If your Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

How much is Medicare increasing?

Apr 07, 2022 · Standard Medicare premiums can, and typically do, go up from year to year. Increases from the standard premium, which is $170.10 a month in 2022, start with incomes above $91,000 for an individual and $182,000 for a couple who …

Are Medicare premiums going up?

Aug 24, 2021 · A lot of Medicare Supplement plans are sold on what is called an “attained age pricing structure.” Essentially, it means that as your age increases, so will your rates. So, basically, you can expect your rates to go up as you get older. You can also expect your rates to be higher if you waited a longer time to sign up for a Medigap policy.

Why is my Medicare rising?

Sep 16, 2020 · You’ll find detailed information on the Social Security web page “Medicare Premiums: Rules for Higher-Income Beneficiaries.” Keep in mind. If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to …

How much will my Medicare premiums be?

Jul 23, 2020 · Policyholders of Medicare Supplement plans should understand that rates are likely to go up every year but fortunately it’s easy to shop your coverage when that happens. It’s important to understand, however, that you may or may not be able to find more affordable coverage because when you elect to make a change because your rate went up, there will be …

Did Medicare rates go up for 2021?

This increased amount is called the Income-Related Monthly Adjusted Amount, or IRMAA. The Part B rate increases in recent years are as follows: 2021 = $148.50 per month. 2020 = $144.60 per month.Feb 15, 2022

What makes your Medicare premium go up?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why did my Medicare premium increase for 2022?

CMS explained that the increase for 2022 was due in part to the potential costs associated with the new Alzheimer's drug, Aduhelm (aducanumab), manufactured by Biogen, which had an initial annual price tag of $56,000.Jan 12, 2022

Is Medicare premiums going up in 2022?

Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.Aug 30, 2021

What is the Medicare MAGI for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.Oct 22, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

What changes are coming to Medicare in 2022?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Did Medicare go up this year?

That's a $15 increase from 2021. 1. Certain older individuals who have less than 30 quarters of coverage and certain individuals with disabilities who have exhausted other entitlement must pay the full premium of $499 a month in 2022, a $28 increase from 2021.Nov 17, 2021

Why your rates are increasing and what you can do about it

Medicare Supplements, also known as Medigap, are subjective to having their rates change. In fact, if you’ve had a Medigap plan for at least a year, it’s likely that your premium has occasionally increased. If this stresses you out, don’t let it. It happens to everyone at some point.

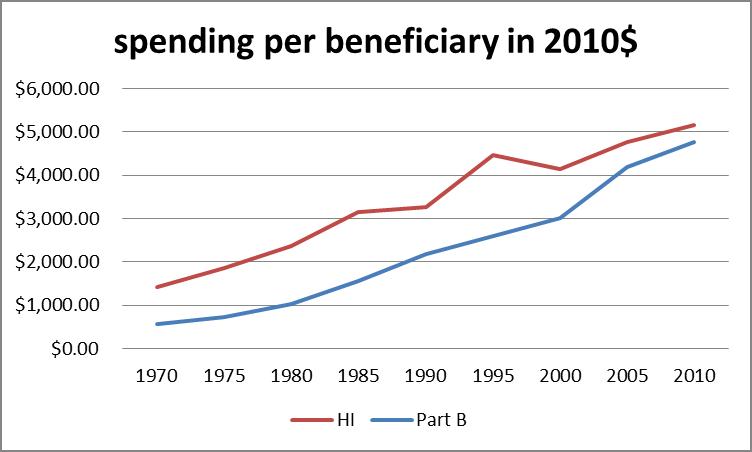

Why are rates increasing

There are a few reasons why your rates could be increasing. The first reasoning lies within the cost of healthcare as a whole. Like many other insurance services, healthcare can undergo inflation to its prices. In fact, it can even go through a deflation of its pricing, but that is a rare occurrence.

How to know if rates are going up

There is one sure-fire way to find out whether your rates are going up, and all it takes is knowing how old you are. A lot of Medicare Supplement plans are sold on what is called an “attained age pricing structure.” Essentially, it means that as your age increases, so will your rates.

How this can affect you

The great thing about Medicare Supplement policies is that it is designed to help you pay for the gap in coverage between your Medicare plan and prescription drug costs. This is especially helpful for those who would struggle to pay for that gap. But what happens if the increase in rates begin to get to be too much?

What you can do

Although it is inevitable that your rates will increase, that doesn’t mean you can’t do anything about it. One thing that you can do is switch Medigap policies. This is a common solution for many Americans who are looking to lower their Medicare Supplement premiums.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

What does it mean to have an age rating?

