If you aren’t getting Social Security benefits, and you won’t be getting them atage 65, you must contact Social Security to apply for Medicare benefits. Seebelow. If you are already getting Social Security benefits, and you are entitledto premium-free Part A, you won’t have to do anything. Social Security willenroll you in both Part A and Part B automatically. You will have to tell themif you don’t want to keep Part B, which requires a premium.

What happens to my Medicare premiums if I receive Social Security?

Feb 24, 2022 · If you don’t receive benefits, you’ll get a bill from Medicare for Part D and from the insurer for Part C. Medicare Costs You Can Deduct From Social Security Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

What happens if you don’t qualify for Social Security benefits?

Jun 01, 2019 · Are medicare premiums deductible if you do not receive Social Security benefits, but pay medicare premiums by check? Have not received a SSA-1099 Medicare premiums paid with out of pocket funds are deductible.

Does Medicare Part B come out of your social security check?

Apr 18, 2018 · You have been charged for 4 months of Medicare Part B premiums. Since you are not receiving a Social Security check, then all Social Security can do is bill you for your Medicare premiums in a quarterly lump sum. Most Americans enrolled in Medicare are paying their Medicare premiums monthly from their Social Security check.

Can you receive Social Security Without Medicare?

Jan 20, 2022 · If you don't qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65. You can also apply online for your Medicare coverage at www.medicare.gov .

How is Medicare pay if not receiving Social Security?

If you are not yet receiving Social Security benefits, you will have to pay Medicare directly for Part B coverage. Once you are collecting Social Security, the premiums will be deducted from your monthly benefit payment.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Does everyone who gets Social Security get Medicare?

Everyone eligible for Social Security Disability Insurance (SSDI) benefits is also eligible for Medicare after a 24-month qualifying period. The first 24 months of disability benefit entitlement is the waiting period for Medicare coverage.

Does Social Security automatically take out Medicare payment?

If you receive Social Security retirement benefits, your Medicare benefits will be deducted automatically. This means that you do not have to do anything to make this happen – it will be automatic when you enroll in Medicare.Nov 15, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How do I know if I qualify for Medicare?

You're 65 or older. You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and. You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.Nov 15, 2021

Do I have to pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What's the difference between Social Security and Medicare?

Social Security offers retirement, disability, and survivors benefits. Medicare provides health insurance. Because these services are often related, you may not know which agency to contact for help.

What happens if you don't pay Medicare premiums?

If one does not keep up with your Medicare premiums, whether it is Part A, B, C and/or D, then they can lose their benefits and may be charged a penalty when they re-enroll. (When one does not have 40 working quarters to qualify for Medicare, then they may have to pay a premium for Part A.)

How long do you have to pay Medicare premiums?

You have been charged for 4 months of Medicare Part B premiums. Since you are not receiving a Social Security check, then all Social Security can do is bill you for your Medicare premiums in a quarterly lump sum. Most Americans enrolled in Medicare are paying their Medicare premiums monthly from their Social Security check.

How to contact Medicare for easy pay?

For those who do not have access to a computer, call 1/800-MEDICARE (800-633-4227) and to request the Medicare Easy Pay form mailed to you or make a copy from Toni’s Medicare Survival Guide® Advanced edition.

Does Medicare take your Social Security check?

Most Americans enrolled in Medicare are paying their Medicare premiums monthly from their Social Security check. Social Security will automatically take the Medicare premiums from a person’s Social Security check. Social Security will send a letter informing the Medicare beneficiary that Social Security is deducting the monthly Medicare Part B ...

Do You Automatically Get Medicare with Social Security?

Medicare and Social Security are two benefits programs managed by the United States government. Medicare currently has over 61 million beneficiaries.

How Does Automatic Enrolling in Medicare Work?

Most people who collect Social Security benefits automatically receive Original Medicare ( Parts A and B) coverage once they're eligible.

Can You Get Social Security and Not Sign Up for Medicare?

Yes, many people receive Social Security without signing up for Medicare.

What Insurance Do You Get with Social Security Disability?

In most cases, people receiving Social Security Disability Income (SSDI) are automatically enrolled in Original Medicare after serving a 24-month waiting period .

Is It Mandatory to Sign Up for Medicare After Age 65?

No, it isn’t mandatory to join Medicare. People can opt to sign up, or not.

What is the difference between Medicare and Social Security?

Both programs help people who have reached retirement age or have a chronic disability. Social Security provides financial support in the form of monthly payments, while Medicare provides health insurance. The qualifications for both programs are similar.

