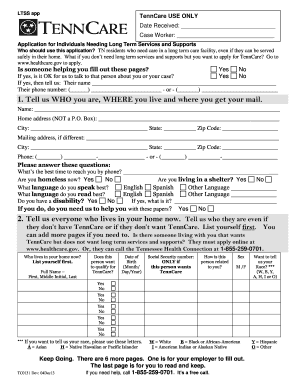

Examples of documentation that may be required for your MSP application include:

- Your Social Security card

- Your Medicare card

- Your birth certificate, passport, or green card

- Proof of your address (e.g., electric or phone bill)

- Proof of your income (e.g., Social Security Administration award letter, income tax return, pay stub)

- Information about your assets (e.g., bank statements, stock certificates, life insurance policies) Contact your local Medicaid office to find out how to fill out an application and which documents you ...

- Reside in a state or the District of Columbia.

- Are age 65 or older.

- Receive Social Security Disability benefits.

- People with certain disabilities or permanent kidney failure (even if under age 65).

- Meet standard income and resource requirements.

How do I qualify for Medicare savings programs?

Your income must be at or below specified limits each month. Your household resources must also be at or below certain limits. If you qualify for one or more of the Medicare savings programs, you may also qualify for the Extra Help program to help with your prescription drug costs. What are Medicare savings programs?

What is a Medicare savings program?

Medicare savings programs help people with lower income pay their Medicare Part A and Part B premiums, deductibles, copays, and coinsurance. To qualify, your monthly income must be at or below a certain limit for each program, and your household resources cannot exceed certain limits.

What are the monthly income limits for Medicare savings programs?

2021 Monthly Income Limits for Medicare Savings Programs Medicare Savings Program Monthly Income Limits for Individual Monthly Income Limits for Married Couple QMB $1,084 $1,457 SLMB $1,296 $1,744 QI $1,456 $1,960 3 more rows ...

How do I qualify for an MSP?

To qualify for an MSP, you first need to be eligible for Part A. Your monthly income must also be below the limits listed in the following chart. In addition to the income limits, you must have limited resources to qualify for an MSP. What Are Countable Resources for Medicare Savings Programs?

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How much money can you have in the bank if your on Medicare?

4. How to Qualify. To find out if you qualify for one of Medi-Cal's programs, look at your countable asset levels. As of July 1, 2022, you may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member.

Is Medicare eligibility based on assets?

Older People with Low Incomes Generally Have Few Assets In determining eligibility for Medicaid and the Medicare Savings Programs, countable assets include items such as money in checking or savings ac- counts, bonds, stocks, or mutual funds.

How much money can you make before it affects your Medicare?

Summary: There is no income limit for Medicare. But there is a threshold where you might have to pay more for your Medicare coverage. In 2022,Medicare beneficiaries with a modified adjusted gross income above $91,000 may have an income-related monthly adjustment (IRMAA) added to their Medicare Part B premiums.

Does Medicare look into your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

What assets are exempt from Medicare?

Other exempt assets include pre-paid burial and funeral expenses, an automobile, term life insurance, life insurance policies with a combined cash value limited to $1,500, household furnishings / appliances, and personal items, such as clothing and engagement / wedding rings.

What are asset limits?

There is a limit to the amount of total assets an applicant household may have and still remain eligible for affordable housing. Household assets include financial assets such as savings accounts, checking accounts, trusts, investment assets (stocks, bonds, etc.), cash savings, miscellaneous investment holdings, etc.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

What is considered an asset for medical?

Medi-Cal limits seniors and people with disabilities to assets of no more than $2,000 for individuals and $3,000 for couples — a restriction that has not changed since 1989. Assets include cash on hand, money in a checking or savings account, a second car, and other resources.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What documents are needed to apply for Medicare?

Before you begin applying, gather supporting documents such as your Social Security and Medicare cards, proof of your address and citizenship, bank statements, IRA or 401k statements, tax returns, Social Security awards statements, and Medicare notices.

What can Medicare save you?

Medicare savings programs can help you pay Part A and Part B premiums, deductibles, copays, and coinsurance.

Why were Medicare and Coinsurance created?

These programs were created because not everyone reaches retirement age with the same ability to handle expenses like Medicare premiums, copays, coinsurance, deductibles, and the cost of prescription drugs.

What to do if medicaid denies application?

If Medicaid denies your application, you may be able to file an appeal. Here are some steps you can take to apply for a Medicare savings program: Familiarize yourself with the kinds of questions you may be asked when you apply. The form is available in multiple languages.

How to apply for medicaid?

To apply for the a program, you’ll need to contact your state Medicaid office. You can check online to find your state’s office locations, or call Medicare at 800-MEDICARE. Once you submit your application, you should receive a confirmation or denial within about 45 days. If you’re denied, you can request an appeal.

How many people will be 65 in 2034?

In 2018, the U.S. Census Bureau predicted that by 2034, 77 million Americans will be 65 years or older. Yet some stark disparities in retirement income exist between racial and ethnic groups in the United States.

Can you bill Medicare for QMB?

Other facts to know about Medicare savings programs. Healthcare providers may not bill you. If you are in the QMB program, your healthcare providers aren’ t allowed to bill you for the care you receive — Medicaid will pay them directly. If you are wrongly billed for a healthcare service, make sure the doctor knows you’re in the QMB program.

Who Qualifies for a Medicare Savings Program?

