Bankruptcy is a legal process that declares a person, business, or organization unable to pay their debts. Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent.

Full Answer

Why is Medicare so expensive for the economy?

Feb 04, 2020 · Medicare For All Could ‘Decimate’ The Economy. WASHINGTON – The unaffordable costs, tax increases and negative economic consequences of proposed one-size-fits-all new government health insurance systems – such as Medicare for All, Medicare buy-in and the public option – continue to make headlines. A new analysis from Penn Wharton reveals …

Is Medicare going bankrupt?

Oct 31, 2017 · Payroll taxes are projected to pay 88% of Medicare hospital insurance costs. That percentage will slowly decline to 81% by 2041, and then it will gradually grow as boomers die off in increasing numbers. So, at first glance, the worst-case scenario for Medicare is that by 2029, payroll tax revenue will only cover 88% of expenses for Part A.

What happens after an economic collapse?

Medicare to go broke three years earlier than expected, trustees say. Government Says Medicare won't be able to cover costs by 2026. Report puts Medicare insolvency sooner …

When will Medicare costs flatten out?

Jan 02, 2021 · It's the year 2057. The entitlement bubble bursts. The US economy utterly collapses. The value of the dollar evaporates. People are living in the streets. And there is no more government coming to the rescue.

What happens if Medicare goes broke?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.Dec 20, 2021

How does Medicare affect the economy?

Tthe introduction of Medicare was associated with a substantial (about 40 percent) reduction in out-of-pocket spending for those who had been in the top quarter of the out- of- pocket spending distribution, the authors estimate.

What happens when Medicare runs out in 2026?

Under current law, if the trust fund runs out, Medicare payments would be reduced to levels that would be able to be covered by incoming tax and premium revenues. That could threaten coverage for tens of millions of Americans, the trustees said.Sep 1, 2021

How long until Medicare runs out of money?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.Dec 30, 2021

What would happen if the US had universal healthcare?

Most agree that if we had universal healthcare in America, we could save lives. A study from Harvard researchers states that not having healthcare causes around 44,789 deaths per year. 44,789 deaths per year means that there is a 40% increased risk of death for people who are uninsured.Dec 4, 2020

How does Medicare and Medicaid affect the US economy?

Total spending for Medicare is projected to increase to 8 percent of GDP by 2035 and to 15 percent by 2080. Total spending for Medicaid is projected to increase to 5 percent of GDP by 2035 and to 7 percent by 2080. A combination of private and public sources finances health care in the United States.

Is Medicare going to stop?

Medicare is running out of money. According to the latest projections from the Congressional Budget Office (CBO), the program's Part A hospital insurance trust fund will be exhausted in 2024. That's just three years away, before the end of President Joe Biden's first term.

Does Medicare make a profit?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).Aug 20, 2019

Is Medicare going around for 40 years?

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That's the same year as predicted in 2020, according to a summary of the trustees 2021 report, which was released on Tuesday.Aug 31, 2021

How much is Medicare in debt?

Gross Federal DebtDebt Now:$30,355,560,978,807.42Debt 2/2020:$23,409,959,150,243.63

Does Medicare have a lifetime limit?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Is Medicare fully funded?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

When did Medicare change to Medicare Access and CHIP?

But that forecast is built on several key assumptions that are unlikely to occur. In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality. As part of the transition, MACRA increased payments to doctors until 2025.

How is Medicare funded?

Rather, they are funded through a combination of enrollee premiums (which support only about one-quarter of their costs) and general revenues —another way of saying the government borrows most of the money it needs to pay for Medicare.

Why did Medicare build up a trust fund?

Because it anticipated the aging Boomers, Medicare built up a trust fund while its costs were relatively low. But that reserve is rapidly being drained, and, in 2026, will be out the money. That is the source of all those “going broke” headlines.

Is Medicare healthy?

Not broke, but not healthy. However, that does not mean Medicare is healthy. Largely because of the inexorable aging of the Baby Boomers, program costs continue to grow. And, as the Trustee’s report forthrightly acknowledges, long-term costs could well increase even faster than the official predictions.

Will Medicare go out of business in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money. Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

Will Medicare stop paying hospital insurance?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.

Will Medicare be insolvent in 2026?

Government Says Medicare won't be able to cover costs by 2026. Report puts Medicare insolvency sooner than forecast. Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

How much did Medicare spend in 2016?

