How many days of skilled nursing care does Medicare cover?

Where these five criteria are met, Medicare will provide coverage of up to 100 days of care in a skilled nursing facility as follows: the first 20 days are fully paid for, and the next 80 days (days 21 through 100) are paid for by Medicare subject to a daily coinsurance amount for which the resident is responsible.

What does Medicare mean by benefit period?

The way that Original Medicare measures your use of hospital and skilled nursing facility (SNF) services. A benefit period begins the day you're admitted as an inpatient in a hospital or SNF. The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row.

What qualifies as skilled nursing care for Medicare?

cover eligible home health services like these:

- Part-Time Or "Intermittent" Skilled Nursing Care Part-time or intermittent nursing care is skilled nursing care you need or get less than 7 days each week or less than 8 hours ...

- Physical therapy

- Occupational therapy

- Speech-language pathology services

- Medical social services

- Part-time or intermittent home health aide services (personal hands-on care)

When does Medicare pay for skilled nursing care?

Traditional Medicare covers the first 100 days of skilled nursing with variable levels of coverage. For the first 20 days, Medicare will pay the qualified skilled nursing expenses in full with qualified providers. For days 21 through 100, you will pay a co-payment for the cost.

What is a SNF benefit period?

A benefit period begins the day you're admitted as an inpatient in a hospital or SNF. The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins.

How many days of SNF are covered by Medicare?

100 daysMedicare covers care in a SNF up to 100 days in a benefit period if you continue to meet Medicare's requirements.

What is the Medicare 90 day rule?

During each benefit period, Medicare covers up to 90 days of inpatient hospitalization. After 90 days, Medicare gives you 60 additional days of inpatient hospital care to use during your lifetime. For each of these “lifetime reserve days” you use in 2021, you'll pay a daily coinsurance of $742.

What is the 100 day rule for Medicare?

Medicare pays for post care for 100 days per hospital case (stay). You must be ADMITTED into the hospital and stay for three midnights to qualify for the 100 days of paid insurance. Medicare pays 100% of the bill for the first 20 days.

How are Medicare days counted?

A part of a day, including the day of admission and day on which a patient returns from leave of absence, counts as a full day. However, the day of discharge, death, or a day on which a patient begins a leave of absence is not counted as a day unless discharge or death occur on the day of admission.

How many days will Medicare pay 100% of the covered costs of care in a skilled nursing care facility?

20 daysSkilled Nursing Facility (SNF) Care Medicare pays 100% of the first 20 days of a covered SNF stay. A copayment of $194.50 per day (in 2022) is required for days 21-100 if Medicare approves your stay.

What happens when Medicare benefits are exhausted?

Once the 60 reserve days are exhausted, you would pay the hospital's full daily charge (except for services covered under Medicare Part B, such as physician visits) if you need to stay in the hospital for more than 90 days in a benefit period.

Can Medicare lifetime reserve days be used for SNF?

The lifetime reserve days do not apply to stays at skilled nursing facilities and stays at psychiatric hospitals.

What is a 60 day wellness period Medicare?

Stopping care or leaving If your break in skilled care lasts for at least 60 days in a row, this ends your current benefit period and renews your SNF benefits. This means that the maximum coverage available would be up to 100 days of SNF benefits.

Does Medicare 100 days reset?

“Does Medicare reset after 100 days?” Your benefits will reset 60 days after not using facility-based coverage. This question is basically pertaining to nursing care in a skilled nursing facility. Medicare will only cover up to 100 days in a nursing home, but there are certain criteria's that needs to be met first.

What are examples of skilled nursing care?

Examples of skilled nursing services include wound care, intravenous (IV) therapy, injections, catheter care, physical therapy, and monitoring of vital signs and medical equipment.

Guide to Explaining The Medicare Hospital Benefit Period

Under Medicare, the hospital benefit period starts once you’ve been admitted to the hospital and expires once you’ve been at home for 60 consecutiv...

