calendar year.

Is Social Security and Medicare included in federal tax rate?

What is FICA tax? FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.Jan 13, 2022

Where do my federal payroll taxes go?

The vast majority of federal payroll taxes go towards funding Social Security and Medicare: Taxes directed to the Social Security program were created by the Federal Insurance Contributions Act (FICA) and are levied equally on employers and employees on all wages up to a certain level.

What percentage of Social Security is funded by payroll taxes?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $142,800 (in 2021), while the self-employed pay 12.4 percent.

What does federal payroll tax pay for?

The federal government levies payroll taxes on wages and self-employment income and uses the revenue to fund Social Security, Medicare, and other social insurance programs. Payroll taxes have become an increasingly important part of the federal budget over time, as the chart below shows.Apr 17, 2020

How do I deduct payroll taxes?

Withhold half of the total (7.65% = 6.2% for Social Security plus 1.45% for Medicare) from the employee's paycheck. For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% (. 0765) for a total of $114.75.Sep 17, 2020

Where do payroll taxes go on Schedule C?

The employer portion of payroll taxes are generally deductible on line 23 of your Schedule C, while employee payroll taxes (withheld from employees and paid by you) are deductible as part of employee wages on line 26 of your Schedule C.

Is SS included in payroll tax?

Social Security is financed by a 12.4 percent payroll tax on wages up to the taxable earnings cap, with half (6.2 percent) paid by workers and the other half paid by employers.Oct 13, 2021

What taxes are taken out of Social Security?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

What is the primary source of revenue for the Social Security program?

Social Security has two primary sources of tax revenues: payroll taxes and income taxes on benefits.Aug 5, 2011

What is a kind of federal payroll tax?

The Federal Insurance Contributions Act (FICA) tax is the type of payroll tax that funds Medicare and Social Security. The amount of FICA taxes withheld from employees must additionally be matched by the employer.

Is payroll tax the same as income tax?

The key difference is that payroll taxes are paid by employer and employee; income taxes are only paid by employers. However, both payroll and income taxes are required to be withheld by employers when they make payroll. The taxes also affect employees differently.Dec 14, 2020

Why do employers have to pay payroll taxes?

A payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance.Jul 25, 2016

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is payroll tax?

Payroll taxes fund social insurance programs including Social Security and Medicare and are the second-largest source of revenues for the federal government. In 2019, the most recent year for which data were not affected by temporary distortions resulting from the pandemic, payroll taxes made up 36 percent of total federal revenues.

What is the maximum amount of Social Security tax?

For 2021, the maximum earnings subject to the Social Security payroll tax is set at $142,800, an increase of $5,100 from the 2020 level.

Why are payroll taxes important?

Payroll taxes are an important component of America’s system of taxation and they fill an essential role in keeping social insurance programs funded and operational. Payroll taxes represent the second-largest source of federal revenues, after income taxes. On the household level, payroll taxes are often the primary federal tax an individual will ...

Which countries have payroll taxes?

Countries such as the Netherlands, Sweden, Germany, and Canada have caps on taxable earnings that are lower than in the United States; others, such as Norway and Ireland, tax all earnings.

What is the difference between FICA and SECA?

The rates for SECA taxes are identical to those for FICA taxes, with the only difference being that the individual is responsible for paying both employee and employer portions of the tax.

What is the federal unemployment tax rate?

Federal Unemployment Tax Act (FUTA) taxes are only paid by employers, at a rate of 6 percent for the first $7,000 of earned income per employee. FUTA taxes support funding for state-administered unemployment insurance programs. Railroad Retirement Act taxes are paid by railroad employees and employers to fund retirement programs for railroad ...

What are the challenges of Social Security?

Social insurance programs, primarily Social Security and Medicare, face serious financial challenges . Those challenges will likely accelerate due to the decline in economic activity and payroll tax revenues caused by the COVID-19 pandemic and legislation in response to it.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

What is the tax rate for Social Security?

The Social Security tax is withheld at a flat rate of 6.2% on gross wages after subtracting any pre-tax deductions that are exempt from Social Security taxation. Not all gross wages are subject to this tax.

What is the Medicare tax rate?

Medicare tax is withheld at the rate of 1.45% of gross wages after subtracting for any pre-tax deductions that are exempt, just as with Social Security. Medicare is assessed at this flat rate and there's no wage base, so the amount withheld is usually equal to the amount for which an employee is liable.

Why are some workers incorrectly classified by their employers as independent contractors rather than employees?

Their earnings would not have any tax withheld in this case because independent contractors are responsible for remitting their own estimated taxes to the IRS as the year goes on.