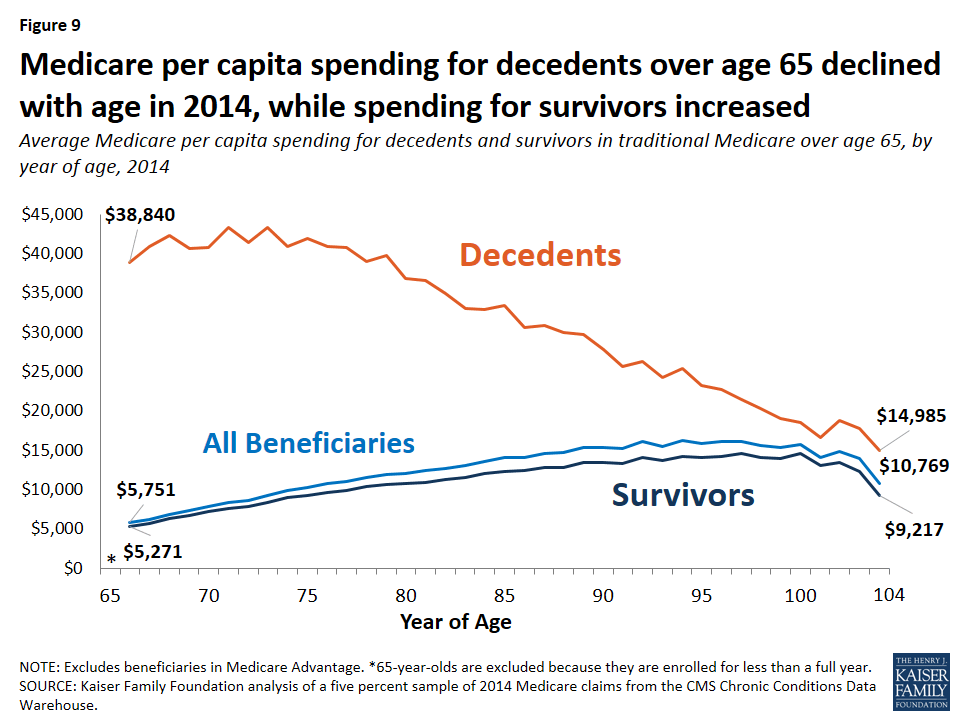

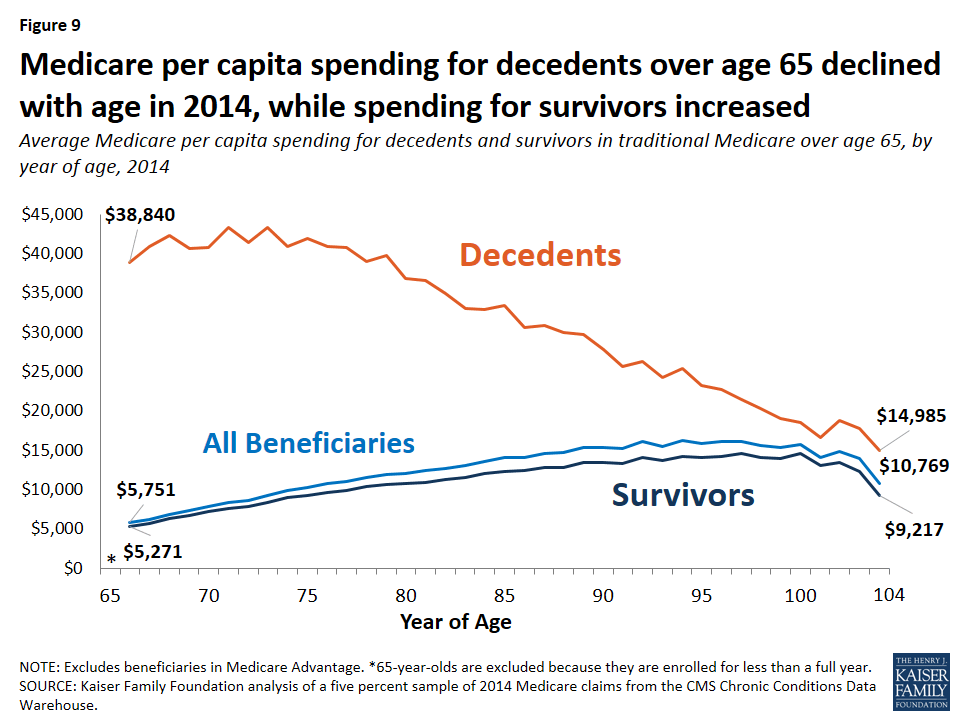

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

Why is there a doctor shortage?

As it stands, there is already an impending doctor shortage because of limited Medicare funding to support physician training. Decrease Medicare fraud, waste, and abuse. Private insurance companies run Medicare Advantage and Part D plans.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

The Dollar Will Collapse

An immediate impact of a precipitous crash would be monetary turmoil. Shock waves would reverberate globally. People would rush to banks and ATMs seeking cash. Cash would be depleted quickly. Banks would need to shutter their doors to reduce withdrawals. Any banks that did not go out of business on that first day would need to cease lending.

There Will Be Supply Shortages and Outages

With businesses closing because of a lack of money, supply shortages would occur. Stores that remain open will struggle to fill their shelves. Feeding one’s family will become a challenge. Life-threatening food insecurity will result. Depending upon how rapidly food supplies are diminished, food issues could lead to starvation.

There Will Be Social Upheaval

Fear and uncertainty could lead to pillaging for survival. Plundering stores for luxury goods would provide people goods to barter. The human instinct for survival will take over. Social structures will be disrupted. Neighborhoods will be dismantled as homelessness grows dramatically. Existence will depend upon one’s ability to step back in time.