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

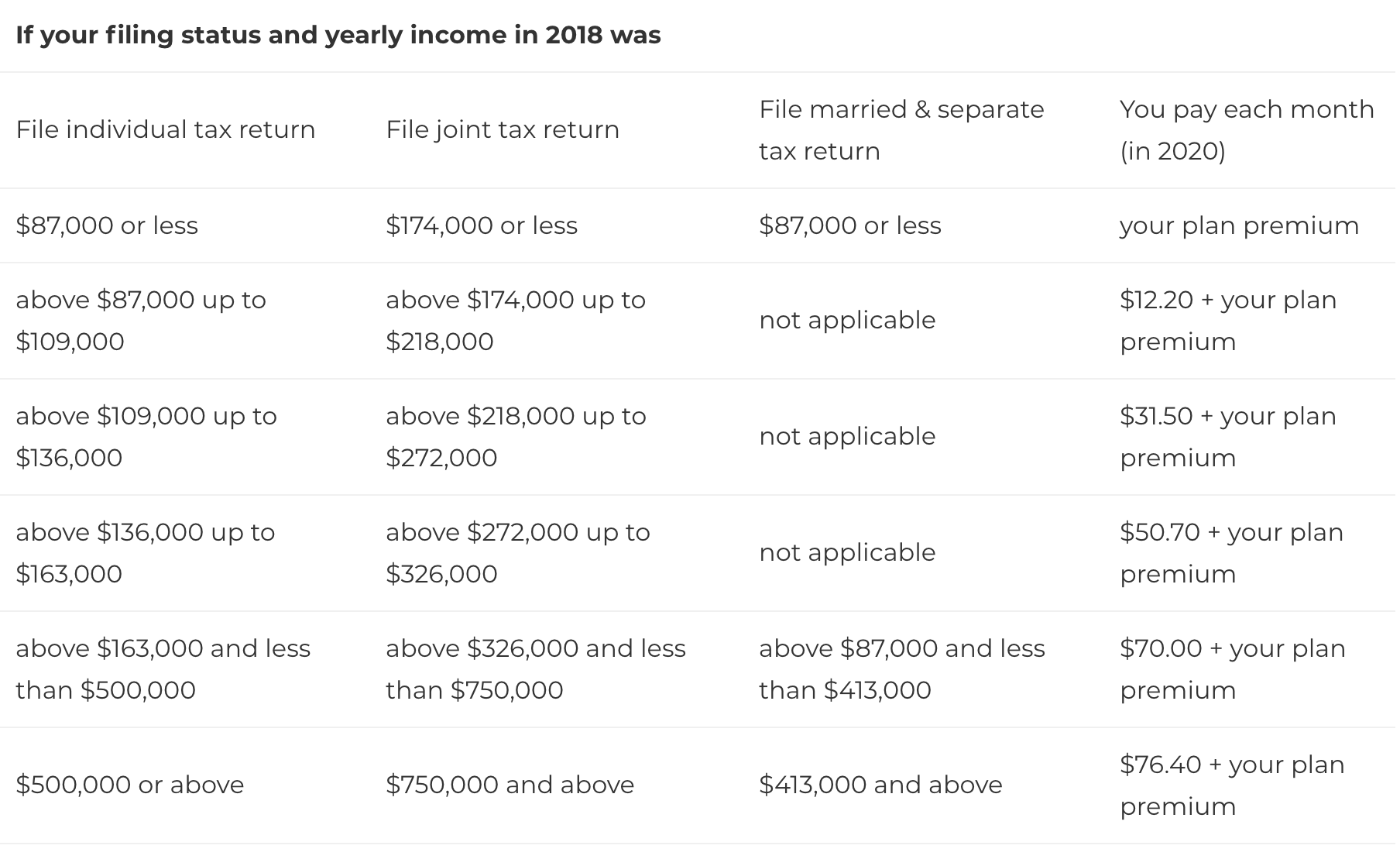

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Part C plans are sold by private insurance companies who contract with Medicare to provide coverage. Generally, Advantage plans offer all the coverage of original Medicare, along with extras such as dental and vision services.

What is Medicare and Medicaid?

Medicare is a health insurance plan provided by the federal government. The program is managed by the Centers for Medicare & Medicaid Services (CMS), a department of the United States Department of Health and Human Services.

How much can my spouse get from my retirement?

Your spouse can also claim up to 50 percent of your benefit amount if they don’t have enough work credits, or if you’re the higher earner. This doesn’t take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

What is Social Security?

Social Security is a program that pays benefits to Americans who have retired or who have a disability. The program is managed by the Social Security Administration (SSA). You pay into Social Security when you work. Money is deducted from your paycheck each pay period.

How many credits do you need to work to get Medicare?

You’re eligible to enroll in Medicare Part A and pay nothing for your premium if you’re age 65 or older and one of these situations applies: You’ve earned at least 40 Social Security work credits. You earn 4 work credits each year you work and pay taxes.

How long do you have to be married to get Social Security?

You were married for at least 9 months but are now widowed and haven’t remarried.

Why do people pay less for Part B?

Some people will pay less because the cost increase of the Part B premium is larger than the cost-of-living increase to Social Security benefits. You might also be eligible to receive Part B at a lower cost — or even for free — if you have a limited income.

Can I use my Social Security to pay my Medicare premiums?

