What forms will I receive to complete my tax return?

You may receive multiple information forms that you can use to complete your tax return and will keep with your tax records. The information forms are: Form 1095-A, Health Insurance Marketplace Statement. Form 1095-B, Health Coverage. Form 1095-C, Employer-Provided Health Insurance Offer and Coverage.

Where do I put medicare on my tax return?

On the top of my return, on the right are Upgrade, Help Center, Community. It is under State Taxes where they ask about health coverage (Massachusetts). I indicated Medicare, and I got the message that seemed to indicate everything was OK.

Do you get a tax form for health insurance coverage?

It’s early January, and your tax forms from the previous year are starting to roll in. But among the standard income statements and documentation for deductions, you may also receive a form that deals with health insurance coverage.

What do I need to file taxes if I have insurance?

Proof of Insurance. You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, it’s a good idea to keep these records on hand to verify coverage. This documentation includes: Form 1095 information forms.

Do I need a 1095 A If I have Medicare?

If you have Part A, you can ask Medicare to send you an IRS Form 1095-B. In general, you don't need this form to file your federal taxes. Part A coverage (including coverage through a Medicare Advantage plan) is considered qualifying health coverage.

Do I need a 1095-B to file my taxes?

You do not need 1095-B form to file taxes. It is for your records. IRS 1095-B form is your proof of the month(s) during the prior year that you received qualifying health coverage.

Do you get a 1099 for Medicare?

Details of the annual benefit statement The annual benefit statement from the Social Security Administration is form SSA-1099/1042S. It is mailed to beneficiaries every January.

Do I need a 1095 A If I have a 1095-B?

You will not add this to your return, Form 1095-B is informational only the IRS does NOT need any details from this form. The form verifies you had health insurance coverage. You can keep any 1095-B forms that you get from your employer for your records.

What is the difference between Form 1095-C and 1095-B?

The 1094-C is the transmittal form that must be filed with the Form 1095-C. Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared responsibility payment.

Do I need a 1095-A If I have a 1095-C?

Only the 1095-A needs to be entered on your return from insurance purchased through the marketplace. If you received a different 1095 form, such as one from employer benefits, you do not need to enter anything on your return.

Does Medicare send out 1099 HC?

Are carriers/employers required to mail Forms MA 1099-HC to Medicare subscribers? No.

How do I get my 1095-a form?

How to find your 1095-A onlineLog in to your HealthCare.gov account.Under "Your Existing Applications," select your 2021 application — not your 2022 application.Select “Tax Forms” from the menu on the left.Download all 1095-As shown on the screen.

How do I get a copy of my 1099 s?

If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcript”. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

What is the difference between a 1095a and a 1095-C?

The 1095-C shows that you had health insurance from a good-sized employer. The 1095-A shows that you bought health insurance from the Marketplace under the Affordable Care Act. If you have Marketplace insurance, then you must enter the 1095-A into TurboTax so it can produce a form 8962.

What happens if I don't file my 1095-B?

Good news the 1095-B does not need to be filed! You don't need your form 1095-B to file your tax return. TurboTax will ask you questions about your health coverage but your form 1095-B isn't needed. Just keep the form for your files.

Are 1095 forms required for 2021?

If anyone in your household had a Marketplace plan in 2021, you'll need Form 1095-A, Health Insurance Marketplace® Statement, to file your federal taxes. You should get it in the mail by early February. Keep it with your important tax information, like W-2 forms and other records.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

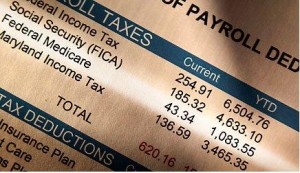

Where are uncollected taxes reported on W-2?

Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax is not reported in box 12 of Form W-2 with code B. The employee may need to make estimated tax payments to cover any shortage.

Can an employer combine wages to determine if you have to withhold Medicare?

No. An employer does not combine wages it pays to two employees to determine whether to withhold Additional Medicare Tax. An employer is required to withhold Additional Medicare Tax only when it pays wages in excess of $200,000 in a calendar year to an employee.

Does Medicare withhold income tax?

No. Additional Medicare Tax withholding applies only to wages paid to an employee that are in excess of $200,000 in a calendar year. Withholding rules for this tax are different than the income tax withholding rules for supplemental wages in excess of $1,000,000 as explained in Publication 15, section 7.

Do you pay Medicare taxes on fringe benefits?

Yes. All wages not paid in cash, such as noncash fringe benefits, that are subject to Medicare tax are subject to Additional Medicare Tax, if, in combination with other wages subject to Medicare tax (and self-employment income if applicable), they exceed the individual's applicable threshold.

What is a 1095-B form?

The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year.

What is a 1095A?

In short, the 1095-A form is the document provided to people who purchase their health insurance through the government-run healthcare Marketplace. The form includes basic personal information, such as your name, address, and insurance provider. It also lists anyone covered on the insurance policy, such as you, your spouse, and any children.

What is Medicare Advantage?

Original Medicare Part A and Medicare Advantage programs provide minimum essential coverage required by law as defined by the Affordable Care Act. The government provides a slightly different form to individuals with this coverage, which can include Medicare Part A, Medicare Advantage, Medicaid, CHIP, Tricare, and more.

Does the 1095-B cover insurance?

Since the 1095-B form also covers certain employer-sponsored plans, it provides space for other people covered by the insurance plan . These extra spaces typically shouldn’t apply to you or be a source of concern.

Does Medicare provide a 1095-A?

Since this form applies only to insurance coverage purchased through the Marketplace, Medicare and Medicare Advantage programs do not provide a 1095-A form.

What is the simplest way to file a tax return?

Filing a tax return electronically is the simplest way to file a complete and accurate tax return as it guides you through the process and does all the math for you. Electronic Filing options include free Volunteer Assistance, IRS Free File, commercial software and professional assistance.

Who will send 1095-C?

Certain employers will send Form 1095-C to certain employees, with information about what coverage the employer offered. The IRS has posted questions and answers about the Forms 1095-B and 1095-C.

What is a 1095-A?

Form 1095-A, Health Insurance Marketplace Statement. If you or your family had coverage through a Marketplace, the Marketplace will send you information about the coverage on Form 1095-A. The form will show coverage details such as the effective date, amount of the premium, and the advance payments of the premium tax credit or subsidy.

What to do if you haven't filed your 2020 taxes?

If you have not filed your 2020 tax return, here's what to do: If you have excess APTC for 2020, you are not required to report it on your 2020 tax return or file Form 8962, Premium Tax Credit. If you're claiming a net Premium Tax Credit for 2020, you must file Form 8962, Premium Tax Credit. For details see: Tax Year 2020 Premium Tax Credit ...

When will the 1040-SR be reduced to zero?

Under the Tax Cuts and Jobs Act, passed December 22, 2017, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018. Beginning in tax year 2019, Forms 1040 and 1040-SR will not have the “full-year health care coverage or exempt” box ...