Do I qualify for a Medicare subsidy?

Those on Medicare with a low income may qualify for a subsidy to help cover the costs of medical care and medications. Even if you don’t qualify for Medicaid, you may be eligible for one of these programs.

Do I qualify for a low-income subsidy?

Some people may find theyre ineligible for Medicaid, yet still eligible for Low-Income Subsidy. If eligible for any of the below programs, you qualify for a Low-Income Subsidy: Otherwise, income and resource limits apply. If your income and resources are above the limits, but you think you may still qualify for a LIS, you should still apply.

What is the income limit to receive Medicare?

There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums.

Who is eligible for a partial premium subsidy?

The individual may be eligible for a partial premium subsidy if his or her income is greater than 135% of the FPL, but is less than 150% of the FPL. NOTE: If the individual’s income falls within this range, he or she is eligible for a partial premium subsidy whether the countable resources are $8,400 or less, or they are $14,010 or less.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is the lowest income to qualify for Medicare?

an individual monthly income of $4,379 or less. an individual resources limit of $4,000. a married couple monthly income of $5,892 or less. a married couple resources limit of $6,000.

How much money can you have in the bank if your on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. As of July 1, 2022 the asset limit for some Medi-Cal programs will go up to $130,000 for an individual and $195,000 for a couple. These programs include all the ones listed below except Supplemental Security Income (SSI).

Are Medicare benefits based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are the income limits for healthcare subsidies 2021?

Obamacare Subsidy EligibilityHousehold size100% of Federal Poverty level (2021)400% of Federal Poverty Level (2021)1$12,880$51,5202$17,420$69,6803$21,960$87,8404$26,500$106,0004 more rows•Jan 21, 2022

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

Can Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Does Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What assets are exempt from Medicare?

Other exempt assets include pre-paid burial and funeral expenses, an automobile, term life insurance, life insurance policies with a combined cash value limited to $1,500, household furnishings / appliances, and personal items, such as clothing and engagement / wedding rings.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

What income is included in MAGI for Medicare premiums?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn't include Supplemental Security Income (SSI).

What is the income limit for 2021?

Income limits are not yet released for 2021, but they are currently $19,140 for an individual and $25,860 for a married couple. There are levels of assistance you can receive from a LIS, depending on your need. You could qualify for partial assistance based on your assets. See the chart below for limits.

What is SSI in retirement?

Supplemental Security Income (SSI) In contrast to Social Security retirement benefits, SSI benefits are available to those with limited income and resources who are over 65, blind, or disabled. Social Security taxes do not fund SSI. Instead, its funding comes from U.S. Treasury general funds.

How long do you have to correct a Social Security claim?

Yet, if you’re denied, you’ll receive a Pre-Decisional Notice, explaining why you aren’t eligible. Then, you have ten days to correct the information. Social Security will send you a Notice of Award, explaining your level of coverage. If you don’t meet the qualifications, you’ll get a Notice of Denial.

Can you get medicaid if you don't qualify?

Even if you don’t qualify for Medicaid, you may be eligible for one of these programs . Although, if you do qualify for Medicaid, you’re automatically eligible for extra help.

Can I apply for medicaid online?

If you’re over 65, you cannot apply online. Instead, call the toll-free number for Social Security or visit your local Social Security office. If you’re eligible for SSI, you will likely be eligible for Medicaid in your state. Being Medicaid-eligible will qualify you to have your state pay your Medicare premiums.

Do you have to have Medicare to be eligible for Medicaid?

To be eligible you must have Medicare and a lower income . Assets must be below a certain amount as well. Some people may find they’re ineligible for Medicaid, yet still eligible for Low-Income Subsidy.

Does QI pay Part B?

Like the SLMB program, a QI program pays your Part B premium. However, the difference is that you can qualify for a QI program with a higher income, but you need to apply each year. You would have priority for these benefits if you received them the previous year.

