...

2015 Social Security and Medicare Tax Withholding Rates and Limits.

What are the Social Security tax withholding amounts for 2015?

5 rows · Jan 01, 2015 · For 2015, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, ...

What is the maximum earned income credit amount for 2015?

6.2 percent. For 2015, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, and Disability Insurance) Tax is $118,500.00. The maximum limit is changed from …

What is the income limit for itemized deductions for 2015?

Apr 21, 2022 · Both you and your employer pay the Medicare Tax as a part of FICA. Your total FICA taxes equal 15.3 percent of your wages — 2.9 percent for Medicare and 12.4 percent for …

What is the FICA rate for 2015?

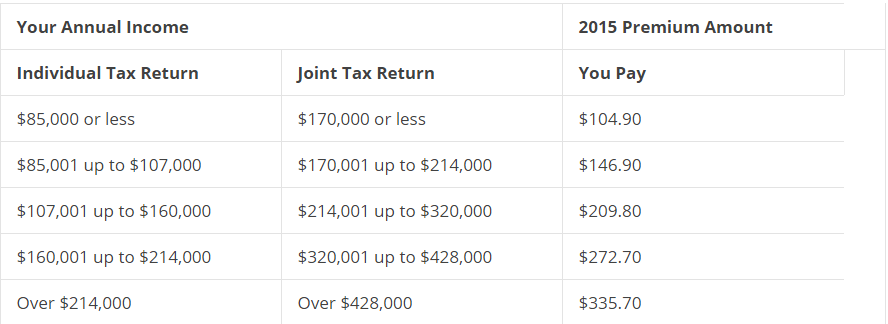

For a single taxpayer in 2015, this ranges from 10% of your first $9,225 in taxable income to 39.6% of earnings in excess of $413,200. Medicare taxes make for an even clearer analogy. Together ...

What was the Medicare tax rate in 2015?

What is the Medicare tax and maximum?

...

2020 Social Security and Medicare Tax Withholding Rates and Limits.

| Tax | 2019 Limit | 2020 Limit |

|---|---|---|

| Medicare liability | No limit | No limit |

Is there a cap on Medicare tax?

What was the Medicare tax rate in 2016?

What is the Medicare tax limit for 2021?

What is the Medicare limit for 2021?

For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.Oct 15, 2020

What is the max yearly Social Security tax?

What is the max Medicare tax for 2022?

For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.

How is Medicare tax calculated?

What is the 2016 Medicare tax rate This rate is applied to what maximum level of salary and wages?

...

2016 Payroll Tax Unchanged; Tax Brackets Nudge Up.

| 2016 Tax Rates: Married Filing Joint Return | |

|---|---|

| If Taxable Income Is: | The Tax Rate Is: |

| Over $466,950 | $130,578.50 plus 39.6% of the excess over $466,950 |

What percentage is Medicare tax?

What is the payroll tax in 2016?

| Tax | Maximum Earnings | Rate |

|---|---|---|

| Social Security Tax | $118,500.00 | 6.20% for the employee and 6.2% for employer |

| Medicare | Unlimited | 1.45% for employee and employer |

| over $200,000 | Additional 0.9% for the part in excess of $200,000 in a calendar year. Employee only. |

What was the maximum Social Security tax in 2015?

This increase meant that the maximum Social Security tax that is payable by an employee in 2015 will be $7,347.00 – which is an increase of $93.00 from the 2014 maximum tax of $7,254.00. Employers will match the employee’s tax.

What is the tax rate for Medicare?

Depending on the amount of a person’s total taxable wages, the combined amount of his or her Medicare and Social Security tax rate would range anywhere between 7.65 percent (6.2 percent + 1.45 percent) to 8.55 percent (6.2 percent + 1.45 percent + 0.9 percent) on Medicare wages that are over $200,000 per year. The combined employer tax rate remains at 7.65 percent.

What is the Medicare tax rate for 200,000?

For the purpose of withholding, covered wages that are over $200,000 per year are taxed at a total rate of 2.35 percent (1.45 percent + 0.9 percent), regardless of a taxpayer’s filing status. The amount of the additional Medicare tax is not matched by an individual’s employer.

Is there a maximum amount of Medicare contributions for 2015?

Therefore, there is no maximum employee or employer contribution amount for Medicare tax for 2015. All covered wages will be subject to Medicare tax at a rate of 1.45 percent. Employers will match the employee’s tax.

Is Medicare tax paid in excess of threshold?

