If you cannot afford your Medicare premiums, your first step should be to see if you qualify for Medicaid Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…Medicaid

Full Answer

What happens if you don’t pay Medicare premiums?

For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment.

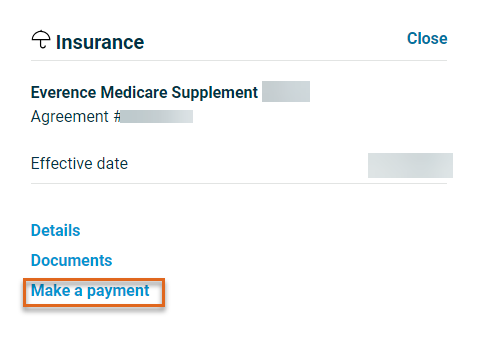

Can I Pay my Medicare premiums with a credit card?

You should make sure that you keep up with your monthly premiums, so your Medicare Parts A and B are not terminated. A simple way to pay a monthly premium or your complete Medicare premium bill by credit card until the Medicare Easy Pay form is activated is by visiting www.Medicare.com and create a Medicare account.

Do you have to pay out-of-pocket costs for Medicare?

Original Medicare (Medicare Parts A and B) provides many benefits, but you may have to pay out-of-pocket costs to use those benefits. Medicare coverage comes with monthly premiums, deductibles, co-payments, co-insurance, and other out-of-pocket costs.

How do I Pay my Medicare premiums monthly?

Google “Medicare Easy Pay” to pay your Medicare premiums monthly from your checking account or visit www.medicare.gov and you can research topics such as how to download and properly set up Medicare Easy Pay.

How do poor people pay for Medicare?

While eligibility for Medicare does not depend on income, lower-income Medicare enrollees qualify for help paying premiums, deductibles, and other cost sharing through Medicaid or the Medicare Low-Income Subsidy (LIS) program. In many cases, eligibility for that assistance is based on the federal poverty line.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Is there a grace period for Medicare premium payments?

Under rules issued by the Centers for Medicare and Medicaid Services (CMS), consumers will get a 90-day grace period to pay their outstanding premiums before insurers are permitted to drop their coverage.

What are the 4 ways people can pay for their original Medicare premiums?

4 ways to pay your Medicare premium bill:Pay online through your secure Medicare account (fastest way to pay). ... Sign up for Medicare Easy Pay. ... Pay directly from your savings or checking account through your bank's online bill payment service. ... Mail your payment to Medicare.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What happens if I let Medicare lapse?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Can I pay my Medicare Part B premium monthly?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

What are Medicare Savings Programs?

Medicare Savings Programs (MSP) can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limit...

How do I apply for Medicare Savings Programs?

Eligibility for MSPs is determined by your state Medicaid office, as the funding for MSPs comes from the Medicaid program. Medicaid is jointly run...

Do you have to apply for an MSP during Medicare's annual election period?

No. You can apply for MSP assistance anytime. As noted above, you’ll do this through your state’s Medicaid office, which accepts applications year-...

Is there financial help for Medicare Part D coverage?

Medicare offers “Extra Help” for Medicare enrollees who can’t afford their Part D prescription drug coverage. If you’re a single person earning les...

Do I Qualify for Medicaid?

If you cannot afford your Medicare premiums, your first step should be to see if you qualify for Medicaid in your state. Medicaid is a combined state and federal program that, for Medicare beneficiaries who are eligible, pays Medicare premiums, deductibles, and copayments. The income and resource requirements vary from state to state.

Do I Qualify for Extra Help for Medicare Part D?

Social Security has a program called Extra Help for Medicare that helps pay for Part D drug plan costs.

Medicare Savings Programs

There are also Medicare Savings Programs you can look into. These programs do have income and resource limits you need to meet to be eligible, but if you do qualify, they can be very beneficial. The programs include:

Need Help?

At The Coleman Agency, we’re here to make sure you’re fully aware of all your Medicare plan options and what you can do to stay within your budget. For more information about the costs of Medicare, call us today at (803) 802-7507!

What happens if you don't pay Medicare?

What happens when you don’t pay your Medicare premiums? A. Failing to pay your Medicare premiums puts you at risk of losing coverage, but that won’t happen without warning. Though Medicare Part A – which covers hospital care – is free for most enrollees, Parts B and D – which cover physician/outpatient/preventive care and prescription drugs, ...

