The U.S. inflation rate, for years held at bay, has been above 4% since April, hitting 6.2% in October, the highest rate in decades. On Nov. 12, the Centers for Medicare & Medicaid Services announced that the standard monthly premium for Medicare Part B would rise to $170.10 in 2022, from $148.50 this year.

Full Answer

What factors determine Medicare rates?

Medigap Premium Rates Are Impacted by Multiple Factors

- Your Gender. You might have been unaware that your gender can be a determining factor in your Medigap rates. ...

- Your Age. Depending on the rating method used by your Medigap carrier, your age may be used to determine your rates.

- Tobacco Use. ...

- Household Discounts. ...

- Rate Increase History. ...

- Rate Locks. ...

What is the current tax rate for Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

How do I calculate the inflation rate?

The Formula for Calculating Inflation

- Calculate- How Much has the Consumer Price Index Increased? ...

- Comparing the CPI Change to the Original CPI Since we know the increase in the Consumer Price Index we still need to compare it to something, so we ...

- Convert it to a Percent

How are Medicare base payment rates increased to reflect inflation?

How are Medicare base payment rates increased to reflect inflation? The market basket index is applied, which is based on the mix of goods and services included in the prospective payment system (PPS).

Do Medicare payments rise with the rate of inflation?

A feature of each payment system is an annual adjustment reflecting rising input costs, as measured by “market baskets” created specifically for the various provider groupings. Thus, as inflation rises, so too do the base payments for a wide array of Medicare-covered services.

How much do Medicare premiums increase each year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

Will there be an increase in Medicare Part B premiums for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022.

Why did Medicare Part B increase so much in 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

How much will Medicare premiums rise 2022?

California Health Advocates > Prescription Drugs - Blog > Why Did Medicare's Part B Premium Rise 14.5% in 2022? If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022.

Do Medicare premiums change each year based on income?

If You Have a Higher Income If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the “income-related monthly adjustment amount.” Here's how it works: Part B helps pay for your doctors' services and outpatient care.

Why is my Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Will Medicare Part B go up in 2023?

Medicare beneficiaries who saw a double-digit-percentage increase in their Part B premiums for 2022 are in line for relief next year, according to a recent statement from the head of the Department of Health and Human Services (HHS).

What will the Part B premium be for 2022?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

How much will Medicare premiums increase in 2023?

8.5%CMS finalizes 8.5% rate hike for Medicare Advantage, Part D plans in 2023. The Biden administration finalized an 8.5% increase in rates to Medicare Part D and Medicare Advantage plans, slightly above the 7.98% proposed earlier this year.

How can I lower my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

What is the cost of Part B Medicare for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

How much did Medicare premiums increase between 1966 and 2017?

Over 51 years, the compounded annual increase in premium cost is roughly 7.7%, which is consistent with high medical care inflation rates.

How many people are on Medicare?

There are roughly 56 million eligible Americans that count on Medicare (or Medicare Advantage plans) to help maintain their physical and financial well-being each and every month. Of these 56 million, about five in six are aged 65 and up.

What is the hold harmless clause on Medicare?

To begin with, about 70% of all Medicare enrollees are protected by the "hold harmless" clause . For Medicare enrollees who are also receiving a Social Security benefit each month, the hold harmless clause prevents their Part B premiums from rising by a faster rate than Social Security's cost-of-living adjustment (COLA), ...

What is a Medigap plan?

Medigap plans are designed to help "fill the gap" of what Medicare members have to pay in out-of-pocket Part B costs. On the surface, a Medigap plan has a monthly premium that's going to increase your overall health costs.

What are the components of Medicare?

Original Medicare, which roughly 70% of eligible members are still enrolled in, is comprised of three key components: Part A, Part B, and Part D. Image source: Getty Images. Part A, also known as hospital insurance, covers in-patient hospital stays, surgeries, and long-term skilled nursing care, as an example.

What is the CPI-W?