All wages that are currently subject to the Medicare Tax are subject to the Additional Medicare Tax, if they are paid in excess of the applicable threshold for an individual’s filing status. Also, all Railroad Retirement Tax Act compensation that is currently subject to Medicare Tax is also subject to the Additional Medicare Tax if it is paid in excess to the applicable threshold for an individual’s filing status.

What was the maximum Social Security tax liability for 2015?

You get this by multiplying $117,000 (the 2014 taxable maximum) by 6.2% (an employee's share of Social Security taxes). For 2015, the figure is $7,347 ($118,500 times 6.2%).

How much Social Security do self employed people pay in 2015?

In the case of Social Security, that amounts to a 12.4% rate. Thus, for self-employed people, the limit for 2015 is exactly double the limit for non-self-employed people: $14,694.

When did the maximum taxable income increase?

The maximum taxable income has increased almost every year since the early 1970s. The one notable exception was the period from 2009 through 2011, when the threshold held constant at $106,800 in the immediate wake of the financial crisis.

Is income tax capped in 2015?

The silver lining, as I pointed out at the beginning, is that things could be worse. Take income taxes as an example. Not only are income taxes not capped, but they eat up a progressively larger share of your earnings as your income increases. For a single taxpayer in 2015, this ranges from 10% of your first $9,225 in taxable income to 39.6% of earnings in excess of $413,200.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

How many people will pay Social Security taxes in 2015?

Of the estimated 168 million workers who will pay Social Security taxes in 2015, about 10 million will pay higher taxes because of the increase in the taxable maximum, the SSA said. Social Security and Medicare payroll withholding are collected together as the Federal Insurance Contributions Act (FICA) tax.

How much is Medicare tax?

For most Americans, the Medicare portion of the FICA tax remains at 2.9 percent, of which half ( 1.45 percent) is paid by employees and half by employers. Unlike Social Security, there is no limit on the amount of earnings (which includes salary and bonus income) subject to the Medicare portion of the tax. This results, for most American wage ...

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings.

What is the FICA tax rate?

This results, for most American wage earners, in a total FICA tax of 15.3 percent (Social Security plus Medicare), half of which is paid by employees and half by employers. Again, self-employed individuals are responsible for the entire FICA tax rate of 15.3 percent (12.4 percent Social Security plus 2.9 percent Medicare).

What percentage of Medicare is employer paid?

The Additional Medicare Tax raises the wage earner’s portion on compensation above the threshold amounts to 2.35 percent; the employer-paid portion of the Medicare tax on these amounts remains at 1.45 percent.

Will Social Security increase in 2016?

On Oct. 15, 2015, the Social Security Administration announced that there will be no increase in monthly Social Security benefit payments in 2016, and that the amount of wages subject to Social Security taxes will also remain unchanged at $118,500 in 2016. See the SHRM Online article Social Security Payroll Tax Threshold Unchanged for 2016.

Is NIIT payroll tax?

Although it is not a payroll tax, HR professionals also should be aware of the net investment income tax ( NIIT) that high earners must pay when they file their income tax returns. This tax consists of a 3.8 percent surtax on investment income, including capital gains, to be paid by those with modified adjusted gross income above $200,000 (single filers) or $250,000 (joint filers).

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the surtax rate for 2021?

The additional tax (0.9% in 2021) is the sole responsibility of the employee and is not split between the employee and employer. If you make more than $200,000 per year in 2021, the 0.9 percent surtax only applies to the amount you make that is over $200,000.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What are the taxes that are withheld from paychecks?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax.

When was the Affordable Care Act passed?

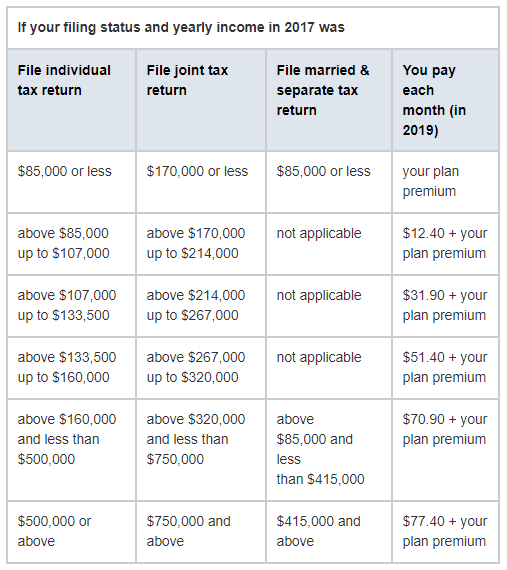

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who can help with Medicare enrollment?

If you’d like more information about Medicare, including your Medicare enrollment options, a licensed insurance agent can help.