To qualify for an MSP, you first need to be eligible for Part A. For those who don’t qualify for full Medicaid benefits, your monthly income must also be below the limits in the following chart.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

Can you get financial assistance if you are on a fixed income?

If you’re also on a fixed income, you could qualify for financial assistance with the high cost of health care. A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

What is the monthly income for Medicare?

If your monthly income is below $1630 (or below $2198 if married) you may qualify for several Medicare cost-savings benefit programs. The following information will help us determine which programs you might be eligible for.

How to apply for MSP?

Before applying for an MSP, you should call your local Medicaid office for application steps, submission information (online, mail, appointment, or through community health centers and other organizations), and other state-specific guidelines. Call your State Health Insurance Assistance Program (SHIP) to find out if you are eligible for an MSP in your state.

How long does it take to get a copy of my medicaid application?

If you are at a Medicaid office, ask that they make a copy for you. You should be sent a Notice of Action within 45 days of filing an application. This notice will inform you of your application status.

How long does it take to get a notice of action from Medicaid?

If you do not receive a Notice of Action within 45 days, contact the Medicaid office where you applied.

What to do if you are denied an MSP?

If you receive a denial and are told you do not qualify for an MSP, you have the right to request a fair hearing to challenge the decision.

What are Medicare Savings Programs?

These are Medicaid-administered benefits that help cover Medicare premiums and out-of-pocket costs, such as deductibles and coinsurance . Who qualifies for Medicare Savings Programs? MSPs are available for Medicare beneficiaries with limited incomes and resources who do not qualify to be fully enrolled in Medicaid. Participants must meet certain income and resource levels and have Medicare Part A to qualify. If requirements are met, Medicare and state Medicaid programs work together to provide assistance through Medicare Savings Programs.

What is Extra Help from Medicare?

Extra Help is a federal program that helps people with limited income and resources pay for their Part D premiums and drug costs. What exactly does Extra Help with Medicare cover? Most people who qualify will pay:

How do I apply for a Medicare Savings Program?

If you have or are eligible for Part A, your income for 2020 is at or below the income limits for any of the programs above, and you have limited resources below the limits above, you should call your state Medicaid program to see if you qualify in the state you reside.

What are the resources included in Medicare?

Countable resources included in the Medicare Savings Program resource limits are money in a checking or savings account, stocks, and bonds.

What if I am not eligible for Medicaid?

If you don’t qualify for Medicaid, Benefits.gov wants you to know you still have options. Since 2002, Benefits.gov has provided millions of citizens with information on over 1,000 government benefits. Fill out our Benefit Finder questionnaire to find out what other benefits you may be eligible to receive. While we don’t accept benefit applications on Benefits.gov, we can help you find where to apply.

What are countable resources in Medicare?

Countable resources included in the Medicare Savings Program resource limits are money in a checking or savings account, stocks, and bonds. Items not included in countable resources are your home, one car, burial plot, up to $1,500 for burial expenses, furniture, and personal items.

What are the requirements for MSP?

Below are general requirements for the MSP: Reside in a state or the District of Columbia. Are age 65 or older. Receive Social Security Disability benefits. People with certain disabilities or permanent kidney failure (even if under age 65). Meet standard income and resource requirements.

How much does Social Security pay for prescription drugs?

This benefit helps pay for prescription drugs and is estimated by the Social Security Administration to have an annual value of $4,900. If you get Extra Help but you’re not sure if you're paying the right amount, call your drug plan.

What are the criteria for Medicaid?

Medicaid limits enrollment to individuals who meet the following criteria: is aged years, is working, and has a disability. returned to work and lost the premium-free Part A. is not getting state medical assistance. meets the resources and income limits.

What are the eligibility criteria for MSP?

To receive MSP benefits individuals must meet the following eligibility criteria: have or be eligible for Medicare Part A. live in the state where they are applying for the QMB program. have limited income, savings, and resources.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is SLMB in Medicare?

The SLMB program helps people who are enrolled in Medicare Part A to pay for their Medicare Part B premiums. They must also have limited resources and income. The program does not help with any other costs, such as copays or deductibles.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How many MSPs are there?

In this article, we discuss the four MSPs, eligibility, and enrollment. Finally, we look at the Extra Help program.

Does Medicare Part B cover premiums?

It covers the cost of Medicare Part B premiums for people who are enrolled in Medicare Part A and have limited resources and income. Medicare allocates the benefits on a first-come-first-served basis. People must reapply annually, and a person who was in a program the previous year is given priority.

What Is the Income Limit for the Medicare Savings Program?

These limits get adjusted each year. For 2021, the Medicare Savings Program income and resource limit s are:

How Much Money Can You Have in the Bank on Medicare?

Money in bank accounts is considered a resource when determining whether you’re eligible for a Medicare Savings Plan. This amount changes depending on which Medicare Savings Program you qualify for. Just like with income limits, your state may accept your application if your resources are higher than the limits allowed. To see if you are eligible, contact your local SHIP.

What is a QMB on Social Security?

If qualified, you will no longer have this premium amount deducted from your Social Security benefit. Qualified Medicare Beneficiary ( QMB): Pays for Medicare Part A premium for people who do not have enough work history to get premium free Part A. QMB also pays the Part B premium, deductibles and coinsurances.

What is the MSP program?

Medicare Savings Program (MSP) The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.