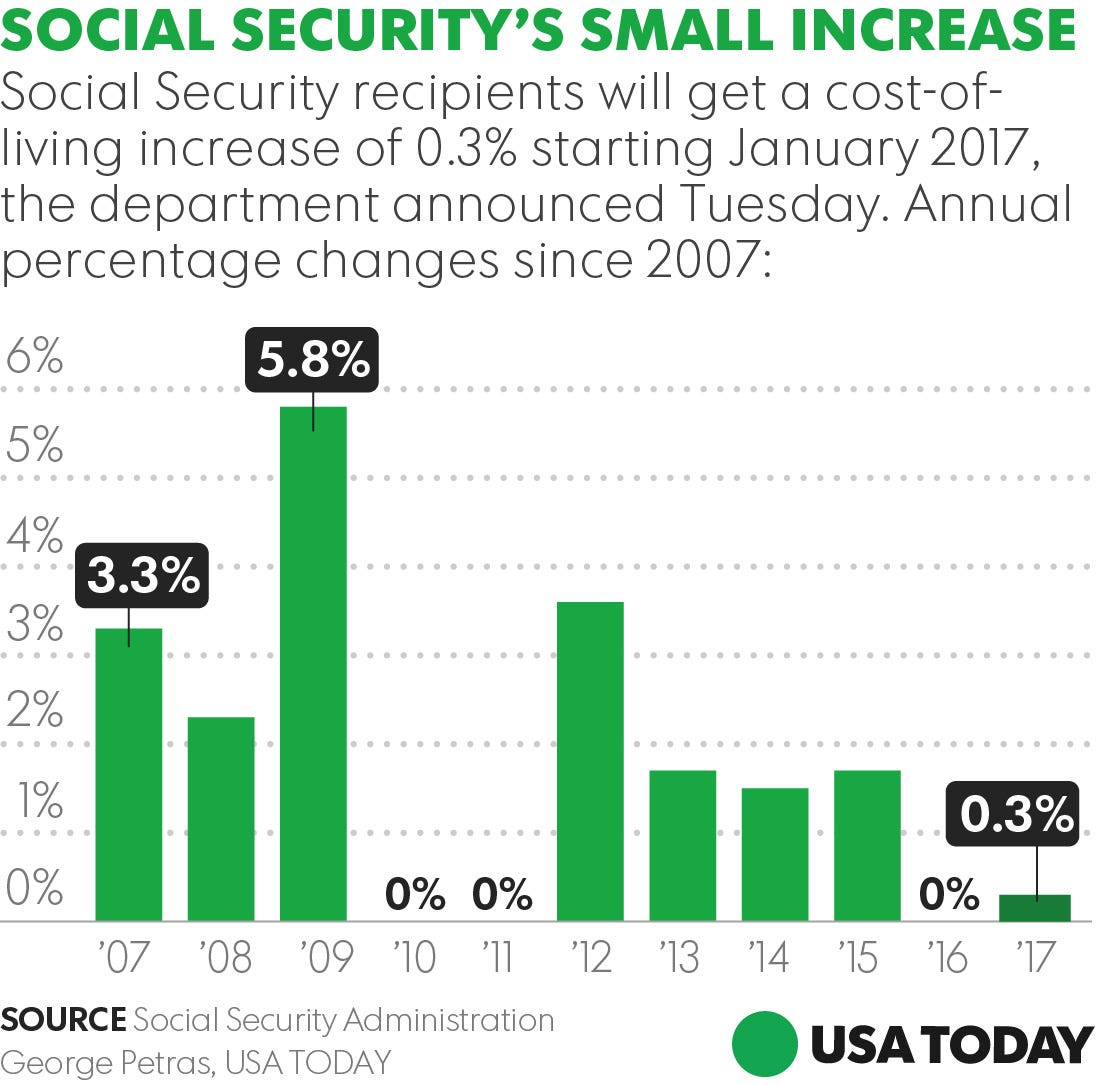

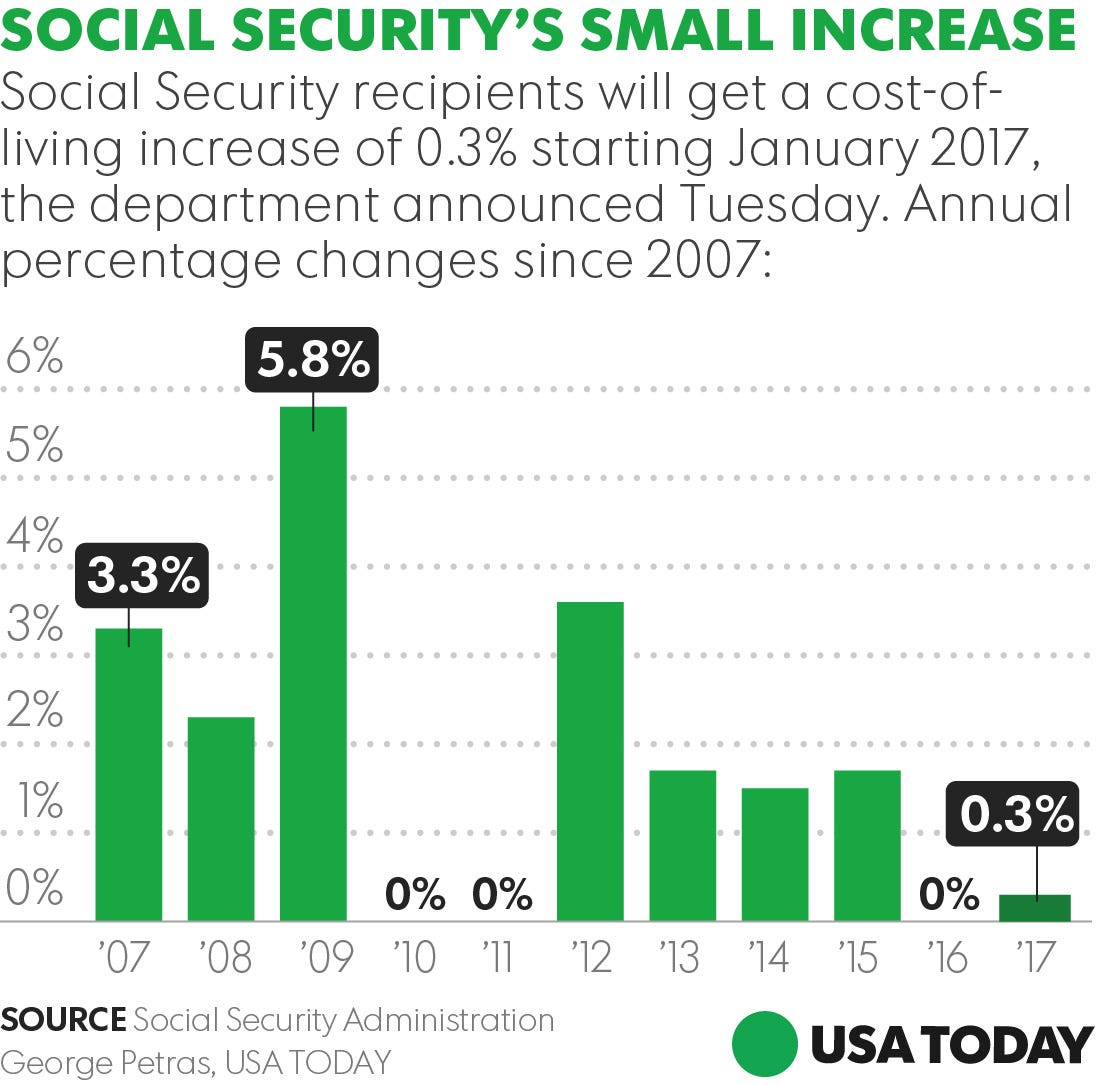

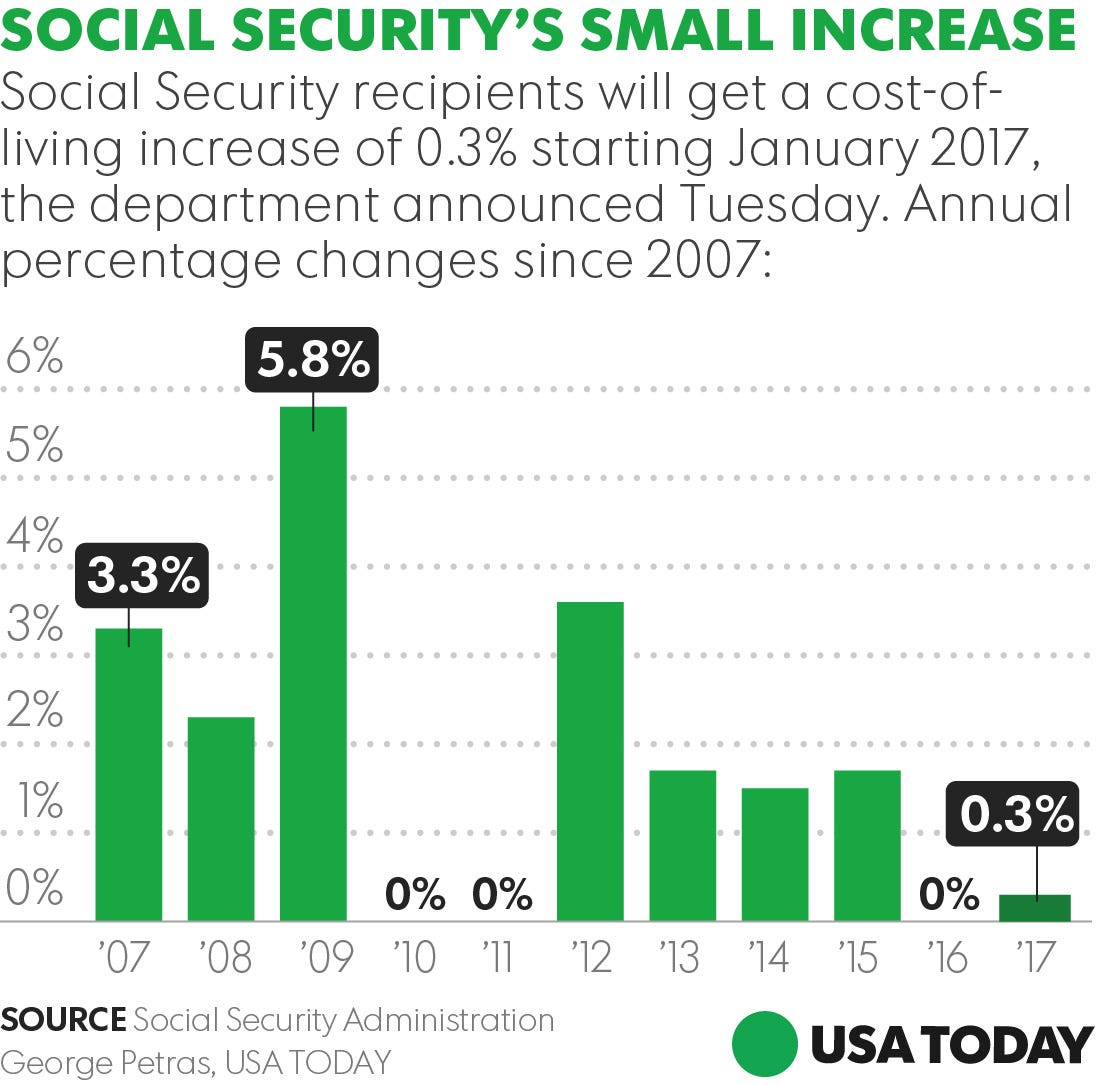

The CPI-W is the measure used to determine whether or not Social Security recipients get a "raise" each year, and if so, by how much. One of the primary reasons Part B costs have skyrocketed in recent years is those aforementioned IV-administered drugs in the outpatient setting.

What is Part A insurance?

Part A, also known as hospital insurance, covers in-patient hospital stays, surgeries, and long-term skilled nursing care, as an example. The great thing about Part A is that there's no premium required for a vast majority of Americans. Just as 40 lifetime work credits qualifies someone to receive Social Security benefits during retirement, ...