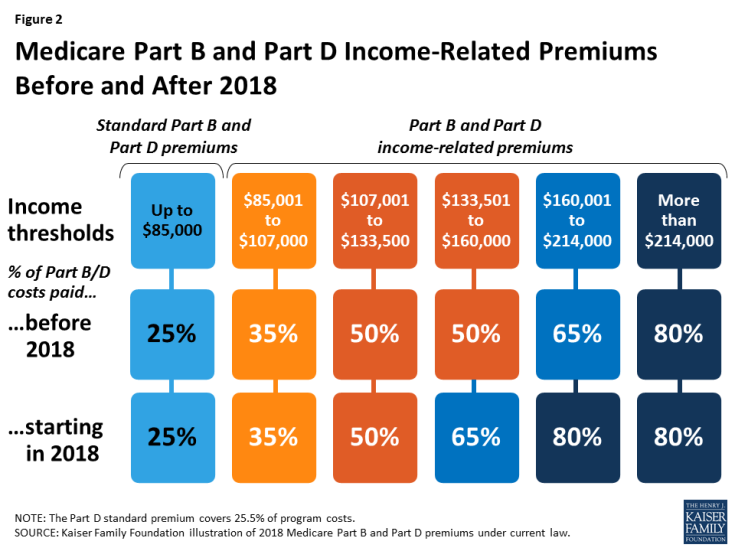

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

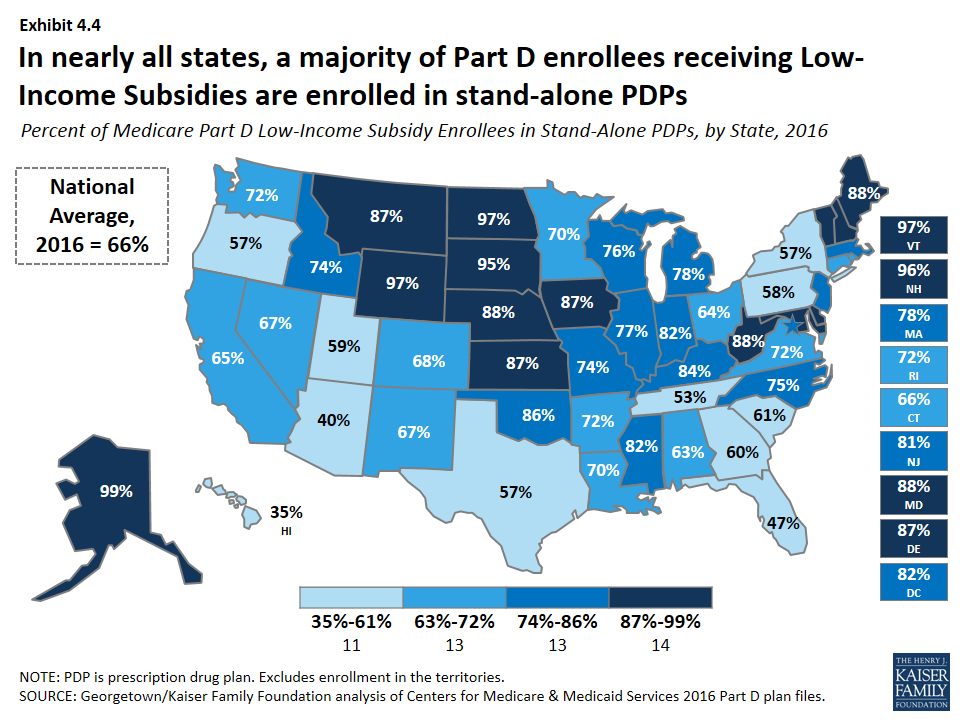

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

Medicaid

Medicaid is a joint federal/state program that helps with medical costs for some people with limited income and resources.

Medicare Savings Programs

State Medicare Savings Programs (MSP) programs help pay premiums, deductibles, coinsurance, copayments, prescription drug coverage costs.

PACE

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

Lower prescription costs

Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits.

Programs for people in U.S. territories

Programs in Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa, for people with limited income and resources.

Find your level of Extra Help (Part D)

Information for how to find your level of Extra Help for Medicare prescription drug coverage (Part D).

Insure Kids Now

The Children's Health Insurance Program (CHIP) provides free or low-cost health coverage for more than 7 million children up to age 19. CHIP covers U.S. citizens and eligible immigrants.

How much income is required to qualify for a 100 percent premium?

To be eligible for a full (100%) premium subsidy, the individual must have countable income less than, or equal to 135% of the FPL for the applicable State and family size.

How much of FPL is eligible for partial premium?

The individual may be eligible for a partial premium subsidy if his or her income is greater than 135% of the FPL, but is less than 150% of the FPL.

Can you file for a subsidy if you live with your spouse?

If the individual filing for a subsidy lives only with his or her spouse, base the income eligibility limit on the poverty level for a two-person family. This is true whether only the individual files, or both spouses file for subsidy.

Which states have separate poverty levels?

2. Separate levels for Alaska and Hawaii. One set of poverty levels apply to the 48 contiguous States and the District of Columbia. Alaska and Hawaii have separate and slightly higher poverty levels.

Do you count a relative as a member of the family for poverty?

If the subsidy applicant lives with a relative and provides that relative with at least one-half support, count the relative as a member of the family for purposes of determining the applicable poverty level. (We do not consider the relative’s income and resources in determining the subsidy.)

How long does Medicaid pay for stay?

Or, a copy of a state document showing Medicaid paid for your stay for at least a month. A print-out from your state’s Medicaid system showing you lived in the institution for at least a month. A document from your state that shows you have Medicaid and are getting home- and community-based services.

What are some examples of documents you can send to Medicare?

Examples of documents you can send your plan include: A purple notice from Medicare that says you automatically qualify for Extra Help. A yellow or green automatic enrollment notice from Medicare. An Extra Help "Notice of Award" from Social Security. An orange notice from Medicare that says your copayment amount will change next year.

How much does a prescription cost for 2021?

Make sure you pay no more than the LIS drug coverage cost limit. In 2021, prescription costs are no more than $3.70 for each generic/$9.20 for each brand-name covered drug for those enrolled in the program. Contact Medicare so we can get confirmation that you qualify, if it's available.

What does the Affordable Care Act cover?

The Affordable Care Act aims to make healthcare coverage more accessible in several ways:

How does my income affect what I pay for coverage?

The ACA provides savings for low-income and moderate-income individuals and families. Generally, the less money you make, the more financial help you will receive under the law.

How does the ACA make individual health insurance more affordable?

Placing certain limits on what insurance providers can charge consumers. Insurers are prohibited from charging consumers higher premiums because they have a pre-existing condition such as cancer or diabetes.

How do I enroll in the ACA?

Use the Find Local Help tool to locate in-person assistance in your area with a navigator as well as with an agent or broker. All of them are trained to walk you through the marketplace process, and services are free.

The bottom line

The Affordable Care Act offers health insurance options for people who don’t have access to job-based insurance and may not qualify for Medicaid. The ACA now offers most enrollees premium subsidies that reduce monthly healthcare costs. Initially, your premium tax credit will be based on your estimated income for the coverage year.