Are Medicare premiums deducted from Social Security payments?

Oct 12, 2018 · The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and …

Is there a deductible for Medicare Part A?

Nov 09, 2018 · For 2019, the Medicare Part B deductible is $185. This is an amount you pay once per year. Some Medigap plans will cover the Part B (medical insurance) deductible, but if they don’t, you will have to pay this amount. For Part A (hospital insurance), the deductible is $1,364 per benefit period.

Is Medicare Part B deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care. Getting Help Paying Deductibles. There are a few ways you can go about avoiding having to pay the deductibles for Part A or Part B. We’ve outlined them below. Medicare Supplements

What is Medicare deductible?

May 15, 2019 · Medicare Part B also employs a deductible. Unlike Part A, Part B has an annual deductible. In 2019, the annual Part B deductible is $185. That means you’re responsible for non-inpatient bills up to that amount. After you reach that deductible threshold, Medicare takes responsibility for 80% of non-inpatient costs. You cover the balance.

What is the Medicare deductible for 2019?

A deductible is the money you will pay before your benefits kick in. For 2019, the Medicare Part B deductible is $185. This is an amount you pay once per year. Some Medigap plans will cover the Part B (medical insurance) deductible, but if they don’t, you will have to pay this amount.

How much is catastrophic coverage in 2019?

