Do I have to enroll in Medicare Part B?

But individuals who work for a small employer (i.e., generally one with fewer than 20 employees*) should enroll in Part B because that will be their “primary” insurance coverage. Employees of large companies (i.e., usually one with more than 20 employees) do not have to enroll in Medicare.

What happens if you don’t have Medicare Part B?

So if you don’t have Medicare Part B and have a $10,000 medical event, you would be responsible for $8,000 before his retirement program kicked in, she said. She said that’s a big risk to take given the cost of healthcare today.

What are the most common Medicare Part B enrollment mistakes?

Here are Part B enrollment scenarios where people often make mistakes, in order of severity (high to low): Coverage purchased in the individual market (e.g., through HealthCare.gov or a state-based marketplace like Covered California) is usually not available to Medicare beneficiaries.

Do I pay a late enrollment penalty for Medicare Part B?

Usually, you don't pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period. Read more about different situations that may affect when you decide to get Part B. If you have limited income and resources, your state may help you pay for Part A, and/or Part B.

Can I refuse Part B Medicare?

Once you have signed up to receive Social Security benefits, you can only delay your Part B coverage; you cannot delay your Part A coverage. To delay Part B, you must refuse Part B before your Medicare coverage has started. You have two options for refusing Part B: 1.

Can I choose not to enroll in Medicare?

Is It Mandatory to Sign Up for Medicare? If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later.

Does everyone have to have Part B Medicare?

Medicare Part B isn't a legal requirement, and you don't need it in some situations. In general, if you're eligible for Medicare and have creditable coverage, you can postpone Part B penalty-free. Creditable coverage includes the insurance provided to you or your spouse through work.

What are the consequences of not signing up for Medicare?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2020, but you didn't sign up until 2022.

Do I automatically get Medicare when I turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Is Medicare Part B worth the cost?

Is Part B Worth it? Part B covers expensive outpatient surgeries, so it is very necessary if you don't have other coverage coordinating with your Medicare benefits.

Do most federal retirees enroll in Medicare Part B?

About 70% of federal retirees enroll in Part B, which means paying two premiums and in essence two duplicative insurance programs. A portion of the retirees that join Part B might do so as a hedge against the elimination of FEHB retiree benefits.

What is the penalty for canceling Medicare Part B?

Your Part B premium penalty is 20% of the standard premium, and you'll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What happens if you opt out of Part B?

But beware: if you opt out of Part B without having creditable coverage—that is, employer-sponsored health insurance from your current job that’s as good or better than Medicare—you could face late-enrollment penalties (LEPs) down the line.

What to do if you drop Part B?

If you’re dropping Part B because you can’t afford the premiums, remember that you could save money on your health care costs in other ways. Consider adding a Medicare Advantage or Medigap plan instead of dropping Part B. Call us to learn more about these alternatives to disenrolling in Part B.

What happens if you don't have health insurance?

Without health insurance that’s as good or better than Medicare, you could start racking up late-enrollment penalties the longer you go without coverage. If you decide to re-enroll in Part B later, these penalties could make your premiums (what you pay for coverage) even less affordable.

How to schedule an interview with Social Security?

Call a Licensed Agent: 833-271-5571. You can schedule an in-person or over-the-phone interview by contacting the SSA. If you prefer an in-person interview, use the Social Security Office Locator to find your nearest location. During your interview, fill out Form CMS 1763 as directed by the representative.

Is it easy to cancel Medicare Part B?

Disenrolling in Medicare Part B isn’t an easy process because it requires an in-person or phone interview. But this is intentional. Canceling Part B could have negative consequences for your wallet (in the form of late-enrollment penalties) and your health (in the form of a gap in coverage).

Can Medicare tack late enrollment penalties?

If you have a gap in coverage, the Medicare program could tack late-enroll ment penalties onto your Part B premiums if you re-enroll in coverage again later. Avoid this pitfall by working with your human resources department to ensure that your company's insurance is indeed creditable (meaning that it’s as good or better than Medicare Part B). You may need to provide documentation of creditable coverage during your Part B cancellation interview.

Does Medicare Advantage offer rebates?

Consider a Medicare Advantage plan that offers a rebate on your Part B premium. Here's how that works: A Medicare Advantage plan provides the same or better coverage than Part A (hospital insurance) and Part B (medical insurance). To receive this coverage, most enrollees pay a premium for their Medicare Advantage plan in addition to the cost ...

How To Sign Up For Medicare Part B

Medicare Part B is optional, and you'll need to be enrolled in Medicare Part A to get it. Some people get Medicare Part A and Part B automatically, while some have to sign up manually. More on this later.