Traditional Medicare Hospital Coverage

Here is a breakdown of how much Medicare will cover and how much you’ll owe out-of-pocket for individual hospital benefit periods: 1. You will be e...

Skilled Nursing With Traditional Medicare Coverage

In an Original Medicare plan, you have to stay for a minimum of three days, or more than two nights, to officially be admitted as a patient in a ho...

Options With Medicare Advantage

You are subject to Medicare’s hospital benefit periods if you have a Medicare Advantage health plan. However, the costs for skilled nursing and hos...

What is Medicare benefit period?

Medicare benefit periods mostly pertain to Part A , which is the part of original Medicare that covers hospital and skilled nursing facility care. Medicare defines benefit periods to help you identify your portion of the costs. This amount is based on the length of your stay.

How long does Medicare Advantage last?

Takeaway. Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of the facility for at least 60 days.

How much coinsurance do you pay for inpatient care?

Days 1 through 60. For the first 60 days that you’re an inpatient, you’ll pay $0 coinsurance during this benefit period. Days 61 through 90. During this period, you’ll pay a $371 daily coinsurance cost for your care. Day 91 and up. After 90 days, you’ll start to use your lifetime reserve days.

How long does Medicare benefit last after discharge?

Then, when you haven’t been in the hospital or a skilled nursing facility for at least 60 days after being discharged, the benefit period ends. Keep reading to learn more about Medicare benefit periods and how they affect the amount you’ll pay for inpatient care. Share on Pinterest.

What facilities does Medicare Part A cover?

Some of the facilities that Medicare Part A benefits apply to include: hospital. acute care or inpatient rehabilitation facility. skilled nursing facility. hospice. If you have Medicare Advantage (Part C) instead of original Medicare, your benefit periods may differ from those in Medicare Part A.

How much is Medicare deductible for 2021?

Here’s what you’ll pay in 2021: Initial deductible. Your deductible during each benefit period is $1,484. After you pay this amount, Medicare starts covering the costs. Days 1 through 60.

How long can you be out of an inpatient facility?

When you’ve been out of an inpatient facility for at least 60 days , you’ll start a new benefit period. An unlimited number of benefit periods can occur within a year and within your lifetime. Medicare Advantage policies have different rules entirely for their benefit periods and costs.

What is the benefit period for Medicare?

Under Medicare Part A (inpatient hospital or skilled nursing facility coverage), a benefit period starts on the day you’re admitted as an inpatient to a hospital or SNF and ends when you’ve left and haven’t received any inpatient care in a hospital or SNF for 60 days in a row.

How long is the benefit period for SNF?

For example, say you stayed at an SNF for 100 days and then went home. Let’s call this benefit period A. Benefit period A ends 60 consecutive days after your discharge from the SNF. If you’re admitted as an inpatient to a hospital on day 61, you begin a new benefit period (benefit period B). If you’re then admitted as an inpatient at a skilled nursing facility, you follow the same coverage schedule as you did in the previous benefit period (benefit period A): your first 20 days at the SNF are fully covered, you pay a per-day coinsurance for days 21 to 100, and you pay all costs after that.

What is coinsurance in Medicare?

The coinsurance cost is the amount you’re responsible for paying after Medicare has paid its portion and you have met your deductible. Along with premiums and deductibles, the coinsurance rate is adjusted yearly, so it may vary from one year to the next. Your coinsurance and other costs may be covered if you have a Medigap or Medicare Advantage policy, depending on the specifics of your plan.

How long does Medicare cover after SNF?

After you’ve spent 100 days in an SNF or hospital, your Medicare coverage ends for that specific benefit period. To get Medicare coverage for an SNF stays once again, you have to begin a new benefit period.

How long does it take to get admitted to a SNF?

Typically, you must be admitted to an SNF within 30 days of leaving the hospital.

When does the benefit period start for a second hospital stay?

If you’re an inpatient in a hospital or skilled nursing facility again after a benefit period has ended, a new benefit period begins for your second inpatient stay, even if the second stay is related to the first one. For example, let’s say you were an inpatient in the hospital for 10 days and then found yourself back in the hospital 70 days after you were discharged—a new benefit period would begin with your second hospital admission.