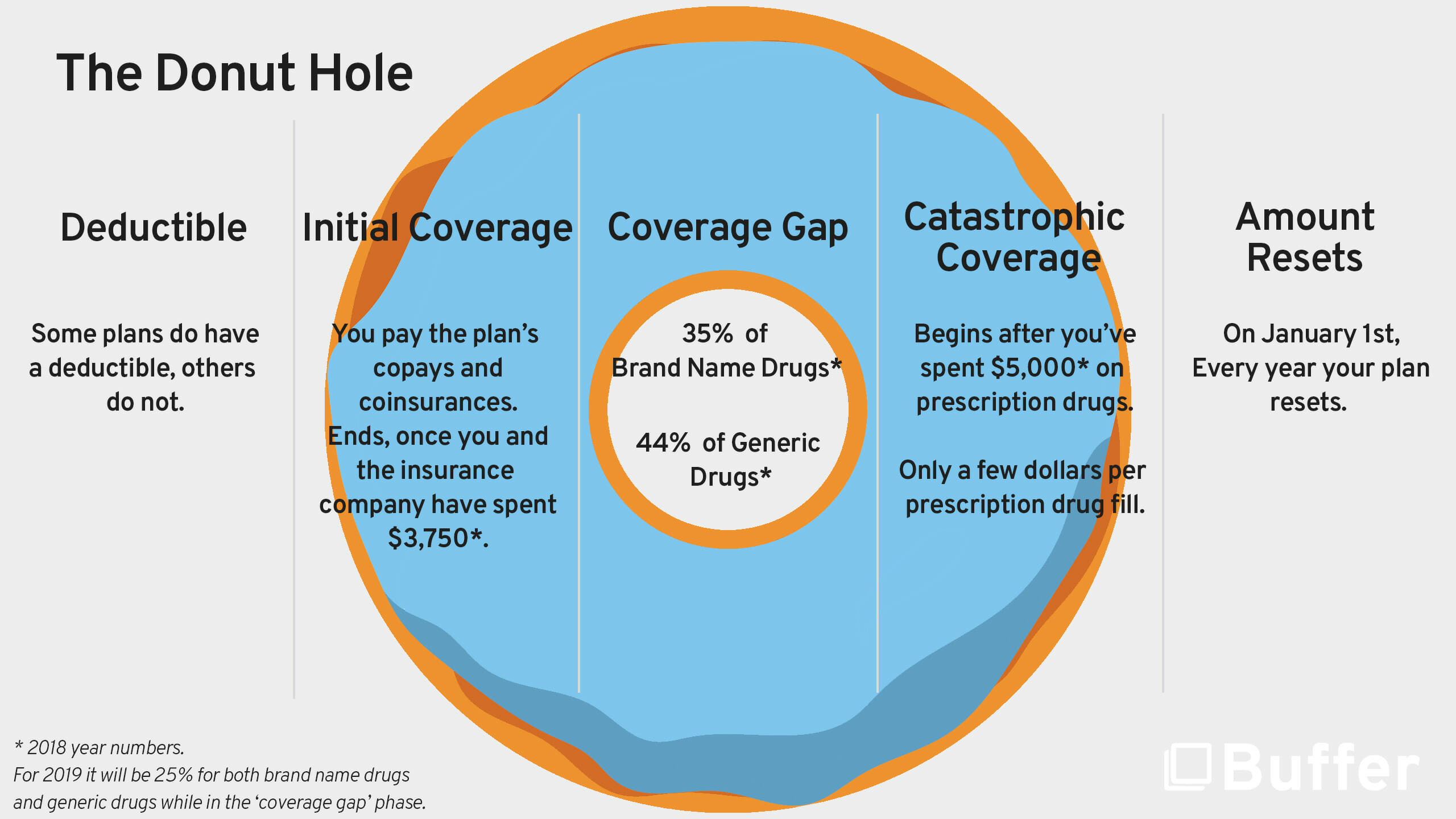

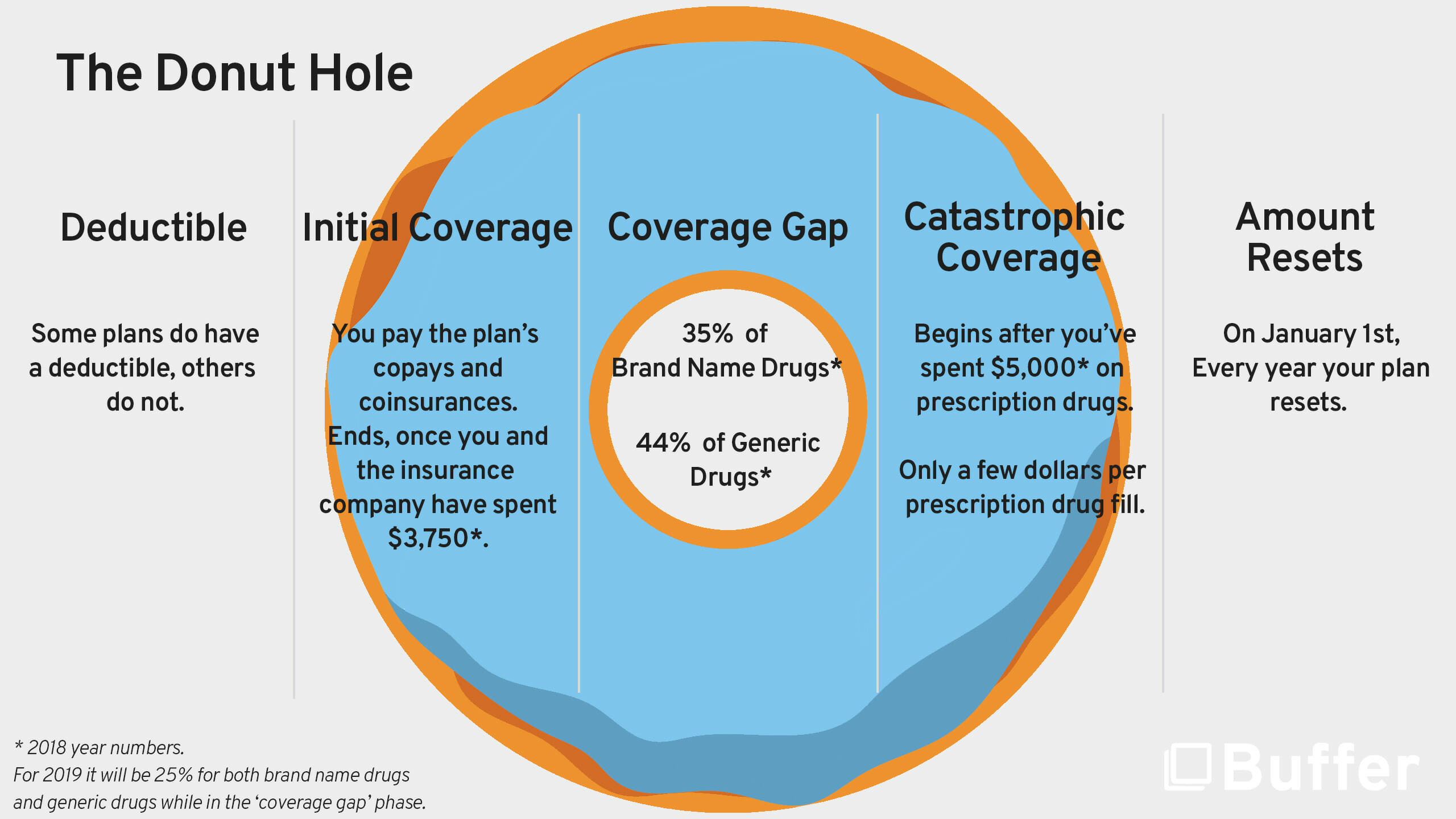

Catastrophic coverage in Part D for 2019 – $5,100. Once you have paid $5,100 in medications, your costs for medications will be $3.40 per generic drug, and $8.50 or 5% (whichever is greater) per brand-name drug.

What is the maximum out of pocket limit for Medicare?

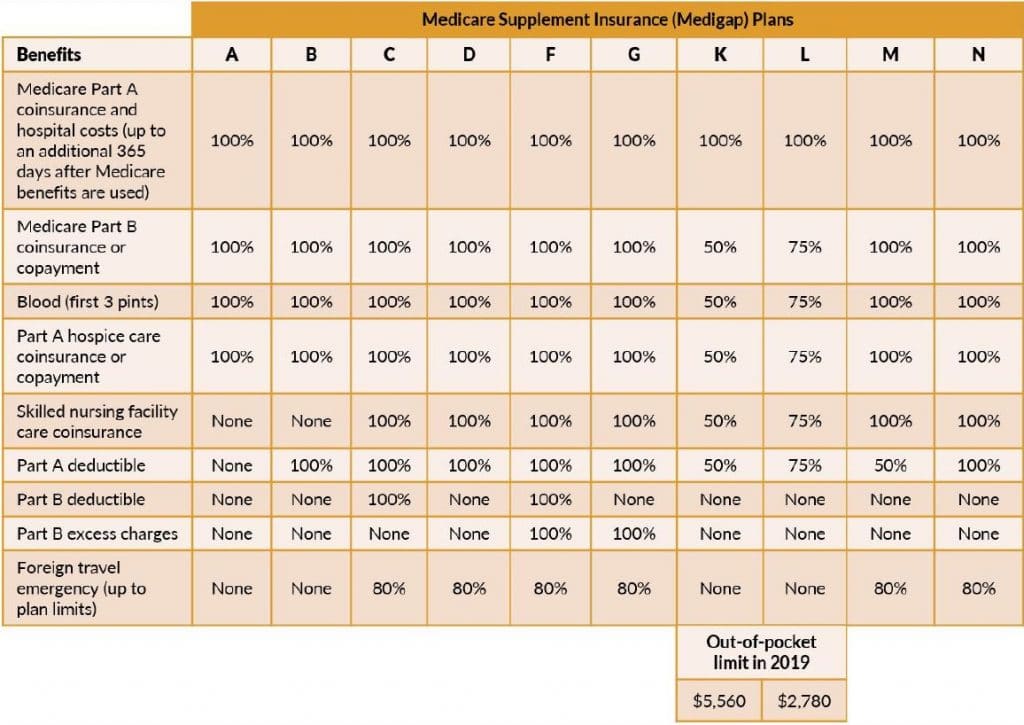

The maximum out-of-pocket limit is the dollar amount beyond which your plan will pay for 100% of healthcare costs. Copayments and coinsurance go toward this limit, but monthly premiums don’t. Here are the details on maximum out-of-pocket limits: 1 Original Medicare – no out-of-pocket limit. 2 Medigap plans – help to pay Part A and B deductibles and coinsurance so that your out-of-pocket costs don’t get too high. 3 Medicare Advantage plans – most have an out-of-pocket maximum of $6,700 (may differ by plan but can’t be higher than $6,700).

