If you miss open enrollment and weren't already enrolled in a plan that was automatically renewed, you may very well be without health insurance, unless you have recently experienced a significant, life-changing event that would trigger a special enrollment period.

Full Answer

What to do when you miss open enrollment?

If a recipient is already enrolled in Original Medicare benefits but opted out of enrolling in a Part C or D plan due to having additional health coverage, the loss of that additional health coverage triggers a special enrollment period for Part C or D that lasts for 63 days after the additional health coverage ends.

What happens if I miss the Medicare annual enrollment period?

Dec 08, 2021 · If you miss the annual enrollment period and the open enrollment period and you do not qualify for a special enrollment period, you may have to wait until the following year to enroll. If you’re feeling overwhelmed trying to navigate the Medicare system, Guided Medicare is here to help. Contact us and we will help you navigate the Medicare maze.

What if I missed my Medicare deadline?

Feb 08, 2021 · During a general enrollment period that opened Jan. 1 and closes March 31, anyone who did not enroll when they should have (as defined by the government) can do so. The downside is that coverage...

Do not miss your Medicare enrollment deadline?

Options to Consider if You Missed Medicare Open Enrollment Make changes during the Medicare Advantage Open Enrollment Period. In 2019, the Centers for Medicare & Medicaid Services (CMS) introduced the Medicare Advantage Open Enrollment Period (MAOEP), which runs each year from January 1 through March 31.

What happens if I miss Medicare open enrollment?

If you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

What happens if someone misses their opportunity to enroll in Medicare during their initial enrollment period or special enrollment period?

Special Situations (Special Enrollment Period) If you don't sign up during your Special Enrollment Period, you'll have to wait for the next General Enrollment Period and you might have to pay a monthly late enrollment penalty.

What happens if I miss the enrollment period?

Try as you may, some employees still miss the deadline for open enrollment. Generally, staff members who miss the deadline will have to wait until the next open enrollment (next year) for coverage. Missing the deadline for open enrollment could result in no coverage or no change(s) in coverage.

What happens if you don't pick a Medicare plan?

If you don't switch to another plan, your current coverage will continue into next year — without any need to inform Medicare or your plan. However, your current plan may have different costs and benefits next year.

Why is there a penalty for late enrollment in Medicare?

Part A late enrollment penalty However, you have to pay a monthly premium. If you're not automatically enrolled and don't sign up for Medicare Part A during your initial enrollment period, you'll incur a late enrollment penalty when you do sign up.

What is the Part B late enrollment penalty?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Can you cancel health insurance when it is not open enrollment?

Although you can cancel your health insurance plan anytime, without having to serve a waiting period.

What is the general enrollment period for Medicare?

The General Enrollment Period for Medicare takes place from January 1 through March 31 of every year. When you enroll during this time, your coverage begins on July 1. It's likely since you delayed enrollment that you'll pay a Part B late enrollment penalty.Oct 5, 2021

How do I delay Medicare enrollment?

If you want to defer Medicare coverage, you don't need to inform Medicare. It's simple: Just don't sign up when you become eligible. You can also sign up for Part A but not Part B during initial enrollment.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.Sep 19, 2017

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

When does Medicare enrollment end?