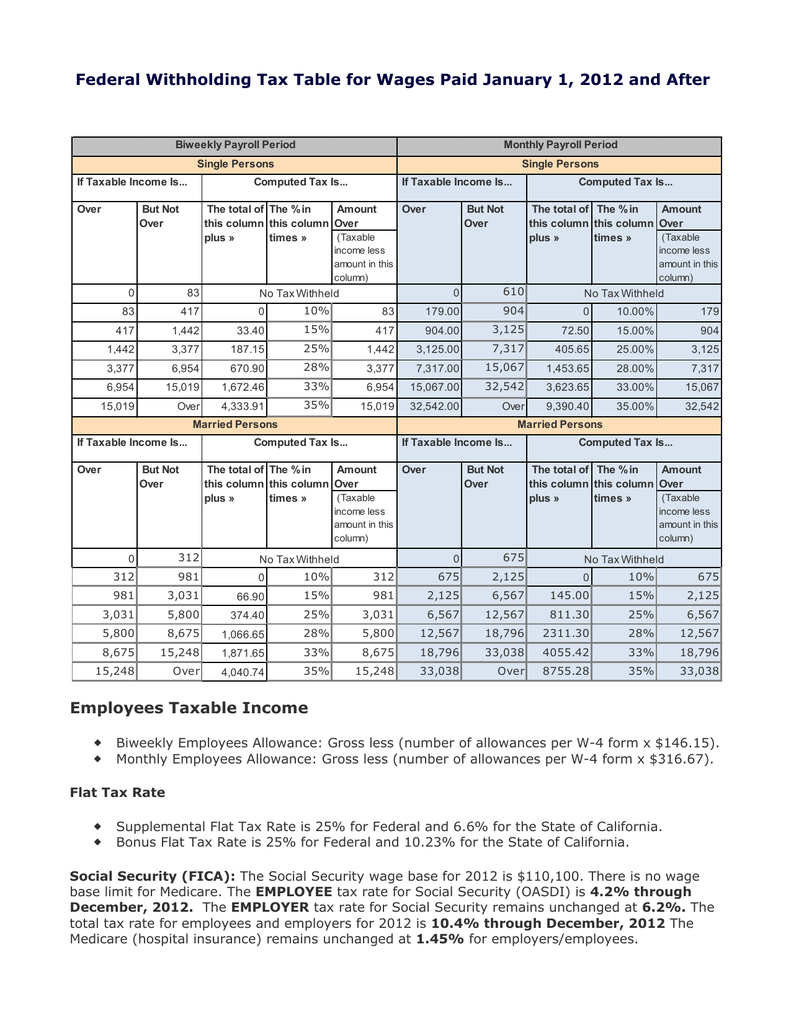

What is federal tax withholding 2021?

Updated April 09, 2021. Employers are required to subtract taxes from an employee's pay and remit them to the U.S. government in a process referred to as "federal income tax withholding.". Employees can then claim credit on their tax returns for the amounts that were withheld. Employers are required to withhold federal income ...

Who is William Perez?

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification. Read The Balance's editorial policies.

What is the purpose of a W-4?

Employers use the information included on Form W-4, completed by each of their employees, to calculate the amount of federal income tax to withhold from each of their paychecks.

Is the W-4 revised for 2020?

The IRS rolled out a revised Form W-4 for the 2020 tax year to accommodate this tax code change. The 2020 form is much easier to complete than the previous version. It does much of the work for you—it's largely a matter of simply answering some questions. The form will provide you—or, more accurately, your employer—with ...

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Motley Fool Returns

Understanding how these taxes work helps you budget for how much you’ll have withheld for all types of taxes. If you have multiple jobs, you can claim the Social Security over payment on Form 1040. If you owe any taxes, the IRS will use part of your refund to pay them off.

Things to Consider About Retirement

If you’re in college, for example, you’re exempt from paying FICA taxes on the wages you earn from an on-campus job. Exemptions apply to some nonresident aliens as well, including foreign government employees and teachers.

What OASDI Tax Is and Why You Should Care

However, if you do take advantage of the exemption, you will be ineligible to receive any of the benefits offered by Social Security. If you’ve ever looked at the details on your paycheck stub, you’ve probably run into the alphabet soup of deductions and withholdings that reduce the amount of money you get to take home on payday.

Social Security and Medicare (FICA) Tax Deductions

Certain religious groups (like the Amish) may apply for an exemption from FICA taxes by filing IRS Form 4029. But by not paying these payroll taxes, you waive your right to take advantage of Medicare and Social Security benefits.