How much does Medicare pay for coinsurance?

For example, under Medicare Part B, after you meet your deductible you will pay 20% of each medical bill, and Medicare will pay 80%. For Part A, coinsurance is a set dollar amount that you pay for covered days spent in the hospital. Here are the Part A coinsurance amounts: Days 1-60 – $0. Days 61-90 – $341 per day.

How much does a day 91 cost?

Day 91 on – $682 per day until you have used up your lifetime reserve days (you get 60 lifetime reserve days over the course of your life); after that you pay the full cost. Skilled nursing facility coinsurance – $170.50. Medigap plans can help you cover 365 additional hospital days. YouTube. Medicare World.

What is a Part D plan?

Part D plans have different tiers as part of the Part D formulary, in which different types of drugs incur lower or higher copays. These will differ according to your individual Part D plan. Copayments in Part D are when you pay a set cost (for example, $10) for all drugs in a certain tier.

Does Medicare Advantage plan count out of pocket?

Under some Medicare Advantage plans, out-of-network expenses do not count toward the maximum out-of-pocket limit, so beware of costs that can add up.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

How much is the 2019 deductible?

Your deductible for each period in 2019 is $1364. That means you’ll be charged up to that amount for any services provided during your inpatient stay at the hospital. The same deductible applies for each benefit period if you’re admitted as an inpatient at a skilled nursing facility for a period of time.

How much is Medicare Part B deductible?

Medicare Part B also employs a deductible. Unlike Part A, Part B has an annual deductible. In 2019, the annual Part B deductible is $185. That means you’re responsible for non-inpatient bills up to that amount.

What does Medicare Part A cover?

Medicare Part A (Hospital Insurance) helps cover inpatient care in hospitals or skilled nursing facilities, in hospice, or home health care. For example, if you have an infected appendix and you are admitted to the hospital for a surgeon to perform an appendectomy, Part A will help cover the costs during your stay, ...

What is Medicare for seniors?

Medicare is the primary hospital and medical insurance coverage for tens of millions of Americans aged 65 or older or under 65 who qualify due to disabilities.

When does the benefit period start?

Your benefit period starts when you get admitted. When you get discharged, a countdown begins. If you go 60 days without receiving more inpatient care, you start a new benefit period. Your deductible goes back into effect for each benefit period.

Is it reasonable for Medicare to know about deductibles?

Any cost above what appears in their normal budget poses a risk to their financial security. Given those circumstances, it is reasonable for Medicare recipients to want to know about what, if any, kind of deductibles apply to their Medicare coverage.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare?

Each part of Medicare carries its own deductible. The Part A and Part B deductibles are standard for each beneficiary of Original Medicare. The Part C (Medicare Advantage) and Part D (prescription drug plan) deductibles will vary from plan to plan. Some Part C and Part D plans may have a $0 deductible. Some Medicare Advantage plans also feature $0 ...

How much is Medicare Part B deductible in 2021?

The Medicare Part B deductible in 2021 is $203 per year, and the Part A deductible is $1,484 per benefit period. Learn more about these costs and what you can expect.

How much is Medicare Part A 2021?

The Medicare Part A deductible for 2021 is $1,484 per benefit period . Unlike the deductible for Part B that operates on an annual basis, the Part A deductible starts and stops with each benefit period. A benefit period begins the day you are admitted for inpatient care at a hospital or skilled nursing facility, ...

What is the deductible for Part D?

Medicare defines a deductible as: “The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.”.

What percentage of Medicare coinsurance is 20 percent?

A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent of a medical bill, while Medicare would pay the remaining 80 percent. It’s worth noting that the 20 percent you will pay as coinsurance is 20 percent of the Medicare-approved amount.

What is the coinsurance for Medicare Part B?

Coinsurance is the amount of the total bill that you must pay. A 20 percent coinsurance means you (the beneficiary) would be responsible for 20 percent ...

What is Medicare Supplement?

Medicare Supplement Insurance (also called Medigap) is a type of privately-sold insurance plan that is used in conjunction with Medicare Part A and Part B.

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.