Common Medicare Enrollment Mistakes

As you prepare to enroll in Medicare Part B, it's important that you make sure to avoid some common mistakes to could be potentially costly in the long term.

Compare Medigap plans in your area

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

How to avoid Medicare Part B late enrollment penalty?

How to Avoid the Medicare Part B Late Enrollment Penalty. The best way to avoid Part B penalties is to plan ahead. You have several Medicare options to choose from, including Original Medicare plus a Medigap Plan. MedicareFAQ can help you through these decisions by answering your questions and helping you prepare for Medicare.

How long do you have to wait to sign up for Part B?

Usually, you will be allowed to sign up for Part B right away, during a “ Special Enrollment Period .”. This is an eight-month period beginning when the employment coverage ends. If you do not enroll during this period, you’ll have to pay a Part B penalty for each full 12 months you wait, beyond the date, the SEP began.

How long does Medicare Part B last?

Your IEP begins three months before your birth month and ends three months after your birth month.

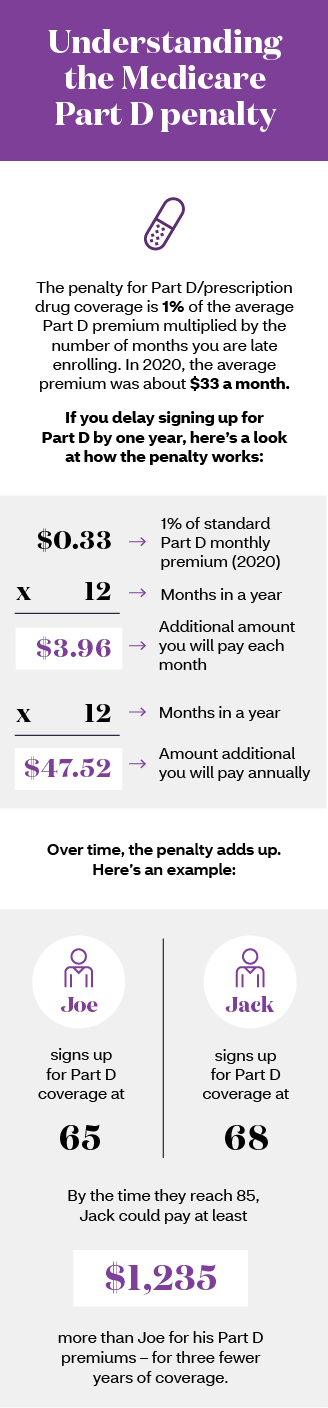

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

When does Part B start?

General Enrollment runs from January 1st to March 31st each year. If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have ...

Is there a cap on Part B late enrollment?

As of now, there is no cap on Part B late enrollment penalty. There has been a bill introduced called the “Medicare Part B Fairness Act” or H.R.1788. This bill would cap the amount at 15% for the current premium.

Is Medicare correct to sign you up for Part B?

Further, your failure to return that card in a timely fashion does not necessarily mean that Medicare was correct to sign you up for Part B and begin to subtract the monthly premiums for Part B from your Social Security. However, it might have been correct.

Can I get Medicare if I turned 65?

You say you chose not to get Medicare, so I assume you already have turned 65. But if you just turned 65, it’s standard for Social Security to send you notice about Medicare enrollment. Social Security administers many aspects of Medicare including the enrollment process and handling the deduction of Part B premiums from monthly Social Security ...

What is the late enrollment penalty for Medicare Part B?

This can be when you turn 65, or under the age of 65 if you’ve been receiving disability payments from Social Security or the Railroad Retirement Board for 24 months.

What happens if you sign up for Part B?

If you sign up for Part B after the initial enrollment period and you’re not eligible for a Special Enrollment Period, you may be subject to a late enrollment penalty. The penalty may be imposed for the duration of Part B coverage. The amount may be as much as 10% more than the monthly premium you would normally pay, ...

What age do you have to be to enroll in Medicare?

Sign-up requirements. Anyone approaching age 65 who is not collecting Social Security or Railroad Retirement Board benefits must enroll in Parts A and/or B when they are first eligible for Medicare or risk incurring Part B late enrollment fees. For some Medicare recipients, a Special Enrollment Period may apply.

How much is the 2020 Part B premium?

Part B, on the other hand, will require you to pay a monthly premium. The 2020 Part B premium begins at $144.60 per month and may increase based on an individual’s modified adjusted gross income and tax filing status. Types of enrollment periods. Enrollment periods fall into three categories:

Can you delay enrollment in Part B?

Special enrollment: If you choose to delay enrollment in Part B because you have creditable coverage through an employer or union, you may enroll without a penalty during a Part B Special Enrollment Period when your employment ends.