How much is Medicare Part B annual deductible?

Nov 10, 2016 · CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part …

Does Medicare Part B have a deductible?

7 rows · In 2017, the annual Medicare Part B deductible is $183. Once you have met your deductible, you ...

What is the current deductible for Medicare Part B?

2017 Medicare Part B Deductible CMS announced that the annual deductible for all Part B beneficiaries will be $183 in 2017, an increase of $17 from the 2016 Part B annual deductible of $166. How Much Does Medicare Part B Coverage Cost? You pay the Medicare Part B premium each month. Most people will pay up to the standard premium amount.

How high will the Medicare Part B deductible get?

Nov 17, 2016 · In response, Congress acted to reduce the increase in premiums for those not held harmless to the level that premiums would have gone up had the hold harmless provision not gone into effect. In addition to the updated premium amounts, CMS announced an increase in the Medicare Part B annual deductible, from $166 in 2016 to $183 in 2017.

What is Medicare Part B annual deductible?

The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What is the annual deductible for Medicare Part B for 2018?

$183 for 2018The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

What is the 2016 Medicare Part B deductible?

($166 in 2016)Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What is the Medicare Part B deductible for 2021?

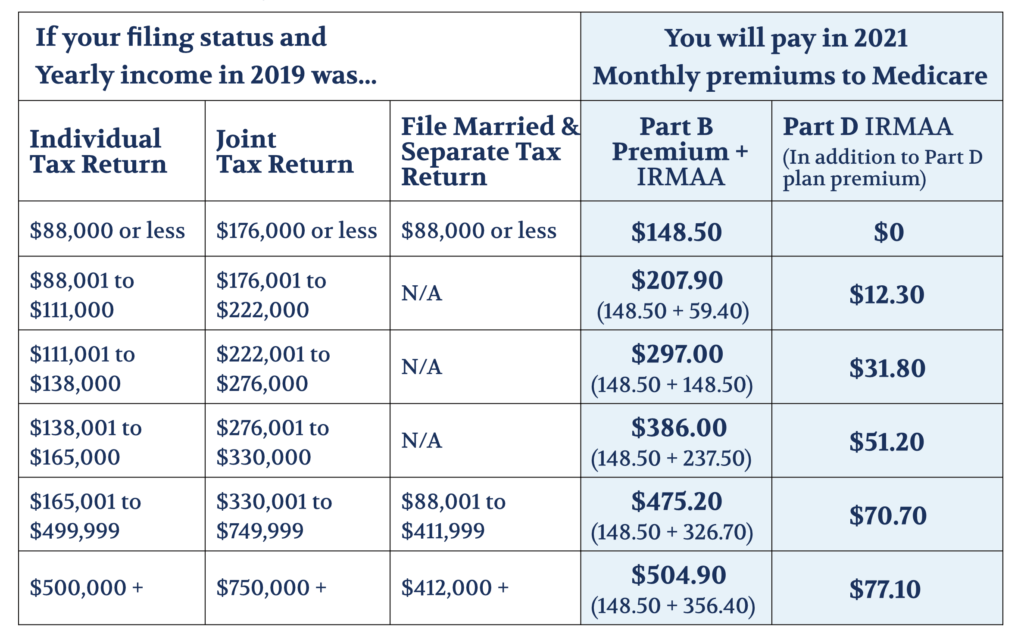

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the Medicare tax rate for 2017?

1.45%Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings....2017 Payroll Taxes Will Hit Higher Incomes.Tax Rate2017 Taxable Income2016 Taxable Income39.6%$235,351+233,476+6 more rows•Oct 19, 2016

What is the Irmaa for 2017?

If Your Yearly Income Is2017 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$53.50$107,001 - $160,000$214,000 - $320,000$133.90$160,001 - $214,000$320,000 - $428,000$214.303 more rows•Jul 31, 2016

What was Medicare Part B premium in 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.Oct 10, 2014

What is the Medicare Part B deductible for 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.Nov 8, 2019

What were Medicare premiums in 2018?

The average basic premium for a Medicare prescription drug plan in 2018 is projected to decline to an estimated $33.50 per month. This represents a decrease of approximately $1.20 below the average basic premium of $34.70 in 2017.Nov 17, 2017

What is the Part B deductible for 2019?

$185 in 2019The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018.Oct 12, 2018

Understanding the Factors that Will Impact Your Medicare Part B Deductible 2017

Original Medicare, the program funded by the Federal Government to help seniors and the disabled obtain affordable health covered California office near me, is comprised of two parts: Medicare Part and Part B. Medicare Part A covers the cost of inpatient care, such as treatments provided in a hospital or a skilled nursing facility.

Medicare Deductible 2017 for Part B

In 2017, the annual Medicare Part B deductible is $183. Once you have met your deductible, you will typically pay 20 percent of the Medicare-approved amount for covered services, such as non-routine physician exams, outpatient therapy, and DME.

Medicare Premiums 2017 for Part B

Medicare Part B premiums are income-based. The standard Medicare Part B premium you’ll pay monthly, if eligible, in 2017 is $134, or up to $1,608 per year. Note, this premium cost may be higher depending on your income. Most Americans receiving Social Security benefits, however, will pay less.

Will I Qualify for Standard Part B Premiums in 2017?

The exact amount of annual premium payments you’ll pay for Part B will be determined by the Social Security Administration, if you are eligible. You may qualify to pay the standard premium amount, or a higher amount, if any of the following scenarios pertain to you:

What is the Medicare Part B deductible for 2017?

2017 Medicare Part B (Medical) Monthly Premium & Deductible. CMS announced that the annual deductible for all Part B beneficiaries will be $183 in 2017, an increase of $17 from the 2016 Part B annual deductible of $166.

How much does Medicare Part D cost?

The 2017 Part D plan premiums range from $12 to $179.

How much does a Part A premium go up?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. Read more under Medicare Part A Special Enrollment Period.

What happens if you don't get Part A?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up.

How long do you have to pay for Part A?

For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period.

Do you pay late enrollment penalty?

Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a special enrollment period. Example: Mr. Smith’s initial enrollment period ended September 30, 2013. He waited to sign up for Part B until the General Enrollment Period in March 2016.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the "hold harmless" provision are: those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2017, dual eligible beneficiaries who have their premiums paid by Medicaid, and.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much does it cost to treat a broken arm?

If you refer back to your broken arm example. Say your treatment cost you $80. If you broke your arm before you reached your Part B deductible amount of $198, you’d have to pay the full $80 for your care or whichever amount you had left to hit your $198 cap.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What is Medicare Part B?

You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019. After you have paid $185 out of your own pocket, your Part B coverage will kick in. Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care.

What is the Part B premium?

The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What does it mean when a provider accepts Medicare?

When a health care provider accepts Medicare assignment, it means they have agreed to accept the Medicare-approved amount as full payment. When a provider does not accept assignment, it means they will still treat Medicare patients, but they do not accept the Medicare-approved amount as full payment .

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...