What would be the inherent financial problems of Social Security?

The inherent financial problems of Social Security could be successfully addressed if the system were changed so that it accumulates reserves in a fully funded system and those reserves are invested in productive assets in the private sector.

How long will Social Security be unable to pay?

Government projections at that time showed, and everyone agreed, that without major changes Social Security would be unable to pay all of its promised benefits within a couple of years, with a yawning, continually growing deficit after that time.

What is the payroll tax rate for Social Security in 2020?

By 2020, the total Social Security payroll tax rate would have to almost double to about 27 percent.

What was the increase in Social Security taxes in 1990?

Payroll tax rates increased repeatedly through 1990, for a total increase of 30 percent.

What happened in the 1970s?

Adverse economic developments soon developed to tip the system into financial failure. Inflation soared in the 1970s, sharply increasing benefit payments indexed to inflation. At the same time, periodic sharp recessions caused unemployment to rise and wage growth to fall, sharply reducing expected revenues.

How much money did the Social Security Trust Fund have in 2011?

In constant 1993 dollars, the combined trust fund assets in 2011 would total about $915 billion . Yet, this is only 75 percent more than current Social Security trust fund assets, which will total about $525 billion for all four trust funds combined this year.

What was the Greenspan Commission's strategy?

A key strategy of the Greenspan Commission was to develop a large surplus in the Social Security trust funds from 1990 to about 2010, to be used to help finance the retirement of the huge baby boom generation starting after 2010.

What do people do when the economy collapses?

One of the first things people do when the economy collapses is rush to the bank in order to withdraw all their funds. One thing many people don’t realize, though, is that banks don’t keep enough cash on hand to pay out anywhere close to the amount of money they owe.

Why are hospitals overcrowded?

Due to factors such as no garbage pickups, unclean drinking water, the spread of disease, inability to afford medications, and a spike in violent crimes, people tend to visit hospitals much more frequently during an economic collapse.

What is the purpose of kidnapping people?

Kidnapping a person of wealth and demanding a ransom is one way for desperate people to acquire money when no other means of acquiring money are available . It isn’t only the wealthy that are at risk, though, as desperate kidnappers will take anyone they can in the hopes that someone will pay the ransom. 2.

Why are riots dangerous?

When people are desperate and angry , they often start rioting, and these riots can quickly become dangerous as people take advantage of the chaos to get away with all sorts of crimes from robbery to vandalism to murder.

Is gas rationed in the wake of economic collapse?

7. Gasoline is Rationed. In the wake of an economic collapse, going to the gas station to fill up may not be a possibility. Gasoline will likely be rationed, if it’s even available in your area. Of course, without gasoline, escaping a dangerous location or situation becomes much more difficult.

Is it safer to rob someone's car or home?

In desperate times, robbing a person’s car is typically safer than robbing a person’s home since the individual being robbed is much less likely to be armed inside their vehicle than they are inside their home.

Can pets go missing?

Pets Go Missing. Even if you can afford to continue feeding your pets during an economic collapse, there’s still no guarantee that they will be safe. Few people have the skills or resources to hunt wild animals when food is scarce. Domesticated animals, however, make for much easier targets.

What were the early warning signs of the 2008 financial crisis?

The early warning signs of the 2008 Financial Crisis were rapidly falling housing prices and increasing mortgage defaults in 2006. 16 Left untended, the resulting subprime mortgage crisis, which panicked investors and led to massive bank withdrawals, spread like wildfire across the financial community. 17 The U.S. government had no choice but to bail out “too big to fail” banks and insurance companies, like Bear Stearns and AIG, or face both national and global financial catastrophes. 18

How much will the global economy cost in 2020?

According to the United Nations’ Conference on Trade and Development, the global economic hit could reduce global growth rates to 0.5% and cost the global economy as much as $2 trillion for 2020. 19 .

What is the Federal Deposit Insurance Corporation?

The Federal Deposit Insurance Corporation insures banks, so there is little chance of a banking collapse similar to that in the 1930s. The president can release Strategic Oil Reserves to offset an oil embargo. Homeland Security can address a cyber threat.

How much did the 2001 terrorist attacks cost the United States?

14 The United States’ response, the War on Terror, has cost the nation $6.4 trillion, and counting. 15

How many people left the Dust Bowl?

Thousands of farmers and other unemployed workers moved to California and elsewhere in search of work. Two-and-a-half million people left the Midwestern Dust Bowl states. 6 The Dow Jones Industrial Average didn't rebound to its pre-Crash level until 1954.

How much would a 4 degree Celsius increase cost the US economy?

One study estimates that a global average temperature increase of 4 degrees celsius would cost the U.S. economy 2% of GDP annually by 2080. (For reference, 5% of GDP is about $1 trillion.) The more the temperature rises, the higher the costs climb.

What is the role of Homeland Security?

Homeland Security can address a cyber threat. The U.S. military can respond to a terrorist attack, transportation stoppage, or rioting and civic unrest. In other words, the federal government has many tools and resources to prevent an economic collapse.