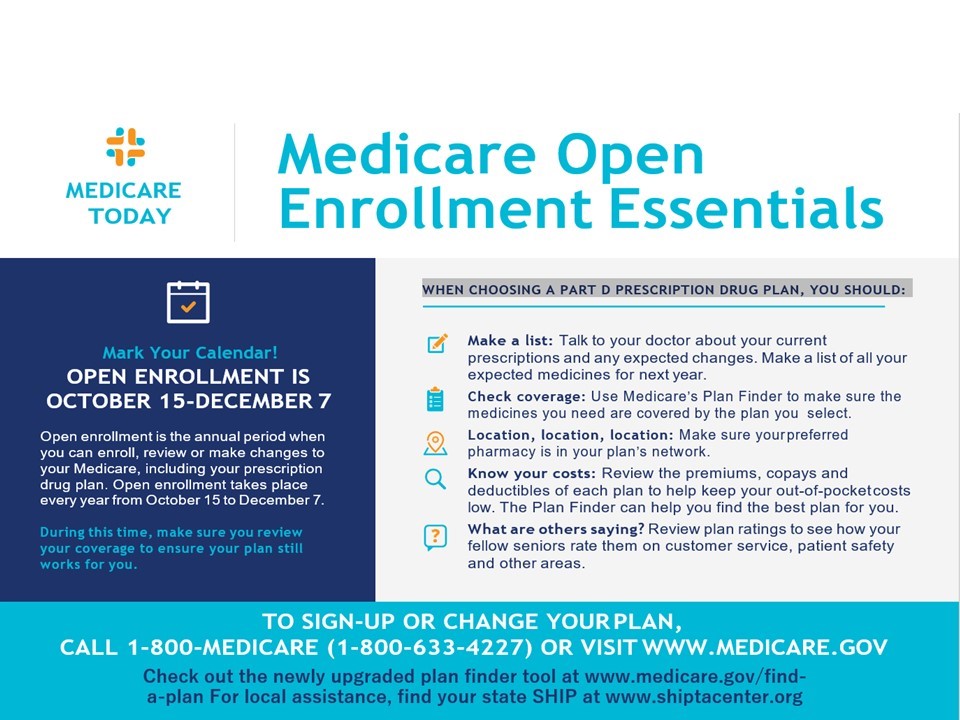

Medicare’s Annual Enrollment Period begins each year on October 15th and ends December 7th. Coverage from enrollment during this timeframe begins on the first day of the following year, January 1st.

What is a special enrollment period?

Special Enrollment Period. Special enrollment periods are activated when a recipient experiences certain qualifying changes to their existing health care coverage. For Parts A and B, a special, penalty-free enrollment period can begin before or following the loss of private health insurance provided by an employer with 20 or more employees, ...

When do you sign up for Medicare?

Generally speaking, you are supposed to sign up for Medicare during a seven-month window that starts three months before your 65th birthday month and ends three months after it. However, if you meet an exception — i.e., you or your spouse have qualifying group insurance at a company with 20 or more employees — you can put off enrolling.

What is the late enrollment penalty for Part D?

For Part D prescription drug coverage, the late-enrollment penalty is 1% of the monthly national base premium ($33.06 in 2021) for each full month that you should have had coverage but didn’t. Like the Part B penalty, this amount also generally lasts as long as you have drug coverage.

How much is Part B premium for 2021?

For each full year that you should have been enrolled in Part B but were not, you could face paying 10% of the monthly Part B standard premium ($148.50 for 2021). The amount is tacked on to your monthly premium, generally for as long as you are enrolled in Medicare.

What happens if you miss the open enrollment period?

If you missed the Open Enrollment Period, don’t feel as though you’re trapped in a plan that doesn’t meet your needs. If the cost of drugs, coverage or key benefits becomes more than you can afford, there may be opportunities to make changes and reduce your out-of-pocket costs. The key is to be proactive.

When does Medicare open enrollment period end?

The Open Enrollment Period lasts from October 15 until December 7 each year, ...

What is Medicare Supplement Insurance?

Research Medicare Supplement Insurance (Medigap) Plans. Medigap Plans are sold by private insurance companies and offer supplemental coverage to be used in conjunction with Original Medicare. Most people purchase a Medigap plan during their individual Medigap Open Enrollment Period. Unlike the annual OEP, the enrollment timeframe ...

How long does Medigap last?

Your Medigap Open Enrollment Period lasts for six months, and during this time, private insurance companies cannot charge more for, deny or restrict your coverage based on medical underwriting and pre-existing conditions. This is not the case after your six-month enrollment period ends, except in certain guaranteed-issue circumstances. ...

Who is Ross Blair?

About Ross Blair. Ross Blair is the founder and Chief Executive Officer of eHealthMedicare.com, a website that makes it easier for seniors and their caregivers to select and enroll in the best Medicare products for their specific needs.

What happens if you miss open enrollment?

If you miss open enrollment and weren't already enrolled in a plan that was automatically renewed, you may very well be without health insurance, unless you have recently experienced a significant, life-changing event that would trigger a special enrollment period .

What is open enrollment insurance?

Open enrollment is also available for individuals or families who buy their own individual/family health insurance through the Affordable Care Act (ACA) exchanges or directly from health insurance companies (ie, off-exchange ). During an open enrollment period, eligible individuals can opt-in or out of plans, or make changes to ...

How long can you have short term health insurance?

Under rules that were finalized by the Trump administration in 2018, short-term health insurance plans can provide coverage for up to 364 days, although more than half of the states have regulations that limit short-term plans to three or six months, or prohibit them altogether. 5 .

Which states have extended open enrollment?

States that run their own exchanges have the option to extend open enrollment by adding a special enrollment period, available to all residents, before or after the regularly scheduled enrollment period. California, Colorado, and DC have permanently extended open enrollment. 1 .

When is open enrollment period?

The open enrollment period typically occurs sometime in the fall , but employers have flexibility in terms of scheduling open enrollment and their plan year, so it doesn't have to correspond with the calendar year. Your company should notify you about your open enrollment period.

Who is Kelly Montgomery?

Kelly Montgomery. Kelly Montgomery, JD, is a health policy expert and former policy analyst for the American Diabetes Association. Learn about our editorial process. Kelly Montgomery. Fact checked by. Fact checked by Ashley Hall on February 23, 2020. linkedin.

