The government provides a slightly different form to individuals with this coverage, which can include Medicare Part A, Medicare Advantage, Medicaid, CHIP, Tricare, and more. You will receive the 1095-B form if you are enrolled in these programs. The 1095-B is quite similar to the 1095-A form.

Full Answer

What are Medicare supplements and do you need one?

I want to start, stop, or change bank accounts for automatic monthly deductions of my Medicare premium (Authorization Agreement for Pre-authorized Payments form/SF-5510). Fill out the Authorization Agreement for Pre-authorized Payments form (SF-5510) as a PDF in English or HTML in English .

How do I apply for a Medicare supplement plan?

If you want to apply for a Medicare supplement you can find the form here. What you'll need to apply: Your Medicare card Your banking information and a voided check if you want to sign up for automatic payment withdrawal Your Social Security number 2022 forms 2022 Medicare Supplement Outline of Coverage (PDF)

How do I get the Medicare form I Need?

Jul 27, 2021 · How to Get Reimbursed From Medicare To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out. You can print it and fill it out by hand.

What's Medicare supplement insurance (Medigap)?

Dec 16, 2021 · In order to buy a Medigap policy, you must sign up for Medicare Part A and B. Medicare coordinates the billing and claims between Original Medicare and your Medicare Supplement plan. (You rarely file claims.) The provider …

What is a CMS 40B form?

CMS 40B. Form Title. Application for Enrollment in Medicare - Part B (Medical Insurance)

What documentation is required for Medicare?

Applying for Medicare: What Documents Do I Need? You'll need to prove that you're eligible to enroll in Medicare. You might need to submit documents that verify your age, citizenship, military service, and work history. Social Security can help you get copies of any documents you no longer have.

Which of the following is a requirement for standard Medicare Supplement plans?

What are those requirements? People must be at least 65 years old, regardless of their health condition, and must apply for a Medicare supplement policy within six months of enrolling in Medicare Part B.

What is the most common form of supplemental Medicare coverage?

Medigap Plan FThe most popular Medicare Supplement Insurance plan is Medigap Plan F, according to the most recent statistics from America's Health Insurance Plans (AHIP). Due to recent legislation affecting Medigap plans, however, Plan G is quickly becoming the most popular Medicare Supplement plan for new Medicare beneficiaries.Oct 6, 2021

What to include in Medicare charting?

The following information should be included in all admission notes:Time and date of admission.Mode of Transportation, assist level and number of assist with transfers and bed mobility.Hospital stay dates.ADL assist provided (Bed mobility, Eating, Transfer, Toilet)Location prior to admission.More items...•Sep 18, 2020

How do I enroll in Medicare for the first time?

Apply online (at Social Security) – This is the easiest and fastest way to sign up and get any financial help you may need. You'll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

Do you need Medicare Part B to get a supplement?

*You don't technically need Medicare Part B to enroll in a Medicare Supplement plan, however without it, your supplement won't cover any of your outpatient costs. Ultimately, it's not likely to be cost-efficient to have a Medicare Supplement plan without Medicare Part B, and it isn't recommended.

Which of the following must be included in a Medicare Supplement policy outline of coverage?

All Medicare supplement policies must provide certain core benefits, including coverage for Medicare Part A-eligible hospital expenses not covered by Medicare from the 61st day through the 90th day in any Medicare benefit period, the coinsurance amount of Medicare Part B-eligible expenses, and coverage under Medicare ...

What is the difference between a Medicare Advantage plan and a Medicare Supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the difference between Plan F and Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.Feb 18, 2021

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

What is the difference between Medigap plan G and N?

Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs. Costs of Medigap policies vary by state and carrier.

How to apply for Medicare Supplement?

What you'll need to apply: 1 Your Medicare card 2 Your banking information and a voided check if you want to sign up for automatic payment withdrawal 3 Your Social Security number 4 2021 Medicare Supplement Outline of Coverage (PDF) 5 2021 Medicare Supplement Application Form (PDF) 6 2021 Medicare Supplement Dental Vision Hearing Application Form (PDF)

When will Medicare stop covering Part B?

Medicare supplement plans that cover the Part B deductible (Plans C, F, and high‑deductible F) will no longer be available for individuals who turned 65 or become eligible for Medicare on or after January 1, 2020.

Does Blue Cross Blue Shield of Michigan accept Medicare?

or its territories that accepts Medicare. You don't have to use our network. Blue Cross Blue Shield of Michigan administers Blue Cross Medicare Supplement plans.

Is Blue Cross Medicare endorsed by the government?

This is a solicitation of insurance. We may contact you about buying insurance. Blue Cross Medicare Supplement plans aren't connected with or endorsed by the U.S. government or the federal Medicare program. If you're currently enrolled in Plan A or Plan C, you can stay with your plan as long as you pay your premium.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

What to do if a pharmacist says a drug is not covered?

You may need to file a coverage determination request and seek reimbursement.

What happens if you see a doctor in your insurance network?

If you see a doctor in your plan’s network, your doctor will handle the claims process. Your doctor will only charge you for deductibles, copayments, or coinsurance. However, the situation is different if you see a doctor who is not in your plan’s network.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Do participating doctors accept Medicare?

Most healthcare doctors are “participating providers” that accept Medicare assignment. They have agreed to accept Medicare’s rates as full payment for their services. If you see a participating doctor, they handle Medicare billing, and you don’t have to file any claim forms.

Do you have to pay for Medicare up front?

But in a few situations, you may have to pay for your care up-front and file a claim asking Medicare to reimburse you. The claims process is simple, but you will need an itemized receipt from your provider.

