If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B. And, the penalty increases the longer you go without Part B coverage.

Full Answer

What is the difference between Medicare Part an and Part B?

to get Medicare later, you’ll have to pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you go without Part B coverage. If you have to pay a penalty for Part A, you’ll pay it for twice as long as you go without Part A coverage. Check when you can sign up based on your situation.

Is it mandatory to have Medicare Part B?

If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them. If you're not lawfully present in the U.S., Medicare won't pay for your Part A and Part B claims, and you can't enroll in a Medicare Advantage Plan or a Medicare drug plan.

What are the requirements for Medicare Part B?

Jun 11, 2019 · If you’re eligible for Medicare Part A and Part B, you might be enrolled automatically. If you’re getting Social Security (or Railroad Retirement Board) benefits when you turn 65, you’re typically enrolled without having to do anything. If you’re under 65 and get disability benefits, you may be enrolled in Medicare Part A and Part B automatically.

Who is eligible for Medicare Part B reimbursement?

In most cases, if someone does not enroll in Medicare Part B (Medical Insurance) when first eligible, they will have to pay a late enrollment penalty for as long as they have Part B. Understanding the Rules for People Age 65 or Older To be eligible for premium-free Part A on the basis of age: A person must be age 65 or older; and

Can you have Medicare Part A only?

What happens if I don't want Medicare Part B?

Can you have Medicare Part A without B?

Can I opt out of Medicare Part B at any time?

Are you automatically enrolled in Medicare if you are on Social Security?

How do you pay for Medicare Part B if you are not collecting Social Security?

What parts of Medicare are mandatory?

Why would Medicare Part A be inactive?

Can you opt out of Part A Medicare?

Do you have to enroll in Medicare Part B every year?

What is Medicare Part A?

Medicare Part A is hospital insurance. It may cover your care in certain situations, such as: You’re admitted to a hospital or mental hospital as an inpatient. You’re admitted to a skilled nursing facility and meet certain conditions. You qualify for hospice care.

Can you get hospice care with Medicare?

You qualify for hospice care. Your doctor orders home health care for you and you meet the Medicare criteria. Medicare Part A may cover part-time home health care for a limited time. Even when Medicare Part A covers your care: You may have to pay a deductible amount and/or coinsurance or copayment.

Does Medicare cover home health?

There may be some services you get in a hospital or other setting that Medicare doesn’t cover.

Do you have to pay Medicare Part A or B?

Although both Medicare Part A and Part B have monthly premiums, whether you’re likely to pay a premium – and how much – depends on the “part” of Medicare. Most people don’t have to pay a monthly premium for Medicare Part A. If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium.

How much does Medicare pay in 2019?

On the other hand, most people do pay a monthly premium for Medicare Part B. The standard premium in 2019 is $135.50, but you may pay more if your income is above a certain level. If you have a low income or no income, in some cases Medicaid might pay your Part B premium.

How many Medicare Supplement Plans are there?

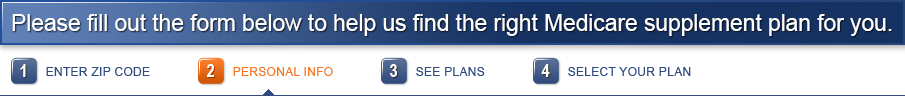

There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance. You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

What are preventive services?

Preventive services, like annual checkups and flu shots. Medical supplies and durable medical equipment, such as walkers and wheelchairs. Certain lab tests and screenings. Diabetes care, such as screenings, supplies, and a prevention program. Chemotherapy.

Do you have to pay Part A and Part B?

Also enroll in or already have Part B. To keep premium Part A, the person must continue to pay all monthly premiums and stay enrolled in Part B. This means that the person must pay both the premiums for Part B and premium Part A timely to keep this coverage. Premium Part A coverage begins prospectively, based on the enrollment period ...

What is Medicare Part A?

Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How long does Part A coverage last?

If the application is filed more than 6 months after turning age 65, Part A coverage will be retroactive for 6 months. NOTE: For an individual whose 65th birthday is on the first day of the month, Part A coverage begins on the first day of the month preceding their birth month.

When does Part A start?

NOTE: For an individual whose 65th birthday is on the first day of the month, Part A coverage begins on the first day of the month preceding their birth month. For example, if an individual's birthday is on December 1, Part A begins on November 1.

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

Do you have to pay a penalty if you don't get Part A?

NOTE: If you don’t get Part A and Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part A and Part B because you have coverage based on your (or your spouse’s) current employment.

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What is medically necessary?

Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What is preventive care?

Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best. You pay nothing for most preventive services if you get the services from a health care provider who accepts. assignment.

What happens if you don't get Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

When does Part B start?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B.

Do you pay late enrollment penalty for Part B?

And, the penalty increases the longer you go without Part B coverage. Usually, you don't pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period.

How many parts are there in Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D. 1 In general, the four Medicare parts cover different services, so it's essential that you understand the options so you can pick your Medicare coverage carefully.

What is Medicare Part A?

Medicare Part A: Hospital Insurance. Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1 .

How much is Medicare Part A?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1 .

What is the gap in Medicare?

Medicare prescription drug plans have a coverage gap—a temporary limit on what the drug plan will cover. The coverage gap is often called the "doughnut hole," and this gap kicks in after you and your plan have spent a certain amount in combined costs.

Does Part A cover hospice?

For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility. 7 . Additionally, if you're hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day's expenses.

How much is Part B insurance in 2021?

1 If you're on Social Security, this may be deducted from your monthly payment. 11 . The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021.