Does YourMedicare.com sell Medicare?

YourMedicare. com takes pride in providing you as much information as possible concerning your Medicare options, but only a health insurance broker licensed to sell Medicare can help you compare your plan options from various insurance companies. When you’re ready, we recommend you discuss your needs with a YourMedicare.com Licensed Sales Agent.

How long do you have to be in hospital before Medicare pays for SNF?

Before your benefit period can even start and before Medicare will cover your SNF care, you have to have spent three days as a hospital inpatient.

What happens after 90 days of Medicare?

After day 90 in a benefit period, and if the person has no more lifetime reserve days available to use, the Medicare recipient is responsible to pay all of the costs associated with their hospital stay. After you’ve spent 60 days out of the hospital, your benefit period will start all over again. At the start of each new period, you will receive ...

How many days do you have to be out of the hospital to get Medicare?

In order to help you make better sense of this, here’s a breakdown. 60 days: How many days you are required to be out of the hospital or after-care facility to become eligible for another hospital benefit period. 60 days: The maximum number of days that Medicare will pay for all of your inpatient hospital care once you’ve paid your deductible ...

How long do you have to stay in a hospital?

In an Original Medicare plan, you have to stay for a minimum of three days, or more than two nights, to officially be admitted as a patient in a hospital. Only then will Medicare start to pay for your care in a skilled nursing center for additional treatment, like physical therapy or for regular IV injections. The amount of time you spend in the hospital as well as the skilled nursing center will be counted as part of your hospital benefit period. Furthermore, you are required to have spent 60 days out of each in order to be eligible for another benefit period.#N#However, the portion you are expected to pay for the costs of a skilled nursing center differs from the portion you pay for hospital care. In facilities like these, you must pay in any given benefit period: 1 $0 for your room, bed, food and care for all days up to day 20 2 A daily coinsurance rate of $161 for days 21 through 100 3 All costs starting on day 101

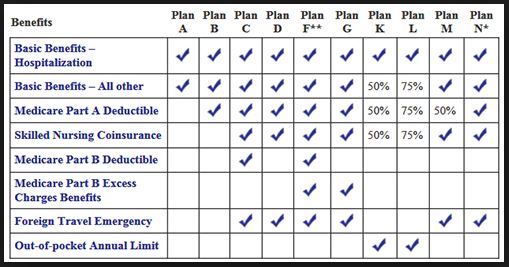

What is Medicare Supplemental Insurance?

As for Medicare supplemental insurance, also known as Medigap, it’s a supplemental policy that you can buy to help offset the costs of Original Medicare.

How much is Medicare coinsurance?

The Medicare recipient is charged a daily coinsurance for any lifetime reserve days used. The standard coinsurance amount is $682 per day. If you’re enrolled in a supplemental Medicare insurance program, also known as “Medigap,” you will receive another 365 days in your lifetime reserve with no additional copayments.

How much is the hospital stay deductible for Medicare?

You will be expected to pay for the initial cost of your hospital stay up to a limit of $1,364. This is your hospital deductible for Medicare Part A. As opposed to other Medicare deductibles, it begins anew with every hospital benefit period, rather than your first admission to the hospital each year. After this deductible is met, Medicare will ...

When does the benefit period end?

The benefit period ends when 60 days have passed since you last received either hospital care or care from a skilled nursing facility.

Why is a benefit period important?

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. With most other types of health insurance (ie, non-Medicare), the deductible is based on the calendar year. Once you meet it, your plan will pay all or part of your costs for the remainder of the year, ...

When does deductible reset for hospitalization?

Once you meet it, your plan will pay all or part of your costs for the remainder of the year, but then your deductible resets on January 1. So if you happen to be hospitalized from December 30 to January 2, you’d have to pay two deductibles with most non-Medicare plans.

How long do you have to be in a skilled nursing facility to be eligible for Medicare?