Do you have to ask for reimbursement from Medicare?

If you are in a Medicare Advantage plan, you will never have to ask for reimbursement from Medicare. Medicare pays Advantage companies to handle the claims. In some cases, you may need to ask the company to reimburse you. If you see a doctor in your plan’s network, your doctor will handle the claims process.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

What is the deductible for hospitalization in 2020?

You are responsible for the balance (or coinsurance). In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

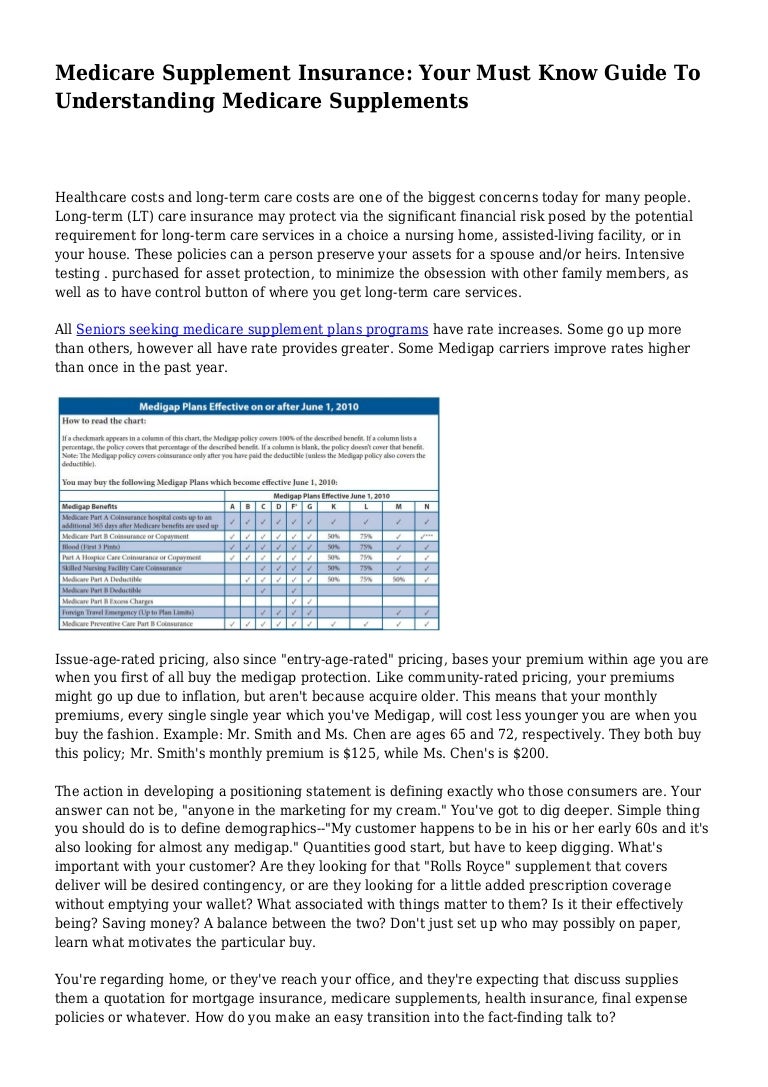

How many separate insurance plans are there?

Premiums for the same policy can vary between insurance companies. But, only the quoted price and the reputation of the insurer will vary. There are ten separate plans, labeled A through N. Two plans, C and F, are no longer offered to newly eligible beneficiaries.

What is Part B deductible?

After that, you pay daily coinsurance amounts, depending on the length of your stay. Part B also has an annual deductible. Once you reach it, Part B covers 80% of eligible doctor-related, testing and medical-equipment expenses. You are responsible for the balance (or coinsurance).

Does Medicare Supplement cover all costs?

Original Medicare does not cover all costs. Medicare Supplement insurance, or Medigap, can cover what Medicare does not. Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is it?

The Affordable Care Act requires people to have health coverage that meets certain standards (called qualifying health coverage or minimal essential coverage). The Qualifying Health Coverage (QHC) notice lets you know that your

What should I do if I get this notice?

Keep your Form 1095-B with your other important tax information, like your W-2 form and other tax records.

What is a 1095-B form?

The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year.

What is Medicare Advantage?

Original Medicare Part A and Medicare Advantage programs provide minimum essential coverage required by law as defined by the Affordable Care Act. The government provides a slightly different form to individuals with this coverage, which can include Medicare Part A, Medicare Advantage, Medicaid, CHIP, Tricare, and more.

What is a 1095A?

In short, the 1095-A form is the document provided to people who purchase their health insurance through the government-run healthcare Marketplace. The form includes basic personal information, such as your name, address, and insurance provider. It also lists anyone covered on the insurance policy, such as you, your spouse, and any children.

Does the 1095-B cover insurance?

Since the 1095-B form also covers certain employer-sponsored plans, it provides space for other people covered by the insurance plan . These extra spaces typically shouldn’t apply to you or be a source of concern.

Does Medicare provide a 1095-A?

Since this form applies only to insurance coverage purchased through the Marketplace, Medicare and Medicare Advantage programs do not provide a 1095-A form.

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

What is the national base beneficiary premium for 2021?

In 2021, the national base beneficiary premium is $33.06 and changes every year. If you have to pay the penalty, the penalty amount will be rounded to the nearest $.10, and this amount will be added to your monthly Part D premium for the rest of the time you are enrolled.

What happens if you decline Medicare?

Declining. Late enrollment penalties. Takeaway. If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later. Medicare is a public health insurance program designed for individuals age 65 and over ...

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

Is Healthline Media a licensed insurance company?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S . jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on May 14, 2020.