Who is Ashley Hall?

Ashley Hall is a writer and fact checker who has been published in multiple medical journals in the field of surgery. Learn about our editorial process. Ashley Hall. Updated on February 08, 2021. Each year, employers with more than 50 employees that offer health benefits must offer an "open enrollment" period.

When will open enrollment end for 2021?

In the individual/family health insurance market (ie, coverage that people buy for themselves, as opposed to getting from an employer), open enrollment for 2021 coverage ended on December 15 in most states. But a one-time COVID-related special enrollment period is being offered on HealthCare.gov (the exchange that’s used in 36 states) ...

When is the SEP open enrollment period?

The SEP will run from February 15 to May 15. Normally, if you missed open enrollment and don’t experience a qualifying event during the year, you might have to wait until the next open enrollment period to sign up for health coverage, depending on the circumstances. But the COVID-related special enrollment period in 2021 is giving millions ...

How long can you have a short term plan?

In 2017, several GOP Senators asked HHS to reverse this regulation and go back to allowing short-term plans to be issued for durations up to 364 days. And the Trump administration confirmed their commitment to rolling back the limitations on short-term plans in an October 2017 executive order. The new rules took effect in October 2018, implementing the following provisions: 1 Short-term plans can now have initial terms of up to 364 days. 2 Renewal of a short-term plan is allowed as long as the total duration of a single plan doesn’t exceed 36 months (people can string together multiple plans, from the same insurer or different insurers, and thus have short-term coverage for longer than 36 months, as long as they’re in a state that permits this). 3 Short-term plan information must include a disclosure to help consumers understand the potential pitfalls of short-term plans and how they differ from individual health insurance.

What is SEP in insurance?

Applicants who experience a qualifying event gain access to a special enrollment period (SEP) to shop for plans in the exchange (or off-exchange, in most cases) with premium subsidies available in the exchange for eligible enrollees.

How long does a short term insurance plan last?

Federal regulations allow a short-term plan (with renewals) to last up to 36 months, although about half the states have more restrictive rules.

When is the American Rescue Plan enrollment period?

Key takeaways. COVID/American Rescue Plan special enrollment period in most states continues through August 15, 2021 or even later. Native Americans and people eligible for Medicaid/CHIP can enroll year-round. If you’ve got a qualifying event, you can enroll in coverage. If none of those apply, a short-term plan is the closest thing ...

How long can you have short term health insurance?

For most of 2017 and 2018, short-term plans were capped at three months in duration, due to an Obama administration regulation.

What happens if you miss your Medicare enrollment?

If you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

When does Medicare Part B start?

The GEP takes place January 1 through March 31 of each year. During this period you can enroll in Medicare Part B. Enrolling during the GEP means your coverage will start on July 1. Until that time, you will not be covered by Medicare.

When is the enrollment period for the 401(k)?

The enrollment period runs February 15, 2021 through August 15, 2021. You don’t need to qualify for a specific life event in order to enroll in or change an existing plan.

How long do you have to apply for medicaid?

If you apply for Medicaid during the Open Enrollment Period and are denied, you have 60 days following the denial to enroll in another health insurance plan; in this case, ...

What are qualifying life events?

The events which make you eligible for a special enrollment period are known as qualifying life events. Qualifying Life Event. Examples. Losing Your Current Health Insurance Coverage. – If you lose your coverage for any reason (apart from not paying your premiums).

What is short term medical insurance?

Commonly referred to as short-term health insurance or temporary health insurance, short-term medical (STM) plans provide consumers with an affordable way to pay for healthcare for a brief period of time. (Most STM plans run for 30- to 364-days, but some plans can be purchased for up to three years.) While these plans do not cover essential health benefits and thus are not ACA-compliant, they do cover a wide range of services and provide a degree of financial security if you need to make an unexpected trip to the emergency room.

How much does concierge medicine cost?

In practices operating on a concierge membership model, patients pay a monthly or annual retainer–typically between $60 and $100 per month– to their doctor or medical office for a contracted bundle of services.

What is faith based healthcare?

Faith-based healthcare is offered through 501 (c) (3) nonprofit charities with a religiously-oriented purpose, and serve as alternatives to health insurance. These plans are often referred to as “health sharing ministries” or “healthcare sharing ministries.” ( Many states have banned the sale of Christian Ministry plans, so it is important to check to see if you can purchase in your state)

Is there an open enrollment period for medicaid?

Unlike healthcare plans sold on the state and federal exchanges, Medicaid has no open enrollment period and you can apply for coverage at any time of year. Eligibility is determined by family size and income, and eligibility guidelines vary from state to state.