Attained age rating means that the company is basing your rates based on your age when you make an application for coverage and doing so means that your rates inevitably creep up with every renewal.

Does Medicare increase your premiums based on age?

With issue age rating, your Medicare Supplement insurance is issued based on your age at application and never increases over time solely because of your age. This, however, doesn’t mean the company will not raise your rates because of other reasons like claims experience and inflation.

Is age considered for Medicare Supplement?

When you buy a Medicare Supplement plan based on community rating, the applicant’s age is not considered for rating. Instead, with community rating, the insurance company charges everyone the same according to which plan you purchase and your rates generally stay the same unless the company increases the rates for everyone because of inflation or increased healthcare costs.

When did Medigap update?

Originally published November 22, 2017. Updated February 7, 2019. After you’ve had a Medigap plan for over a year, you probably started noticing that your premium increases every now and again.

How long does a plan stay the same?

With the attained age pricing structure, most companies have a 12-month rate guarantee, which means the price of your plan will stay the same for at least a year.

Can you avoid Medicare rate increases?

You can’t avoid rate increases. It’s just part of having a Medicare Supplement. However, you do have some ammunition in your back pocket – you can go price shopping! In the world of Medicare Supplements, every insurance carrier has to follow government regulations, which means each plan must have the same benefits.

If I get cancer, are my rates going to go up?

No, Medicare Supplement companies cannot single you out for rate increases due to illness.

Do my Medigap rates increase if I have to stay in the hospital?

No, your Medigap rates are not going to increase if you are hospitalized. Hospital coverage comes from your Medicare Part A coverage, and your Medigap coverage would only be supplementing that coverage. It’s why they call them Medicare Supplement plans.

Does health ever play a role in how much you pay for Medigap premiums?

Health plays an important role in determining eligibility for certain plans. Some plans require what is called medical underwriting for those enrolling in a Medigap plan after their open enrollment period or switching plans after age 65.

Do Medigap plan premiums increase each year?

Typically, your Medigap plan premiums will go up a little bit each year. There are two different reasons your plan may have a rate increase: company rate increases and age-related increases.

Is my rate increase affecting just me?

If your Medigap rates have gone up, that increase is not happening to just you. It’s happening to all the fellow policyholders in your state.

Conclusion

Rate increases cannot be based on individual health concerns. Increases are determined by the age of the insured and market costs. A serious medical diagnosis is only going to affect your rates if you opt to change to a plan that requires underwriting.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Initial Enrollment

If your eligibility begins when you’re 65, your initial enrollment period begins three months before the month you turn 65 and ends three months after the month you turn 65.

What If You Delay Enrolling in Medicare?

If you don’t sign up for Medicare during your initial enrollment period, you’ll still have the opportunity to do so during each subsequent year’s General Enrollment Period. You may also have the opportunity to sign up during certain Special Enrollment Periods (SEPs).

How long is the open enrollment period for Medicare?

Your Medigap open enrollment period is the six-month period that begins the day you are both 65 and enrolled in Medicare Part B. During this time, insurance companies cannot deny you coverage or charge you more for a policy based on your medical history.

What is medical underwriting?

Medical underwriting is a process used by insurance companies that examines a person’s health status to determine how much he or she should be charged for health insurance. Typically, tobacco use is one of the factors that insurance companies take into account when reviewing an underwritten application.

Does tobacco affect Medicare?

by Christian Worstell | Published March 31, 2021 | Reviewed by John Krahnert. Yes, tobacco use can impact Medigap rates. In fact, tobacco use is one of many personal health factors that could potentially impact how much you pay for Medicare Supplement Insurance (if you sign up outside of your open enrollment period).

Can you get more for Medigap if you miss the open enrollment period?

Outside of Open Enrollment. If you have a history of tobacco use and miss your open enrollment period, you could end up paying more for your Medigap policy. Once you miss your six-month window, insurers are allowed to use underwriting to deny you coverage or charge you more for the same policy.

How long do you have to enroll in Medicare after leaving your employer?

Medicare’s Special Enrollment Period will grant you two full months to enroll in Medicare after leaving your employer’s insurance even if you already had Medicare previously. Even better, you will not have to pay any late-enrollment fees or penalties.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

How long does it take to get a medicare supplement?

You may also want to get a Medigap Plan (Medicare Supplement), for which you will have 63 days and guaranteed issuance, meaning the insurance companies have to approve your application.