You also must enter a Medicare-certified skilled nursing facility within 30 days after leaving the hospital. In order for Medicare to pay for care in a skilled nursing facility (SNF), you first have to be hospitalized as an inpatient.

How long does Medicare last?

Your Medicare benefit period starts the day you are hospitalized as an inpatient and ends once you have been out of the hospital or a skilled nursing facility for 60 days.

How often do you pay a Medicare deductible?

Most health insurance plans have you pay a deductible once a year. With Medicare, you could face multiple Part A deductibles over the course of the year depending on your need for hospital care. It is important to understand that the Medicare benefit period applies to inpatient hospital stays only.

What is the Medicare deductible for 2020?

In 2020, the Part A deductible is $1,408. Any physician fees, however, will be charged to Medicare Part B and are not included as part of the Part A benefit.

What are the 60-60-60-30 rules?

Understanding the 60-60-60-30 rules can help you to make sense of them. Know how much you are expected to pay and how much Medicare will cover. It may encourage you to consider enrolling in a Medigap plan for healthcare savings down the road.

How long does Medicare reserve days last?

Medicare offers you 60 lifetime reserve days to extend your Medicare benefit period. Any hospital stays lasting longer than 91 days will require use of lifetime reserve days. These reserve days cost $704 per hospital day in 2020. Medicare only allows you 60 lifetime reserve days total.

How much will Medicare cut for readmissions?

Any readmissions for these reasons could result in Medicare cutting payments to those hospitals by as much as 3%. 1

How long do you have to be in a skilled nursing facility to qualify for Medicare?

The patient must go to a Skilled Nursing Facility that has a Medicare certification within thirty days ...

How long does it take for Medicare to cover nursing?

Medicare will cover 100% of your costs at a Skilled Nursing Facility for the first 20 days. Between 20-100 days, you’ll have to pay a coinsurance. After 100 days, you’ll have to pay 100% of the costs out of pocket.

What does it mean when Medicare says "full exhausted"?

Full exhausted benefits mean that the beneficiary doesn’t have any available days on their claim.

What is skilled nursing?

Skilled nursing services are specific skills that are provided by health care employees like physical therapists, nursing staff, pathologists, and physical therapists. Guidelines include doctor ordered care with certified health care employees. Also, they must treat current conditions or any new condition that occurs during your stay ...

How long does a SNF stay in a hospital?

The 3-day rule ensures that the beneficiary has a medically necessary stay of 3 consecutive days as an inpatient in a hospital facility.

How many days of care does Part A cover?

Part A benefits cover 20 days of care in a Skilled Nursing Facility.

Does Medicare cover hospice in a skilled nursing facility?

Does Medicare pay for hospice in a skilled nursing facility? Yes, Medicare will cover hospice at a Skilled Nursing Facility as long as they are a Medicare-certified hospice center. However, Medicare will not cover room and board. What does Medicare consider skilled nursing?

What is a benefit period?

A benefit period is the way the Original Medicare program measures your use of inpatient hospital and skilled nursing facility (SNF) services. It begins the day that you enter a hospital or SNF and ends when you have not received inpatient hospital or Medicare-covered skilled care in a SNF for 60 days in a row.

How long does it take to get a new benefit after leaving the hospital?

If you go into the hospital or SNF after one benefit period has ended (more than 60 days after you left), a new benefit period begins. There is no limit to the number of benefit periods you can have, or how long a benefit period can be.

How much is skilled nursing facility coinsurance?

Skilled nursing facility coinsurance: $0 for the first 20 days of inpatient care each benefit period; $161 per day for days 21-100. Let’s say you enter the hospital as an inpatient on May 1 and go home on May 15 (14 days in the hospital).

When do you have to pay deductible for SNF?

You must meet your Part A deductible at the beginning of each benefit period as well as pay a daily coinsurance depending on how many days you stay at the hospital or SNF during one benefit period . After you meet your Part A deductible at the beginning of the benefit period , the first 60 days of your inpatient hospital stay are covered ...