What happens if you fail to make your Medicare payment?

Only once you fail to make your payment by the end of your grace period do you risk disenrollment from your plan. In some cases, you’ll be given the option to contact your plan administrator if you’re behind on payments due to an underlying financial difficulty.

How long does it take to pay Medicare premiums after disenrollment?

If your request is approved, you’ll have to pay your outstanding premiums within three months of disenrollment to resume coverage. If you’re disenrolled from Medicare Advantage, you’ll be automatically enrolled in Original Medicare. During this time, you may lose drug coverage.

How long do you have to pay Medicare Part B?

All told, you’ll have a three-month period to pay an initial Medicare Part B bill. If you don’t, you’ll receive a termination notice informing you that you no longer have coverage. Now if you manage to pay what you owe in premiums within 30 days of that termination notice, you’ll get to continue receiving coverage under Part B.

What happens if you miss a premium payment?

But if you opt to pay your premiums manually, you’ll need to make sure to stay on top of them. If you miss a payment, you’ll risk having your coverage dropped – but you’ll be warned of that possibility first.

When does Medicare start?

Keep track of your payments. Medicare eligibility begins at 65, whereas full retirement age for Social Security doesn’t start until 66, 67, or somewhere in between, depending on your year of birth.

When is Medicare Part B due?

Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment.

What is the number to call for Medicare?

1-800-557-6059 | TTY 711, 24/7. These programs include: Medicare Savings Programs. Extra Help. Medicaid. Programs of All-Inclusive Care for the Elderly (PACE) Take a look at some of these programs and find out if you’re eligible.

How many types of Medicare savings programs are there?

There are four types of Medicare Savings Programs, each with its own qualifications and benefits. All help cover Medicare premiums and the associated out-of-pocket costs.

Is Medicare out of pocket?

However, there are still out-of-pocket costs associated with Medicare, such as premiums, deductibles, coinsurance and more. You may qualify for certain government and private programs that offer help paying for these costs.

Can you use QI if you qualify for medicaid?

Applications must be submitted every year, and are accepted on a first-come, first-serve basis. You can’t use QI benefits if you qualify for Medicaid. However, those who meet the criteria for QI also qualify for Extra Help. 2020 Monthly Income Limits*. Individuals: $1,456.

Can I get extra help if I have full medicaid?

You may automatically qualify for Extra Help if you already have full Medicaid coverage, if you get Supplemental Security Income (SSI) benefits from the Social Security Administration, or if you get help paying your Medicare Part B premiums from a Medicare Savings Program.

Where is Medicare available?

Medicare financial assistance is available to those with limited incomes and resources living in the U.S. territories of Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa. Territory programs may vary.

What does an orange Medicare notice mean?

An Extra Help “Notice of Award” from Social Security. An orange Medicare notice that says your co-payment amount will change next year. A Supplemental Security Income (SSI) award letter as proof you have SSI.

What is extra help for medicaid?

If you qualify for Medicare cost assistance in your state, you automatically qualify for the Extra Help program, which helps pay for prescription drug coverage under Medicare Part D.

What is a bill from a nursing home?

A bill from an institution (such as a nursing home) or a copy of a state document showing Medicaid paid for your stay for a month or more. A print-out from the state Medicaid system showing that you lived in the institution for a month or more and Medicaid paid for it.

What is Medicaid for Medicare?

Medicaid is a federal and state program that helps reduce the costs associated with health care that are usually not covered by Original Medicare, such as nursing home care and personal care services. It is for those with limited income and resources.

Can I get QI if I qualify for medicaid?

You cannot access QI benefits if you qualify for Medicaid. Qualified Disabled and Working Individuals (QDWI) Program. The QDWI program reduces the cost of Medicare Part A premiums. In 2017, the monthly income limit is $4,105 for individuals and $5,499 for married couples.

Does Medicare have out-of-pocket costs?

Original Medicare (Medicare Parts A and B) provides many benefits, but you may have to pay out-of-pocket costs to use those benefits. Medicare coverage comes with monthly premiums, deductibles, co-payments, co-insurance, and other out-of-pocket costs. There are several programs available to reduce the overall cost of health care services ...