Can I use Social Security benefits to pay my Medicare premiums? Your Social Security benefits can be used to pay some of your Medicare premiums . In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance (SSDI) or Social Security retirement benefits.

Can I deduct healthcare expenses?

Depending on your premiums and other healthcare spending, you might not reach this number. If your spending is less than 7.5 percent of your AGI, you can’t deduct any healthcare expenses, including premiums. However, if your healthcare spending is more than 7.5 percent of your income, you can deduct it.

Does Medicare cover prescription drugs?

Medicare Part D plans cover prescription drugs. Part C and Part D plans are optional. If you do want either part, you’ll also have multiple options at various price points. You can shop for Part C and Part D plans in your area on the Medicare website.

Can a deceased spouse receive Medicare?

You can also receive Part A without paying a premium if you qualify because of a disability. You can qualify for Medicare because of a disability at any age.

Who Pays The Premium For Medicare Advantage Plans

You continue to pay premiums for your Medicare Part B benefits when you enroll in a Medicare Advantage plan . Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate.

Look Closely At Your Bill

The type of “Medicare Premium Bill” you get shows if you’re at risk of losing your Medicare coverage for late payments:

Analyze Medicare Premiums With A Licensed Agent

Deductibles, coinsurance and other out-of-pocket costs may not always be predictable expenses, but premiums will be there month after month.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How Much Is Taken Out Exactly

There is no standard amount that is taken out of your Social Security check when you sign up for Medicare. Instead, the amount deducted depends on several factors. Each part of Medicare has a different cost. On top of this, Part C and Part D are offered by private plans, which means their monthly premiums vary even more.

How Do I Know If I Will Have Money Taken Out Of My Social Security Check

If you receive Social Security retirement benefits, your Medicare benefits will be deducted automatically. This means that you do not have to do anything to make this happen it will be automatic when you enroll in Medicare.

Nearly All Medicare Advantage Enrollees Are In Plans That Require Prior Authorization For Some Services

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees are in plans that require prior authorization for some services in 2021.

Does a postal worker have health insurance?

Health insurance for postal workers is provided by the Federal Employee Health Benefits Program (FEHBP). It generally provides strong coverage and, I’m assuming, covered you as a retiree’s spouse while your husband was alive. The key question here is what happened to your coverage when your husband passed away.

Is Medicare correct to sign you up for Part B?

Further, your failure to return that card in a timely fashion does not necessarily mean that Medicare was correct to sign you up for Part B and begin to subtract the monthly premiums for Part B from your Social Security. However, it might have been correct.

Can I get Medicare if I turned 65?

You say you chose not to get Medicare, so I assume you already have turned 65. But if you just turned 65, it’s standard for Social Security to send you notice about Medicare enrollment. Social Security administers many aspects of Medicare including the enrollment process and handling the deduction of Part B premiums from monthly Social Security ...

What happens if you refuse Medicare Part B?

If you refuse Medicare Part B, the only change will be that Part B’s premium will no longer be deducted from your Social Security benefit. However—and this is a huge “however”—refusing Part B is foolish. Because, at some point—I guarantee— you will want to enroll in Part B again.

How long do you have to wait to get Medicare if your B or D is lapsed?

And if your Part B or D is lapsed for more than three years , you may not be able to get it back. It is suggested by Social Security to apply for Medicare three months prior to your 65th birthday and in your case 3 months before the month you wish to retire. Related Answer. Cameron Beck.

What are the exceptions to Medicare?

There are very limited exceptions: 1 Civilian federal government employees hired before 1984. They pay the 1.45% tax for Medicare but not the 6.2% tax for Social Security. 2 25% of state and local government employees with a pension plan. There are also other limited exceptions that apply for, say, some on-campus college student employment. 3 And see cartoon below for one important

How much tax do you pay on Medicare?

They pay the 1.45% tax for Medicare but not the 6.2% tax for Social Security. 25% of state and local government employees with a pension plan. There are also other limited exceptions that apply for, say, some on-campus college student employment. And see cartoon below for one important exception.

When does Medicare start?

Medicare doesn’t start until age 65. You can refuse Part B then. If you’re still working and covered by a health plan at work, that makes sense. However, refusing Part B because, for example, you don’t feel like paying the premium, is extremely foolish. As in, Don’t do it! Those that do always come crawling back.

Is Medicare a good deal?

Again, the devil resides in the details, so please visit The United States Social Security Administration for the whole picture. Medicare is actually a pretty good deal. I’m sure you’ve heard of health coverage through a “single payer system.”. That’s what Medicare is. The single payer is the federal government.

When do you need to sign up for Part A and Part B?

If you aren’t getting benefits from Social Security (or the RRB) at least 4 months before you turn 65, you'll need to sign up with Social Security to get Part A and Part B.”. Part C (Medicare Advantage Plan) and Part D ( Prescription Drug Plan) are optional but I believe most people do get part D.