Full Answer

What is the Medicare Part a deductible for 2016?

The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. The Part A deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What are the Social Security and Medicare tax withholding rates for 2016?

2016 Social Security and Medicare Tax Withholding Rates and Limits. For 2016, the maximum limit on earnings for withholding of Social Security (Old-Age, Survivors, and Disability Insurance) Tax remains $118,500.00.

What is the FICA tax rate for 2016?

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2016 (or 8.55 percent for taxable wages paid in excess of the applicable threshold). The information in the following table shows no change in Social Security and Medicare withholding limits from 2015 to 2016.

Will the Part B deductible increase in 2016?

Thus, changes to the calculation of the standard Part B premium made in the Bipartisan Budget Act of 2015 also affected the deductible. The annual Part B deductible will be $166 in 2016, increasing by $19 over the 2015 amount of $147 (Figure 5).

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

How much of your Medicare plan is covered by generic drugs?

While in the coverage gap, you may have to pay: 45% of your plan’s cost for covered brand-name drugs. 58% of your plan’s cost for covered generic drugs. To learn more about your Medicare plan options, you can call one of eHealth’s licensed insurance agents by calling the number shown below.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How much is coinsurance for 61 days?

Coinsurance for days 61 to 90: $322 per day. Coinsurance for days 91 and beyond: $644 per day. Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period.

Is there a penalty for late enrollment in Medicare Part A?

Note that beneficiaries who delay enrollment in Medicare Part A after they first become eligible may be subject to a late-enrollment penalty in the form of a higher premium. Medicare Part B has an annual deductible ($166 in 2016).

What is the maximum Social Security tax for 2016?

The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2016 is $7,347.00. There is no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax.

What is the FICA tax rate for 2016?

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2016 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

When did Medicare withholding change?

Note: The Patient Protection and Affordable Care Act signed into law March 23, 2010, created the “additional Medicare Tax” that changed Medicare withholding computations effective January 1, 2013. All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of ...

Is Medicare taxed on self employment?

All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of the applicable threshold are subject to the additional Medicare Tax.

What is the Medicare surcharge for 2016?

Higher-income Medicare beneficiaries, with a modified adjusted gross income greater than $85,000 for individuals and $170,000 for couples in 2016, who are required to pay an income-related surcharge in addition to the standard monthly Part B premium amount.

What was the impact of the Bipartisan Budget Act of 2015 on Medicare?

The Bipartisan Budget Act of 2015 averted an unprecedented increase in the 2016 Medicare Part B premium for the 30 percent of Part B enrollees who would have otherwise have faced a 52 percent increase in their premiums. It also reduced the level of increase in the Part B deductible that would have affected virtually all beneficiaries in traditional ...

How much does Medicare pay for Part B?

Most beneficiaries pay the standard premium amount, while higher-income Part B enrollees pay a greater share of costs, ranging from 35 percent to 80 percent, depending on their income, and state Medicaid programs pay the premium on behalf of beneficiaries who are dually eligible for Medicare and Medicaid.

Can a COLA increase Medicare Part B?

In a year where the Social Security COLA is insufficient to cover the amount of the Medicare Part B premium increase for an individual, the law prohibits an increase in the Part B premium that would result in a reduction in that individual’s monthly Social Security benefits from one year to the next. (For an example of how the hold-harmless ...

Will Medicare Part B increase in 2016?

Because people who are new to Medicare in 2016 have not been paying Part B premiums in 2015, the increase in the Part B premium cannot result in a decrease in their Social Security benefits in 2016. This group includes people reaching age 65 in 2016 who enroll in Medicare Part B, and people who worked beyond age 65 and sign up for Part B in 2016.

Does Medicare Advantage cover coinsurance?

An exception is Medicare Advantage enrollees, who typically pay the Part B premium but may not face the same cost-sharing requirements for Medicare-covered services as beneficiaries in traditional Medicare, including deductibles and coinsurance or cost sharing.

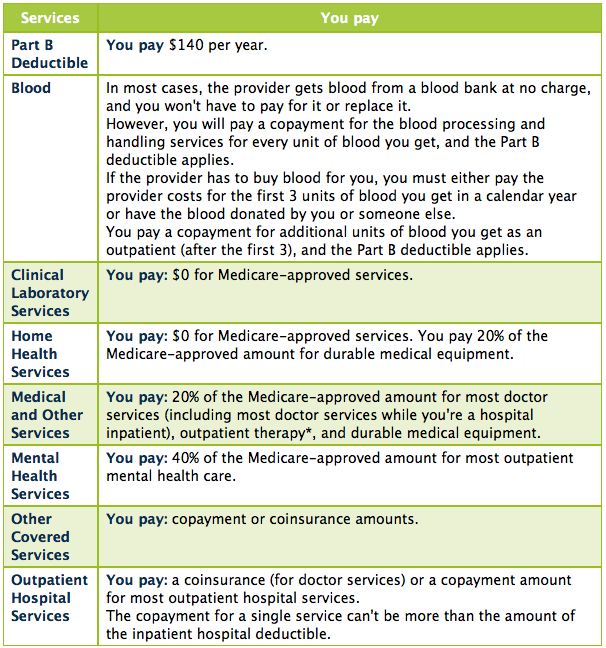

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is the maximum amount you can deduct on a 1040?

You generally can deduct only the part of your medical and dental expenses that exceeds 10% of the amount on Form 1040, line 38. However, if either you or your spouse was born before January 2, 1952, you can deduct the part of your

What line do you have to check to deduct state and local taxes?

If you elect to deduct state and local in-come taxes, you must check box a on line 5. Include on this line the state and local income taxes listed next.

Can you deduct medical insurance premiums?

To the extent you weren't reimbursed, you can deduct what you paid for:Insurance premiums for medical and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status.

Wage Base Limits

Only the social security tax has a wage base limit. The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2022, this base is $147,000. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Is Medicare a part of self employment?

Medicare as Part of the Self-Employment Tax. You'll take something of a double hit on the Medicare tax if you're self-employed. You must pay both halves of the tax because you're the employee and the employer.