Number of the Day: The most relevant or interesting figure in personal finance

Medora Lee began covering the financial markets in 1992 and has interviewed U.S. Treasury secretaries and CEOs of Fortune 500 companies. Her work at outlets including Reuters, theStreet.com, and Forbes.com schooled her in stocks, commodities, and bonds and now she translates Wall Street for Main Street at The Balance.

Article Sources

Centers for Medicare & Medicaid Services. “ CMS Announces 2022 Medicare Part B Premiums .” Accessed Nov. 15, 2021.

Prices Increased Faster Than Inflation for Half of all Drugs Covered by Medicare in 2020

While momentum to enact the Build Back Better Act (BBBA) has stalled in Congress, public support for legislation to lower prescription drug costs is likely to persist, particularly in light of concerns about rising prices due to inflation.

Price Increases Outpaced Inflation for Half of all Drugs Covered by Medicare in 2020

Among the 1,947 Medicare-covered drugs with price increases above the rate of inflation in 2020, one-third (668 drugs) had price increases of 7.5% or more – the current annual inflation rate.

Prices Rose Faster Than Inflation for Most of the 25 Top-Spending Drugs in Both Part B and Part D in 2020

Among the 25 drugs covered by Medicare Part D with the highest total gross spending (not accounting for rebates), 23 had price increases greater than inflation in 2020 ( Table 1 ).